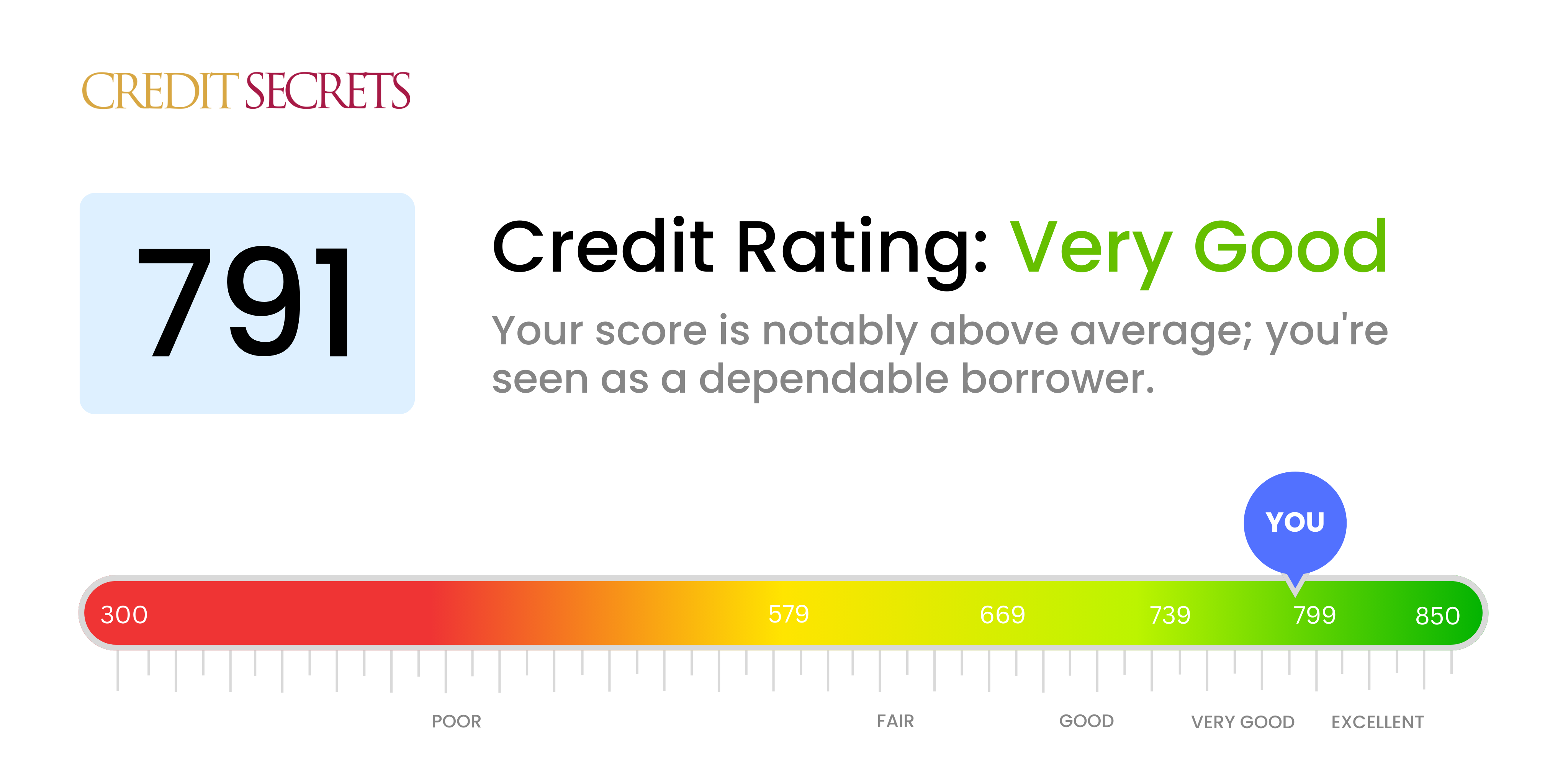

Is 791 a good credit score?

With a credit score of 791, you're in a very strong position. This falls within the "very good" range, indicating that you have managed your credit responsibly and lenders are likely to view you as a low-risk borrower.

By maintaining this high score, you find it easier to get approved for loans and credit cards. Not only that, you can also expect to benefit from lower interest rates on borrowing and more favorable terms in general. It's crucial to continue practicing financial habits that contribute to keeping your score in this range, including making payments on time and not using a high percentage of your available credit.

Can I Get a Mortgage with a 791 Credit Score?

With a credit score of 791, chances are high that you will be approved for a mortgage. This score is well above the average, indicating a strong history of responsible credit use and timely repayment of debts. Lenders look favorably upon such scores, deeming you a low-risk borrower.

In the mortgage approval process, you can expect your credit history to be scrutinized thoroughly, beyond just your credit score. Details such as length of credit history, types of credit lines you have managed, and how promptly you have paid off your debts will be considered. With a score this high, it's also likely you’ll be offered a lower interest rate. This is because lenders view you as less risk, and this can greatly affect the amount you'll pay back over the duration of the loan. Be sure to think about these financial commitments as you proceed with the mortgage process.

Can I Get a Credit Card with a 791 Credit Score?

Securing a credit card with a credit score of 791 is an achievable task. This score is viewed positively by lenders. It typically means that you have a history of responsible financial management with few to no missed or late payments. Remember, your credit score is a critical factor in financial decision-making. This helps in obtaining favorable terms on credit cards and loans.

Being in this credit bracket allows you to consider a wider range of credit cards, including premium travel and awards cards that offer lucrative rewards and benefits. These cards often require high credit scores for approval. Of course, choosing among these should depend on your lifestyle and financial circumstances. Some cards offer benefits like cash back on groceries or benefits on travel expenditures. Make sure to do your research to maintain your current credit score and secure the best possible option. Please note, even with a high credit score, it is crucial to remember that the best card for you will ideally offer low interest rates and fees.

If you have a credit score of 791, you're in excellent financial standing. Will you likely be approved for a personal loan? The answer is yes. Your credit score suggests a highly responsible borrowing behavior and reliability, making you an attractive prospect for lenders.

Going into the personal loan application process, you can expect to receive not only an approval but also considerably favorable terms. Thanks to your high credit score, lenders are likely to offer you lower interest rates, more flexibility, and greater loan amounts compared to applicants with lower scores. While the overall terms and conditions may still vary depending on the specific lender, the high likelihood for approval and favorable terms is undisputed, making it an optimal time for you to reach out to your preferred lenders and explore the opportunities a personal loan can provide.

Can I Get a Car Loan with a 791 Credit Score?

Having a credit score of 791 easily puts you in an excellent position to receive approval for a car loan. This number signifies to lenders that you're a highly trustworthy borrower with a proven history of repayment success. You can expect lenders to view your application favorably.

When it comes to obtaining a car loan, those with superior credit scores like 791 can look forward to rewarding conditions. You're likely to be offered lower interest rates, which can significantly decrease the overall cost of the car. This in part is due to lenders being more confident in your ability to repay the loan on time. Remember that while your high credit score certainly helps smooth out the car purchasing process, always review all terms and conditions thoroughly before proceeding.

What Factors Most Impact a 791 Credit Score?

Having a credit score of 791 means you're doing great financially, but there's always room for growth. You might be wondering what has most impacted your current status. Well, let's delve in:

Payment Punctuality

Your consistent pattern of timely bill payments has likely played a significant part in your impressive credit score. Having no payment delays indicates to lenders that you are a responsible borrower.

Validate: Ensure there are no inaccuracies on your credit report regarding payment delays, as these can drastically impact your score.

Credit Utilization

Keeping your credit utilization ratio low has probably positively influenced your score. This means you've successfully managed the balance between the credit limit available to you and the amount you owe.

Validate: Look at your credit statements. Check that your balances are consistently low compared to your available credit.

Credit History Tenure

Having a lengthy and solid credit history can help boost your score. It implies you've displayed long-term financial responsibility.

Validate: Examine your credit report to confirm the age of your accounts. Greater age is typically better for your score.

Diversity of Credit

Maintaining diverse types of credit—like credit cards, loans, and mortgages—can provide a boost to your score, as long as they're well-managed.

Validate: Review your credit report for a mix of types of credit. Remember, managing this mixture properly is crucial for maintaining your high score.

No Public Records

Lack of public records such as bankruptcies and tax liens is probably a significant factor contributing to your high score.

Validate: Review your credit report to ensure no public records are listed erroneously.

How Do I Improve my 791 Credit Score?

A credit score of 791 is well above average, positioning you within the ‘excellent’ credit range. However, fine-tuning your financial habits can possibly lead to an even better score. Here are some practical steps tailored to your current situation:

1. Maintain Payment Consistency

With a score like yours, it’s obvious you’ve been keeping up with your bills. Therefore, your primary task is to continue paying your dues on time. Missing even a single payment can cause a significant dent in your score.

2. Keep Credit Utilization Low

Keep track of your credit card balances and ensure they remain below 20% of your credit limit to maintain your high score. The lower the balance, the better for your credit score.

3. Extend Credit History

Consider keeping old accounts open and in good standing. A longer credit history can enhance your score as it demonstrates to lenders you can manage credit responsibly over a longer period.

4. Limit New Loans or Credit Cards

Whilst new loans or credit cards may be tempting, each one results in a hard inquiry, which can lower your score. Hence, limit applications to when absolutely necessary.

5. Diversify Credit Types

Introduce different types of credit into your credit mix. Managing a mortgage, auto loan, and credit card well can reflect positively on your credit score by showing versatility in your ability to handle different types of credit.