Is 790 a good credit score?

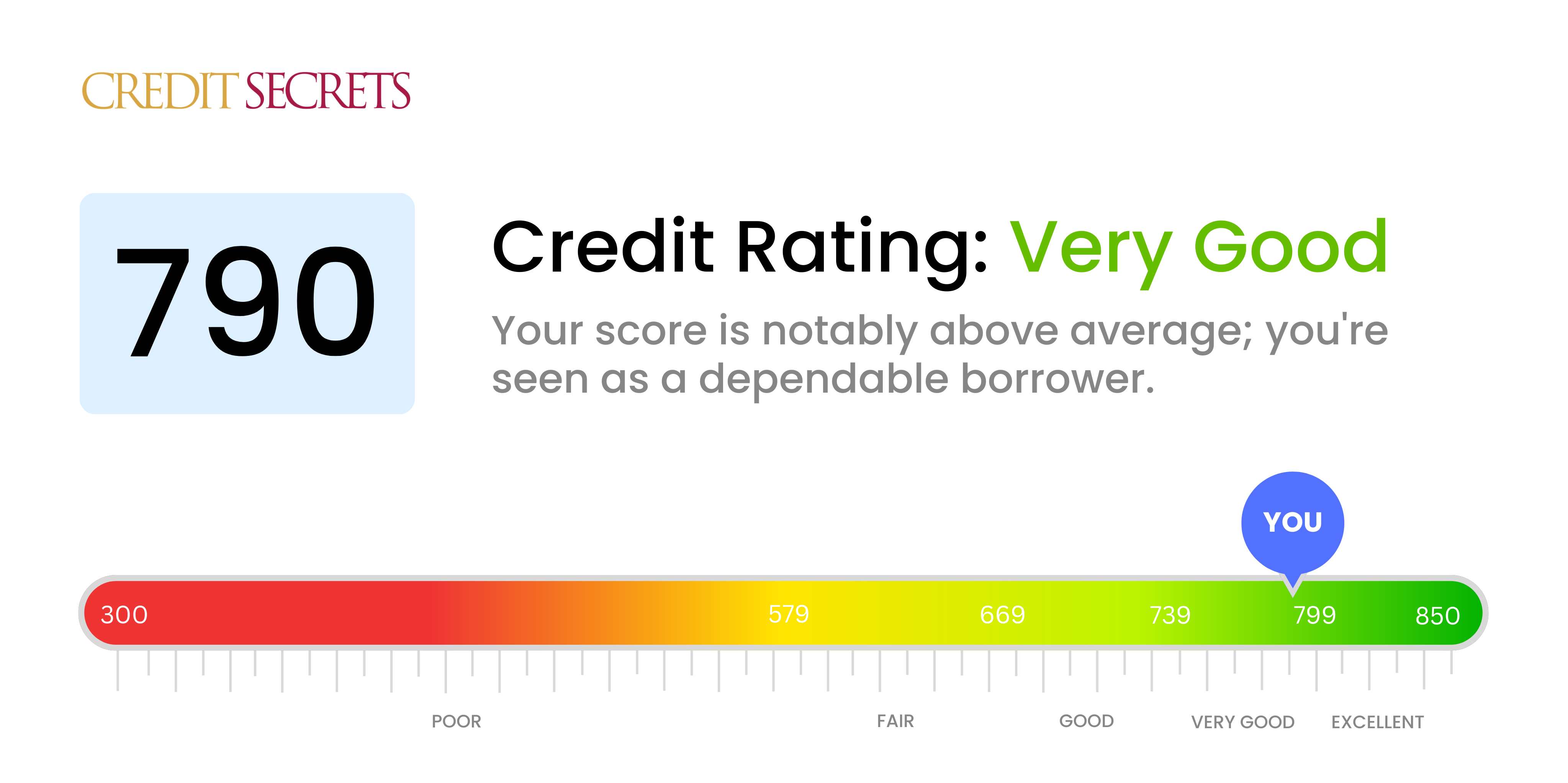

Your credit score of 790 places you firmly in the 'Very Good' range. This means that your responsible credit habits have paid off, as only 'Excellent' scores are higher.

A score of 790 can open doors to better lending rates and easier approval for things like credit cards and mortgages. Unlike those with lower scores, you likely won’t need to worry about being approved for credit. However, remember that maintaining this high score requires continued financial responsibility. Keep your spending and borrowing habits steady to stay on this positive path.

Can I Get a Mortgage with a 790 Credit Score?

With a credit score of 790, your chances of being approved for a mortgage are extremely high. This score is well above average, reflecting your responsible management of financial obligations and reliability in repaying debts on time. It's evident that you've been diligent about maintaining a good credit standing, and this will instill confidence in lenders.

Your high credit score not only increases your likelihood of mortgage approval, but it also has additional benefits. You can anticipate favorable interest rates and terms, as lenders see very low risk in extending credit to you. This is tremendously beneficial because lower interest rates can save you thousands of dollars over the life of your mortgage loan. It's important to bear in mind that while your credit score is a critical factor, lenders also consider other aspects like your income and debt-to-income ratio. So, while a high credit score increases your chances, approval isn't guaranteed. Keep up the good work, and remember, every financial decision counts.

Can I Get a Credit Card with a 790 Credit Score?

Having a credit score of 790 is great news for anyone wanting to apply for a credit card. This score reflects a history of smart financial choices and consistent reliability, making you an attractive prospect for lenders. Being alert about your solid credit standing is an essential step towards leveraging it to achieve your financial goals.

With such a high score, a wide range of credit card options are open to you. For instance, premium travel cards, offering lucrative rewards like free flights or hotel stays, could be a good match. You might also consider cash back cards that provide a percentage back on every purchase you make. Remember, the best credit card is one that suits your lifestyle and spending habits, so take your time in finding the right fit. With a credit score of 790, you also have a strong chance of securing a credit card with lower interest rates, reflecting the lower risk you pose to lenders.

A credit score of 790 is a fantastic sign of financial health, suggesting that you've been consistently responsible with your credit. It falls into the 'excellent' range and indicates a history of timely payments and sensible borrowing. This score is usually well received by lenders, making it highly likely that you will be approved for a personal loan. This is excellent news for your future financial planning.

Given such a high credit score, during the personal loan application process, it is expected that you'll experience a more streamlined process compared to those in lower credit tiers. You may be offered lower interest rates and more favorable terms. This is due to lenders viewing you as a low-risk borrower because of your high score. Just remember, while it's likely you'll receive positive feedback from lenders, don't forget to shop around for the best loan offers tailored to your specific needs.

Can I Get a Car Loan with a 790 Credit Score?

With a credit score of 790, there's likely no need to worry about being approved for a car loan. This high level of credit score signifies financial responsibility and trustworthiness to lenders. Typically, any score above 700 is seen as excellent, markedly exceeding the 660 score that most lenders seek. Therefore, having a 790 credit score puts you in good stead for favorable terms on a car loan.

There are many advantages that come along with this impressive score. You can expect a smooth car purchasing process, with most lenders eager to present their best offers. There's a high likelihood of approval, but also possibly competitive interest rates and loan terms. Because your credit score indicates a low financial risk, lenders are more willing to provide attractive rates. Nonetheless, it's still important to carefully review all proposals and understand the terms before making commitments. Remember, maintaining this high credit score carries on not only with getting the car loan, but also with managing it effectively.

What Factors Most Impact a 790 Credit Score?

Navigating a credit score of 790 means understanding the various factors shaping it. This score is exemplary, you're in the top credit tier, but it does denote room for refinement. Keep these factors in mind:

Payment History

Timely payments signify reliable credit behavior. While a score of 790 suggests you're usually on-time, any missed payments can cause a score drop.

How to Check: Investigate your credit report for any signs of missed or late payments. Instances from the past could be influencing your current score, even if your recent payment history is impeccable.

Credit Utilization

Limiting credit use ideally to less than 30% of your available credit helps increase your score. Bruising your score slightly may be high credit utilization.

How to Check: Analyze your current credit statements. If balances are approximating or surpassing 30% of your limits, you've identified a possible factor.

Length of Credit History

A short credit history may be affecting your score, even though 790 is excellent.

How to Check: Inspect your credit report to gauge the lifespan of your credit accounts. If they are fairly new, your credit history length might be a hindrance to achieving the perfect score.

Credit Mix

A diverse mix of credit types indicates well-rounded credit management skills.

How to Check: Reflect on your variety of credit accounts. A balanced blend of credit cards, retail accounts, installment loans, and mortgage loans can help bump your score up.

Derogatory Marks

While unlikely with a 790 score, any derogatory marks such as bankruptcies or tax liens can significantly drag down your score.

How to Check: Thoroughly review your credit report for any such marks. Any existing can be addressed to further improve your score.

How Do I Improve my 790 Credit Score?

With a credit score of 790, you’re already doing fantastic, but there are a few steps you can take to edge even closer to perfection. Here are some impactful and accessible strategies to take your credit score higher:

1. Maintain Existing Accounts

It’s vital to maintain the health of your existing accounts. This means paying all of your bills on time every month and keeping your credit card balances well below your credit limits. Consistency plays a significant role in maintaining a high credit score.

2. Avoid Unnecessary Credit Inquiries

Avoid applying for new lines of credit unless absolutely necessary. Each credit inquiry can cause a slight dip in your score. If you already have sufficient credit, think twice before applying for more.

3. Long-Term Strategy

Continuing to keep your oldest credit accounts open, even if they’re not in use, can benefit your score by increasing the length of your credit history. Just make sure there are no annual fees associated with these accounts.

4. Diversify Your Credit

If your credit portfolio lacks diversity, consider taking on different types of credit, such as an installment loan or a retail card. Remember to only take on new credit if it makes sense for your financial situation, and manage these responsibly.

5. Monitor Your Credit Report

Regularly review your credit report for any inaccuracies that could be unfairly pulling down your score. If you spot any inaccuracies, report them to the credit bureaus for correction.