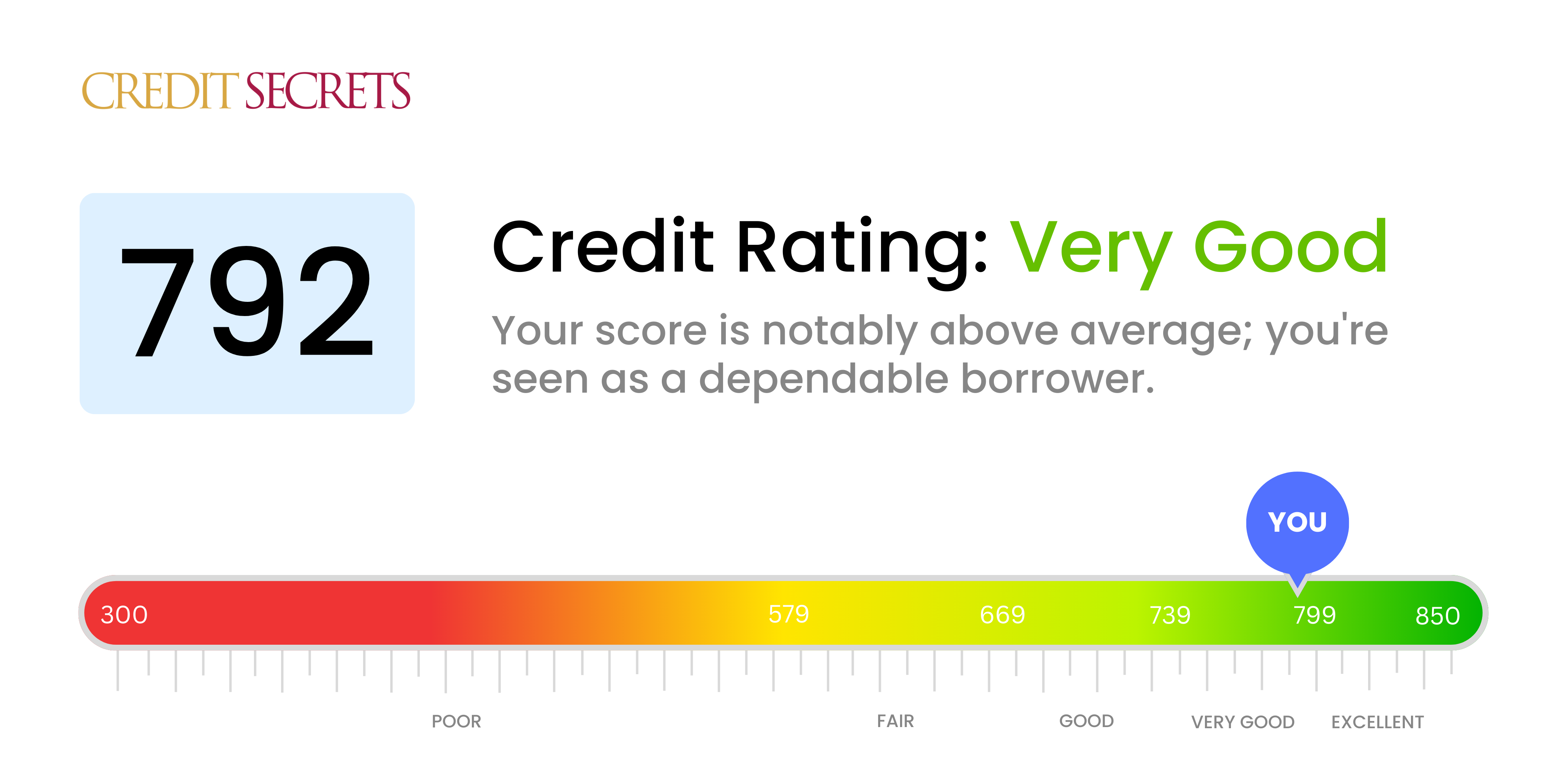

Is 792 a good credit score?

With a credit score of 792, you're just a few points away from the excellent range, which is certainly something to be proud of. As it stands, your score still falls into the very good range, and this is a strong position, indicating to lenders that you're a reliable borrower.

This high-level score will likely open the doors to better interest rates, more favorable terms on loans, and even influence things like insurance premiums and rental applications. Remember that maintaining this score is important, so continue practicing responsible credit habits like paying bills on time, keeping balances low, and regularly checking your credit reports for accuracy.

Can I Get a Mortgage with a 792 Credit Score?

A credit score of 792 is an excellent rating and indicates a strong financial history with a low risk of default. Therefore, you are likely to be approved for a mortgage.

However, getting approved for a mortgage involves more than just a high credit score. Lenders will also examine your employment history, your current income, and your total debt. These other factors should be in good standing to maximize your chances of securing a mortgage. With a credit score of 792, though, you can expect favorable interest rates, which means lower monthly payments, and saving thousands of dollars over the life of the loan. A score at this level shows lenders that you've been responsible with credit, implying you're a lower risk to lend to. Although approval isn't guaranteed, a high score like yours can go a long way towards making the mortgage process smoother and more successful.

Can I Get a Credit Card with a 792 Credit Score?

If you have a credit score of 792, that's considered an excellent score, which can put you in a favorable position when applying for a credit card. Remember, this is not a guarantee, but in general, lenders interpret this kind of score as a sign of financial responsibility and likelihood of repaying debts on time, making you less of a risk.

Leveraging such a strong score, you can aim for high-quality credit cards that come with remarkable benefits. Secured or starter cards could be easily accessible to you, but they would likely offer less value in rewards compared to what you could potentially get. Instead, consider premium travel or rewards cards. These cards often provide points, miles, or cash back on everyday purchases. They commonly offer sign-up bonuses, as well as other perks like access to airport lounges or free hotel stays. The interest rates tend to be lower for such cards, reflecting your lower risk profile. With careful management, these credit cards can further enhance your financial standing.

With a credit score of 792, you stand in a strong position when seeking approval for a personal loan. Lenders regard this score as a solid indication of good financial behavior, which is a pivotal parameter for loan decisions. As a result, your chances of being approved for a personal loan are high. This doesn't mean loan approval is completely guaranteed, as there are other factors lenders consider, but your credit score won't likely be an obstacle.

The loan application process can be smoother for you with a healthy credit score. Because your score is seen favorably, you may enjoy more competitive interest rates, a broader range of loan options, and quicker approval times. Nevertheless, it's always beneficial to shop around to ensure you're getting the most favorable terms. Regardless of your solid score, remember that timely repayment is important to maintain or improve your credit in the future.

Can I Get a Car Loan with a 792 Credit Score?

With a credit score of 792, you're on solid ground in the eyes of most lenders. This score is well within the good to excellent range, and it's likely that you'll be readily approved for a car loan. A high credit score like yours typically indicates a history of responsible financial behavior, which lenders value highly.

Because of your strong credit score, you can generally expect to receive favorable terms on your car loan. This likely means lower interest rates, which will make your loan more affordable over time. Remember, lenders use your credit score as a measure of your trustworthiness. A high score like yours indicates a lower risk for the lender, which is rewarded with more beneficial loan terms. Your careful attention to your credit has led you to this position of financial advantage. Well done.

What Factors Most Impact a 792 Credit Score?

An exceptional credit score of 792 can be attributed to a plethora of favorable financial habits. Let's delve deeper into what likely factors contribute to a score of this magnitude.

Exemplary Payment History

Consistent punctuality with payments is a leading factor contributing to your current high score. Any late payments or missed obligations would reflect negatively on your score.

How to Check: Obtain a copy of your credit report to scan for any discrepancies that might indicate late or missed payments.

Responsible Credit Utilization

Effectively managing your available credit is crucial to reaching and maintaining your current credit score. Utilizing less of your available credit, generally below 30%, indicates sensibility on your part and is favorable in credit score calculations.

How to Check: Evaluate your credit statements to identify your utilization percentage. A lower ratio is an indicator of successful credit management.

Long-standing Credit History

Holding onto existing credit accounts over a long period implies trustworthy credit behavior and is likely a contributing factor to your high credit score.

How to Check: Inspect your credit report for the age of your oldest and most recent accounts and the average duration of all accounts.

Well-rounded Credit Mix

Handling a mix of credit types (credit cards, loans, mortgages) shows ability to responsibly manage multiple lines of credit.

How to Check: Consider the different types of credit listed on your credit report. A healthy blend suggests good credit management skills.

Clean Public Record

Unfavourable public records like bankruptcies or tax liens can significantly impair your score, so your clean record thus far is commendable.

How to Check: Scrutinise your credit report for any public records hinting at past financial pitfalls.

How Do I Improve my 792 Credit Score?

Having a credit score of 792 is considerably strong! This is a high score range which opens up great opportunities. However, there are impactful ways to tweak your credit habits to achieve an even better score.

1. Review Your Credit Report

At this level, errors on your credit report can be detrimental. Review your reports frequently to correct any inaccuracies. Act fast upon spotting errors as this process can take a while.

2. Maintain Low Balances

Credit score models pay attention to how much of your available credit you’re using. Even with a high score, try to keep your balances low, ideally below 10% of your credit limits. This is representative of good credit management.

3. Keep Oldest Accounts Open

Long-standing accounts with good payment history have a positive impact on your credit score. So even if you’re no longer using these credit cards, consider keeping them open unless there are unavoidable fees.

4. Limit New Credit Applications

Each time you apply for credit, a hard inquiry is added to your report. Multiple inquiries within a short timeframe might signal financial trouble to lenders and could negatively affect your score.

5. Diversify Your Credit

A varied mix of credit types, such as installment loans and revolving credit, indicates you’re capable of responsibly managing different types of credit.

Remember, becoming a credit superstar is a journey. Stay consistent, persistent and patient with your financial practices for ultimate success.