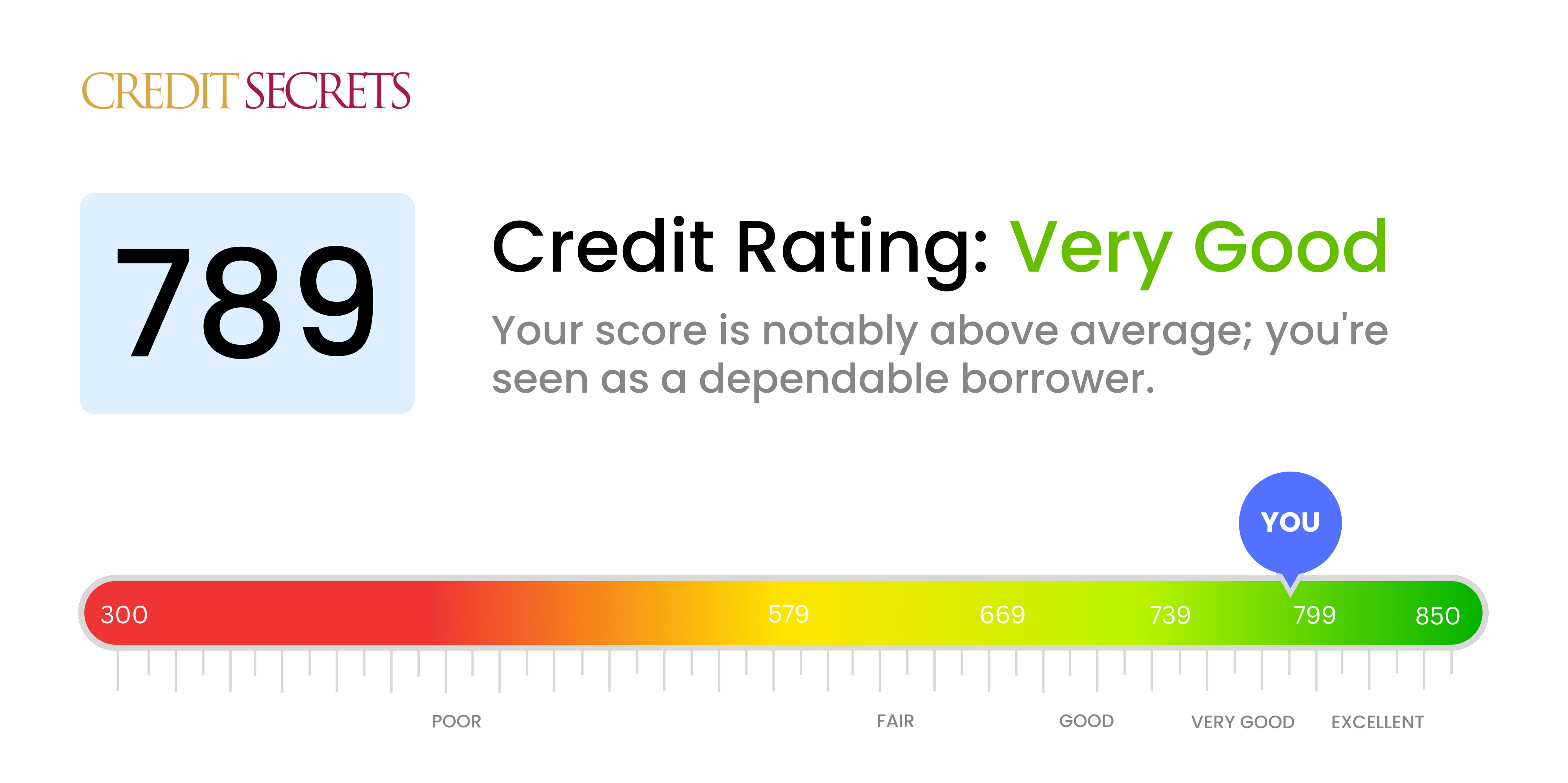

Is 789 a good credit score?

With a credit score of 789, you're in a very good standing. This credit rating means that lenders perceive you as a low-risk borrower which can afford you favorable loan terms, low interest rates, and a better chance of approving your credit applications. However, it's essential to continue good financial habits to maintain or even improve your score.

Remember, credit scores can fluctuate based on various factors like payment history, debt levels, and length of credit history. Despite your score being very good, your financial journey doesn't end here. It's always beneficial to strive for an excellent credit range, which starts from a score of 800. By continuing to make on-time payments, looking to reduce your total debt, and keeping a close eye on your credit reports, you can rest assured that you're on the path towards excellent credit.

Can I Get a Mortgage with a 789 Credit Score?

With a credit score of 789, you are in a favorable position to be approved for a mortgage. This score is significantly above the average and demonstrates a track record of reliable financial behavior, consistent on-time payments, and responsible credit use.

As you move through the mortgage approval process, you can expect lenders to perceive you as a low-risk borrower. This could potentially maximize not only your approval odds but also your bargaining power when it comes to interest rates and terms. With this strong credit score, you're likely to have a wider array of options and the ability to secure advantageous terms on your mortgage. Keep in mind, while a high credit score is important, lenders also take into account other factors such as your income stability and debt-to-income ratio. However, with a score of 789, you've already taken a significant step towards acquiring your mortgage.

Can I Get a Credit Card with a 789 Credit Score?

A credit score of 789 is excellent and you're likely to get approved for most credit cards. This score indicates you've been conscientious about your financial responsibilities, making payments on time and keeping debt levels manageable. On this note, lenders will definitely see you as a low-risk borrower!

In your situation, it's crucial to optimize the rewards of a good credit score. Premium credit cards, especially those offering travel rewards and cash back, might be your best pick. These types of cards often come with significant perks like free hotel stays, airline miles, and even insurance. However, it's also important to understand that they typically come with higher interest rates and annual fees. Always compare different options before making a choice. Remember, having a high credit score means you have many advantages, so make sure to enjoy them while maintaining your smart financial habits.

With a credit score of 789, you're in a fortunate position. This score is well above the average and signifies to lenders that you are responsible with your credit. It's highly likely that if you apply for a personal loan, you will be approved, given this credit score.

Applying for a personal loan in your scenario would be a straightforward process. Your superior credit score indicates that you've shown excellent credit management, which puts you in good light with lenders. You'll be subject to less intense scrutiny compared to someone with a lower score, reducing the stress involved. Plus, not only are you more likely to get approved, but you can also enjoy the perks of lower interest rates, which is a significant advantage. Keep in mind that other factors may still apply, so a high score isn't a guarantee, but it certainly increases your prospects positively.

Can I Get a Car Loan with a 789 Credit Score?

A credit score of 789 indicates a stellar financial history. This places you in an elite category of borrowers and significantly increases the likelihood of obtaining approval for a car loan. Creditors view a score in this range as indicative of a borrower with a strong history of responsibly managing their credit, which signals less risk for the lenders. This could put you in a favorable position when it comes to purchasing a car.

Because your credit score is robust, you'll most likely experience a smoother loan acquisition process. You can expect to secure approval readily, and with favorable terms. In fact, borrowers with credit scores in your range often qualify for lower interest rates due to the diminished risk you present to lenders. However remember that while a good score considerably improves the loan approval process, lenders also take into account other factors such as income and employment stability. Keeping a close eye on all these aspects can help in managing your financial health better.

What Factors Most Impact a 789 Credit Score?

Comprehending a credit score of 789 can enable you to maintain a robust financial path. Decoding the relevant factors for this score can empower you to sustain your existing credit health. Like any financial endeavor, this too is unique, a continuous process with opportunities to learn and improve.

Payment History

Your payment record influences your score heavily. With a score of 789, it's likely you have a strong history of on-time payments.

Validation: Crosscheck your credit report for any late payments or defaults. If none are there, it speaks well of your financial discipline.

Credit Utilization

With a score like 789, your credit utilization ratio is likely in good shape. This means you've wisely used your available credit limit.

Validation: Reflect on your credit card statements. If you usually utilize a smaller portion of your limit, this factor is in your favor. Maintain this to keep your score high.

Length of Credit History

A long history of credit can contribute positively to your score. Given your credit score, it suggests a good length of credit history.

Validation: Inspect your credit report. Long-standing accounts would suggest a strong average credit age.

Credit Mix

You likely have a healthy mix of different credit types contributing to your high score.

Validation: Consider your combination of credit cards, installment loans, and mortgages. A good assortment aids in maintaining your score.

Public Records

Public records may have minimal or no impact on your credit score of 789. Given your score, it's likely you have a clean slate of public records.

Validation: Review your credit report for any public records such as bankruptcies or tax liens. Where none are listed, this boosts your score positively. Continue to manage financial obligations wisely to keep public records clean.

How Do I Improve my 789 Credit Score?

With a credit score of 789, you’re in an excellent position, but there are always ways to further enhance your financial health. Here are some situation-specific strategies tailored to your already high credit score.

1. Keep Balances Low

A key factor in maintaining your high score is keeping your credit utilization low, ideally less than 30% of your available credit limit. This demonstrates responsible credit management and can help you inch your score higher.

2. On-Time Payments

At this level, even a single late payment could significantly impact your score. Ensure all bills are paid on time. Automating payments can be a great way to safeguard against this.

3. Maintain Old Accounts

The length of your credit history can affect your score. Keep your oldest credit lines open, even if you don’t use them often. This shows lenders a long history of credit management.

4. Avoid Excessive Hard Inquiries

Each time a lender checks your credit report due to an application you’ve made, it’s called a ‘hard inquiry’ and can temporarily lower your score. Limit credit applications.

5. Diverse Credit Portfolio

Diversification is key to a robust credit score. Maintain a diverse mix of installments and revolving credit accounts to showcase your ability to handle different types of credit.