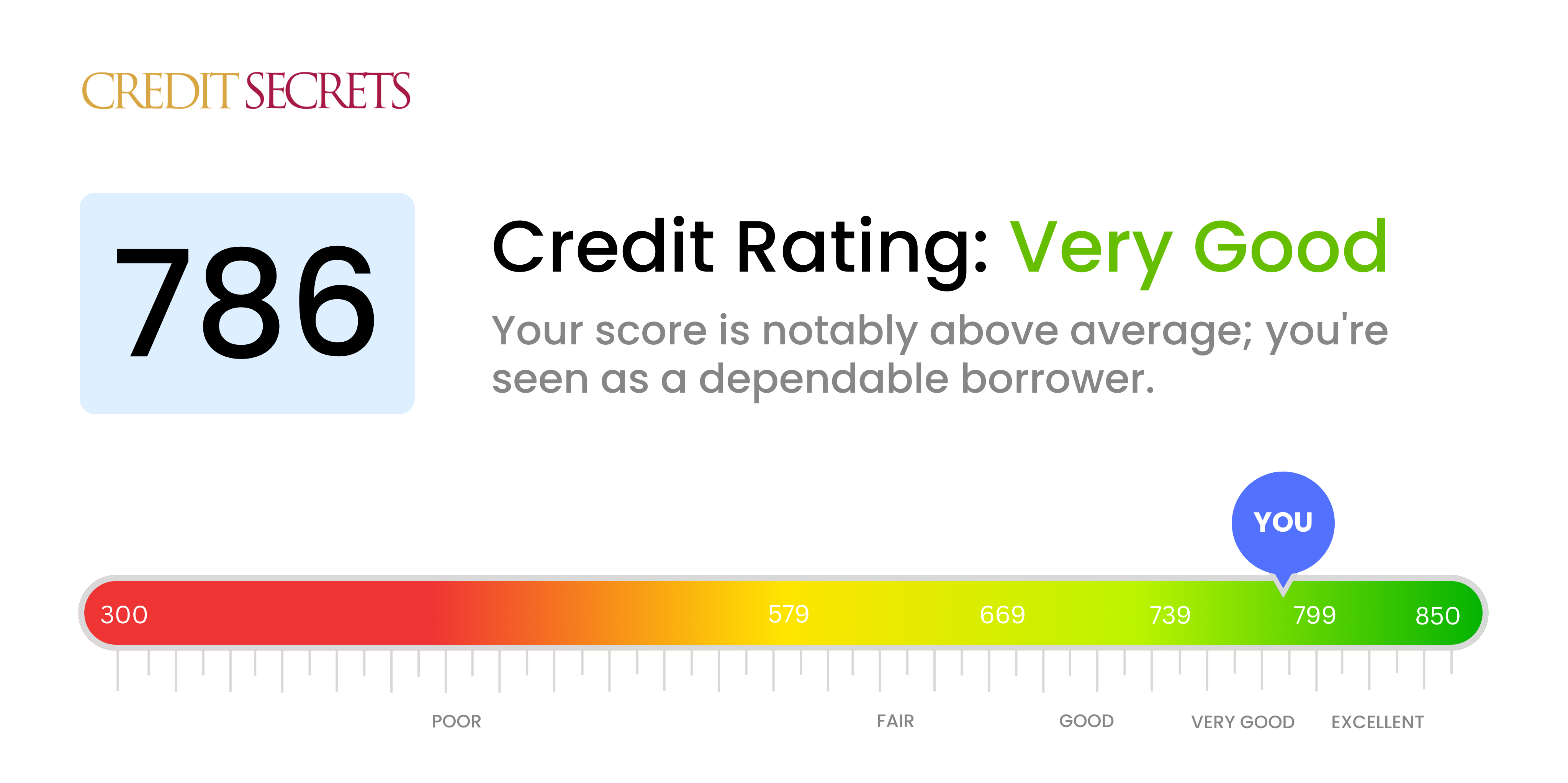

Is 786 a good credit score?

Your credit score of 786 falls into the 'Very Good' category. This means you're usually seen as a reliable borrower and can probably expect lenders to offer you fairly competitive interest rates and loan terms. You've done a commendable job building your credit, and maintaining these responsible financial habits should only continue to benefit you.

While your score isn't in the top tier of 'Excellent', it's definitely leaning in that direction. So keep being conscious about your financial decisions because with a bit more work, your score might get even higher. A very good score like yours is a great asset when it comes to making significant purchases such as a house or car, and can also come in handy if you ever need a personal loan. Remember, every positive financial action you take can help further boost your credit score.

Can I Get a Mortgage with a 786 Credit Score?

With a credit score of 786, you are positioned favorably for mortgage approval. This score is well within the range that most lenders consider excellent, suggesting responsible credit usage and a history of on-time payments.

During the mortgage approval process, you can anticipate that lenders will view you as a low-risk borrower. Therefore, you are expected to receive competitive interest rates. This means that the overall cost of your mortgage is likely to be lower in comparison to someone with a lower credit score. Although the approval is not guaranteed and lenders will consider other factors such as income and employment stability, a high credit score like yours places you in a strong position for mortgage approval. Keep in mind that maintaining this high score by managing your credit responsibly is key to safeguarding your favorable lending potential.

Can I Get a Credit Card with a 786 Credit Score?

With a credit score of 786, it's highly likely to be approved for a credit card. This score reflects responsible financial management and trustworthiness in the eyes of lenders. This is a promising position to be in, but remember, understanding your credit status is important as it presents exciting possibilities for financial progress.

A score like this opens doors to a broad range of credit cards, from secured cards to premium travel cards. As such, choosing the right card depends on your financial needs and goals. If you're looking to establish longer credit history, starter cards might be a good fit. Meanwhile, if you're a frequent traveler, premium travel cards can offer useful rewards. Those looking to carry a balance might consider cards with lower interest rates. Remember, while a high credit score often grants access to cards with better terms and lower interest rates, always review all terms and conditions before making your final decision.

With a credit score of 786, you are standing in a very favorable position when it comes to applying for a personal loan. Lenders typically see the score of 786 as evidence of your financial responsibility and reliability. Your high credit score portrays you as a low-risk borrower who is unlikely to default on a loan. Thus, you are likely to be approved when applying for a personal loan.

In the loan application process, your excellent credit score might even unlock better interest rates and terms for you. Lenders are willing to offer competitive rates to borrowers with a high credit score because they see them as less risky. As you proceed with your application, be aware that each lender might have different criteria, but with a credit score of 786, you are well-positioned for positive responses. Nonetheless, it's always important to review the terms of any loan carefully to ensure they align with your financial goals.

Can I Get a Car Loan with a 786 Credit Score?

With a credit score of 786, your chances of getting approved for a car loan are significantly high. Lenders typically prioritize individuals whose credit scores are above 660 and fortunately for you, your score is well above this minimum threshold. This isn't to say it's an absolute guarantee, however, your score does reflect good financial habits which lenders appreciate.

Being in this high score range, you can anticipate smooth sailing during your car purchasing process. Of course, it's essential to keep in mind your credit score isn't the sole determining factor; lenders will still consider aspects like your past credit history and income. Nevertheless, a credit score of 786 could result in more favorable loan conditions, like lower interest rates. This is because a lender views a higher credit score as less risk, indicating a consistent history of timely payments. Making smart choices throughout this process is key in maintaining your solid financial standing.

What Factors Most Impact a 786 Credit Score?

A score of 786 shows strong credit management skills. However, understanding which factors have impacted this score can help you maintain or possibly increase it. Every person's financial journey is unique, and understanding yours will pave the way for future financial success.

Credit Utilization

Your low credit utilization rate is likely contributing significantly to your high credit score. Your ability to keep your balance low compared to your credit limit shows lenders you can manage debt responsibly.

How to Check: Examine your credit card statements. If your balances are well below your limits, this will positively impact your score.

Payment History

Having a consistent payment history probably plays a large part in your credit score. Timely payments demonstrate reliability to lenders.

How to Check: Review your credit reports for any records of late payments. Consistent on-time payments indicate proper handling of credit.

Length of Credit History

Your score suggests that you may have a longer credit history, which reflects positively on your overall creditworthiness.

How to Check: Review the opening dates on your credit report's accounts. A longer history of managing credit can help your score.

Credit Mix

Having a diverse mix of credit types can contribute to your score. This shows lenders that you can handle different types of credit.

How to Check: Your credit report will indicate the variety of credit accounts you have. A rich blend of credit cards, retail accounts, installment loans, and mortgages is beneficial.

Public Records

The absence of public records like bankruptcy or tax liens on your credit report would also have a positive impact on your score.

How to Check: Scrutinize your credit report for any public records. Resolve any that exist to improve your credit standing. Understand that resolving these items can take time.

How Do I Improve my 786 Credit Score?

Having a credit score of 786 is quite commendable, representing a good credit history. To push your score from the ‘good’ category into the ‘excellent’ range, consider these specific steps tailored for your current situation:

1. Consistent On-Time Payments

At this juncture, maintaining a 100% on-time payment is crucial. Even a single late payment can cause a significant plunge in your credit score. Set reminders or automatic payments to ensure you don’t miss due dates.

2. Keep Low Credit Utilization Ratio

One of the significant factors credit bureaus consider is the percentage of your available credit you are utilizing. Routinely keeping this ratio below 10% can have a positive impact on your score.

3. Monitor Your Credit Regularly

Regularly checking your credit report can help you quickly identify any discrepancies or false information that could negatively impact your credit score. Ensure all data is accurate, and promptly dispute any errors with the credit bureau.

4. Limit New Credit Applications

Each time you apply for credit, a hard inquiry is made on your report, which could reduce your score. Try to limit applications for new credit and instead work to maximize the credit you already have.

5. Maintain A Mix Of Credit Types

Handling different types of credits, like a mortgage, credit card, and car loan, demonstrates your ability to responsibly manage diverse types of credit. However, only add new credit products that you truly need and can safely manage.