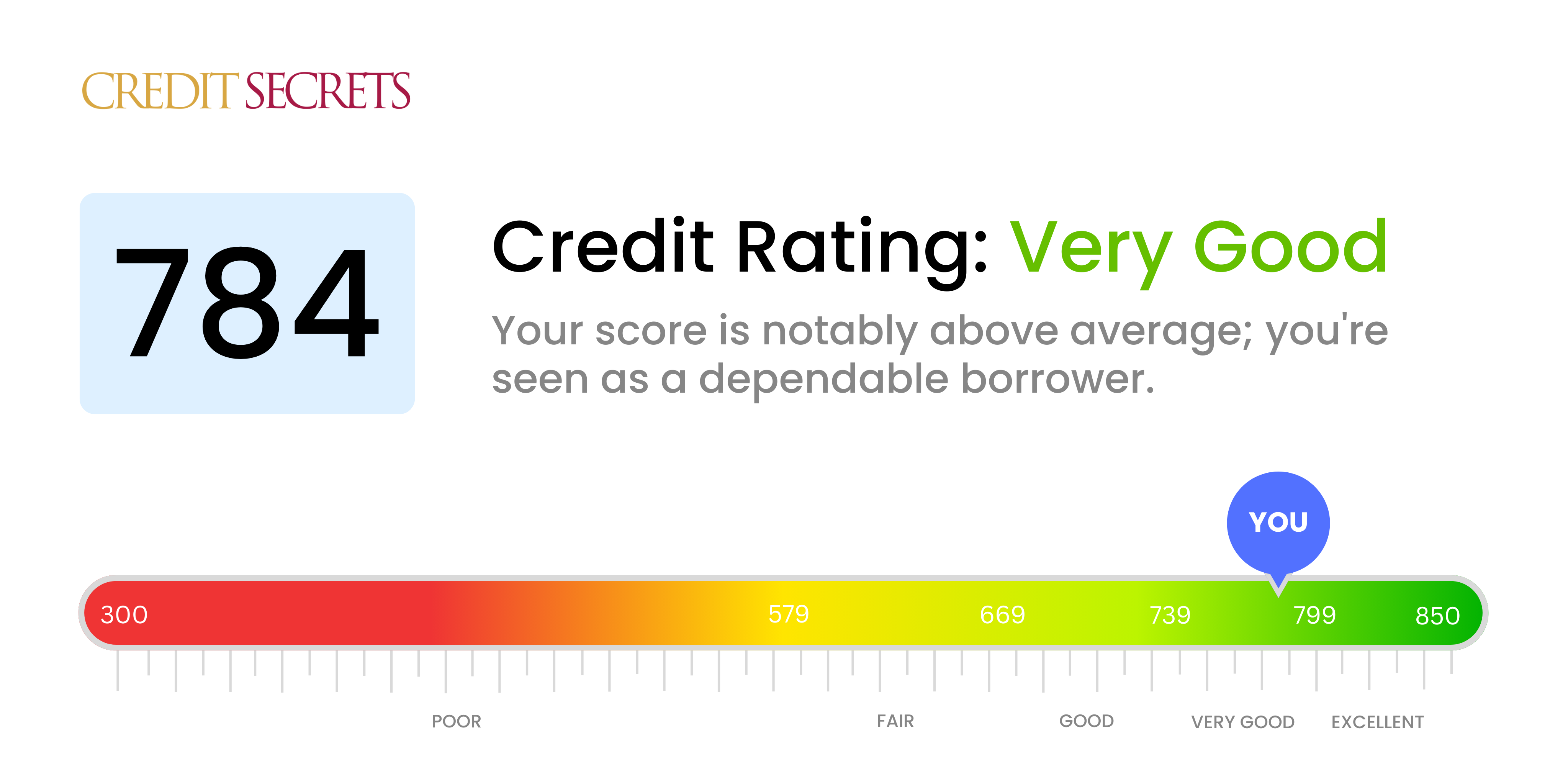

Is 784 a good credit score?

Your credit score is 784, which is considered to be very good. You should feel reassured because lenders, credit card companies, and landlords often view scores in this range positively, paving your way for loan approval with favorable terms and lower interest rates. Yet, it still leaves room for improvement to elevate it into the next, excellent bracket. No matter the score, maintaining good credit habits like timely payments and low debt balances will always be beneficial.

Can I Get a Mortgage with a 784 Credit Score?

With a credit score of 784, you are indeed in a strong position to be considered for a mortgage approval. Your score is notably above the average and falls into the 'excellent' range. This tells potential lenders that you’ve responsibly managed your credit, and are less of a risk for them to lend out money. Keep in mind that lending policies vary, and many factors beyond just your credit score will be taken into account.

The mortgage approval process is a rigorous one. The lender will evaluate your financial health including your income, assets, debts, and more. Interest rates on your mortgage are also largely determined by your credit score. With a score of 784, you can expect to be offered rates at the lower end of the market, which, when amortized over the lifespan of a mortgage loan, can result in significant cost savings. However, ensure you understand all terms and conditions before committing to a loan. A solid credit score like yours is a great stepping stone towards achieving your financial goals.

Can I Get a Credit Card with a 784 Credit Score?

With a credit score of 784, the chance of being approved for a credit card is highly likely. That strong score shows a history of responsible financial behavior, which creditors favor. It's essential to know your credit status, and luckily for you, a 784 score represents a very good credit situation. Remember, this didn't happen by accident, but through careful financial planning and discipline.

Given this high score, more premium credit cards are within your reach. These can come with benefits like travel points, cash-back rewards, and lower interest rates. Remember that while these cards can offer attractive advantages, it's important to continue managing your finances wisely. This includes making payments on time, keeping balances low, and not taking on more credit than needed. By doing this, you can continue enjoying the financial stability that a high credit score brings.

A credit score of 784 is indeed impressive and generally associated with great financial responsibility. Typically, lenders consider this to be a good score, and this effectively enhances your chances of being approved for a personal loan. This score portrays you as a reliable and low-risk borrower, crucial attributes that lenders look for while extending credit.

In regards to the personal loan application process, with your credit score of 784, you can expect to have a more straightforward experience. Potential lenders might not require a closer look into your financial history, thanks to the trust your credit score commands. You'll likely also benefit from lower interest rates as your scoring is an indicator of your probability to repay the loan punctually. As a result, lenders are more willing to provide loans at competitive rates. However, remember to thoroughly review the loan terms before accepting, ensuring they are within your repayment capabilities.

Can I Get a Car Loan with a 784 Credit Score?

With a credit score of 784, you are in a good position to be approved for a car loan. Lenders generally look favorably upon scores above 660, and your score far surpasses this. This is because a higher score indicates to lenders a low risk of potential difficulties in repaying the loan.

When it comes to the car purchasing process, this impressive credit score might unlock attractive benefits for you. This includes potentially lower interest rates, making the loan less costly over time. You can also expect a smoother approval process, and perhaps a wider choice in loan providers due to your high credit score. It's important to still carefully consider the terms and understand the total cost of the loan. This excellent score reflects your prudent management of credit and puts you in a strong position to navigate the car purchasing journey.

What Factors Most Impact a 784 Credit Score?

Understanding a score of 784 involves recognizing the factors that contribute to your credit health. This is a significant step towards maintaining or improving your financial performance. Always remember that every financial journey is distinct and is a process of growth and learning.

Payment Consistency

A consistent payment track record can have a positive impact on your credit score. Timely payments without defaults are essential.

How to Verify: Analyze your credit report for any late payments or defaults. Ponder on practices that ensure prompt payments, as they play a crucial role in your score.

Debt Management

Effective debt management, particularly keeping credit card balances low, can influence your score positively.

How to Verify: Review your credit card statements. If your balances are far from the limits, this is a positive contribution to your score.

Credit Account Longevity

An extended credit history tends to bolster your score.

How to Verify: Check the age of your oldest account, the age of your newest account, and the average age of all accounts on your credit report. Also, consider if you have recently opened new accounts.

Variety in Credit Types

A diverse mix of credit types aids in having a good score. Responsibly handling new credit is also beneficial.

How to Verify: Look at your mix of credit accounts. Assess whether you have responsibly managed applying for new credit.

Public Records

A lack of public records like bankruptcies or tax liens significantly aids in maintaining a higher credit score.

How to Verify: Check your credit report for such public records. Ensure that such instances are absent or are being duly addressed.

How Do I Improve my 784 Credit Score?

Having a credit score of 784 is a commendable achievement, placing you in the ‘Very Good’ category. However, a few strategic steps can take you to the ‘Exceptional’ level. Let’s consider the most impactful actions you can take for your specific situation.

1. Review Your Credit Report

Getting a copy of your credit report from all three bureaus and examining them closely is crucial. Look out for any discrepancies or errors – such as late payments that weren’t late or accounts you don’t recognize – which can bring your score down unfairly. Dispute these errors immediately.

2. Maintain Older Accounts

The length of your credit history plays an important role in your credit score. Rather than closing unused cards, keep your oldest accounts open and in good standing to preserve your credit age.

3. Limit New Inquiries

If you are consistently applying for new credit, it can appear to lenders as though you’re in financial trouble which can impact your credit score. Heavily curtail any new inquiries.

4. Regularly Pay Balances in Full

Pay off your balances monthly. Regularly paying your credit card bill in full conveys financial stability and responsibility, positioning you for an even higher credit score.

5. Perfect Your Payment History

Your payment history is a critical factor in your credit score. To keep your score pristine, ensure all bills are paid promptly. Using automatic payments can be helpful to ensure no payments are skipped or late.