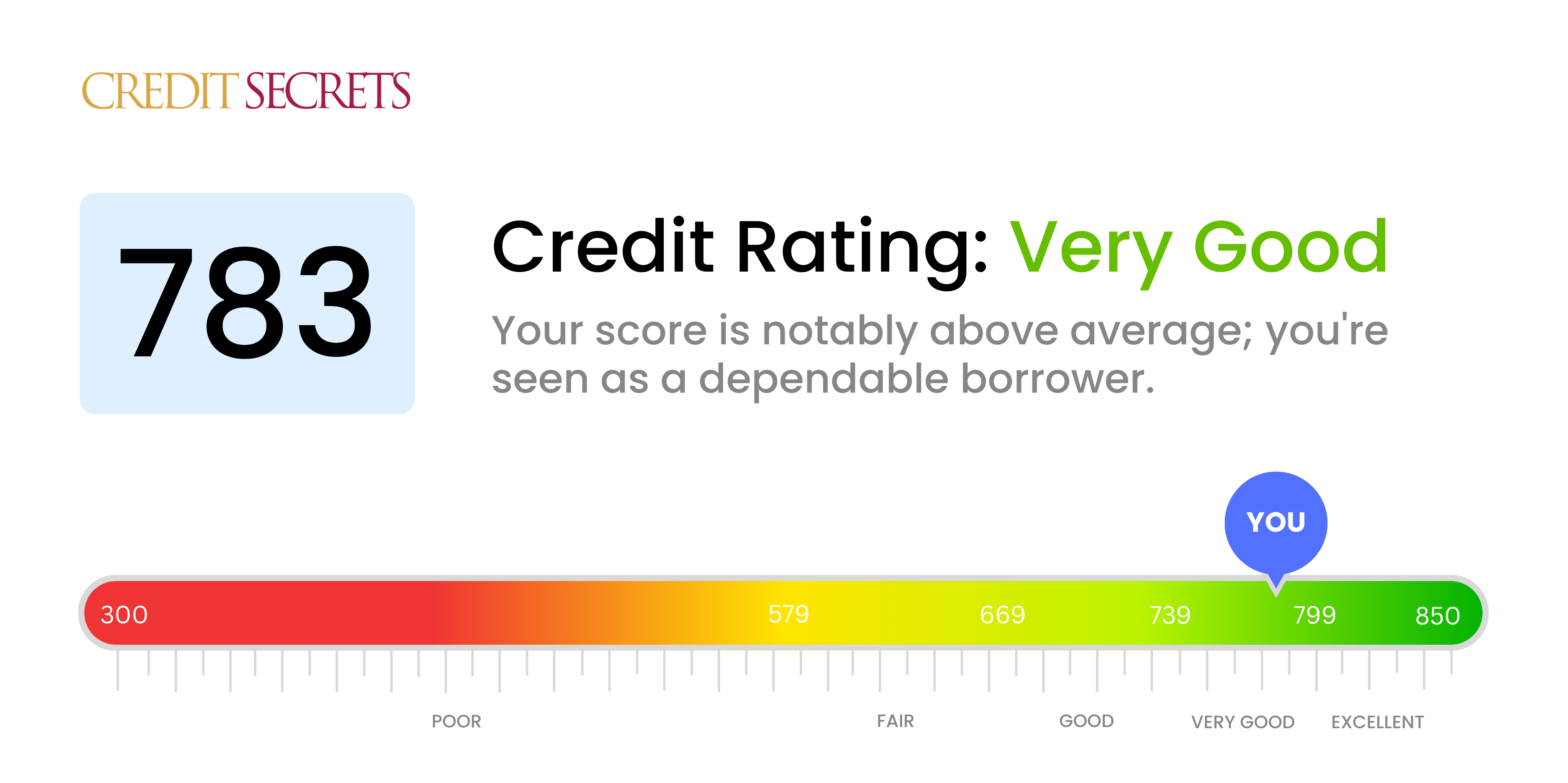

Is 783 a good credit score?

Your credit score of 783 is categorized as 'Very Good' on the conventional credit score scale. With this rating, you are likely to find yourself in comfortable standing with lenders, enjoying generally lower interest rates and more favorable loan terms to assist you in achieving your financial ambitions.

Can I Get a Mortgage with a 783 Credit Score?

A credit score of 783 is often seen as excellent and should provide a strong basis for mortgage approval. Lenders generally consider such scores to be indicative of a reliable borrower with a strong financial track record. While this doesn't automatically guarantee approval, it certainly positions you favorably.

In terms of the mortgage approval process, you can expect close scrutiny of your current financial situation including income, debts, and savings. Even with a stellar credit score, lenders may need to ensure your ability to handle potential mortgage payments. This could mean gathering bank statements, pay stubs, tax returns, and other financial documents. Furthermore, your high credit score could also qualify you for favorable interest rates, as lenders reward low-risk borrowers with lower rates. While this process could seem daunting, your credit score of 783 positions you well for a favorable outcome.

Can I Get a Credit Card with a 783 Credit Score?

Having a credit score of 783 is quite impressive. You are highly likely to be approved for most credit card offers due to this high score, reflecting a long history of responsible credit management. It's essential to understand the value and trust your score conveys to lenders, translating to more credit opportunities.

Given your high score, you are in a position to be choosy and select a card that offers the most benefits. Premium travel cards might be a great fit for you, providing perks like miles or points for travel, dining, and other expenses. Additionally, cards with cashback benefits or those offering 0% interest rates for an initial period may be within your reach. Remember, even with such a high score, it's still essential to manage and maintain your credit responsibly. Be sure to routinely monitor your credit utilization rate and make payments on time to continue enjoying the benefits of your excellent credit score.

If you're holding a credit score of 783, you're in an excellent position to be approved for a personal loan. This high credit score indicates to lenders that you are a reliable borrower, with a history of paying back your debts in a timely manner. This significantly increases your chances of approval for a loan, especially compared to individuals with lower credit scores.

During the personal loan application process, you can expect lenders to review your credit report thoroughly. With such a strong credit score, you're likely to be offered loans with more favorable terms, including lower interest rates. Understand that each lender might still have their own specific criteria, but broadly speaking, your credit score of 783 puts you in a strong position. This score serves as a testament to your financial responsibility and will likely contribute to an easier, smoother loan application process.

Can I Get a Car Loan with a 783 Credit Score?

With a credit score of 783, there's a very high likelihood of gaining approval for a car loan. Credit scores are a key factor in lending decisions, and a score above 700 is generally considered excellent. Your 783 score places you firmly within this excellent bracket, providing a strong reassurance to lenders of your creditworthiness and ability to repay borrowed money.

When it comes to the car purchasing process, a stellar credit score like yours grants you added advantages. Lenders may offer competitive interest rates and favorable terms due to your demonstrated reliability in handling credit. Remember, though, to carefully scrutinize the terms of any loans offered. Understanding the details is essential. Even with a great score like yours, car ownership is a significant commitment, so it's important to ensure the loan's terms are best for your financial situation. Keep this aspect in mind, and the road to car ownership should be smooth.

What Factors Most Impact a 783 Credit Score?

A score of 783 is quite impressive on the credit scale. However, there's always room for improvement, and understanding why your score is where it is can push you closer to that perfect 850 mark. Your score results from several key factors, all interplaying uniquely in your financial history.

Credit Utilization

At this score, your credit utilization is likely controlled. You're probably not overextending your credit limits. But, if you are, work on bringing those balances down.

How to Check: Look at the balances on your credit statements. Are they way below your limits? Keeping this balance to limit ratio low is an excellent practice.

Payment History

With a score like 783, odds are you've been consistently timely with your payments. If you've missed any, even a single instance could negatively affect your score.

How to Check: Read through your credit report for any overdue payments. Every timely payment makes a difference.

Length of Credit History

Chances are, your credit history is extensive, which is working in your favor. Opening new accounts can temporarily lower your score.

How to Check: Reflect on the duration of your oldest, newest, and average age of all credit accounts. Be cautious about opening new lines of credit.

Credit Mix and New Credit

Given your score, it's likely you have a good mix of credit types and haven't been applying for new credit excessively.

How to Check: Observe your mix of credit accounts. Fewer credit inquiries are better for your score.

Public Records

At 783, it's doubtful you have financial red flags like bankruptcies or liens, as these significantly lower your score.

How to Check: Inspect your report for public records. Resolving these issues can give your score a substantial boost.

How Do I Improve my 783 Credit Score?

With a credit score of 783, you are in the “excellent” credit range. Despite the high score, there’s always some room for improvement. Here are a few specific steps you can take:

1. Maintain On-Time Payments

Consistency with payments is key to a good credit score. Ensure all bills and debts are paid on time. Utilize alarms or calendar reminders to avoid missing due dates.

2. Keep Credit Card Balances Low

Even with a high credit score, it’s essential to use your credit cards responsibly. Try to keep your balances low relative to your overall credit limit, ideally under 10%.

3. Avoid Unnecessary Credit Inquiries

Credit inquiries can slightly lower your credit score. As you enjoy an excellent credit status, anticipate future credit needs and plan accordingly to avoid a pile-up of inquiries.

4. Retain Old Debt on Your Report

Positive history with your credit is beneficial. Instead of removing old debts from your report immediately after they’re paid off, keep them as they show you have a history of repaying your debts responsibly.

5. Diversify Your Credit

A diverse credit portfolio can boost your credit score. Consider incorporating different types of credit, like installments, mortgages, or retail accounts, into your credit history and manage them responsibly.