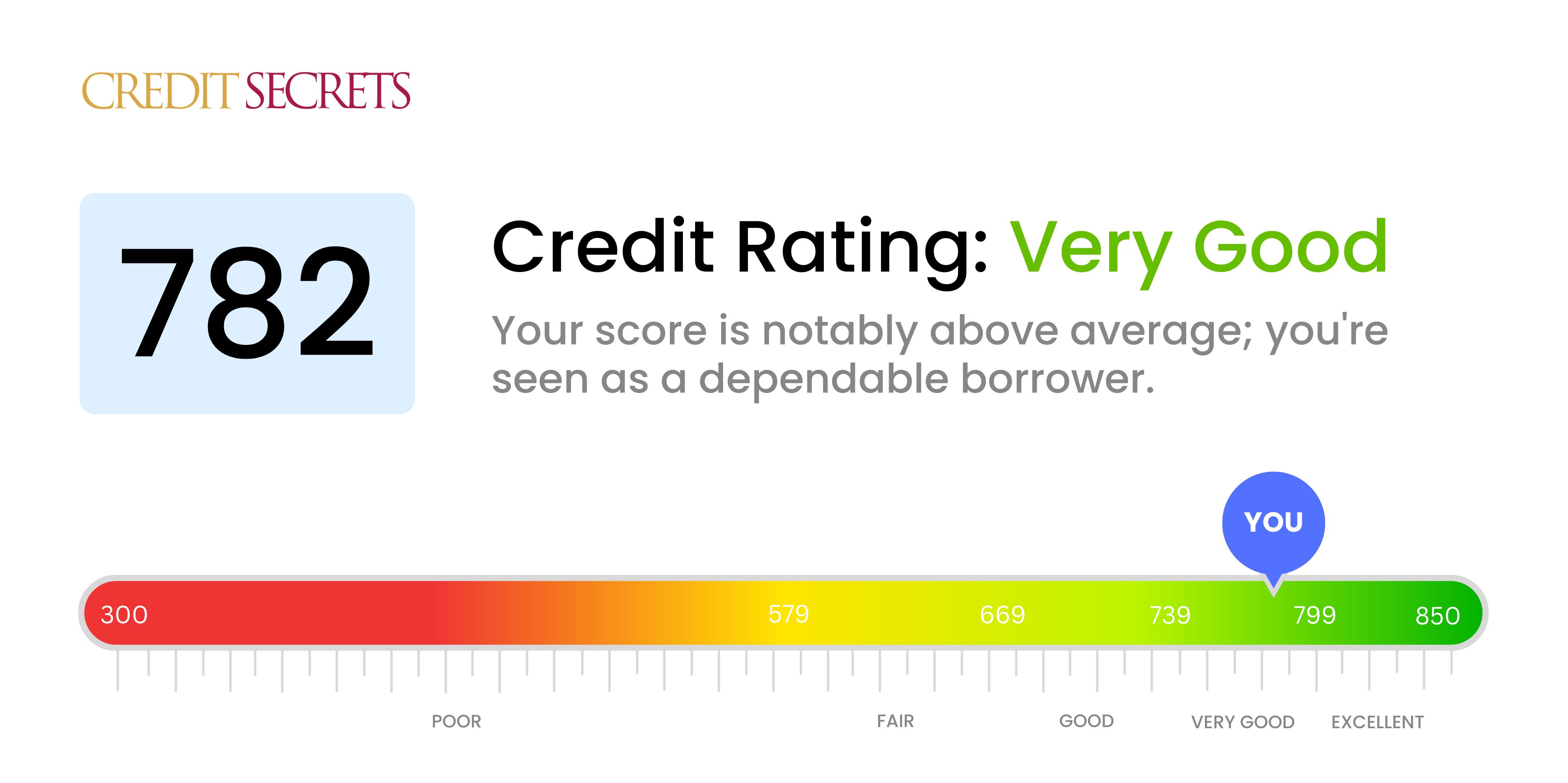

Is 782 a good credit score?

Your credit score of 782 is considered to be very good. This level of score demonstrates that you have been responsible with your credit and financial obligations in the past, which lenders view favorably.

With this credit score, you can likely expect to receive lower interest rates on loans and credit cards, and have more options when it comes to acquiring lines of credit. It shows you're a trustable borrower and financial institutions are more likely to offer their best deals. However, continue to manage your finances prudently to maintain or even improve your current standing to reach the 'excellent' credit score range.

Can I Get a Mortgage with a 782 Credit Score?

If you have a credit score of 782, you will be pleased to know that your chances of getting approved for a mortgage are excellent. This score is significantly above average, indicating a history of responsible credit use and prompt bill payments. You've done a fantastic job so far, and lenders will likely see you as a low-risk borrower.

Being approved for a mortgage is just the beginning of the process. Expect to provide substantial documentation of your income and debts and be prepared for a thorough evaluation of your financial status. Furthermore, a high credit score like yours usually translates into a better interest rate on your mortgage, potentially saving you thousands of dollars over the life of the loan. As the process unfolds, your excellent score should make navigating it smoother, but remember: while approval is likely, it's not guaranteed.

Can I Get a Credit Card with a 782 Credit Score?

With a credit score of 782, you are quite likely to get approved for a credit card. This score signifies a solid history of timely payment and responsible credit usage which lenders highly appreciate. It's a good indicator that you're capable of managing your finances effectively and responsibly. However, keep in mind that approval also depends on other considerations such as income and existing debts.

Given your high score, there should be a variety of credit cards available to you. You might look into premium rewards cards, which often require higher credit scores, but offer significant benefits such as travel rewards, cash back or zero percent interest rates. Regardless of the type of card you choose, ensure to continue managing it wisely to maintain or even enhance your high credit score. Remember, while enjoying the advantages of having a good credit score, be careful not to fall into the pitfall of overspending, leading to a decrease in your credit score.

With a credit score of 782, you are in a strong position when it comes to applying for a personal loan. This score indicates to lenders that you have a solid track record of responsibly managing and repaying your debts, which makes you a low-risk borrower. Therefore, you're likely to be approved for a personal loan as per traditional lending standards. This is a hard-earned advantage on your credit journey.

In terms of the loan application process, your high credit score might expedite the process and improve your chances of receiving favorable terms. Generally, lenders offer lower interest rates to borrowers with higher credit scores. This means you're likely to benefit from lower monthly repayments and a lesser total cost of loan compared to borrowers with lower scores. Just remember, while high scores enhance approval chances, lenders also consider your income, employment history and other factors when determining your loan terms and conditions.

Can I Get a Car Loan with a 782 Credit Score?

With a credit score of 782, you are in a strong position to be approved for a car loan. Your exemplary score is well above the average threshold of 660 that many lenders consider 'good credit'. Featuring in this high-ranking category is indicative of your responsible financial habits, and suggests to lenders that you pose a minimal risk.

When it comes to acquiring a car loan with a credit score as high as 782, there are a few expectancies. You're likely to be offered more favorable terms like lower interest rates. This is because your high credit score indicates a low risk for lenders. It also can smooth out the entire car purchasing process as it assures lenders of your capability to pay back the loan timely. With a top-tier credit score like yours, you can approach this process with confidence and optimism.

What Factors Most Impact a 782 Credit Score?

Understanding a credit score of 782 can equip you with the knowledge necessary to further enhance your financial stability. Recognizing the pivotal factors that have likely influenced your score is the key to continued credit health.

Payment Regularity

The steadiness of your payments significantly impacts your score. If there have been missed payments, it's possibly an influencing factor.

How to Check: Scrutinize your credit report looking for missed or late payments. Take into account any scenarios of overlooked payments, as they might have contributed to your score.

Credit Usage

Excessive use of available credit is a factor that can lower your score. If you're using a high amount of your available credit, this might have influenced your score.

How to Check: Analyze your credit card usage. If balances are consistently high despite a good credit limit, then it could be a factor affecting your score.

Duration of Credit History

A sustained credit history is instrumental in achieving a better score. A relatively new credit history might be an underlying factor.

How to Check: Look at your credit report for the age range of your accounts and the average age. Reflect on whether you have opened up new credit accounts recently.

Diversity of Credit and New Credit Management

Maintaining an assortment of credit types and handling new credit responsibly are key to a good score.

How to Check: Consider your combination of credit accounts, such as credit cards, installment loans, and home loans. Reflect on whether you've been cautious when applying for new credit.

Public Record

Public records like legal judgments can greatly affect your score.

How to Check: Check your credit report for any legal judgments. Attend to any public records that may need to be addressed.

How Do I Improve my 782 Credit Score?

Having a credit score of 782 sets you solidly in the ‘Excellent’ category. However, there’s still some margin for advancement. Below are some precise steps tailored for this score level:

1. Continual On-Time Payments

Continuing to make payments on-time is key. Payment history is the largest factor affecting your credit score. So keep paying all bills before due date—it can only help your score.

2. Watch Your Credit Utilization Ratio

Maintain a low credit utilization ratio. Even with a high credit score, it’s important to use less than 30% of your available credit. Regularly paying off card balances is a great habit to ensure this.

3. Consider Length of Credit History

Longer credit history typically, but not always, means improved credit. The longer accounts have been open and in good standing, the better chances to improve your score. Be patient, and let the accounts age.

4. Limit New Credit Inquiries

Having fewer hard inquiries on your credit history portrays you as less of a risk to lenders. Therefore, apply for new credit sparingly, as unnecessary applications can reduce your score.

5. Foster a Diverse Credit Portfolio

A healthy mix of credit types can positively impact your credit score. This can include credit cards, mortgage loans, installment loans, and finance company accounts. However, it’s always essential not to open unnecessary accounts just to diversify.