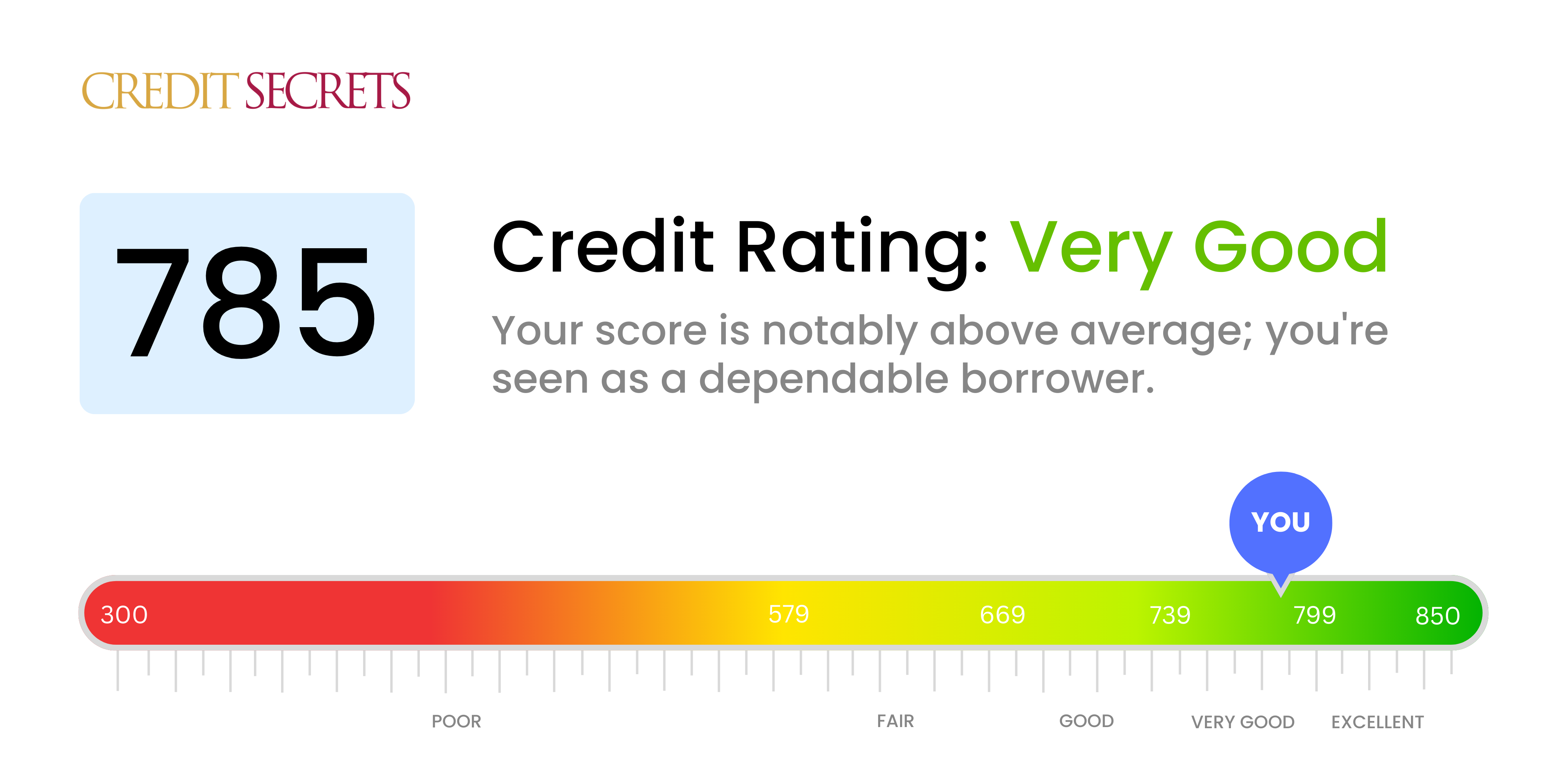

Is 785 a good credit score?

Your credit score of 785 is classified as very good and that's a solid position to be in. With this rating, you can expect to have a strong standing in the eyes of lenders, which usually results in better terms and interest rates for loans and credit cards.

Remain consistent with responsible financial behavior to possibly push your score into the "excellent" range. Even so, it's important to remember that while credit scores are key, lenders will also consider other factors such as income and debt-to-income ratio. Always endeavor to make timely payments, use a small percentage of your available credit, and apply for new credit only when necessary.

Can I Get a Mortgage with a 785 Credit Score?

Possessing a credit score of 785 indicates a strong financial history and responsible credit management. This is significantly above the minimum requirement for most lenders, thus it is highly likely you'll get approved for a mortgage. Your commendable credit score demonstrates that you are a reliable borrower, which mortgage lenders find very appealing.

In the mortgage approval process, you can expect smoother proceedings due to your high credit score. Lenders might offer you more favorable terms, such as lower interest rates, considering the reduced risk your credit score represents. Nevertheless, it's important to keep in mind that your credit score is only one factor amongst many that lenders evaluate. Factors such as income, employment history, and debt-to-income ratio also play crucial roles. Use your strong credit score as leverage in negotiating excellent mortgage terms.

Can I Get a Credit Card with a 785 Credit Score?

With a credit score of 785, you're positioned well to be approved for a credit card. This high score illustrates responsible credit management and is seen favorably by lenders. It's important, however, to continue acting responsibly with your credit to uphold this advantageous ranking.

In your situation, you have a broad range of credit cards available to you. Opting for premium travel cards can provide perks such as travel points and cashback rewards that can be beneficial if you frequently travel for business or leisure. Alternately, if you are seeking to build more credit or increase your limit, starter cards might be an excellent choice, often offering lower interest rates. Remember, even with a high credit score, you should maintain responsible credit habits, such as making payments on time, keeping balances low, and only taking on credit you can afford. Doing so will help preserve or even further improve your credit score.

In terms of traditional lending standards, a credit score of 785 stands strong. Any person with this score is almost certain to be approved for a personal loan, as it accurately demonstrates reliability and a consistent, responsible approach towards financial obligations. Your credit score of 785 implies that you've managed your financial commitments efficiently and is a comforting sign to lenders regarding your creditworthiness.

With a high credit score like yours, you can foresee a smooth, undemanding personal loan application process. Lenders will perceive you as a low-risk borrower, which can lead to benefits such as a larger loan amount, more favorable loan terms, and lower interest rates. It's also likely that your application will move swiftly through its required stages. Remember, though, despite these advantages, it's still paramount you clearly understand your loan agreements and remain committed to maintain your high credit standing.

Can I Get a Car Loan with a 785 Credit Score?

A credit score of 785 is generally seen as very good by lenders, which puts you in a strong position to be approved for a car loan. This type of high score suggests that you have a history of responsible borrowing and timely repayments, which is exactly what lenders want to see. They know you're likely to repay the loan on time, so there isn't a high risk associated with lending to you.

Car buying experience with this score should be smoother, as your excellent credit score will likely secure low-interest rates, saving you a considerable amount of money over the term of the loan. Although lenders consider other factors too, such as income and employment history, your high credit score of 785 can certainly have a positive impact on the loan terms you're offered, making your car buying journey that much easier.

What Factors Most Impact a 785 Credit Score?

A credit score of 785 is excellent, placing you well above the average. You've clearly been handling crucial elements of your credit health successfully. Yet, just as perfection is elusive, there's always room for slight improvements. Let's identify the key factors relevant to your score and how they could be enhanced.

Existing Credit Accounts

Even with a high score, maintaining your existing credit accounts responsibly remains important. Any lapse could impact your score.

How to Check: Regularly check your credit card statements to keep track of your balances and payment statuses.

Credit Applications

At this score range, avoid applying for new credit too frequently as it may signify risk to lenders, which could dip your score.

How to Check: Keep a track of recent enquiries made on your credit report. If there are many, consider slowing down on applications.

Debt-to-income Ratio

Whilst not a direct factor in your credit score, a low debt-to-income ratio can make you more appealing to lenders, increasing your chances of credit approval at competitive rates.

How to Check: Calculate your debt-to-income ratio by dividing your monthly debt payments by your monthly gross income.

Monitor for Errors

Keeping an eye out for errors on your credit report is crucial. Even a small error could bring down your high score.

How to Check: Regularly examine your credit report for discrepancies or unauthorized activities.

Credit Mix

At your current score, diversification of credit can be beneficial. A mix of credit cards, installment loans, and mortgages reflect positively on your financial stability.

How to Check: Evaluate your current credit types and consider adding a different type, if prudent.

How Do I Improve my 785 Credit Score?

With a robust credit score of 785, you’re at a point where maintaining a high level of financial health is crucial. Here’s how to further strengthen your score:

1. Keep Your Credit Utilization Low

Your credit utilization ratio is a significant factor in your credit score. Although your ratio might be in good shape now, make it your aim to keep it below 10%. Achieve this by paying off balances before statement closing dates, and try to maintain low balances on credit cards and other revolving credit lines.

2. Manage Your Payment Schedule

Paying your bills on time is essential. Late payments can impact your credit score dramatically. Set up automatic payments or reminders to ensure you never lose sight of a payment due date.

3. Restrict Hard Inquiries

Applying for additional credit lines may result in hard inquiries, which can negatively affect your credit score. Because you’re at a high score level now, limit the number of credit applications and only apply when absolutely necessary.

4. Review Your Credit Regularly

Ensure no erroneous negative information affects your credit score by regularly reviewing your credit reports. If you spot any discrepancy, proactively dispute it through the respective reporting bureaus.

5. Don’t Close Unused Accounts

Keeping old, unused accounts open can benefit your length of credit history, a component of your credit score. As long as there’s no annual fee, keep these accounts open and occasionally use them for trivial purchases to keep them active.