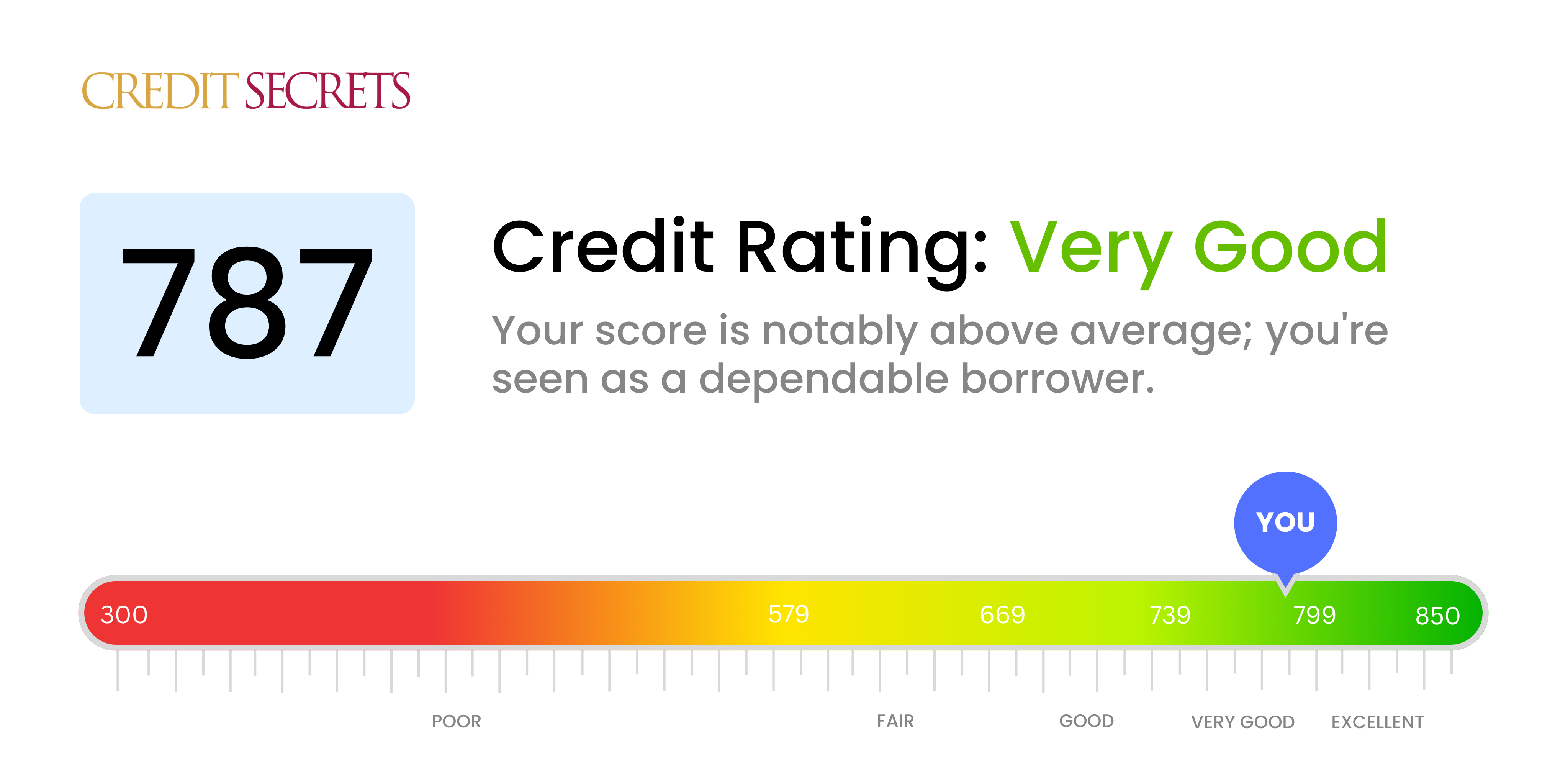

Is 787 a good credit score?

With a credit score of 787, you're already far ahead of many when it comes to financial health; it's considered to be a 'Very good' score. Having a 'Very good' credit score implies you have consistently made timely payments on your credit lines and this reflects positively on your creditworthiness.

When you apply for loans or credit cards, lenders see that 787 score as a sign of a responsible borrower. This means you might have better chances of approval for credit as well as the opportunity to secure lower interest rates. In the long run, this can save potentially significant amounts of money. It's also important to remember, maintaining and improving your score requires continuous regular payments, controlled spending, and diligent financial management.

Can I Get a Mortgage with a 787 Credit Score?

With a credit score of 787, you are in a very favorable position when applying for a mortgage. This score is well above the average and indicates that you have a strong history of responsible credit use and timely bill payments. Lenders view borrowers with these scores as low risk, and you are likely to gain approval for a mortgage.

The mortgage approval process will involve lenders probing into your financial history, assessing your income, and your existing debts. Even with a high credit score, maintaining stable employment and manageable levels of debt can aid in the process. Being in a prime credit range like this can also afford you the benefit of lower interest rates. Remember, though the path ahead seems smooth, it is essential to continue to manage your finances wisely to maintain your solid credit standing.

Can I Get a Credit Card with a 787 Credit Score?

With a credit score of 787, you are in an excellent position to be approved for a credit card. This score reflects responsible financial management and reliability. Lenders see you as a low-risk applicant, making it easier for you to gain approval. This position is an admirable one, achieved through consistent and smart financial decisions.

Given such a high credit score, premium cards often reserved for the most creditworthy applicants can easily be within your reach. These can include cash back cards, travel rewards cards, or cards with low interest rates. Premium credit cards often offer beneficial features like high rewards rates, extensive travel benefits, and significant sign-up bonuses. Despite these benefits, it's still important to read through and understand all credit card terms to ensure it aligns with your financial habits and goals. Keep in mind, even though your high score grants you access to most cards, pay close attention to interest rates and fees before making a final decision.

If you have a credit score of 787, you can breathe a sigh of relief. This is a well above average score and indicates to lenders that you are not a risky borrower. Chances are extremely high that not just one, but several lenders would approve you for a personal loan. But remember, each lender has its own requirements.

When applying for personal loans, you can expect generally smoother processing and potentially lower interest rates. A high credit score like 787 will likely qualify you for the lender’s best rates. However, bear in mind that lenders also consider other factors like your income and job stability. While having a 787 credit score paves the way, you should still prepare to present a full financial picture. The process might require some effort, but your credit score is a solid foundation that speaks well of your financial discipline.

Can I Get a Car Loan with a 787 Credit Score?

With a credit score of 787, you're quite likely to be approved for a car loan. This score is well within the "excellent" credit range of 720-850, and lenders appreciate a strong score like this when evaluating potential borrowers. Having such a solid credit score indicates that you have consistently managed your debt responsibly, often leading to more favorable loan terms.

Being approved for a car loan with this credit score often means that you can expect some of the best interest rates available. These lower interest rates can significantly reduce the overall amount you pay for your vehicle in the long run. While navigating through the car purchasing process, remember that a high credit score gives you the advantage of being able to shop around for the best loan terms, helping to solidify the best possible deal for you.

What Factors Most Impact a 787 Credit Score?

Examining a credit score of 787 can offer meaningful insight into your financial habits. Unpacking the elements that shape your score will enable a better understanding of your financial standing and help strategize ways to maintain this strong position. Your personal financial journey is distinctive; embrace it as a platform for growth and knowledge.

Payment History

Your strong credit score suggests a consistent payment history. Timeliness in settling your credit obligations greatly boosts your score.

How to Check: Look over your credit report for a pattern of on-time payments. Rank your payment habits and identify potential areas for improvement.

Credit Utilization

Low credit utilization is a likely factor in your high score. Maintaining a balance significantly less than your limit is rewarded by the credit bureau.

How to Check: Scrutinize your credit card statements. Notice your balances with respect to your limits. Strive to keep this ratio low at all times.

Length of Credit History

With a score of 787, you most likely have a sustained credit history. Long-standing credit accounts are seen as a sign of reliability.

How to Check: Analyze your credit report to understand the age of your oldest and latest accounts and the mean age of all of your accounts. Observe the effects of new accounts on your score.

Credit Variety

Having a diverse mix of credit might have contributed to your excellent score. Managing multiple types of credit shows your adeptness at handling varied financial responsibilities.

How to Check: Consider the different types of loans and credit accounts you hold, such as credit cards, mortgage loans, and retail accounts. Evaluate your ability to manage different credit forms effectively.

Impact of Public Records

Your superior score suggests minimal negative public records. Outstanding legal obligations can be seriously detrimental to your credit score.

How to Check: Go through your credit report to find any public records. Seek to resolve any listed items swiftly and responsibly.

How Do I Improve my 787 Credit Score?

Possessing a credit score of 787 means you’re already placed in a great spot with commendable credit status. However, there’s always room for improvement. Here are a few steps tailored for your current situation to elevate your credit score further:

1. Maintain On-Time Payments

You’re likely already doing a good job with this, but it’s crucial to remember that consistent, on-time payments have a significant impact on your credit score. Always aim to pay not just the minimum, but the full amount, if possible.

2. Review Your Credit Report Regularly

It’s important to regularly review your credit report for inaccuracies. An error could potentially lower your score, so keeping a close eye on your report allows you quickly handle any discrepancies that may arise.

3. Stay Below Your Credit Limit

Although your credit limit may be high, it’s advisable to use no more than 30% of your available credit. This shows lenders you’re responsible with your credit usage and not relying heavily on borrowed money.

4. Maintain Long-standing Accounts

The length of your credit history plays a role in your score. Try to keep your oldest credit accounts open and in good standing to demonstrate a long-term history of reliable credit use.

5. Diversify Your Credit

You may consider diversifying the types of credit you have. If you only have credit cards, a personal loan or a mortgage could add to your credit mix and potentially boost your score.