Improve Your Credit and Unlock Access to Better Credit Cards

Credit Cards and Credit Scores Go Hand-in-Hand

And for many Americans, credit card debt is often their biggest issue when it comes to poor credit scores.

A Real Life Example

Jordan’s credit score hovered around 620, primarily due to high credit card balances, late payments, and a lack of diverse credit accounts. These factors limited Jordan’s access to credit cards with favorable terms, such as low interest rates, rewards programs, and high credit limits. Frustrated with paying high interest and missing out on rewards, Jordan set a goal to improve their credit score within a year.

Jordan began by obtaining a copy of their credit report to identify any errors that could be disputed and corrected, a move that quickly improved their score by a few points. Recognizing the impact of credit card balances on credit scores, Jordan focused on reducing their credit utilization ratio. They achieved this by:

- Paying down the balances on existing credit cards, starting with those with the highest interest rates.

- Not closing old credit cards to maintain a longer credit history and lower overall credit utilization ratio.

- Applying for a credit limit increase on a card they had managed responsibly for years, without intending to use the extra credit.

Moreover, Jordan committed to making all future payments on time, setting up automatic payments to avoid late fees and additional interest charges. To diversify their credit mix, Jordan took out a small installment loan for a laptop they needed for work, ensuring it was something they could comfortably afford.

Over the course of a year, Jordan’s credit score improved significantly. By reducing their credit utilization ratio to under 30%, correcting errors on their credit report, and making consistent, on-time payments, Jordan’s score rose to 720. This improvement opened the door to credit card offers that were previously out of reach, including those with 0% introductory APR, generous cash-back rewards, and significant signup bonuses.

Jordan’s story illustrates the positive impact that strategic financial management can have on one’s credit score. By understanding the factors that affect credit scores and taking concrete steps to address them, individuals can significantly improve their financial standing. Jordan’s journey from a mediocre credit score to one that unlocked the best credit card offers serves as an inspiring example of financial transformation through dedication and smart financial practices.

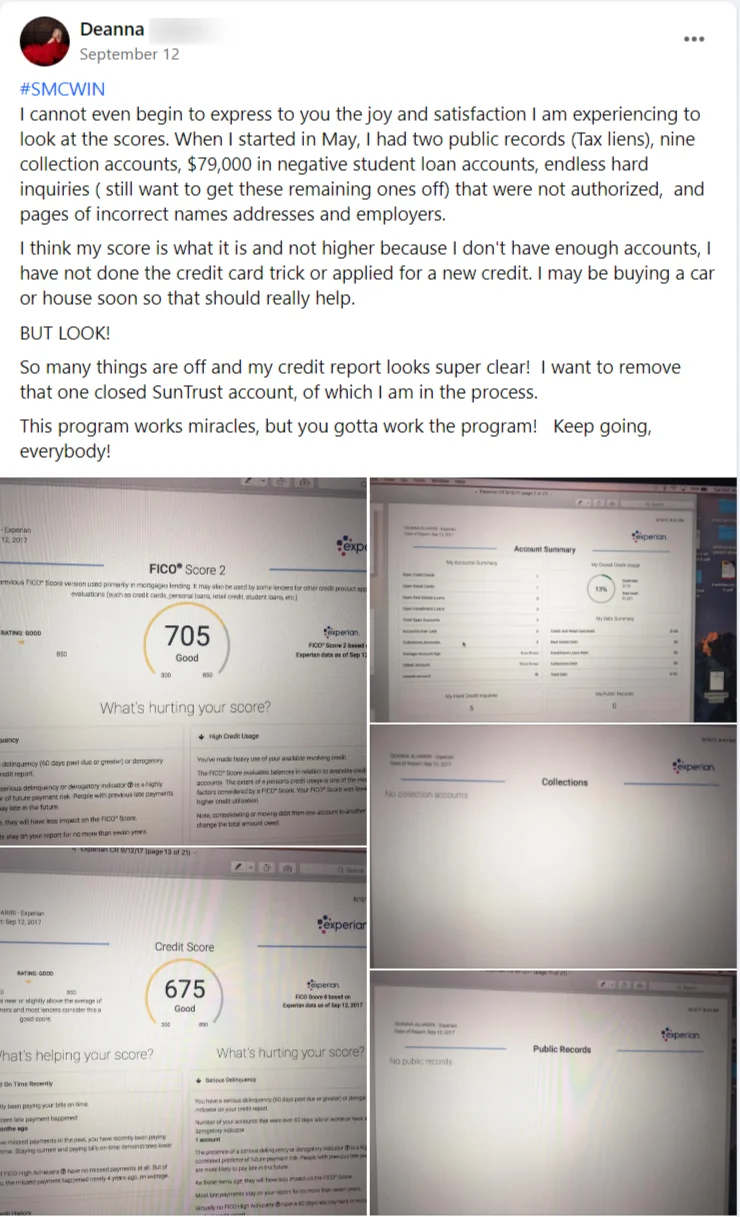

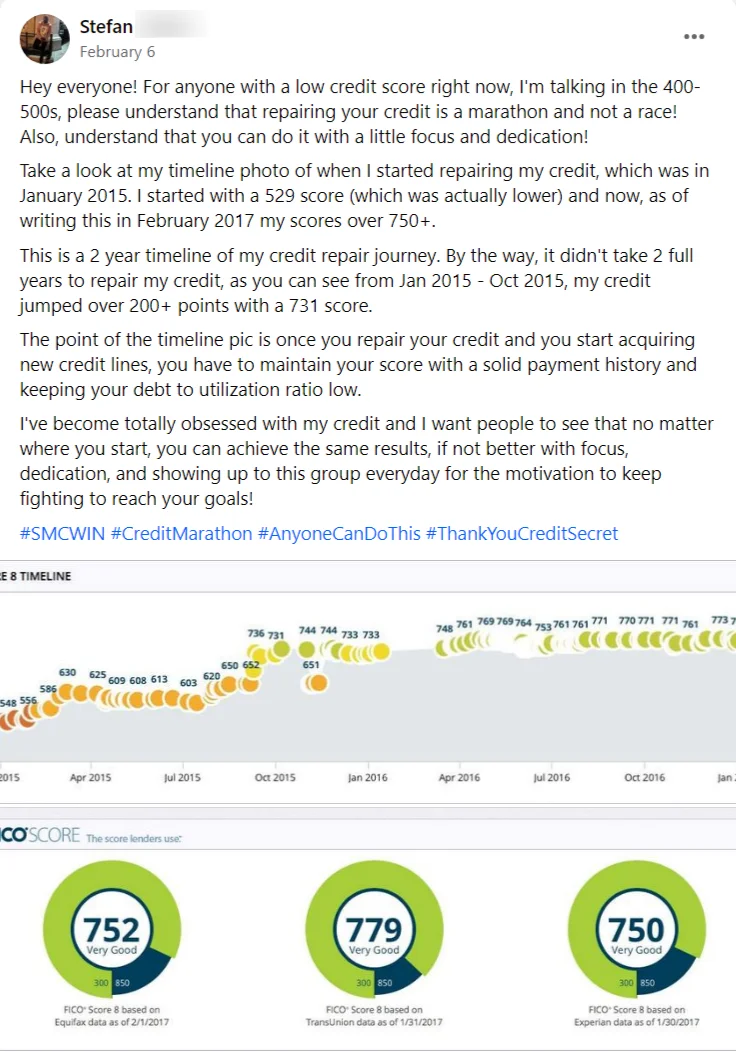

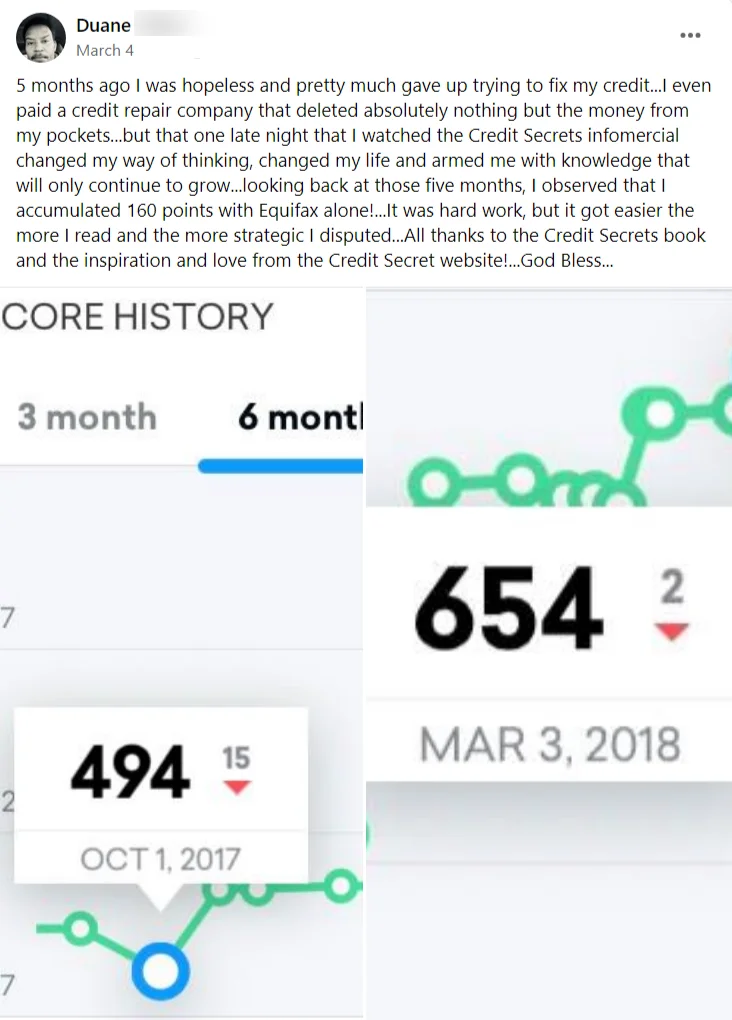

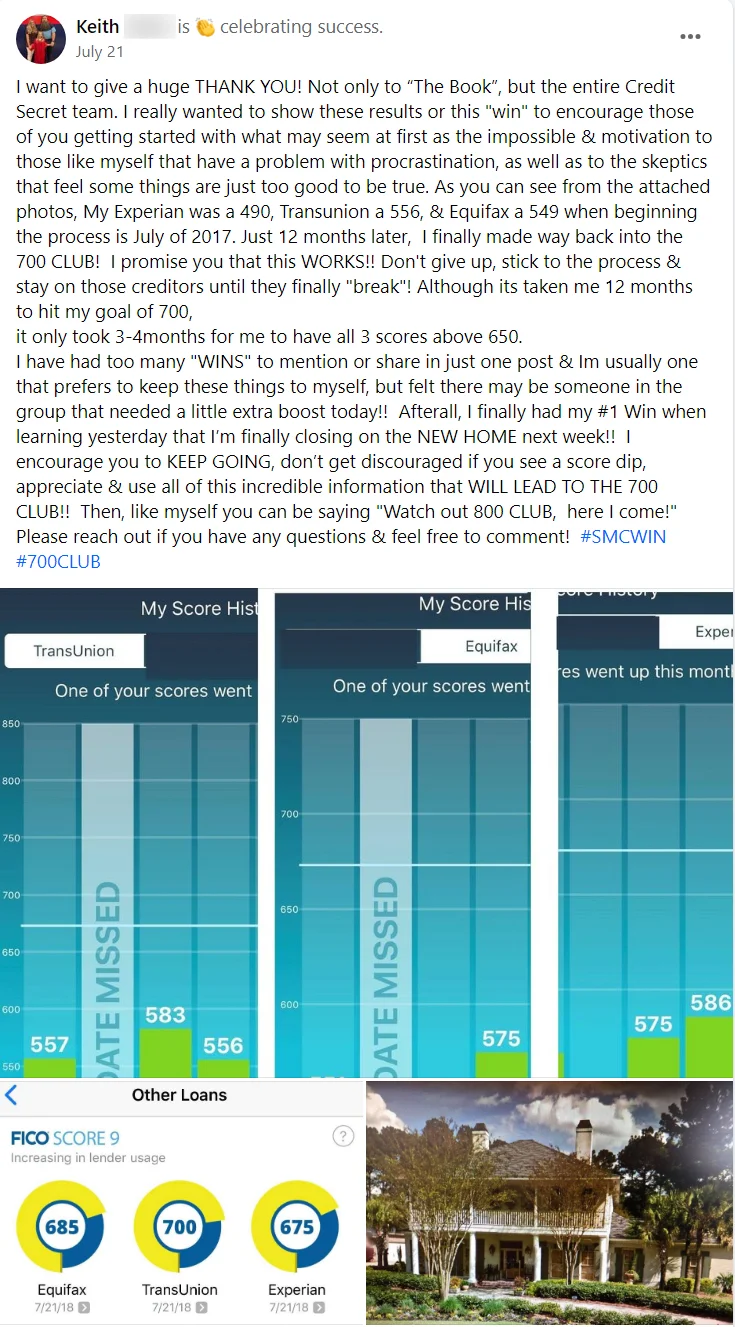

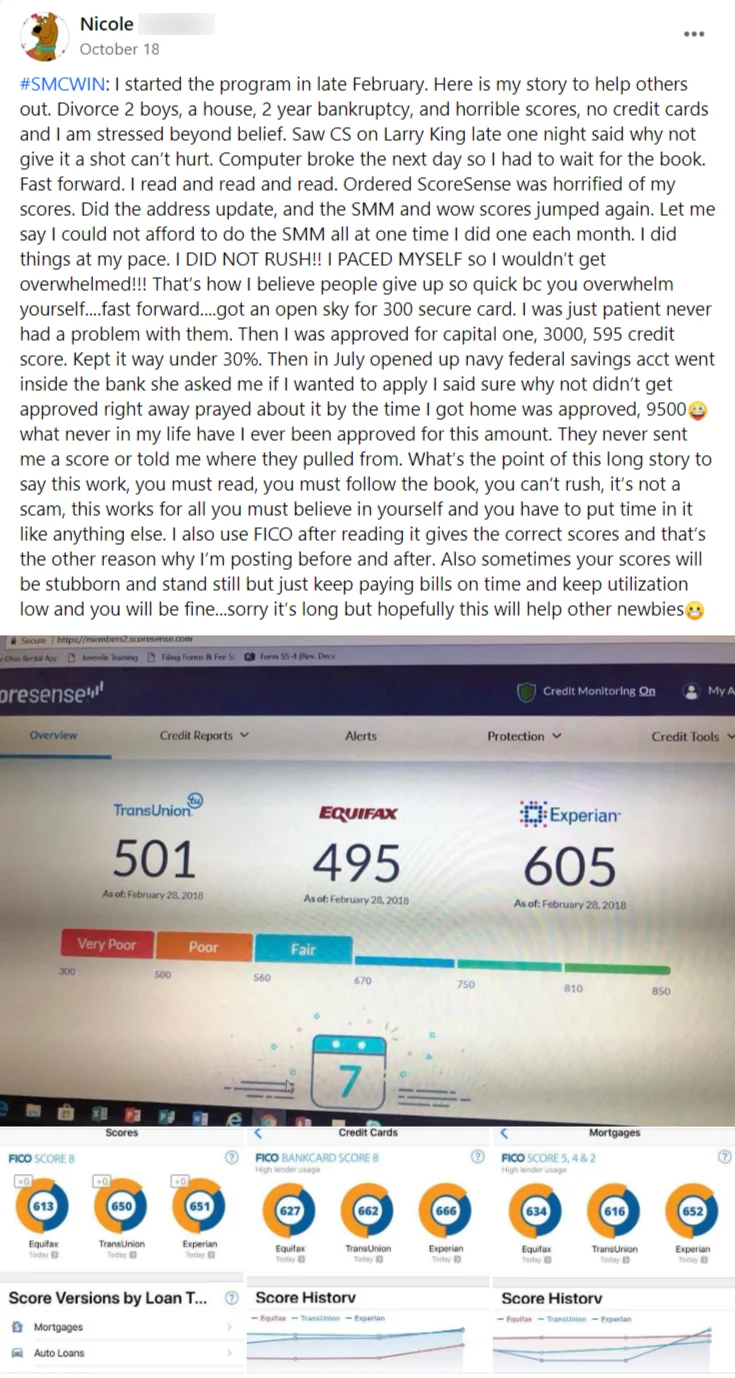

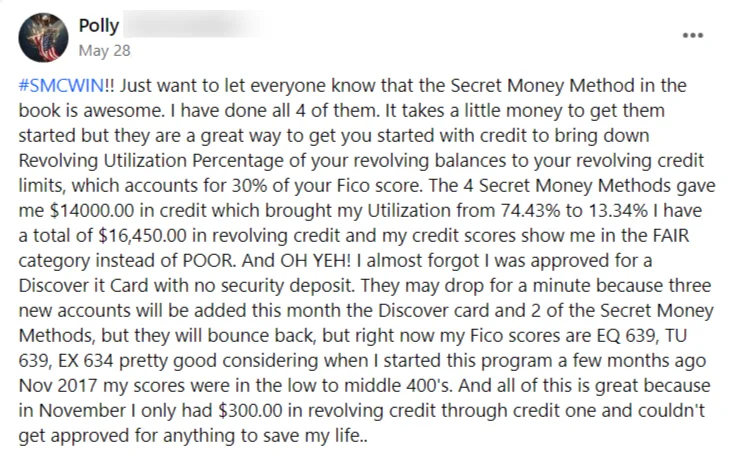

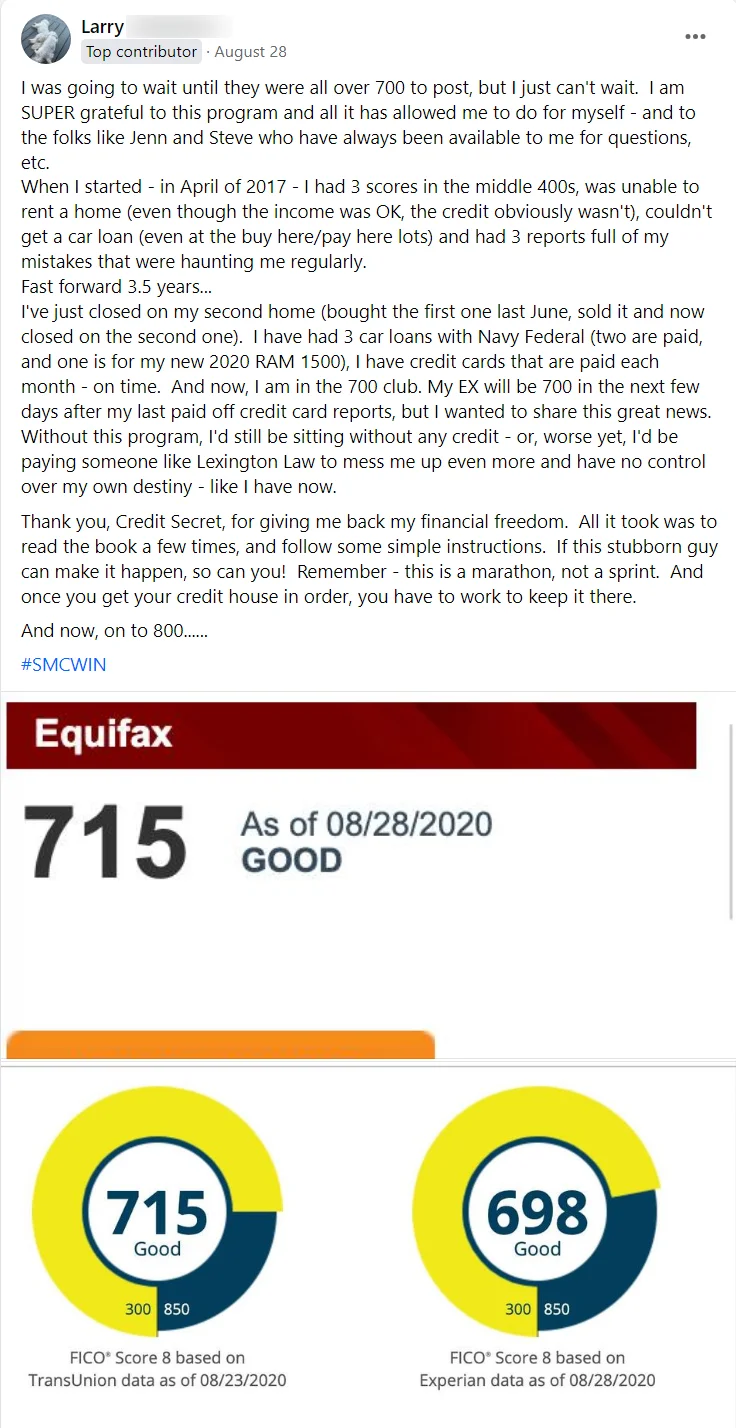

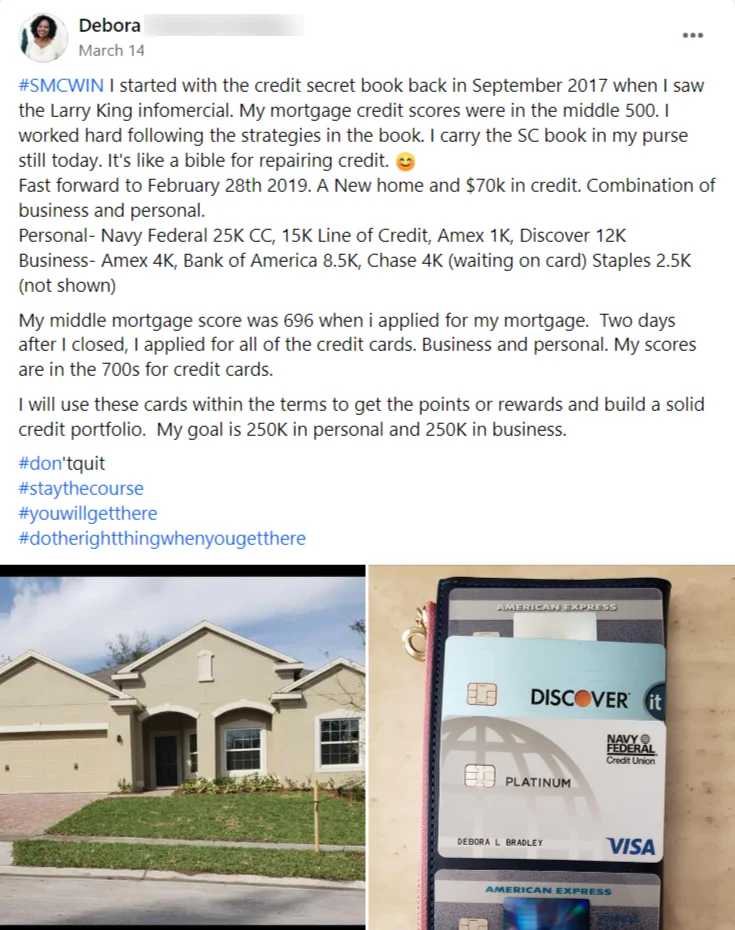

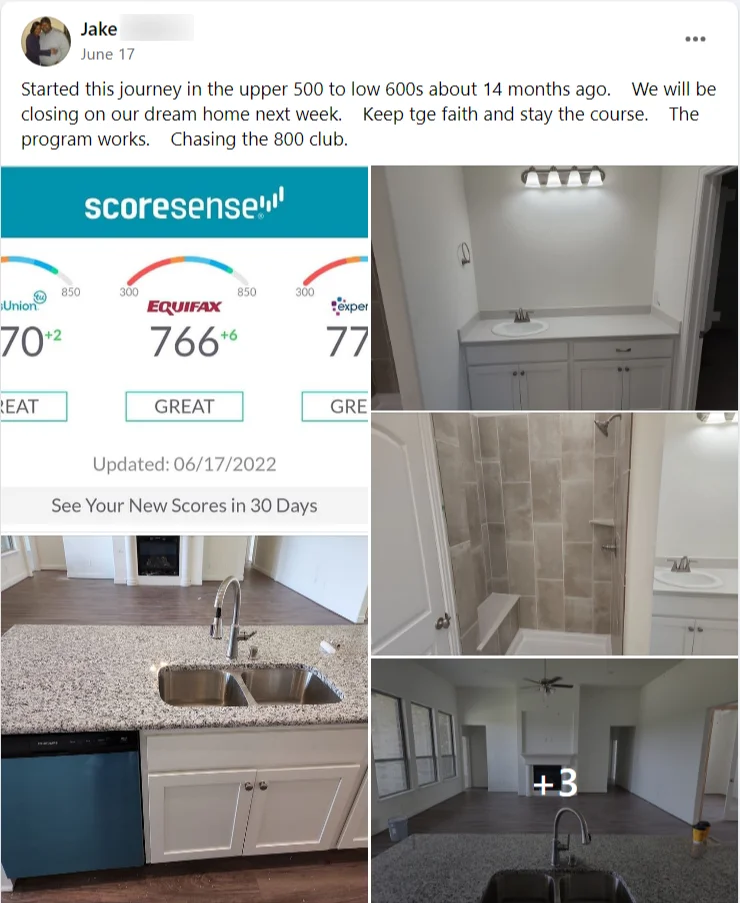

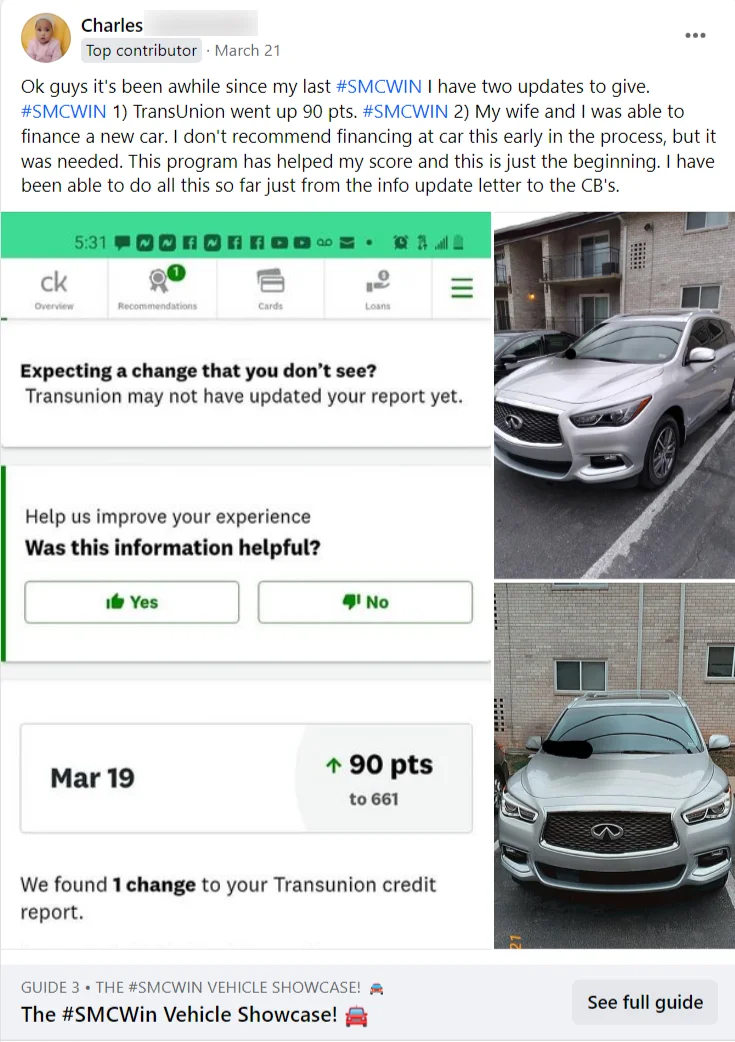

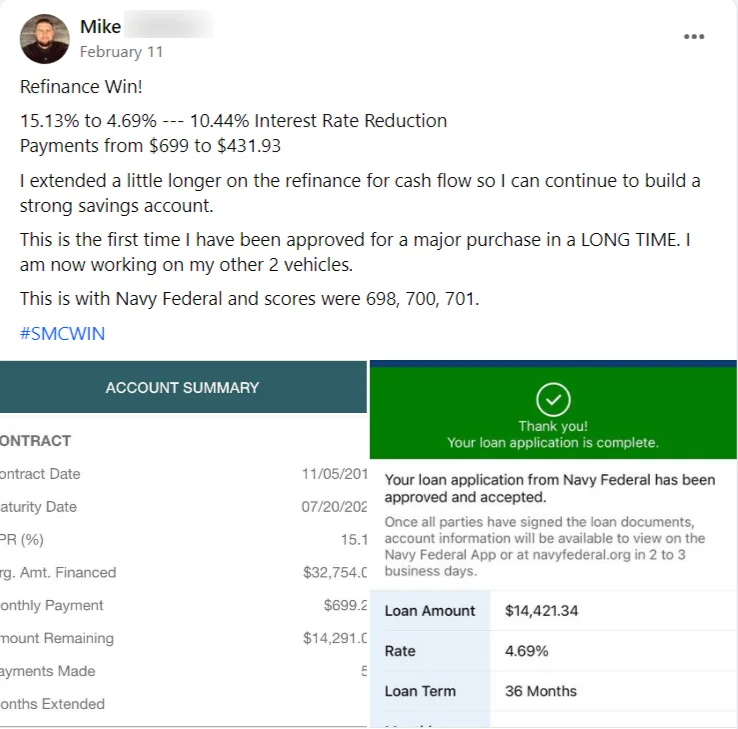

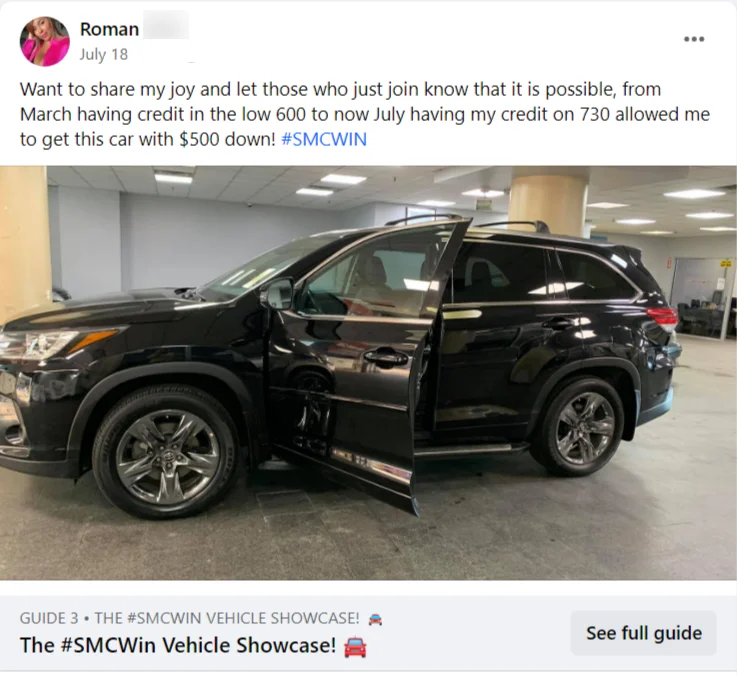

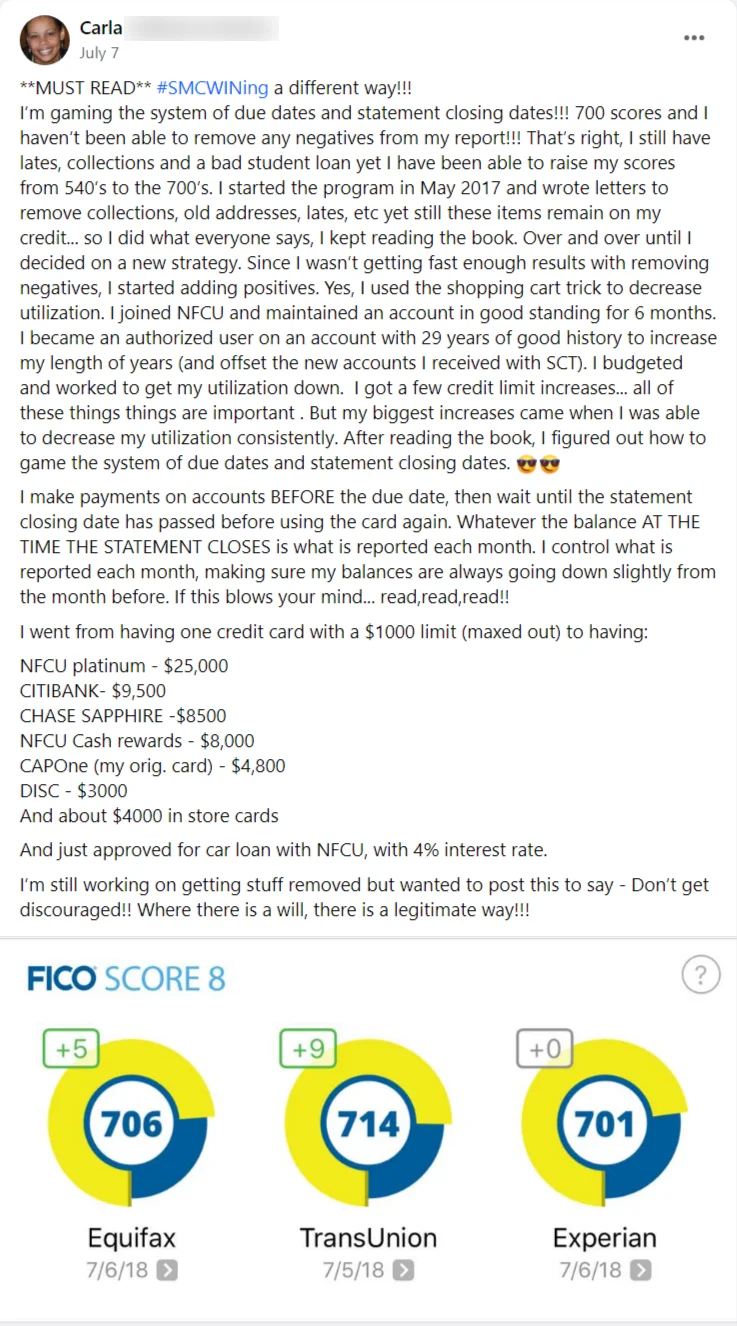

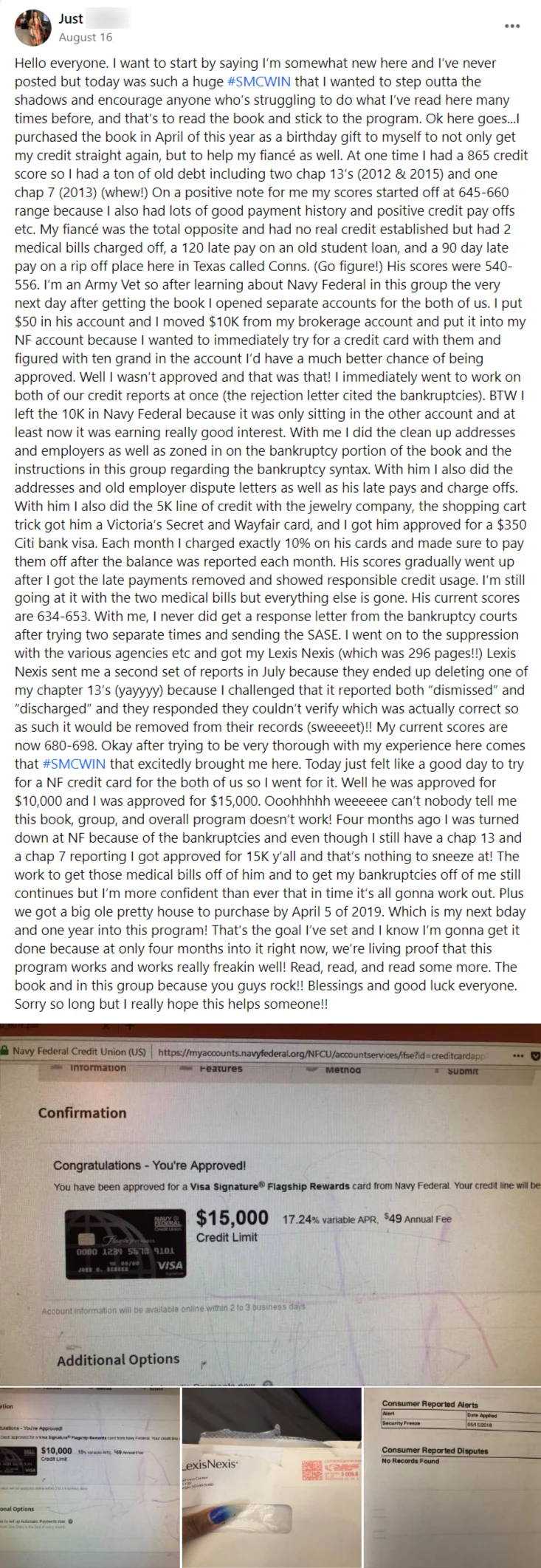

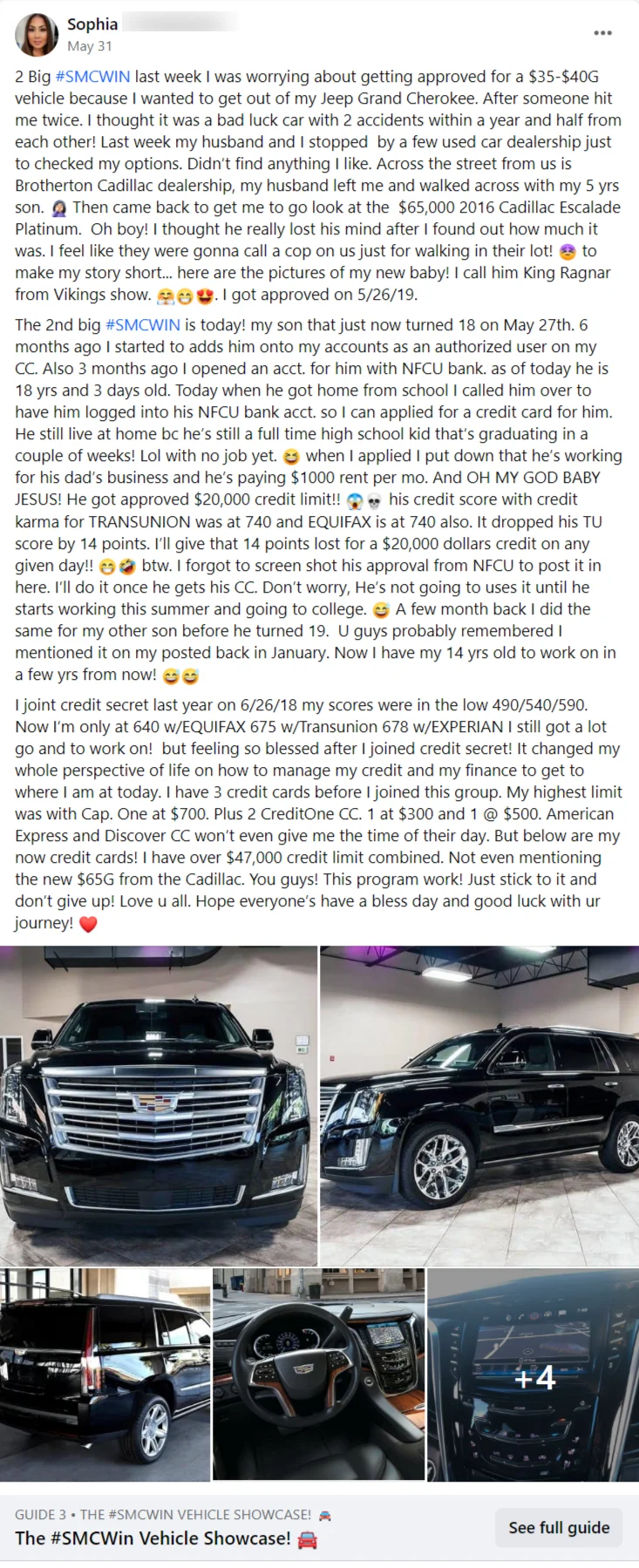

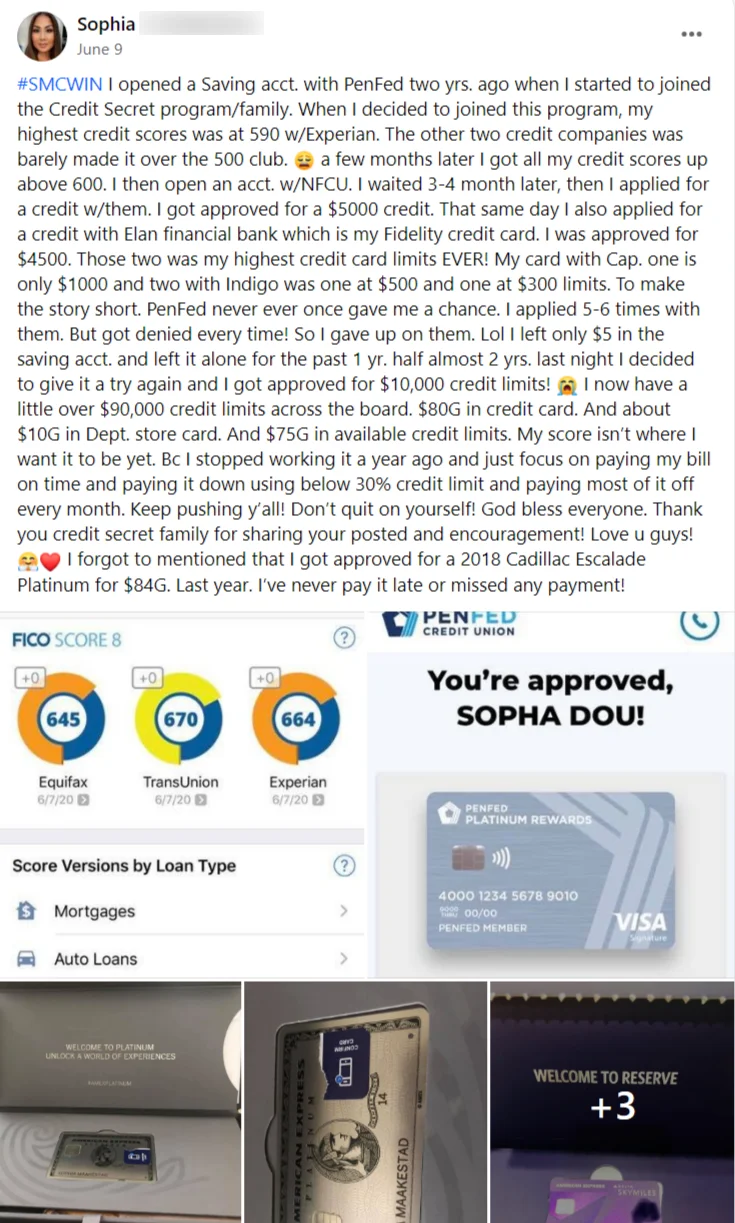

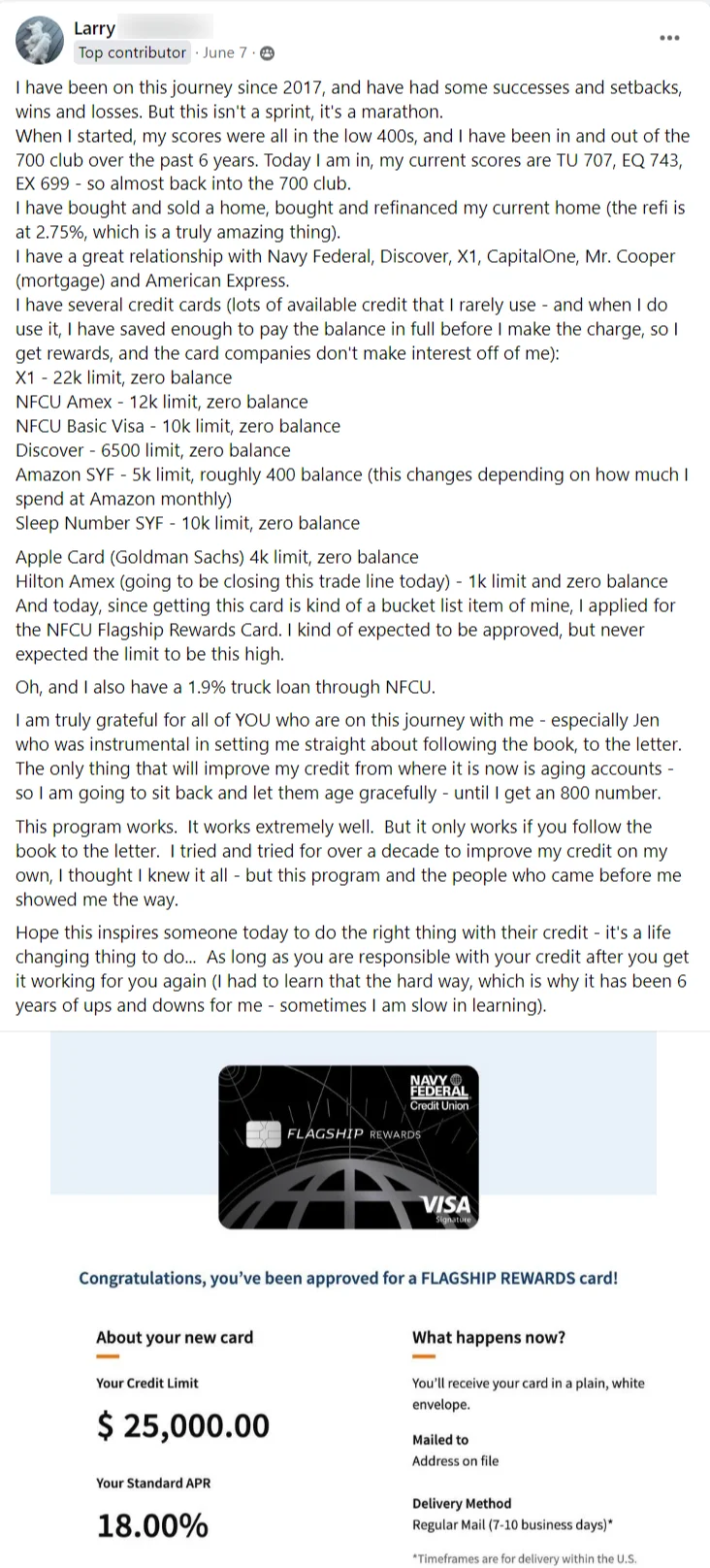

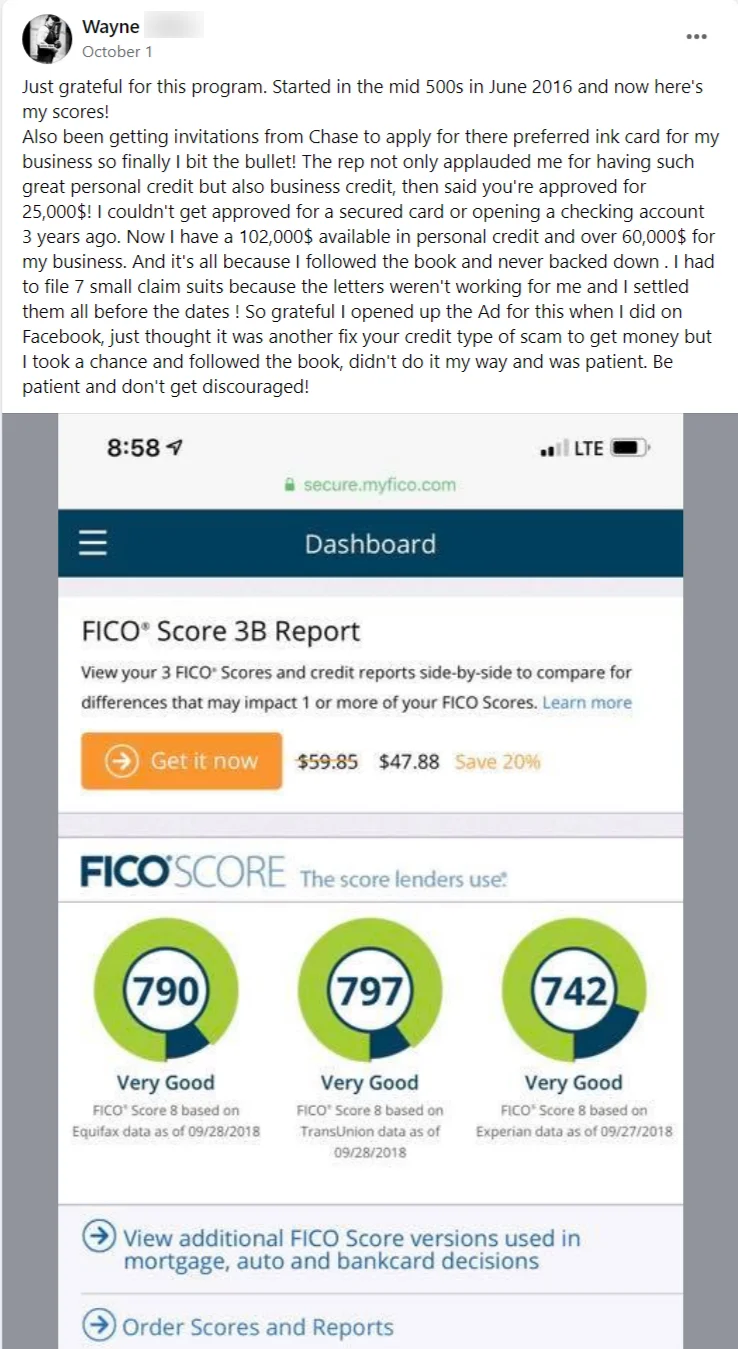

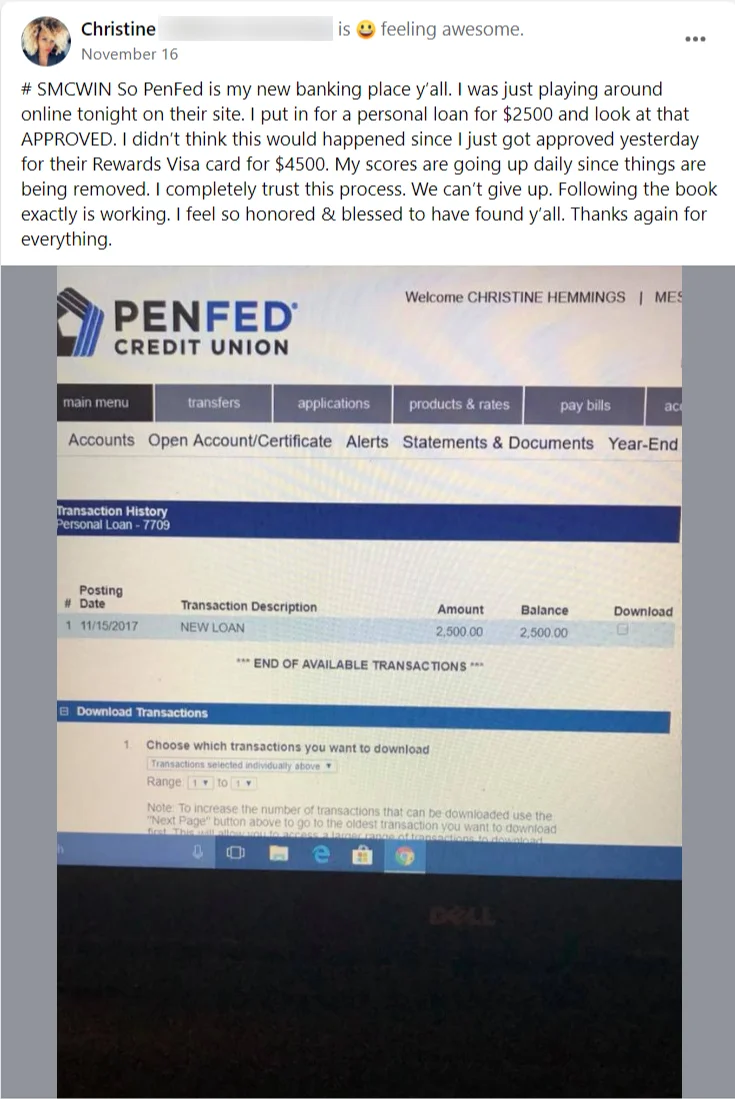

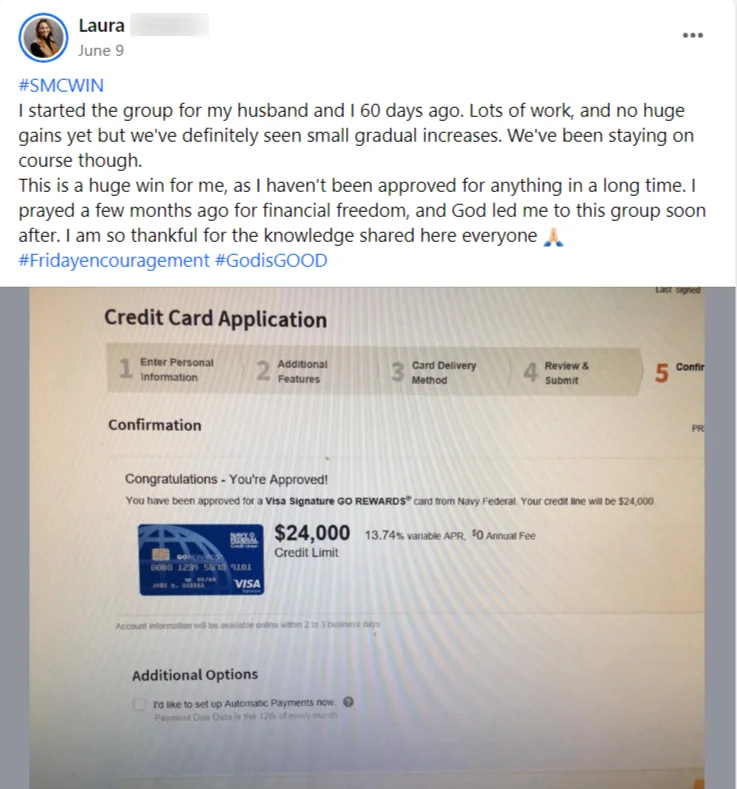

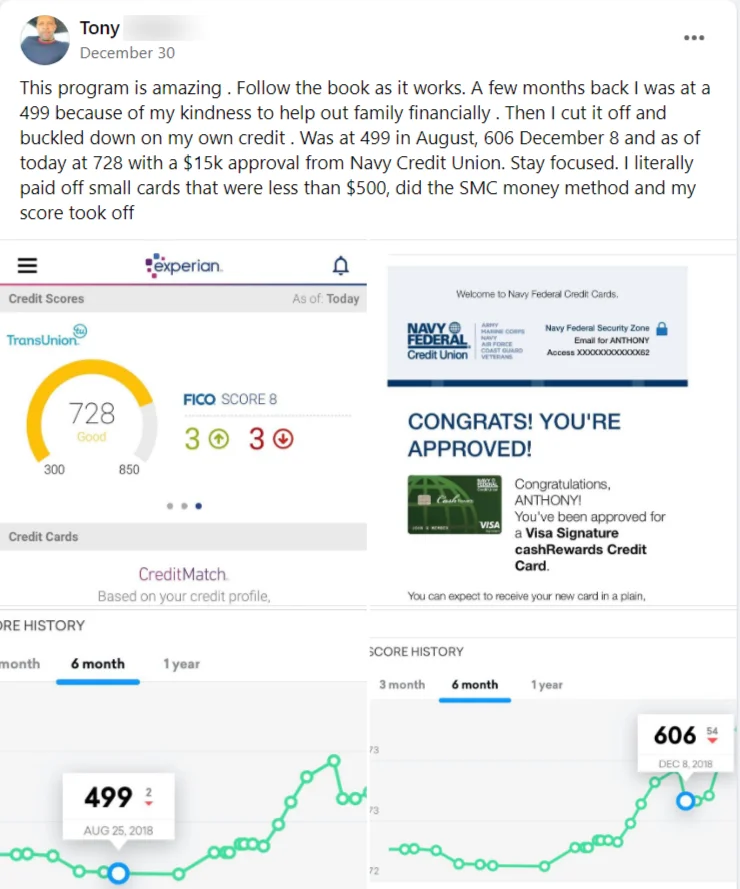

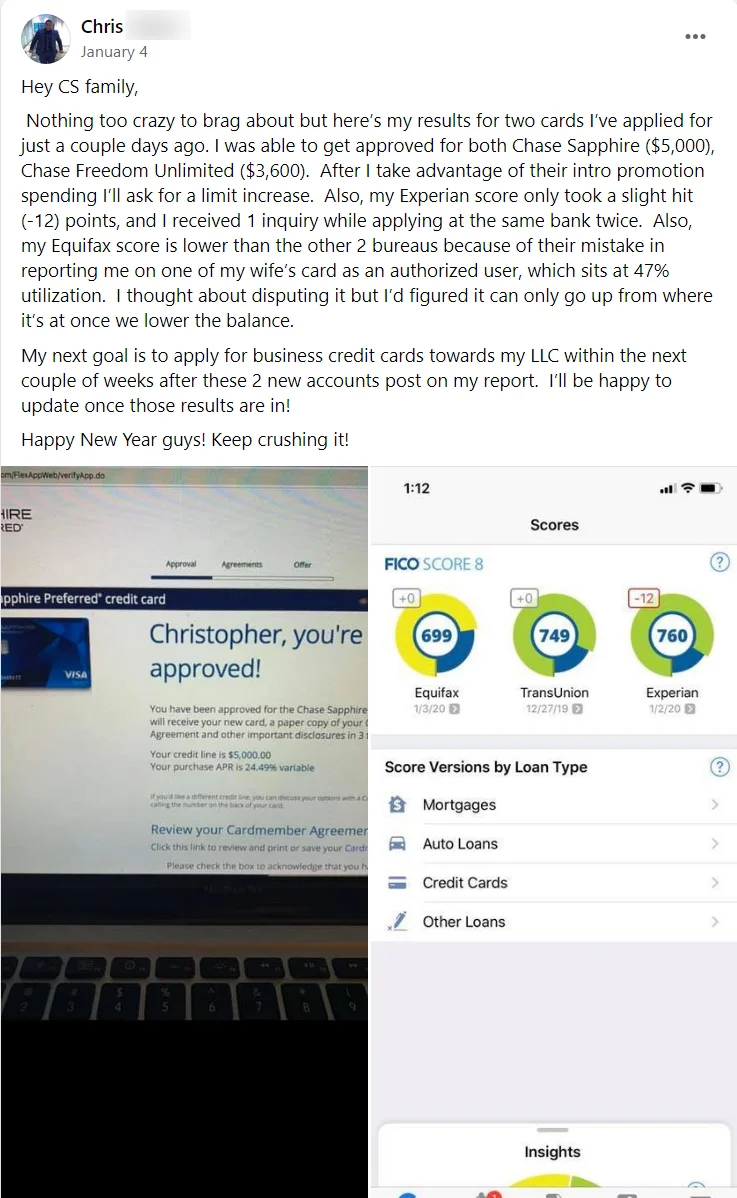

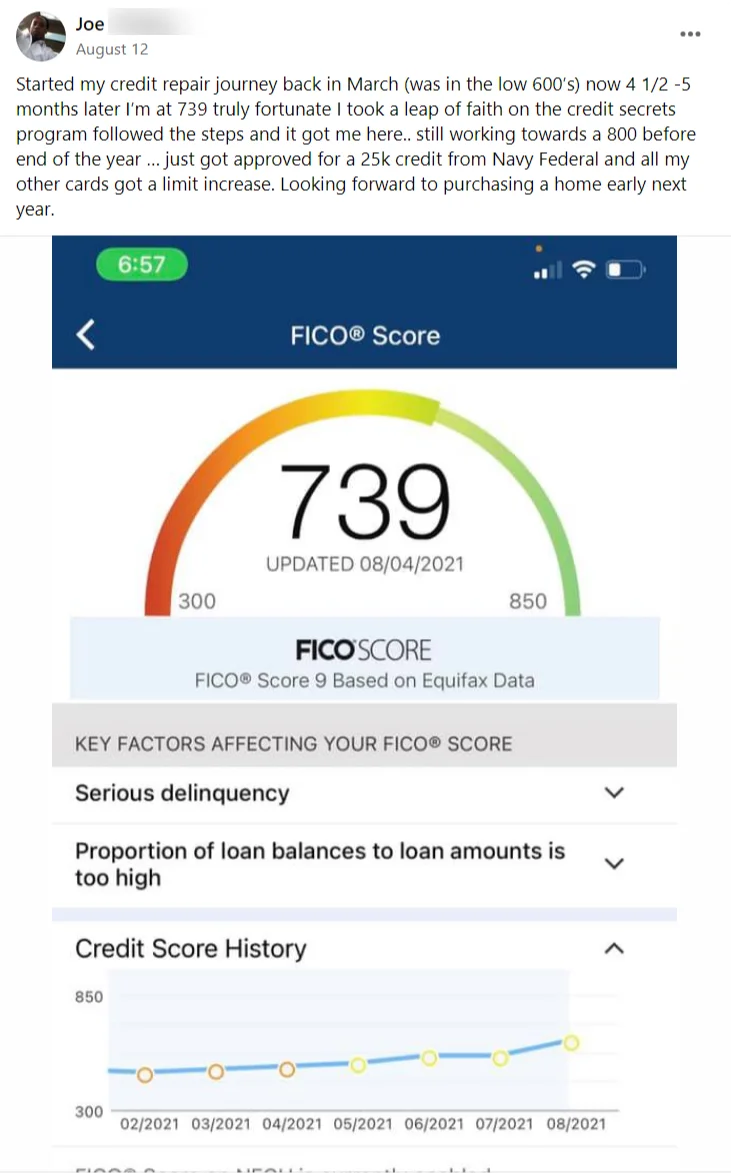

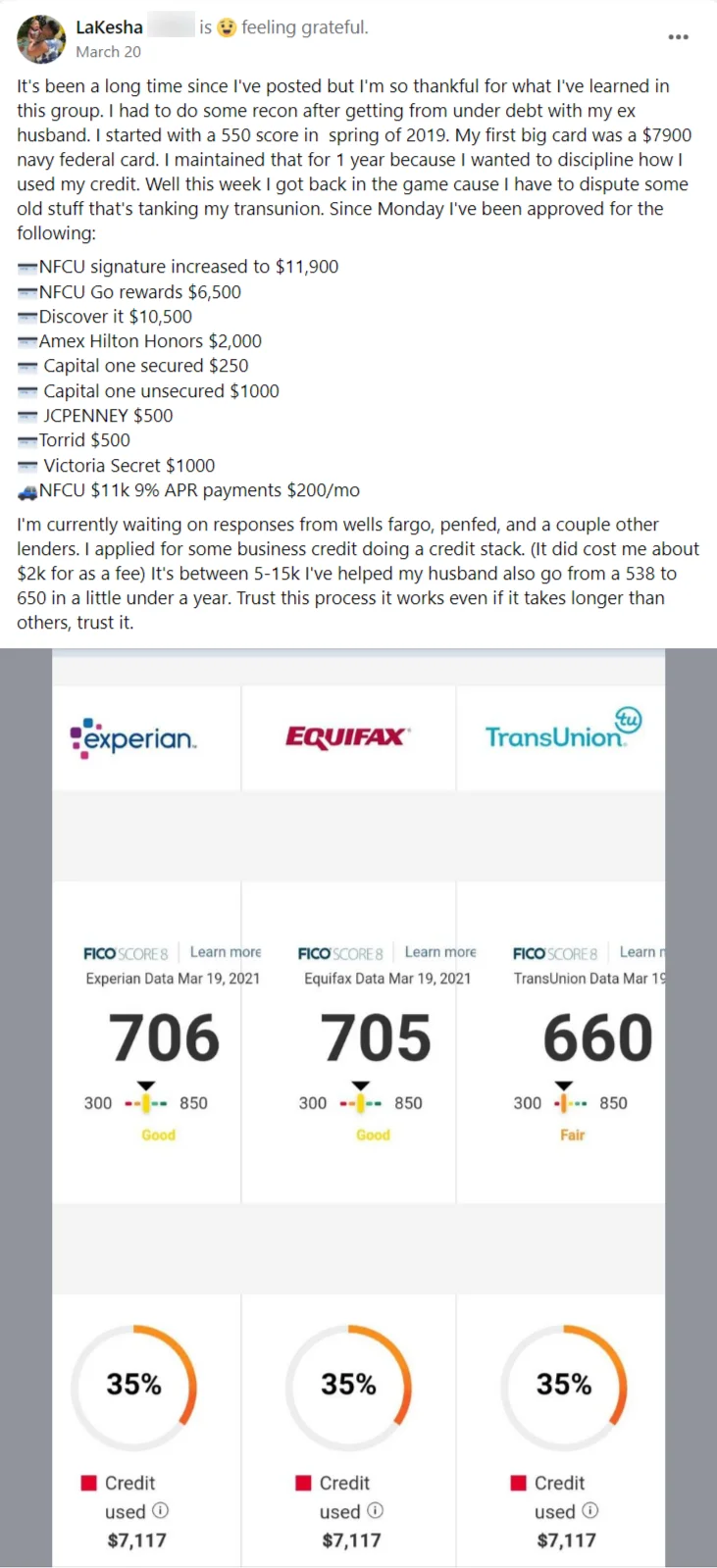

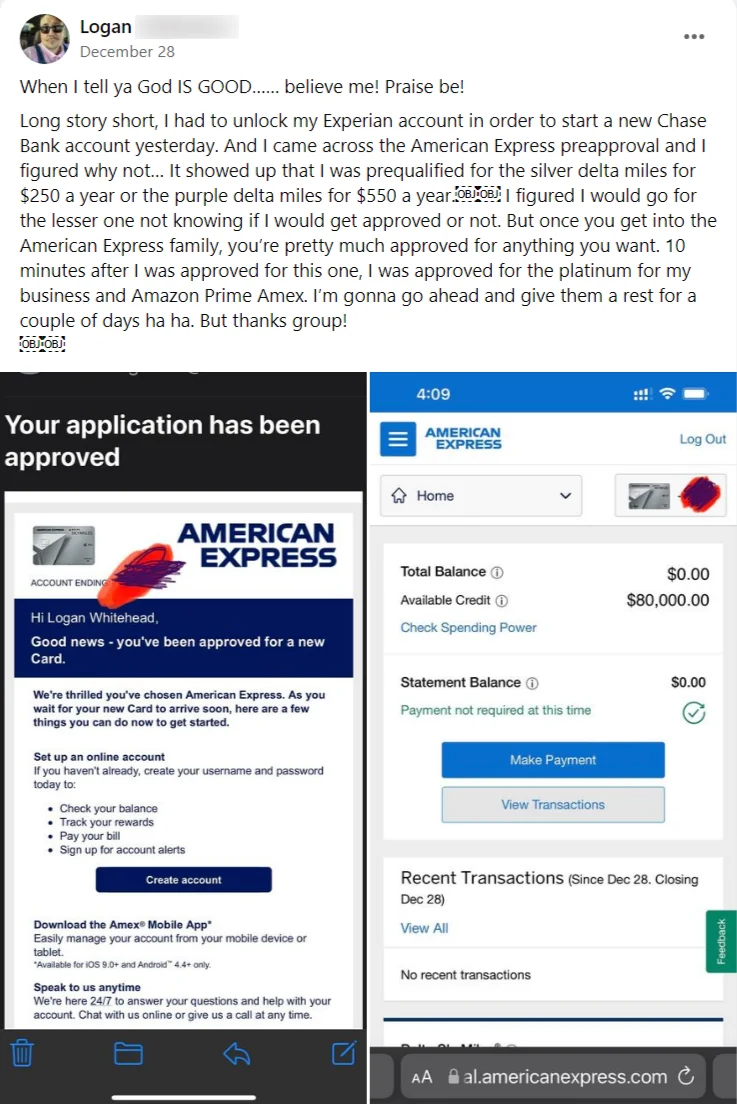

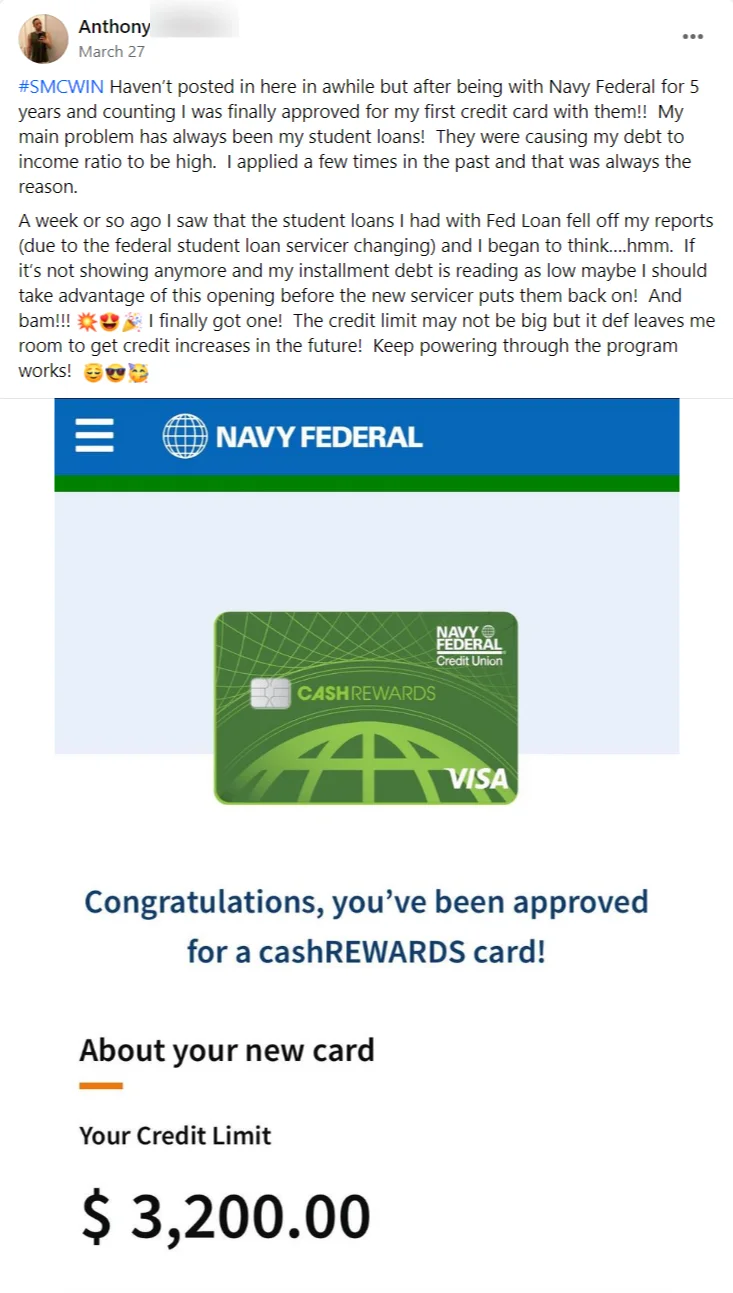

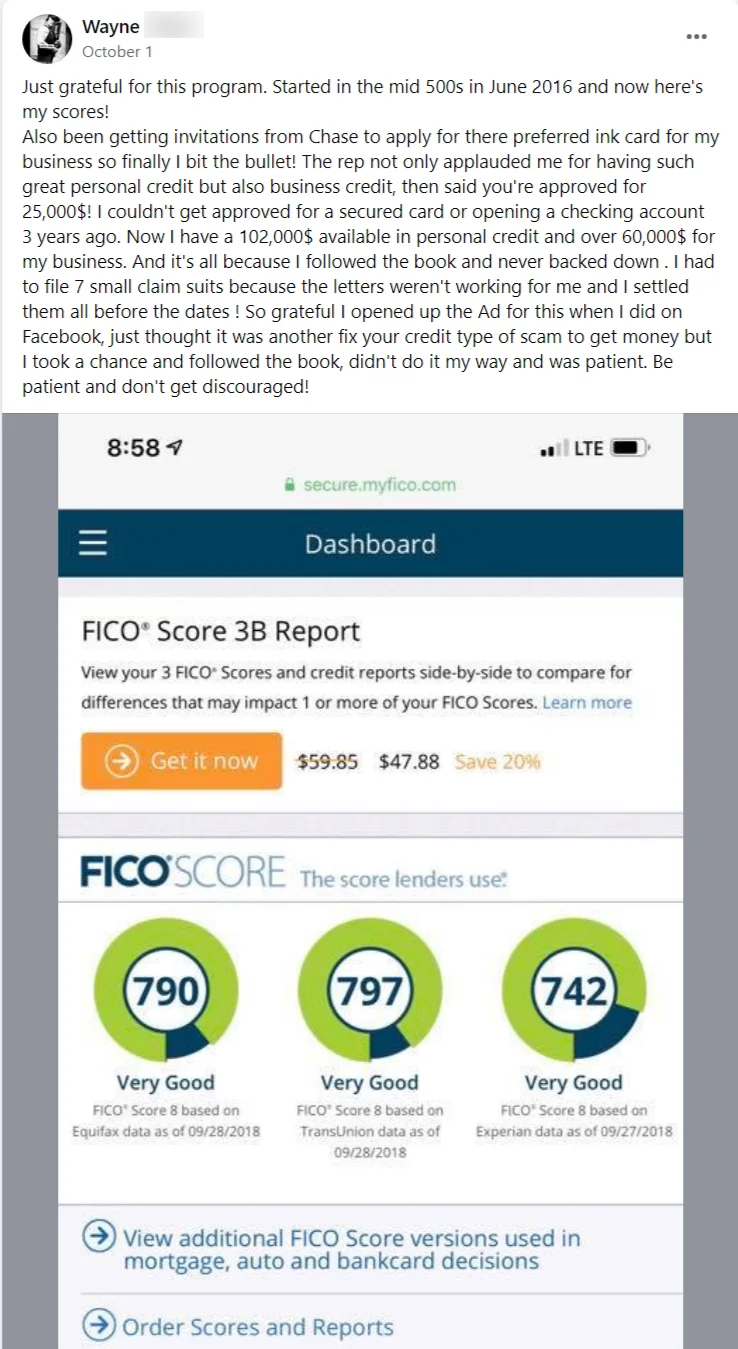

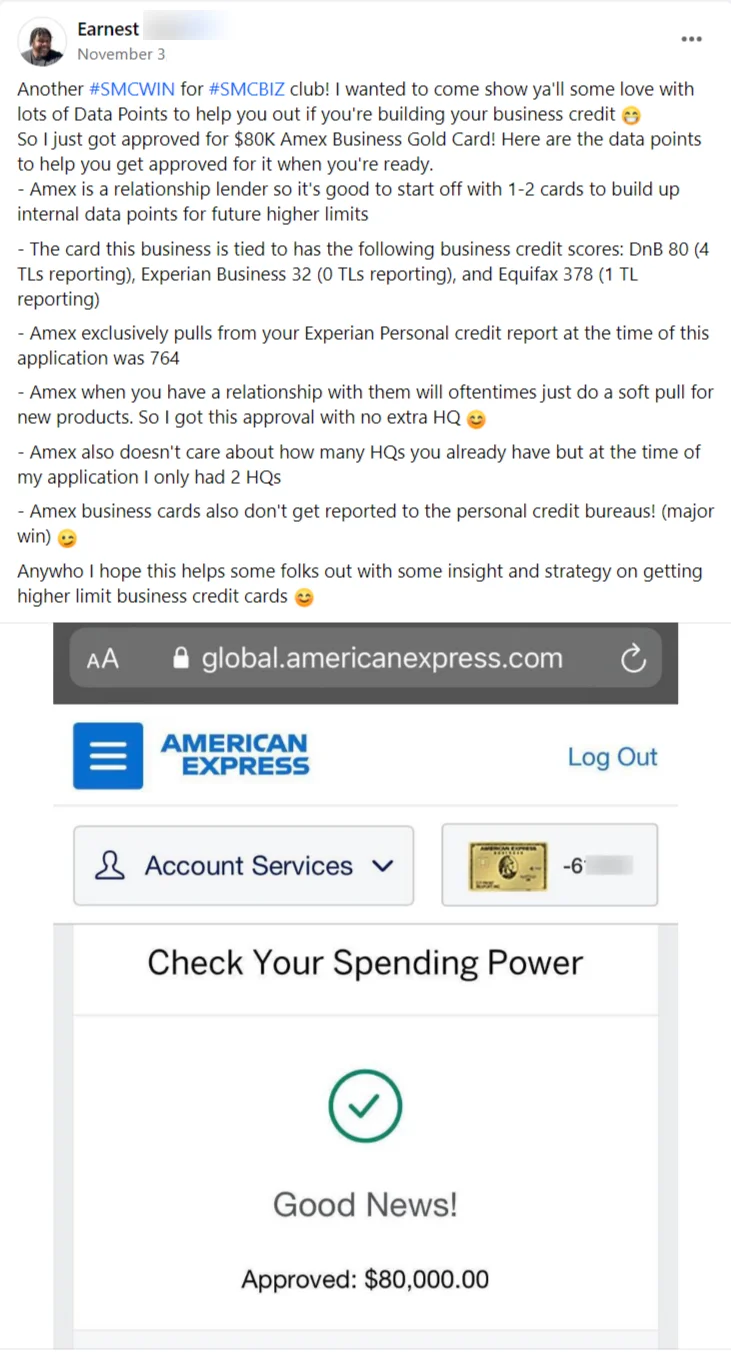

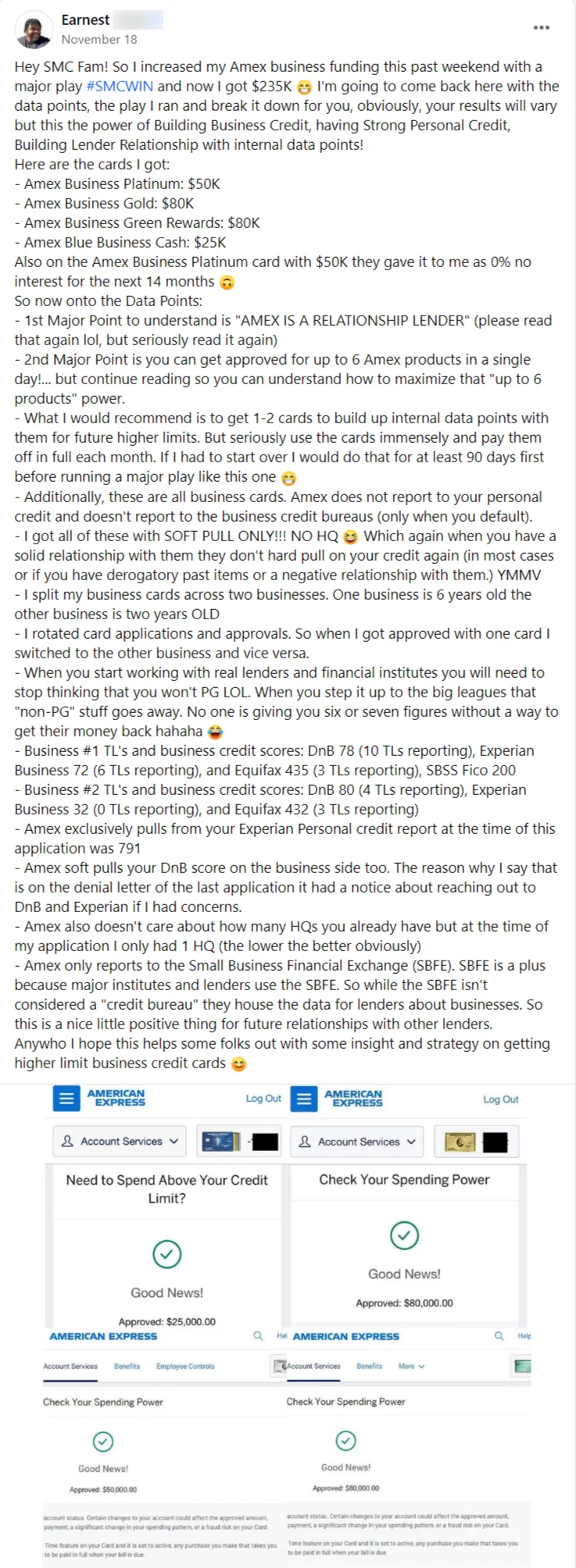

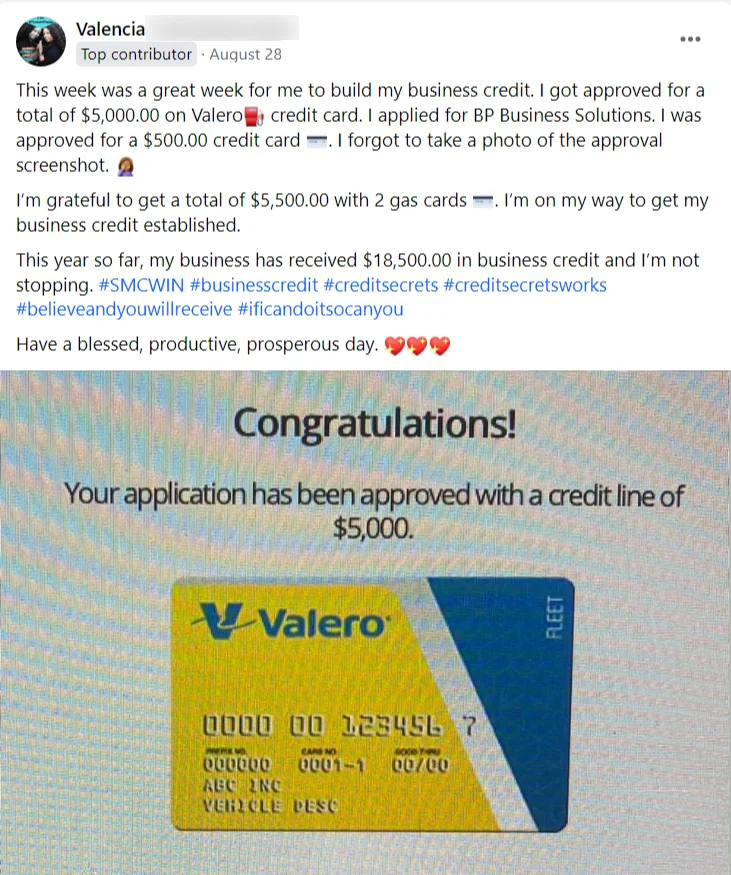

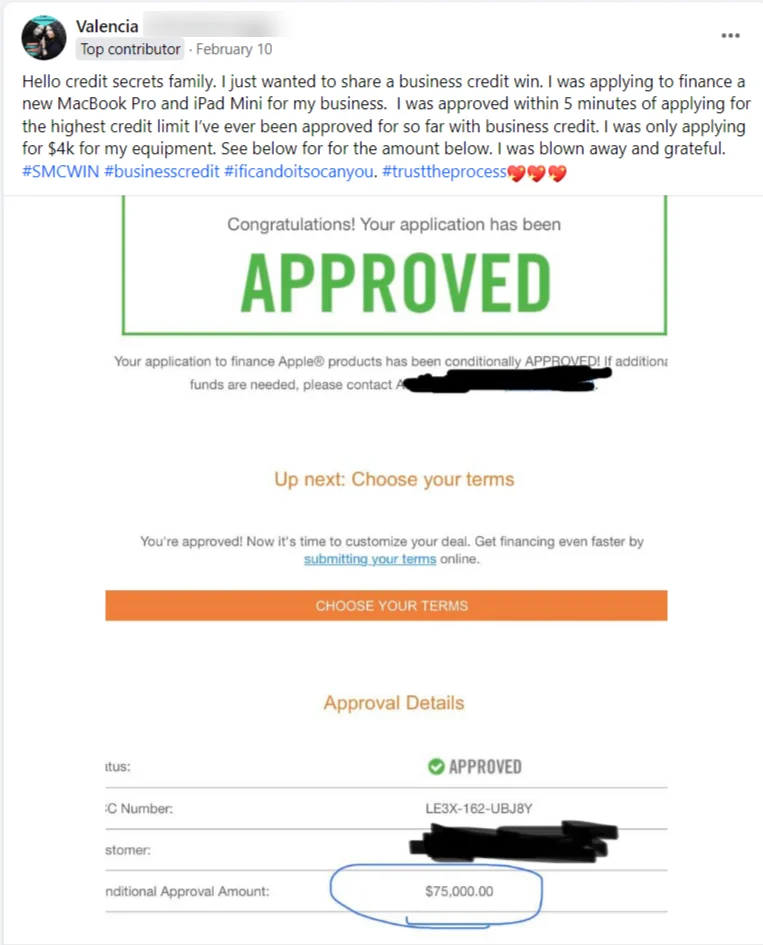

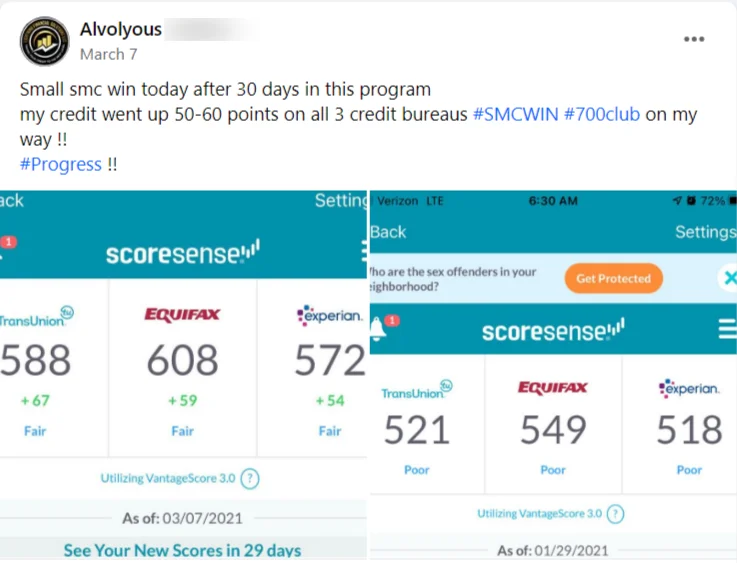

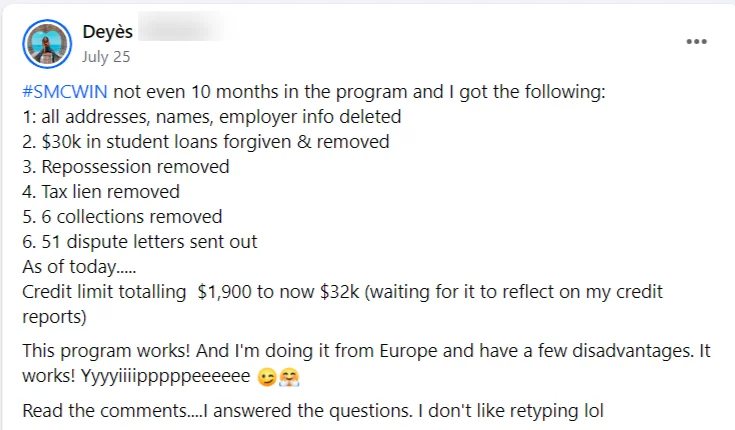

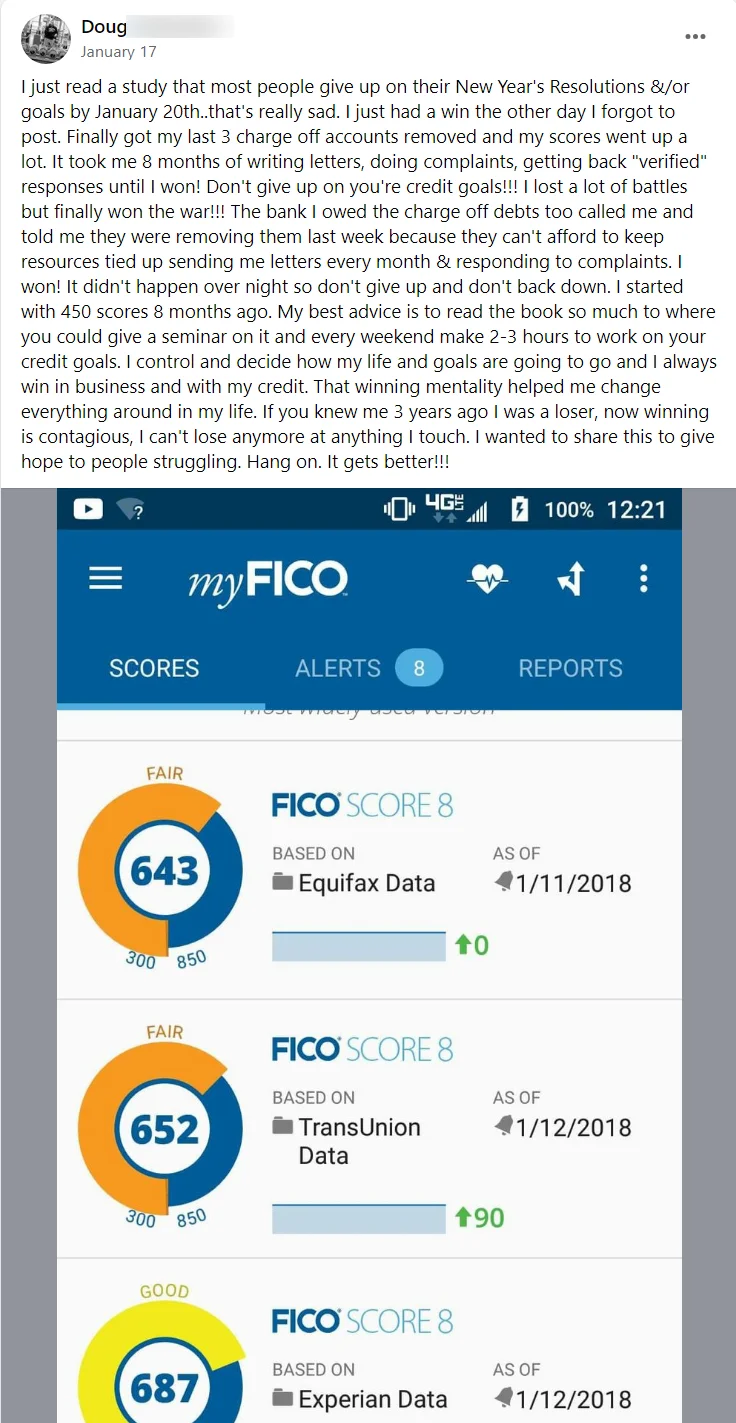

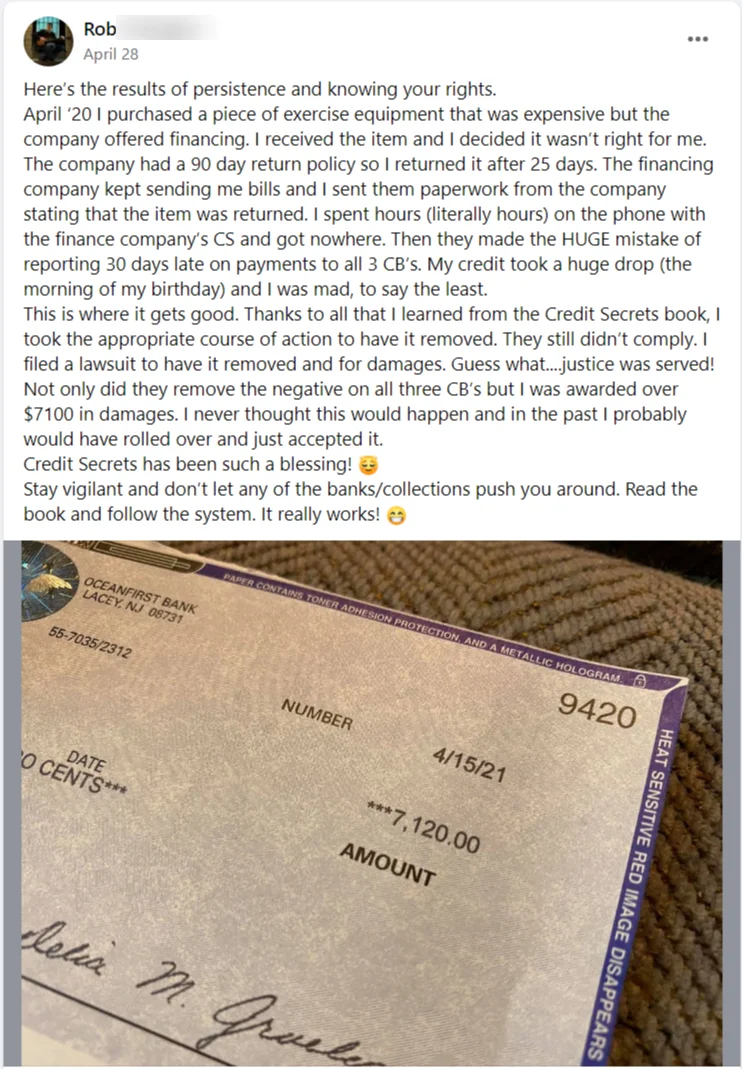

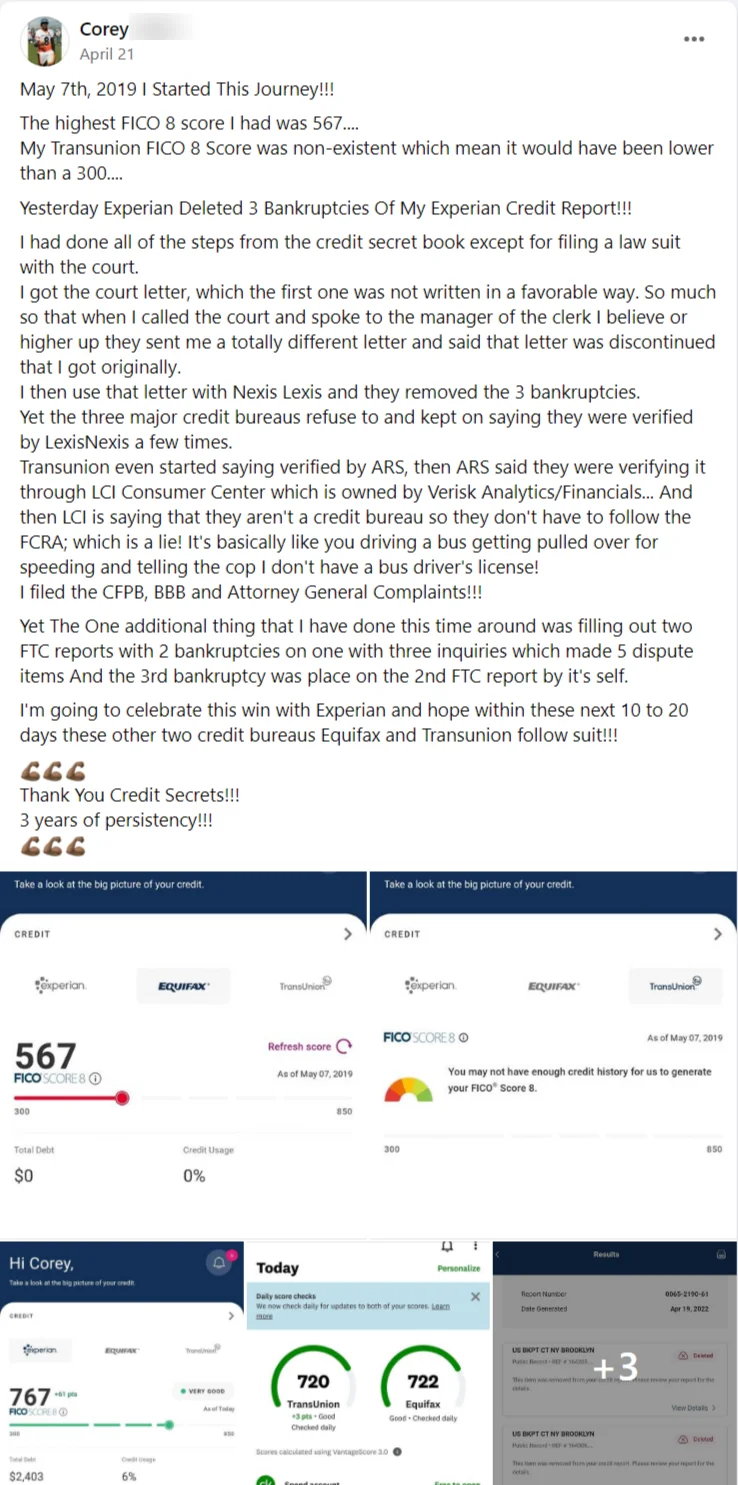

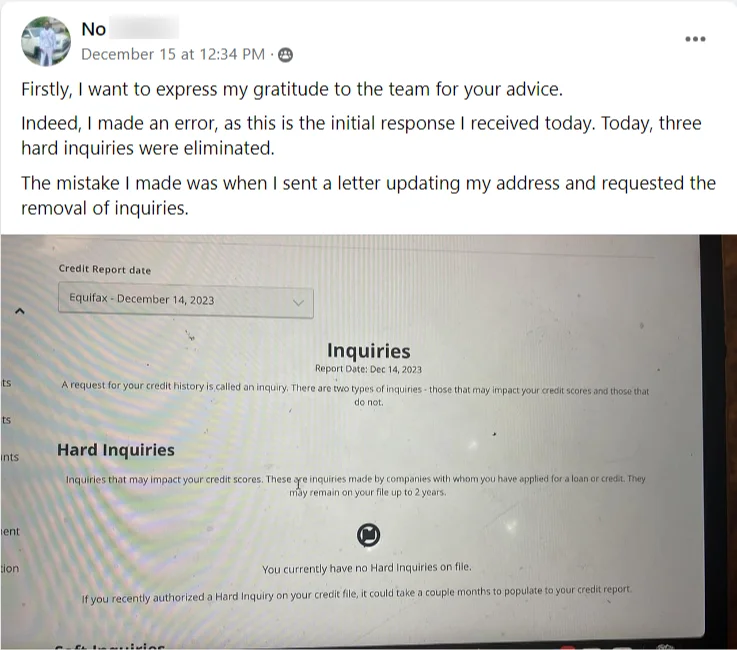

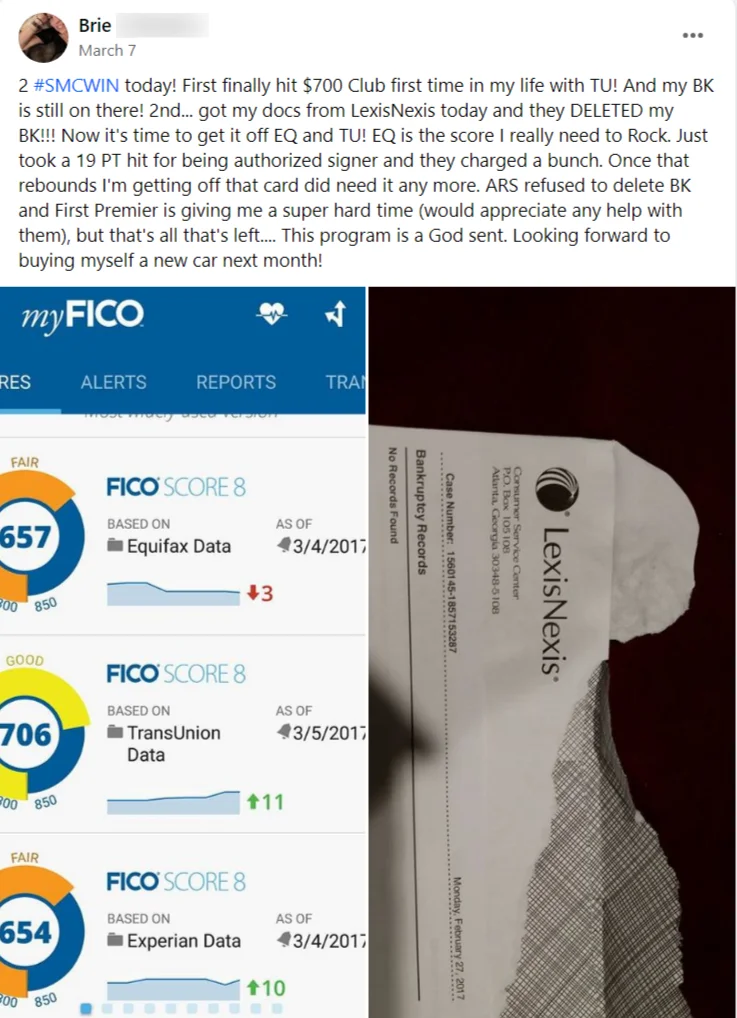

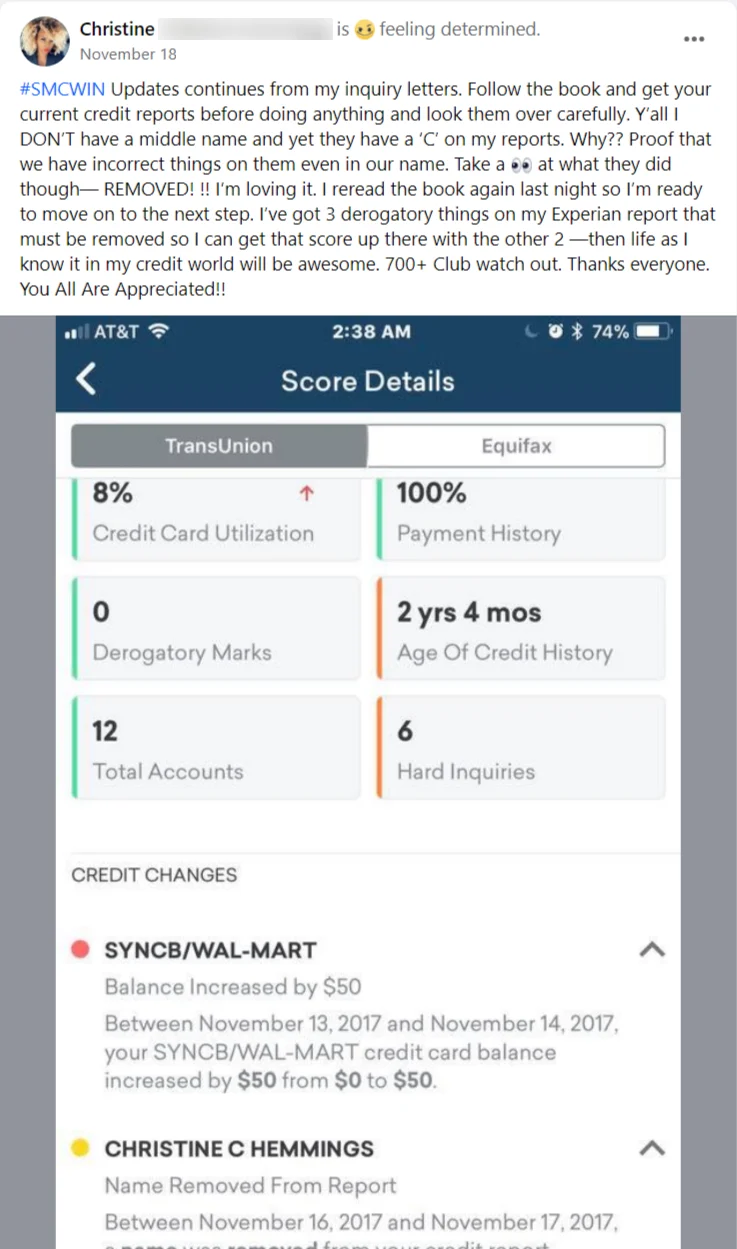

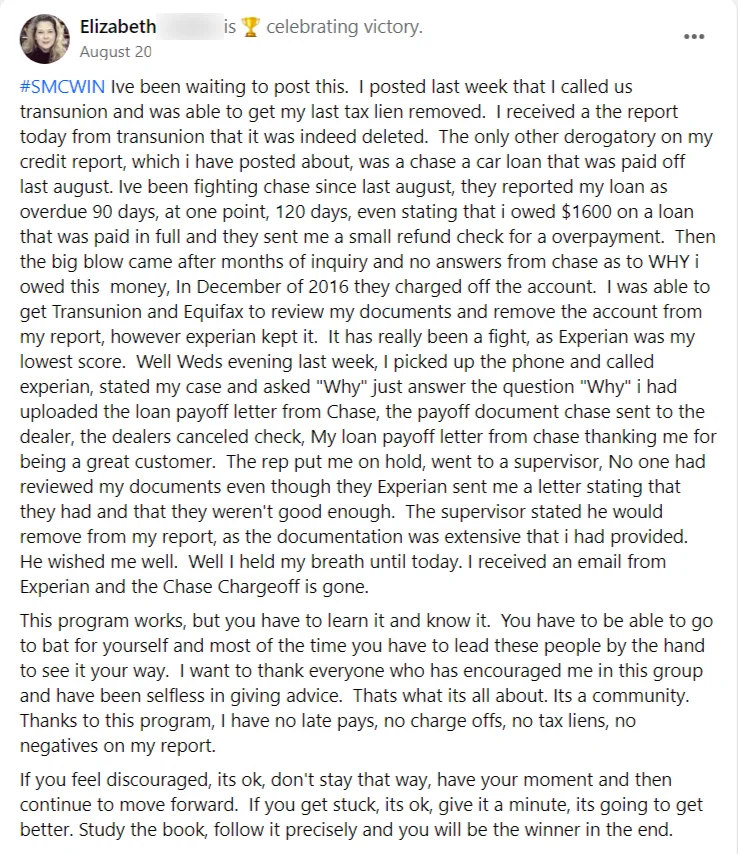

Hear From Real Customers

Discover The Program Now Helping Over 1 Million Americans Finally Get the Credit Scores They Deserve...

Unlock your financial future now!