How Does a Personal Loan Affect Your Credit Score?

Everything in life was going well, but suddenly, a huge medical bill is on your table. Your microwave broke down, and the electrician handed you a ridiculously large sum as his payment. Should you take more debt to get out of this situation?

In most situations, people opt for debt as a personal loan. Getting a personal loan is a great way to pay major expenses. But there’s one crucial aspect that most people forget.

It is the impact of a personal loan on your credit score. Overall, it’s not bad for your credit score, but if it’s unpaid for a longer duration, you have to face severe consequences.

Keep reading to learn more about whether applying for a loan hurts your credit and the connection between personal loans and credit scores. This can help you decide whether personal loans are the right choice for you.

The Immediate Impact of a Personal Loan on Your Credit Score

Suppose you’ve decided to apply for a personal loan. First, lenders will conduct a hard inquiry on your credit report. But you might have concerns: do personal loans hurt your credit? If yes then how does a personal loan affect credit score?

Every hard inquiry leads to lowering your credit score by a few points. Here’s what it means.

Multiple inquiries within a short period = Credit score keeps dropping

It makes lenders believe that you’re in a poor financial situation. Thus, concerns arise about your ability to manage additional debt. It temporarily leaves a negative impact on your credit score.

When your loan is approved, then the overall debt is increased. This additional debt leads to a higher credit utilization ratio. This results in a slight decrease in your credit score.

Long-Term Effects of Personal Loans on Credit Scores

Now you have the answer to whether personal loans can hurt your credit. Moreover, you have clarity regarding how a personal loan affects credit scores. Let’s dive deeper. Getting a personal loan is not a bad thing. But not paying the loan on time is a terrible thing that leaves a long-lasting negative impact on credit scores. According to TransUnion, the average personal loan debt per borrower in the United States is 10,749. You must get rid of personal loan debt as soon as possible.

The ideal thing in this regard is the on-time and consistent payment of personal loans. Payment history is a crucial factor for determining credit score. Here’s how it goes.

Get a personal loan → Make payments on time → Responsible borrowing behavior → Paying off loans → Improves creditworthiness → Increases your credit score.

Personal loans also contribute to a diverse credit mix. It’s another factor in credit scoring models. Suppose you have various credit types like installment loans and revolving credit and are managing them properly. It tells lenders you can manage various credits responsibly.

But there’s another aspect about personal loans.

These are used for debt consolidation. But how does it work?

You’ll combine multiple debts into a single loan. There’s a fixed repayment plan and interest rate. You can simplify debt repayment by consolidating high-interest debts like credit balances into personal loans. It’ll lower your credit utilization ratio and increase your credit score.

Factors Influencing Credit Score Calculations

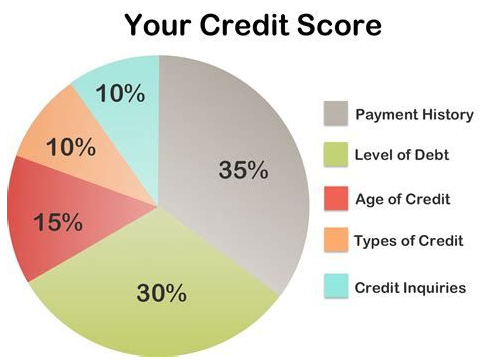

Source: dpsnetwork

The credit bureaus have a systematic approach to calculating credit scores. Knowing this lets you make better financial decisions and secure your future.

The key factors involved in calculating credit scores are as follows. Knowing about this helps you understand personal loans and credit scores in a much better way.

- Payment History: Timely payment shows responsible deny management.

- Amounts Owed: It initially increases your credit utilization ratio. But with repayment, you can lower it and improve your credit score.

- Length of Credit History: By opening new personal loans, the average age of credit accounts shortens. But with time, consistent loan payments contribute positively to the length of credit history.

- Types of Credit Used: These loans add diversity to your credit mix. Thus enhancing your credit score.

- New Credit Inquiries: Initial inquiry has a short-term negative impact on credit score. But with responsible financial behavior, the effect diminishes.

Strategies for Managing Personal Loans and Credit Health

Start by making a proper plan for debt repayment. Timely payment is the key to managing it effectively, which will also increase your credit score. Avoid taking more debts or over-borrowing unless it’s super necessary.

Only borrow what you need and can afford to repay. Often, people get blinded by the temptation to take out more than necessary. It will only lead to financial strain and increase the risk of default.

Regularly check your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). Look for any inaccuracies or discrepancies and dispute them quickly. It’s a crucial step for protecting your credit report and score.

Keep your credit utilization ratio low and diversify your credit mix. Don’t open new credit accounts unnecessarily. Apply for new credit only when necessary.

If you think you can’t manage all of this alone, don’t hesitate to contact experts and utilize credit monitoring services. Credit monitoring services keep you informed about your credit health and help keep the road to financial well-being nice and smooth.

Don’t stop here. Instead, take steps towards your financial stability. How can you do that?

By being financially literate. We have compiled some of the best financial health and credit score tips in the Credit Secrets book. If you want to understand credit management at a deeper level, give it a read now.

Navigating Loan Applications and Credit Checks

Loan applications should be handled carefully. Lenders often do a hard inquiry, which lowers your credit score. Now, you should ensure that the number of hard inquiries is limited so you don’t impact your scores too much or appear to be desperate for a loan. You always want to minimize the impact on your credit score. So, the answer to the question: does applying for a loan impact your credit?

Yes, to some extent.

Here’s a pro tip: Use pre-qualification tools offered by lenders. It allows you to get estimates of loan offers without lowering your credit score.

Don’t just accept the first loan offer. Shop around and compare several options. Research different lenders, including:

- Banks

- Credit unions

- Online lenders

Use loan comparison tools to compare offers from different lenders in one place. Consider the short-term and long-term impact of loans and choose an offer that aligns with your financial goals.

Conclusion

Sometimes, getting a personal loan is important to keep life moving. However, don’t keep yourself stuck there. Instead, take proper measures to utilize your right to take a personal loan while improving your credit score. Pay on time, check for discrepancies, and contact us for assistance.

Most people take personal loans on a whim. They don’t consider their financial situation. Avoid making this mistake.

If you want expert help regarding financial management and credit improvement, then reach out to us today. We have helped several people become financially stable and achieve good credit scores.

Jenn Cartwright

What's Trending