What Credit Score Do You Need For a Personal Loan?

Personal loans act as a life savior for individuals who seek financial flexibility to cover expenses. These include medical bills, home improvements, debt consolidation, or unexpected emergencies. But can anyone get personal loans?

The truth is that taking out personal loans isn’t a piece of cake. Your credit score plays a critical role in a personal loan journey because that’s the first thing lenders will consider before giving you a loan. No one wants to give money to someone who’s financially irresponsible.

The higher the credit score, the lower the risk perceived by lenders. The cherry on top is that you can get a loan at favorable terms.

But not all lenders are the same. The general guidelines are similar. However, every lender has different criteria for evaluating loan applications, and the minimum credit score for personal loans may vary.

For instance, most traditional banks and credit unions are strict and only provide loans to individuals with high credit scores. However, online lenders or alternative financial institutions are lenient.

Let’s dive deeper and learn more about what credit score is needed for a personal loan, whether applying for a loan hurts your credit, the minimum credit score for a personal loan, and much more.

Understanding Credit Score Requirements for Personal Loans

Before getting personal loans, you should understand the credit score requirements of lenders. Most lenders prefer borrowers with good credit scores ranging from 690 and above. But if you’ve got bad credit scores, you can find lenders accepting borrowers with credit scores. However, the typical minimum credit score for a personal loan is 560 to 660.

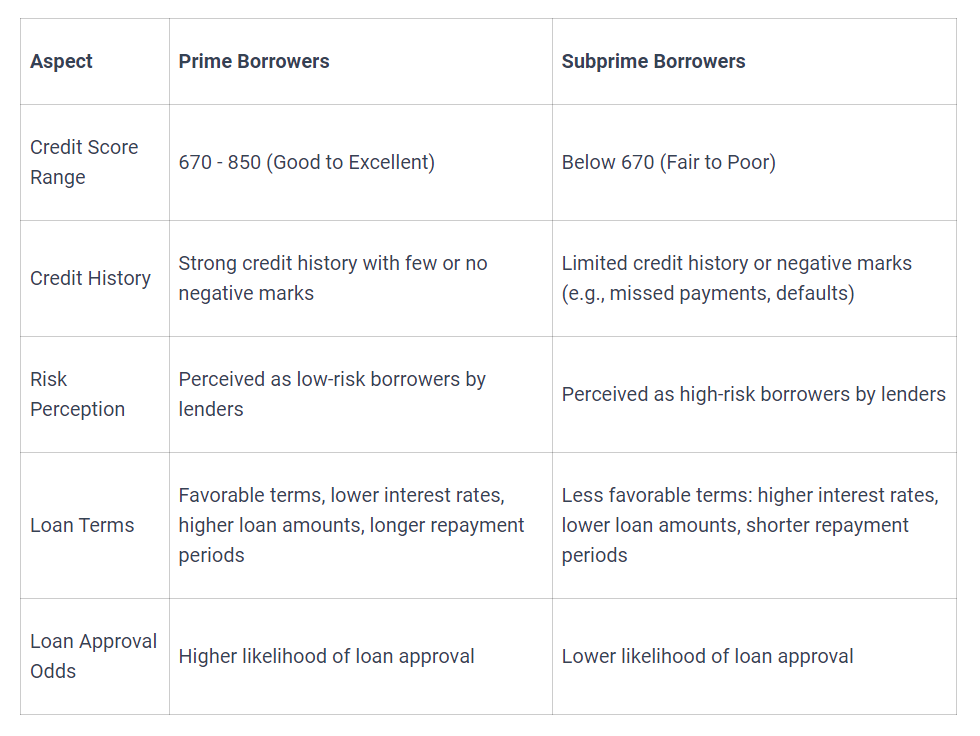

Lenders typically categorize borrowers into two main groups.

Credit scores directly impact various aspects of loan terms. Lenders use credit scores to assess the risk of lending money.

How much interest rate should be on personal loan terms?

What are the chances of loan approval?

What’s the repayment period of the loan?

Borrowers with high credit scores are considered less risky; they often qualify for lower interest rates. It also increases the likelihood of loan approval and the maximum loan amount borrowers qualify for. It also influences the length of the repayment period offered by lenders.

Factors That Influence Your Credit Score

Your credit score calculation is extremely important. Lenders don’t want to provide a loan to someone who has a low credit score. Do you know why?

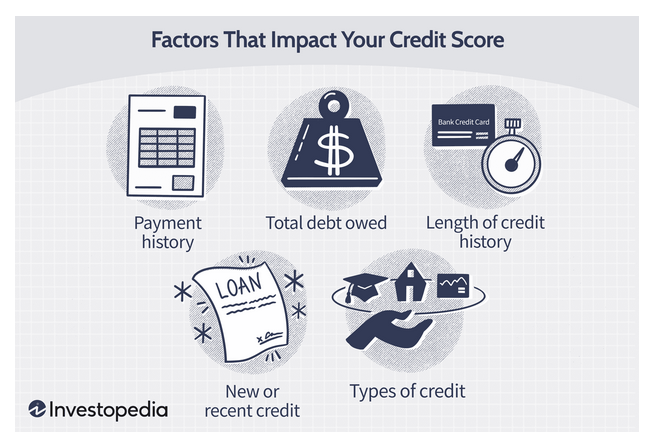

It’s because there’s a high risk associated with it. That’s why you should know five primary factors that impact your credit score.

Source: investopedia

Let’s understand each of these and how lenders interpret them.

- Payment History: It accounts for the largest portion of your credit score. It shows how financially responsible you are and how timely payments are. Lenders view the consistent history of on-time payments positively. Meanwhile, late payments indicate a high risk to lenders.

- Credit Utilization: It is the measurement of credit you use compared to the total available credit limit. You should keep your credit low, ideally well below 30%. A low credit utilization ratio suggests responsible credit management and low risk to lenders.

- Credit Age: It refers to the length of time your credit accounts have been open. Longer credit histories are viewed more favorably. It provides more data to lenders and assesses your creditworthiness.

- Types of Credit: It includes a mix of credit accounts an individual has, such as credit cards, installment loans, and retail accounts. Lenders prefer a mix of credit types as it shows a well-rounded credit profile and improves your credit score.

- New Credit Inquiries: The number of recent inquiries made on your credit report. For lenders, multiple inquiries are a huge red flag as they show financial strain and a higher likelihood of taking on additional debt.

Strategies to Improve Your Credit Score for Loan Approval

If you’re worried that you don’t have the best credit score for personal loan approval, don’t sweat. All you need to do is use some strategies to improve your credit score and increase your chances of loan approval.

First, you should understand your credit score and obtain credit reports from three major credit bureaus (Equifax, Experian, and TransUnion). Review all reports carefully and check for any inaccuracies. Make timely payments because it positively impacts your credit score. Your credit balance should be low relative to your credit limits.

High credit utilization = Negative impact on credit score

Don’t open multiple credit accounts quickly because this lowers your credit score. But what if you notice that your credit report has errors? What should you do?

You should immediately file a dispute with the relevant credit bureau. Share all the relevant documents along with proof of the error(s).

However, all of these are just short-term financial habits. The real financial transformation happens when you become financially literate.

Access our book Credit Secrets, now for deeper insights into credit management strategies.

Options for Applicants with Lower Credit Scores

What if you don’t have the credit score needed for a personal loan? A low credit score doesn’t mean you can’t get a personal loan. You can try many alternate options to secure loans even with a low credit score.

You can opt for secured loans and back it with collateral such as a vehicle or savings account. So, even if the borrower defaults, the lender may extend credit even to those with lower credit scores.

Another method is enlisting a co-signer with a strong credit profile and co-signing loans with them. Here’s how it goes.

An individual with a low credit score enlists a co-signer → If the primary borrower defaults, → Co-signer is responsible.

Individuals with low credit scores face high-interest rates. Often, the loan terms are unfavorable in comparison to those with high credit scores. Because the perceived risk is high enough to offset the high interest rate, it is charged with stricter terms.

The Personal Loan Application Journey

The journey of getting a personal loan can be hectic. But you should know every step you need to take. First, do initial research by researching different options and factors, such as their fees and interest rates. Some lenders offer pre-qualification and pre-approval.

- Pre-qualification: It’s a soft credit inquiry that doesn’t impact your credit score and provides an estimate of your loan eligibility.

- Pre-approval: It includes hard inquiry, which temporarily lowers your credit score. It allows you to look at all your loan options.

After choosing a lender, you should complete the loan application process. Add detailed information about your income, employment history, debts, etc. Provide all the documents to verify the information. In the underwriting process, the lender’s team analyzes your financial situation.

Now that evaluation is done, the lender decides on your loan approval. You’ll receive a final loan offer if approved according to the terms and conditions. Review the offer and sign only if you agree with all the terms.

Navigating Loan Offers and Making Informed Decisions

The biggest mistake individuals make while looking for a personal loan is accepting the first offer. Even if you don’t have a high credit score needed for a personal loan, you should compare loan offers.

Consider the annual percentage rate (APR), which includes interest rates and fees expressed as yearly percentages. You should opt for a lower APR rate because it indicates an affordable loan. Pay close attention to additional fees associated with the loan and assess the lender’s reputation.

While reviewing the fine print, carefully check the terms and conditions in the loan agreement, including the repayment schedule. Don’t sign unless you fully understand all contractual obligations in the agreement. It helps you make informed decisions.

Conclusion

Securing a personal loan is not difficult. But what’s challenging is ensuring your credit score doesn’t lower during this journey. You should carefully use strategies and improve your credit score while securing a personal loan.

Doing this alone can be stressful and hectic. That’s why you should get assistance from experts for comprehensive financial planning and loan assistance.