Is Your Credit Score Keeping You from a Personal Loan?

Personal Loans are Closely Tied to Credit Scores

A Real Life Example

Sophia and Lucas find themselves exploring the possibility of consolidating their debt through personal loans, each facing distinct credit situations.

Sophia, boasting a robust credit score of 750, applies for a personal loan to consolidate her high-interest credit card debt. She is offered a loan with a competitive interest rate of 5.8% over a three-year term. This low rate translates to reduced monthly payments, enabling Sophia to manage her debt more efficiently and save a significant amount of money on interest over the loan’s duration. The consolidation simplifies her finances, replacing several high-rate payments with a single, more manageable monthly payment.

Lucas, on the other hand, has a credit score of 620 due to past financial missteps. When he applies for a similar personal loan, the best interest rate he is initially quoted is 11.5%, making his consolidation efforts less appealing due to the higher monthly payments and increased cost over the life of the loan.

Motivated to improve his financial standing, Lucas takes proactive steps towards enhancing his credit score. He focuses on paying bills on time, reducing his credit card balances, and disputing inaccuracies on his credit report. After diligent effort over nine months, Lucas’s credit score improves to 680.

With his enhanced credit score, Lucas reapplies for the personal loan and is offered a much more favorable interest rate of 7.5%. This rate decrease significantly lowers his monthly payments, making the consolidation of his debt more feasible and financially advantageous.

Sophia and Lucas’s journeys highlight the profound impact credit scores have on the terms of personal loans and underscore the importance of credit health in achieving financial goals. Both managed to consolidate their debts effectively, but Lucas’s journey also demonstrates the potential benefits of improving one’s credit score.

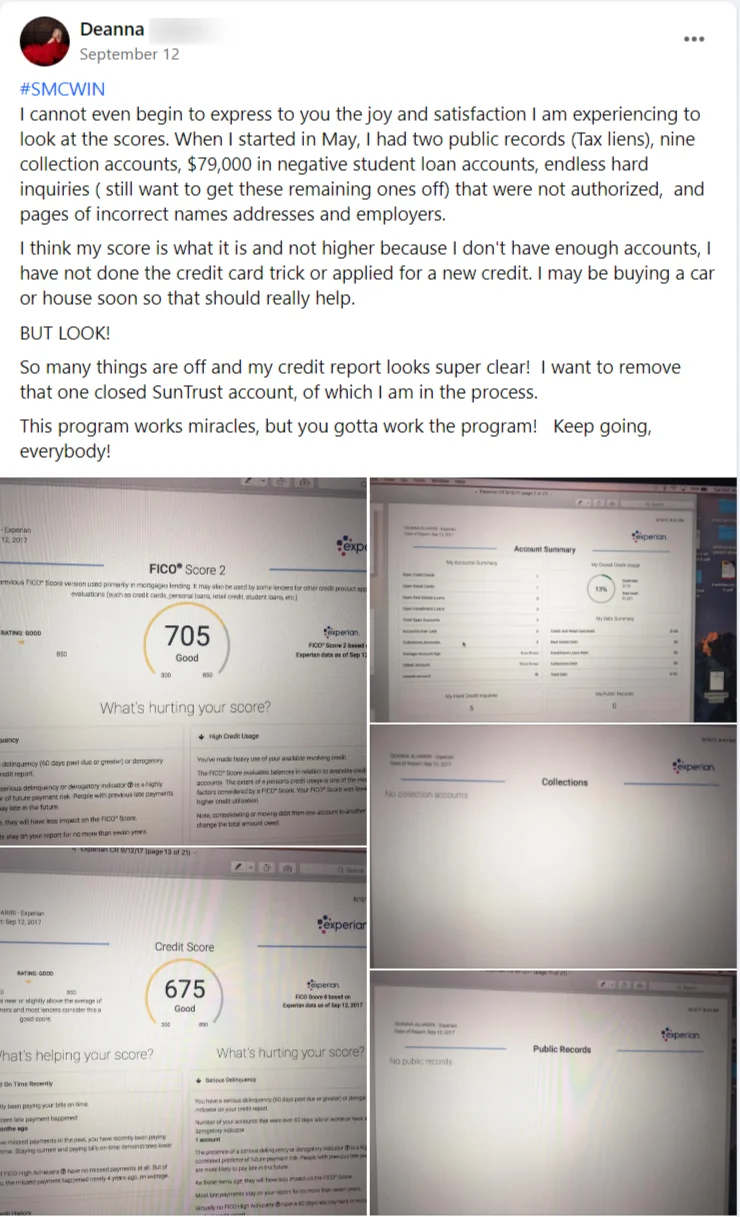

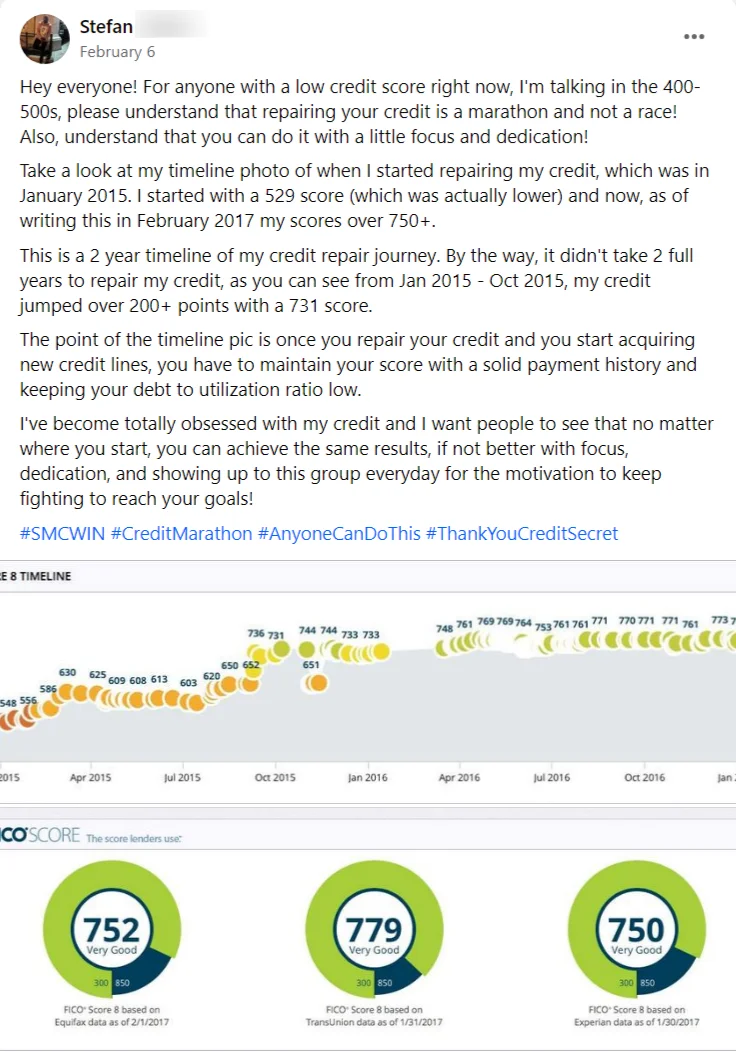

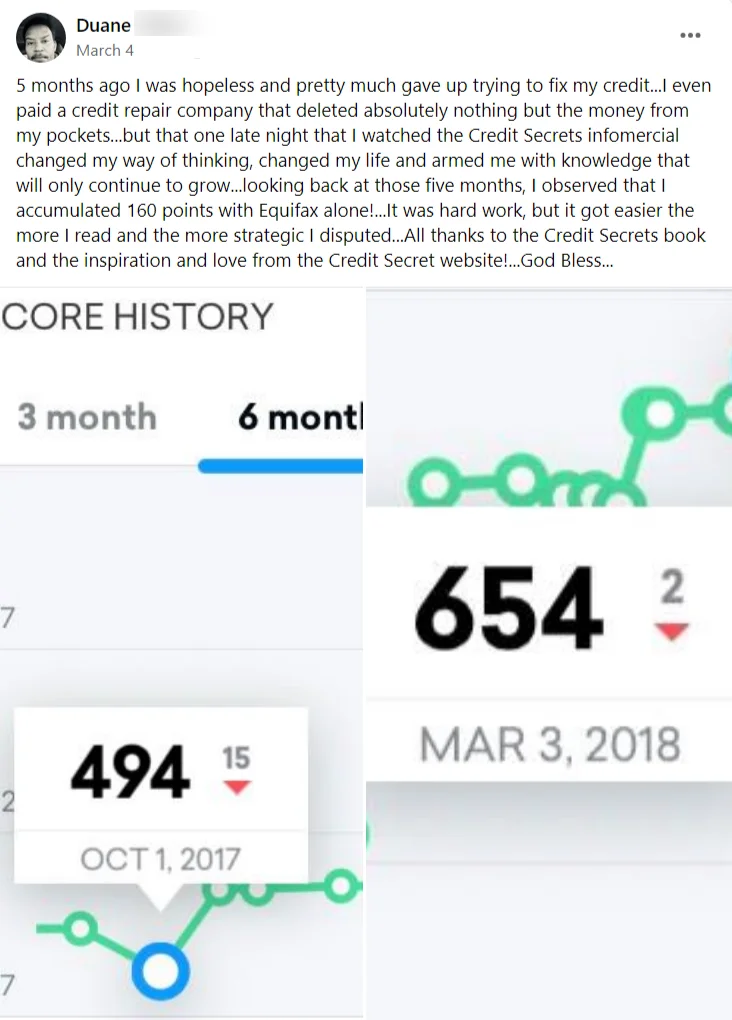

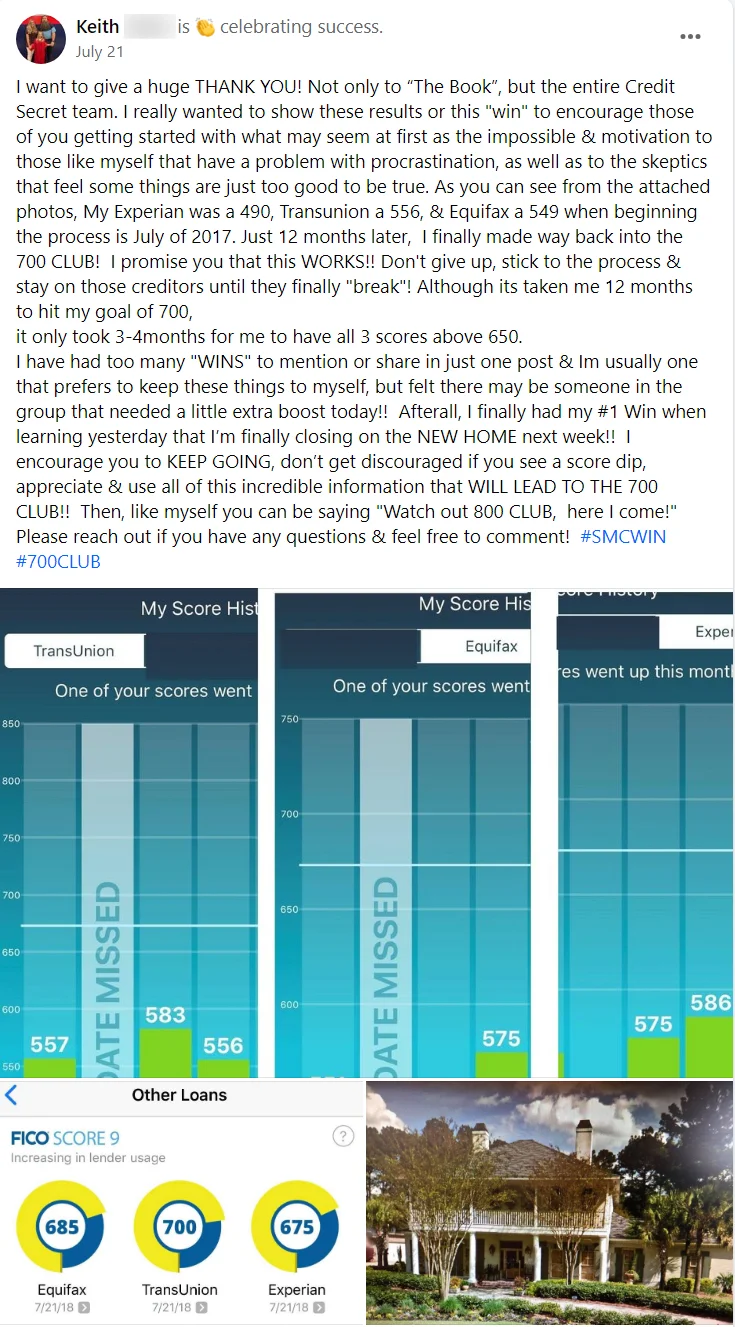

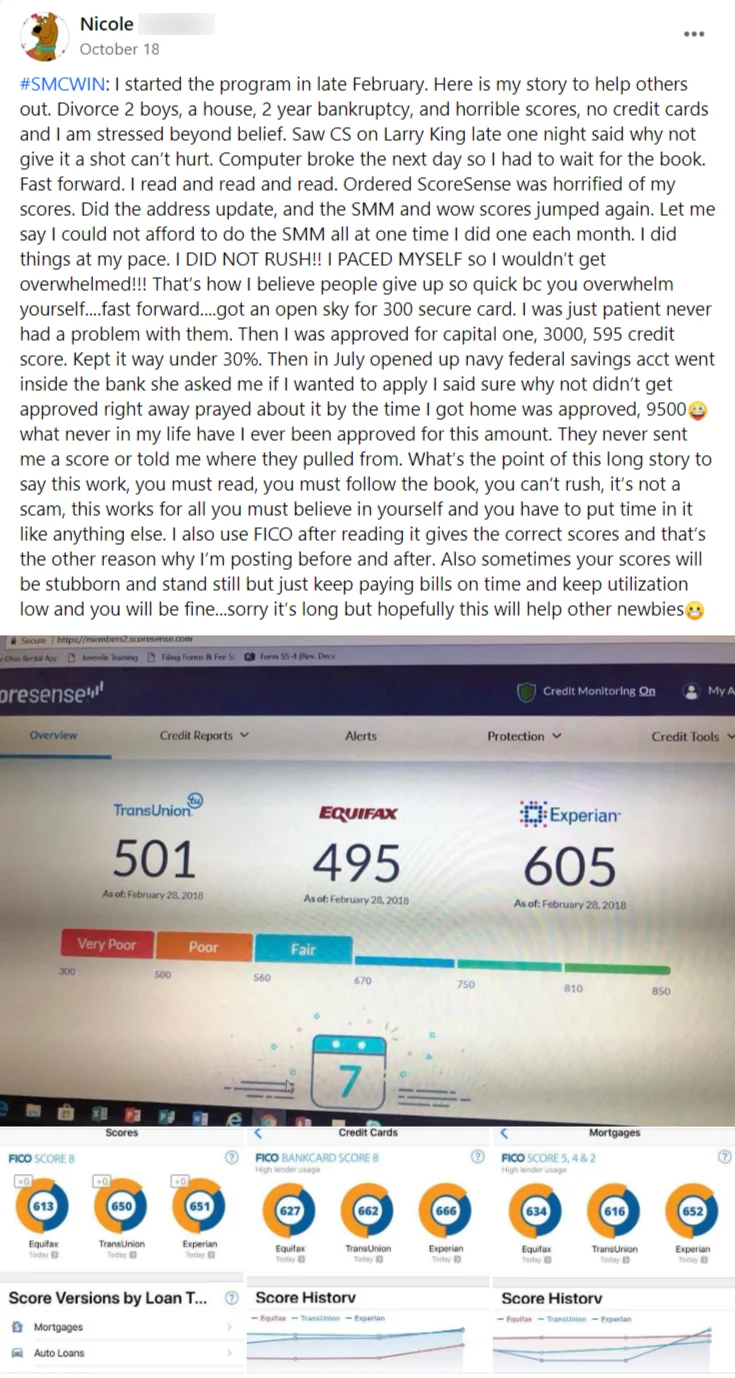

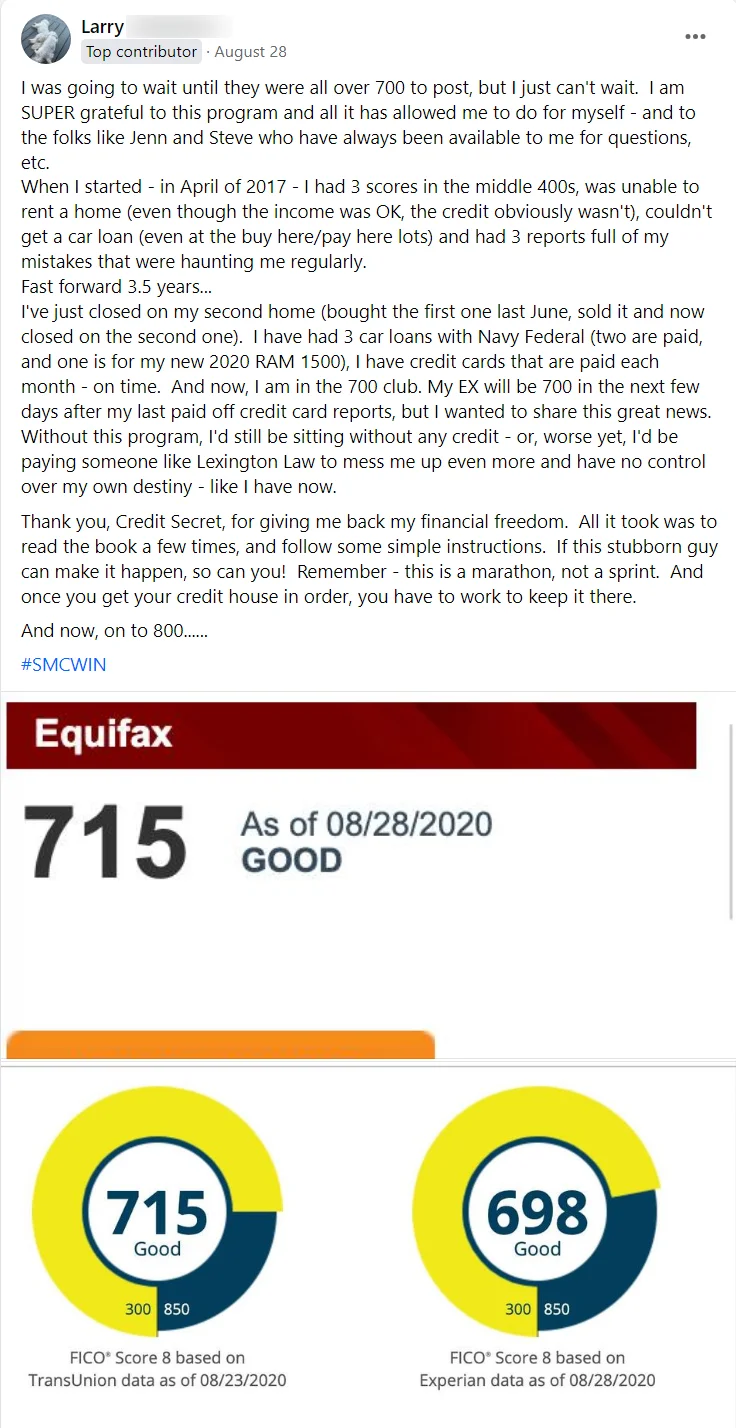

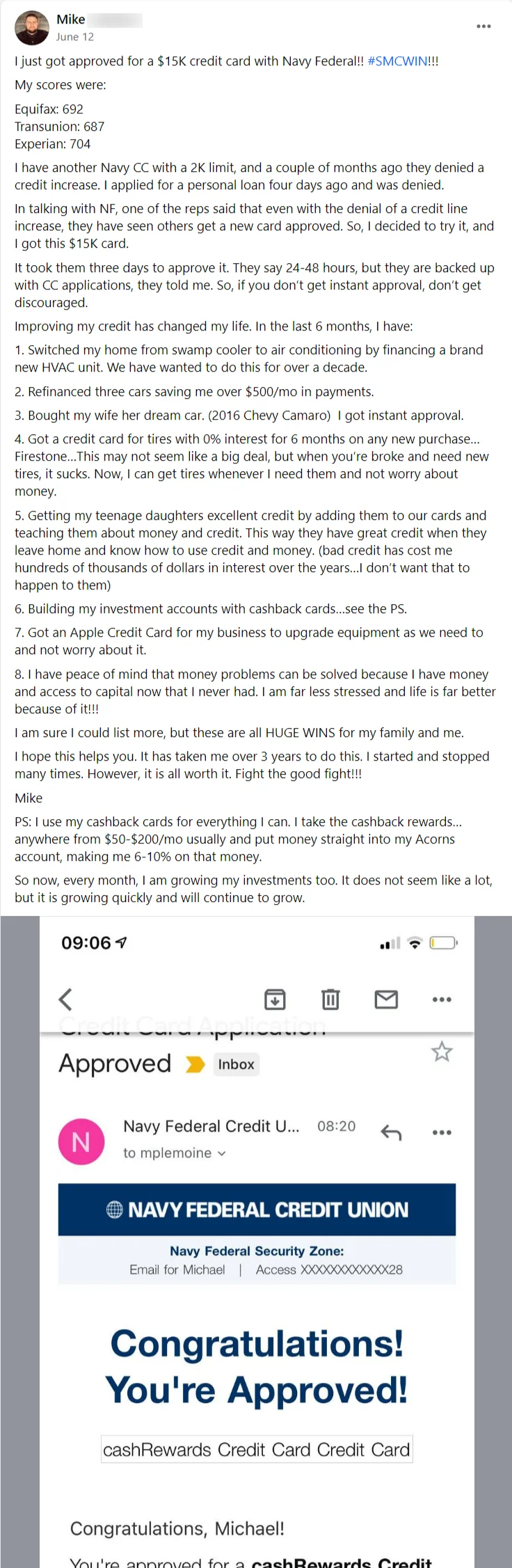

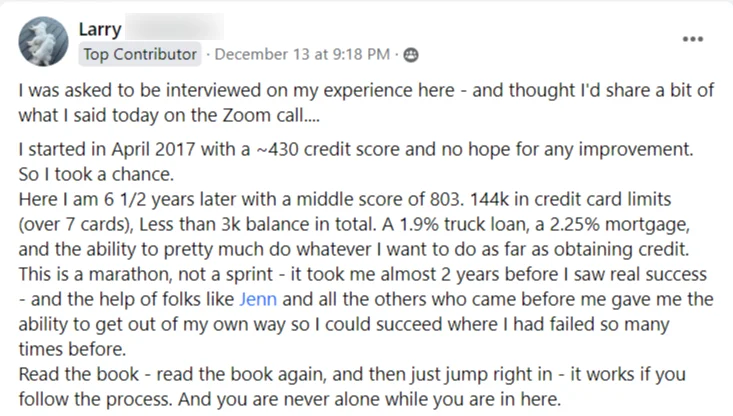

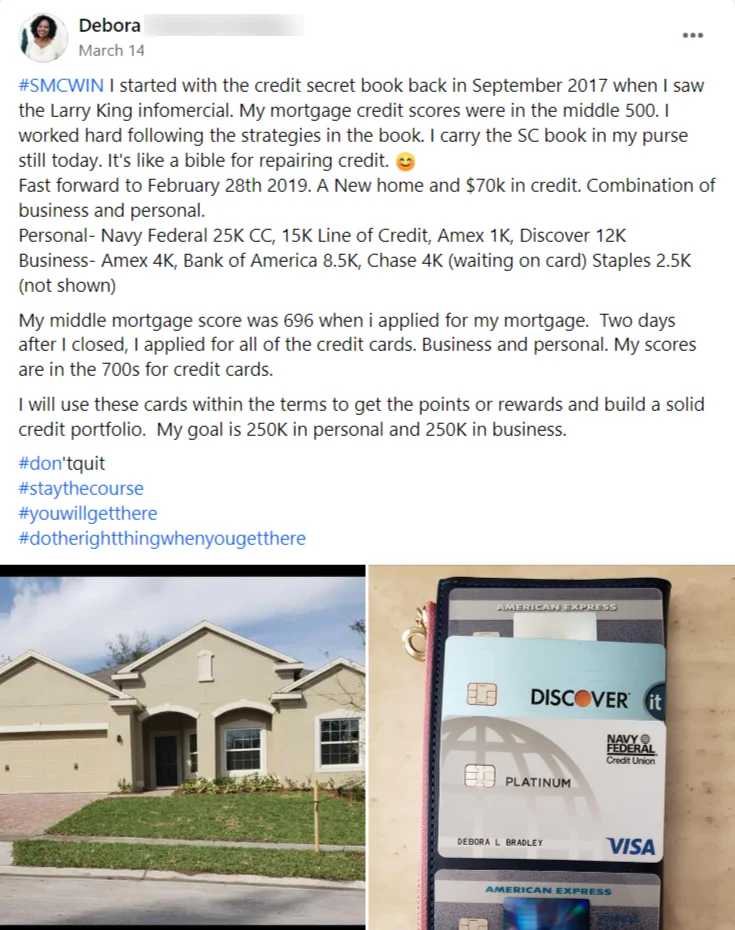

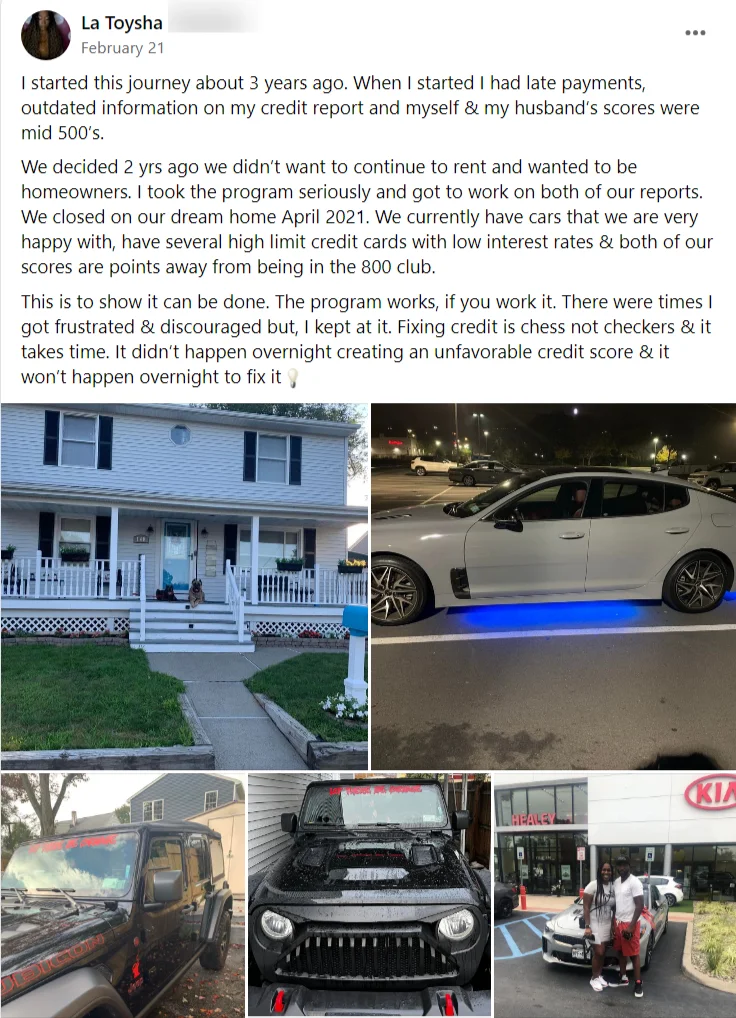

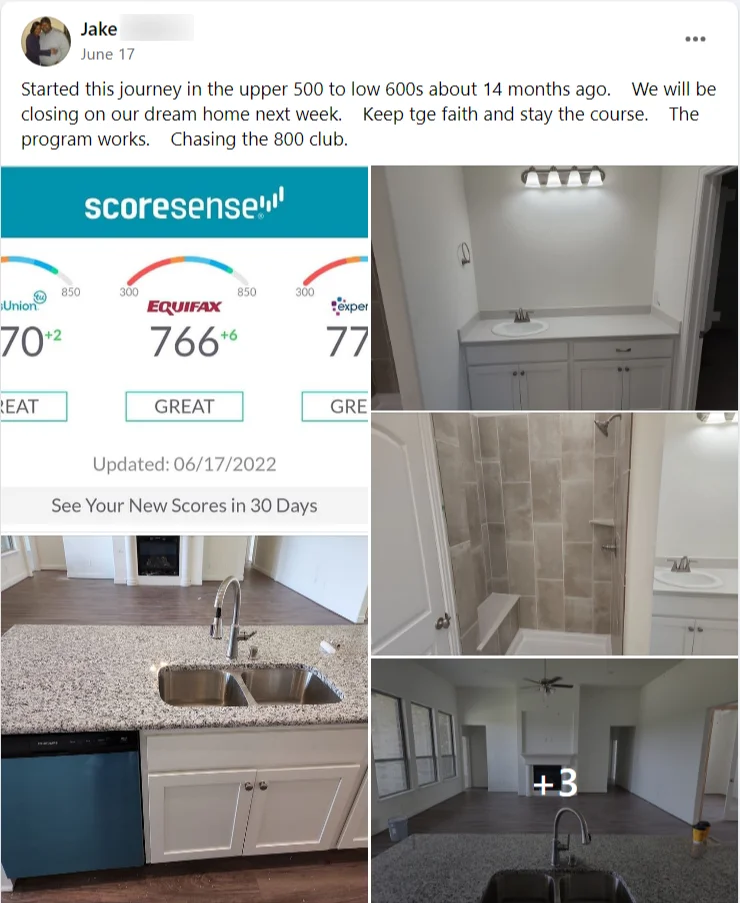

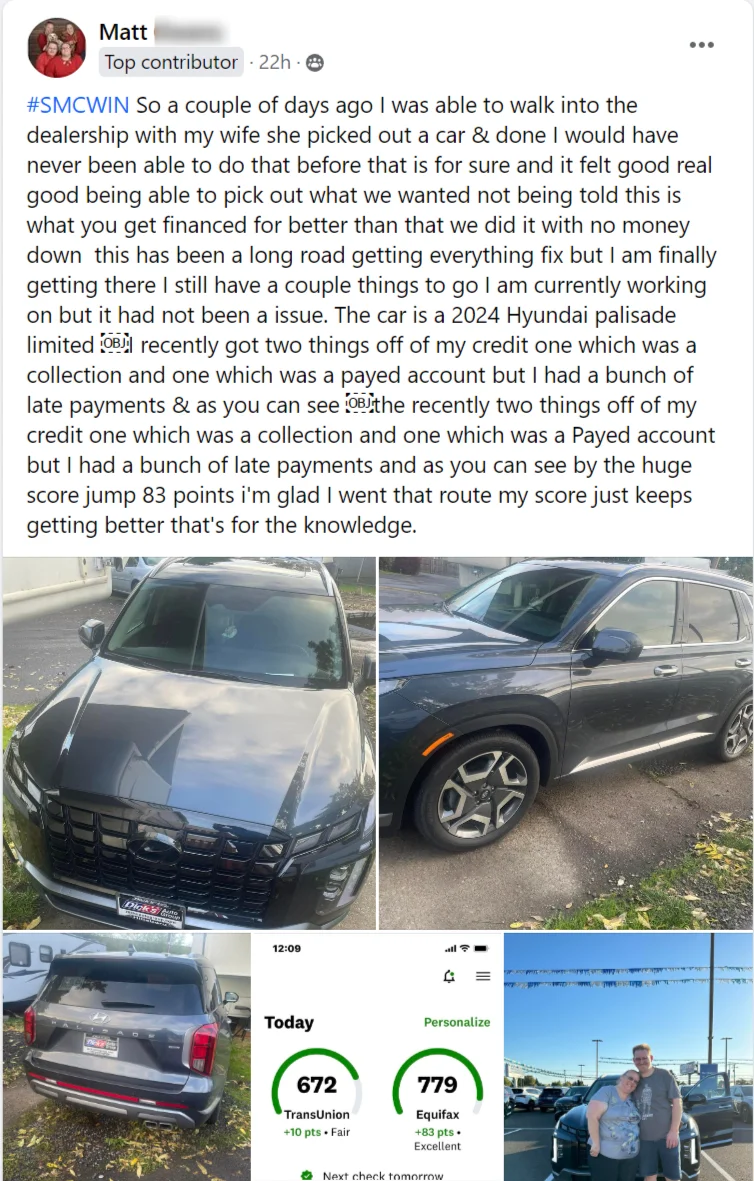

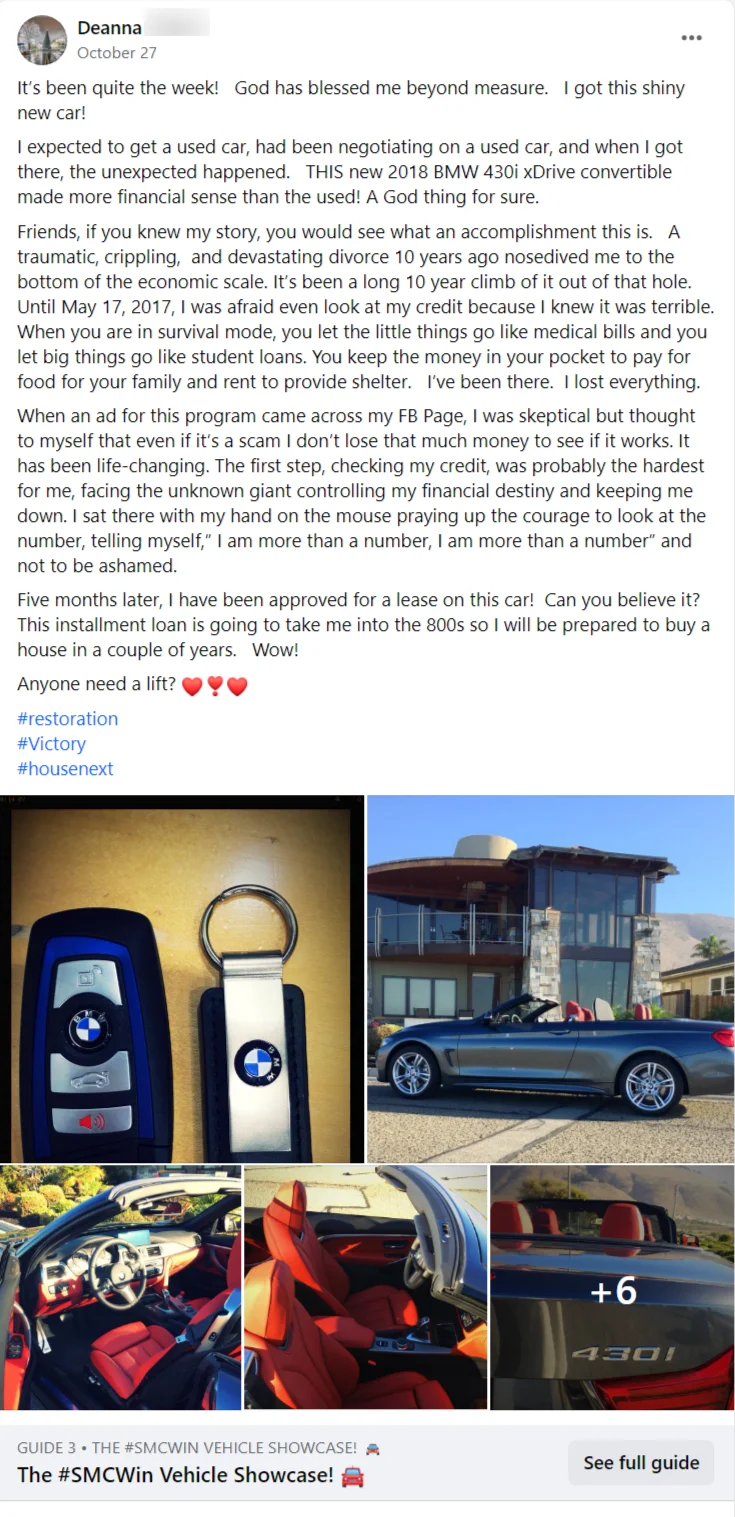

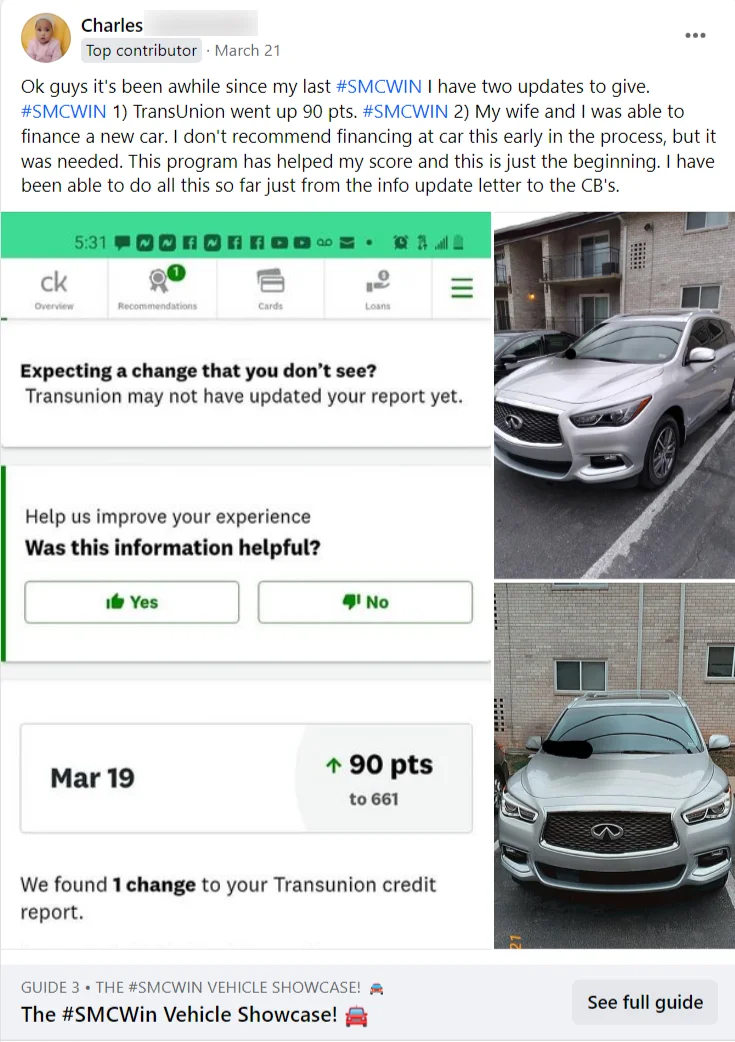

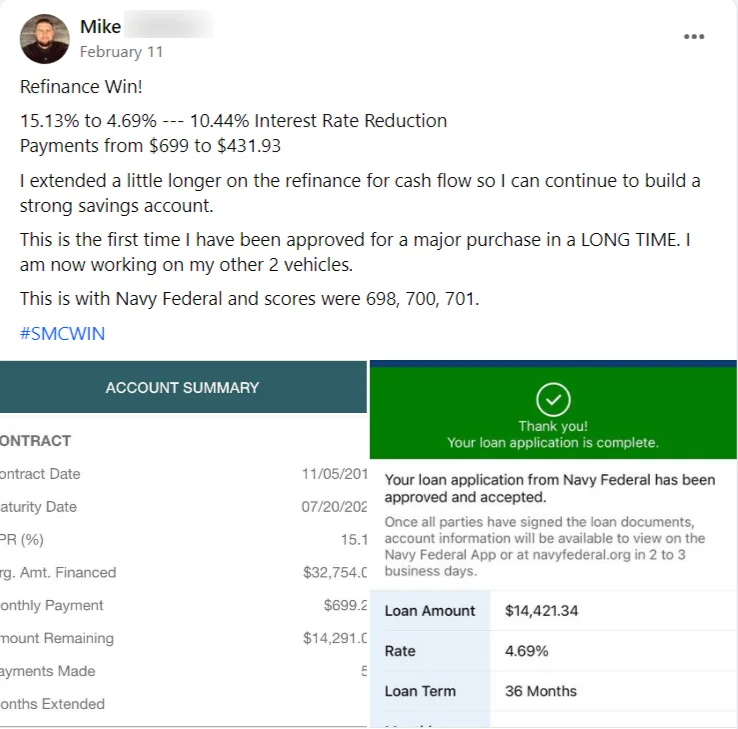

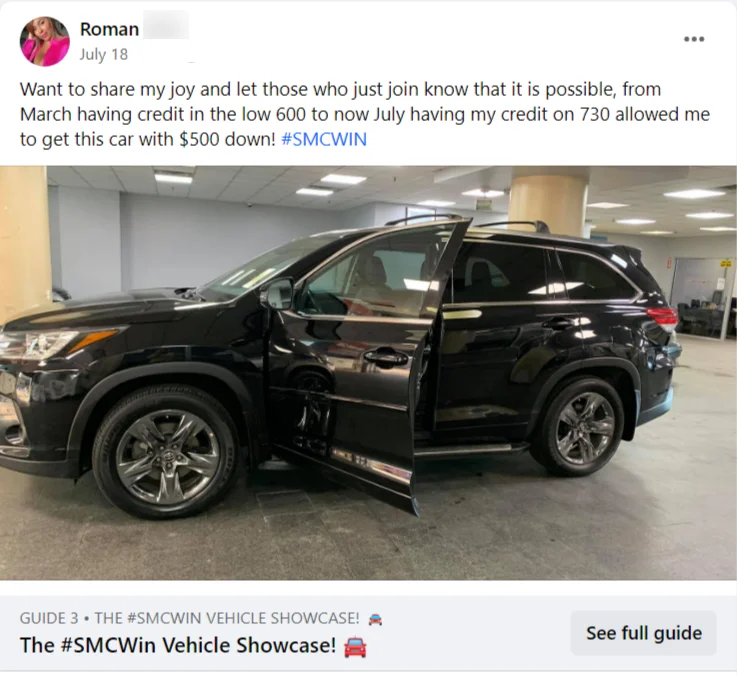

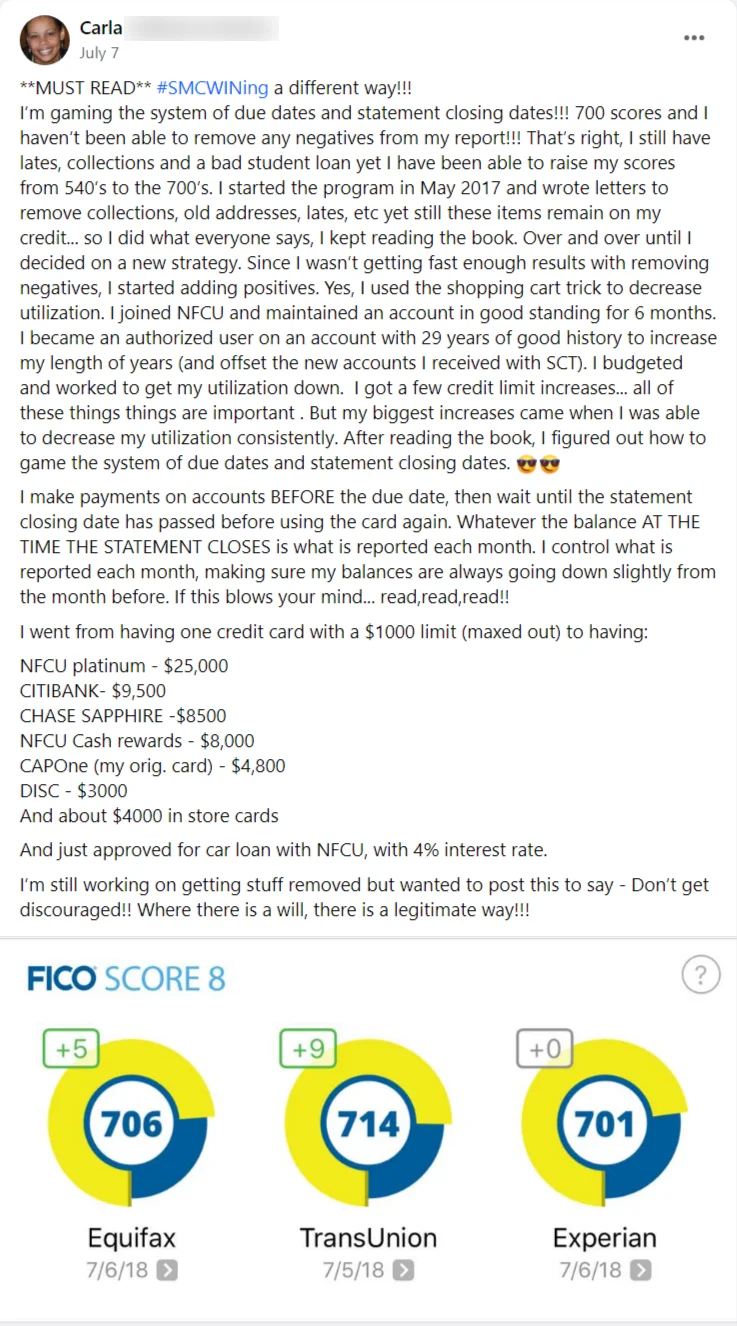

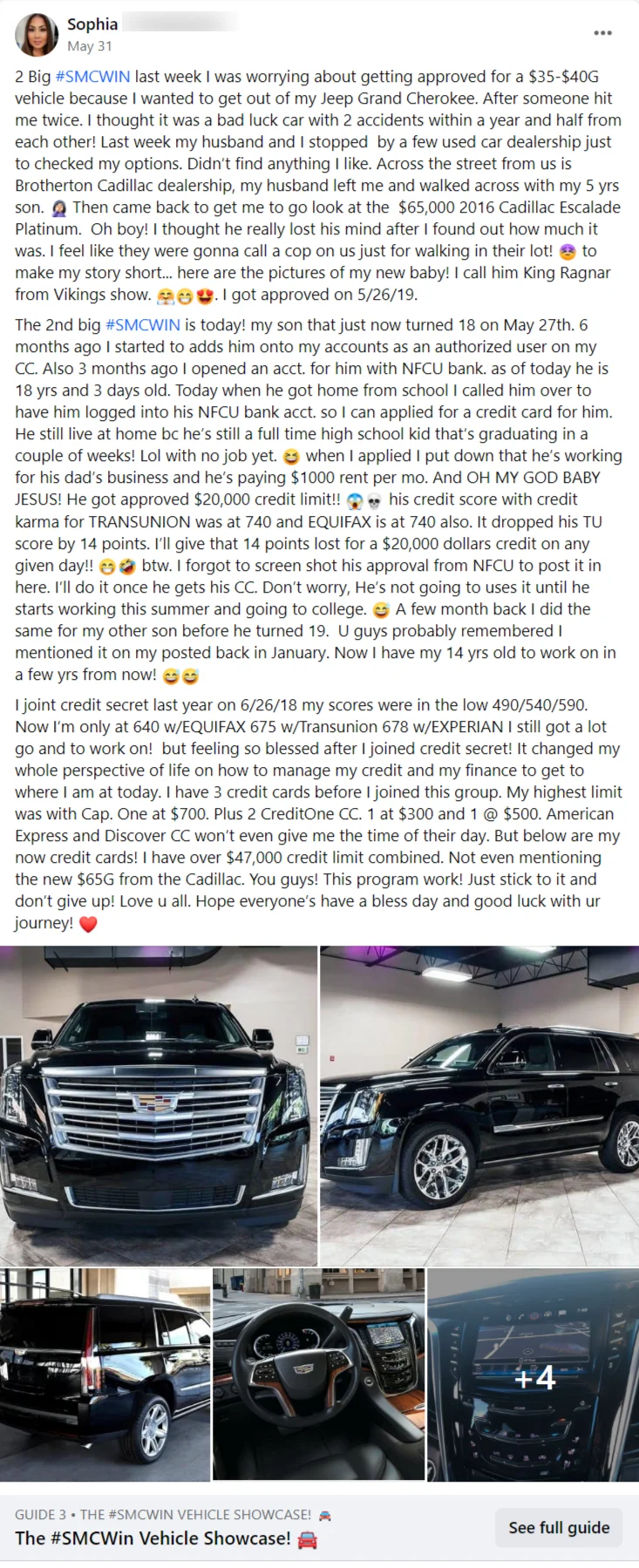

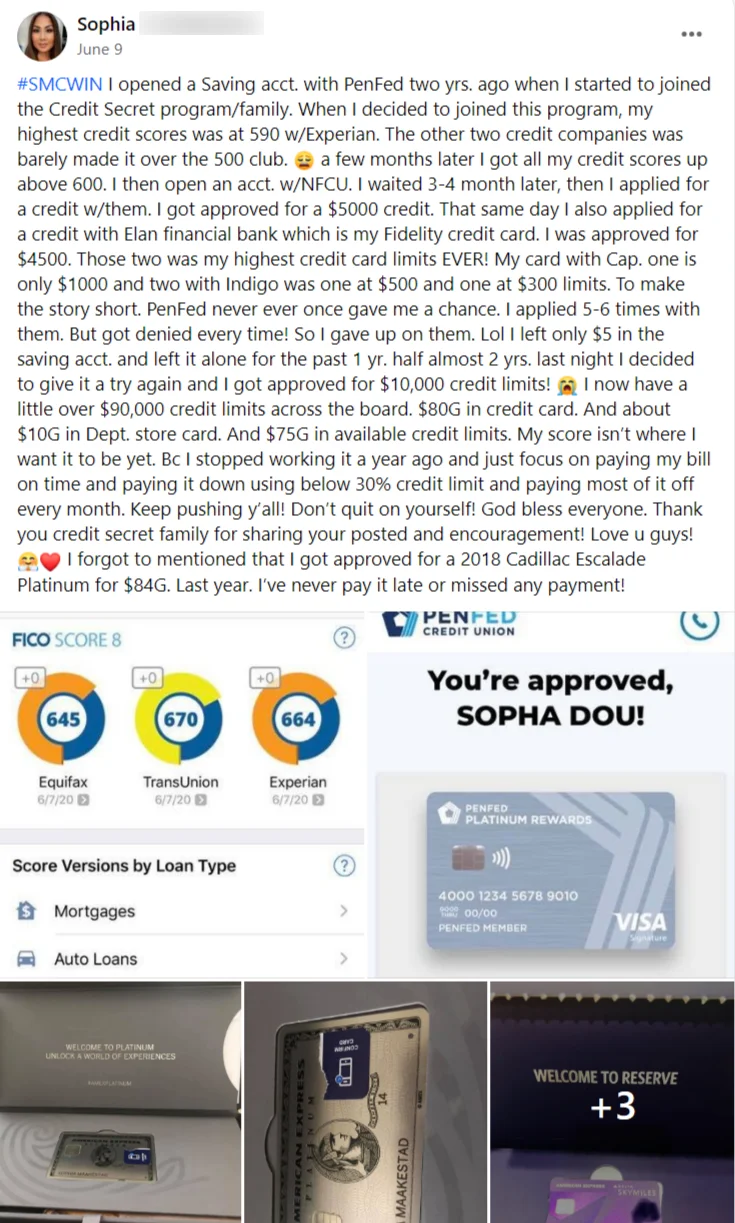

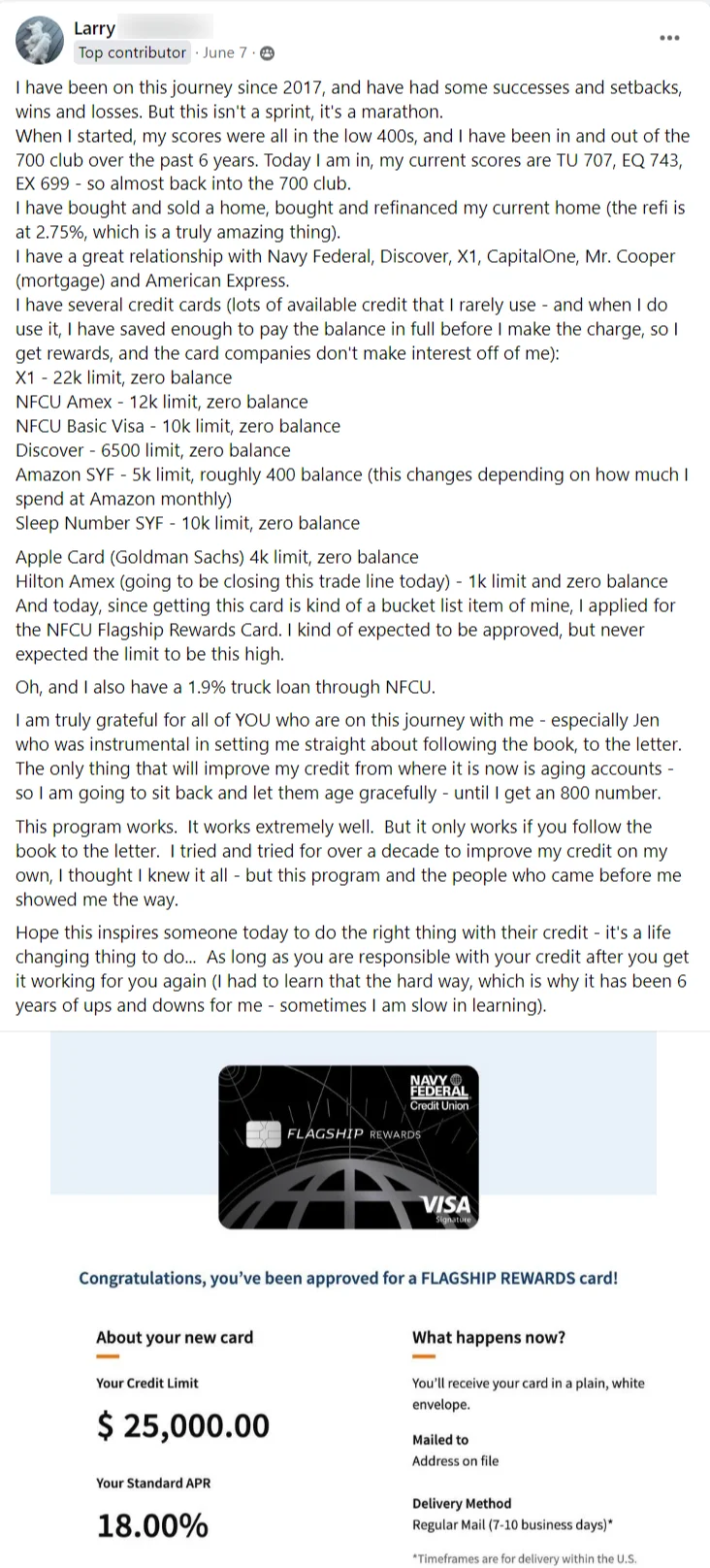

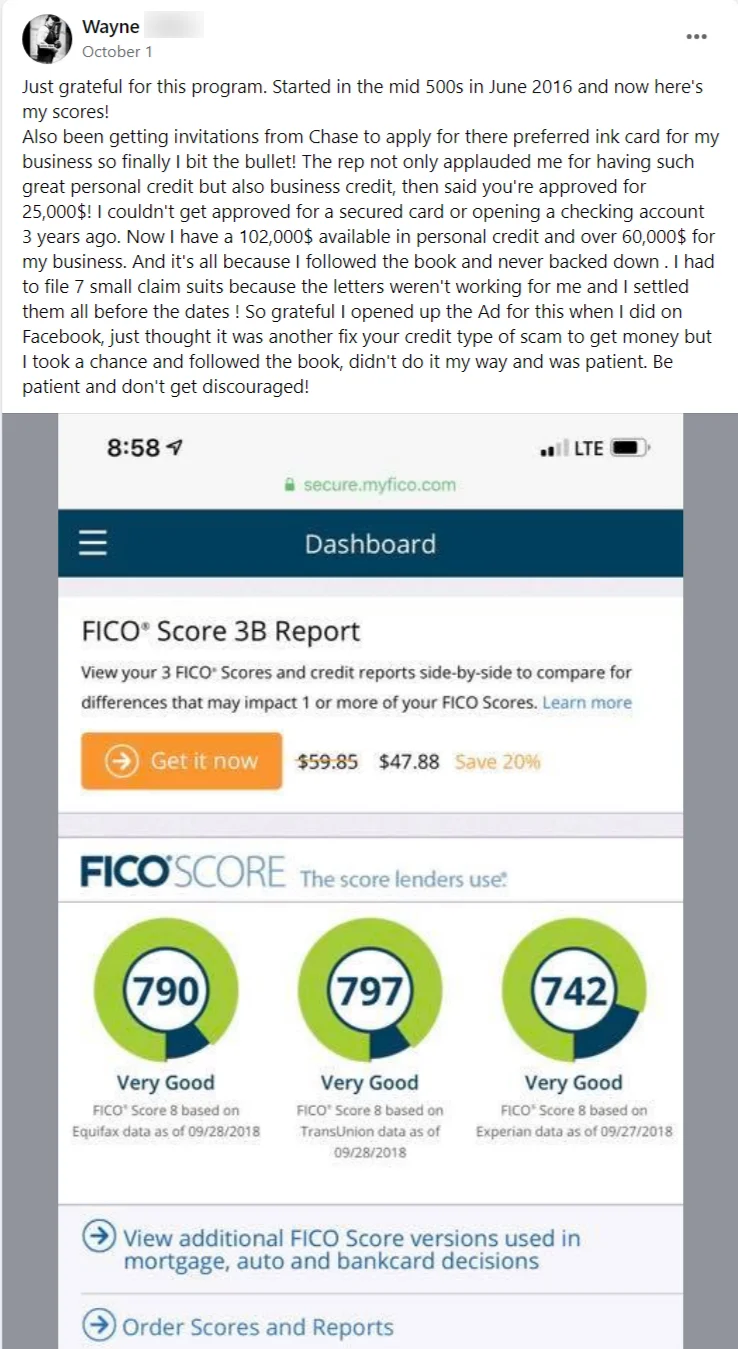

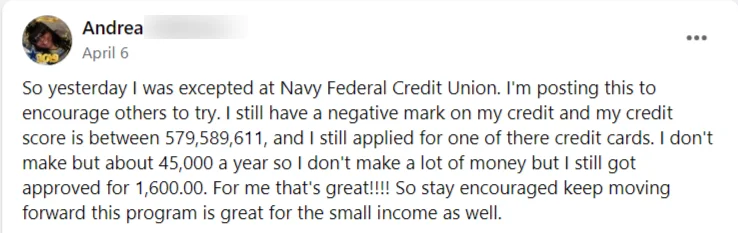

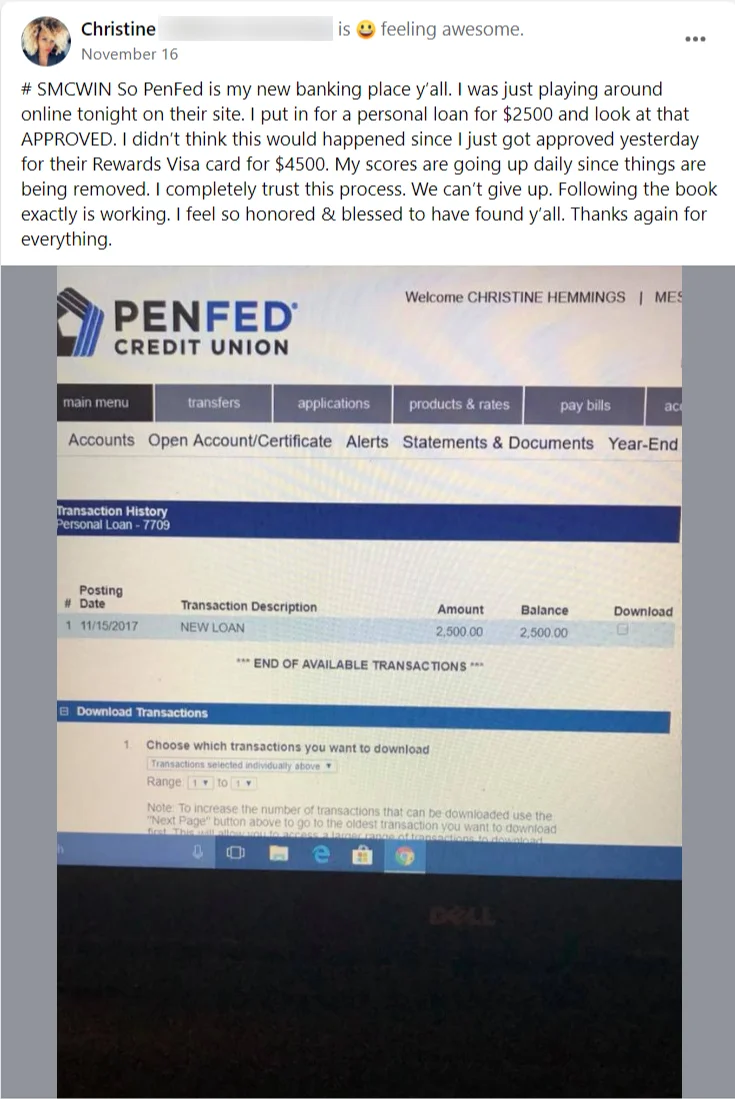

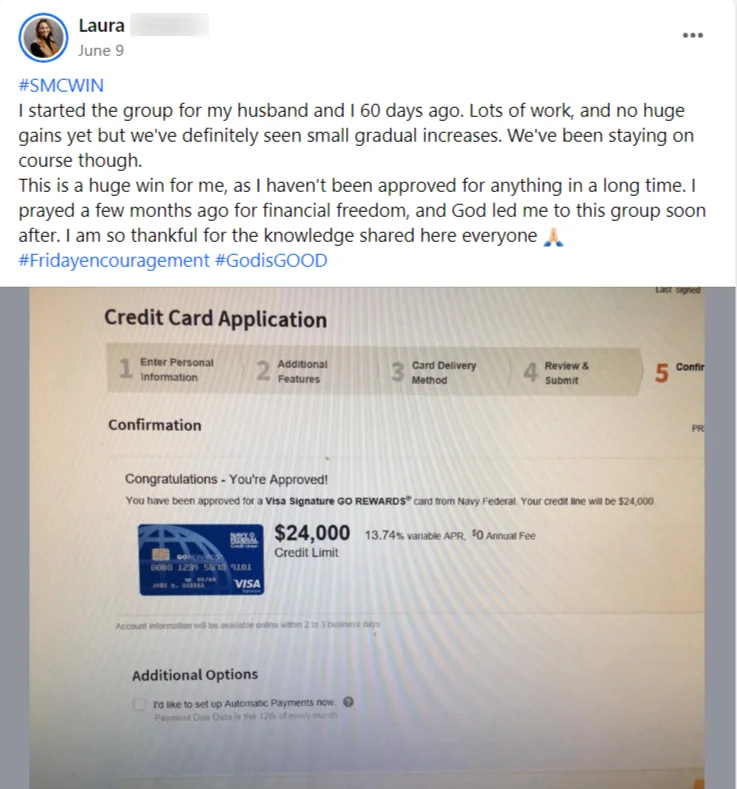

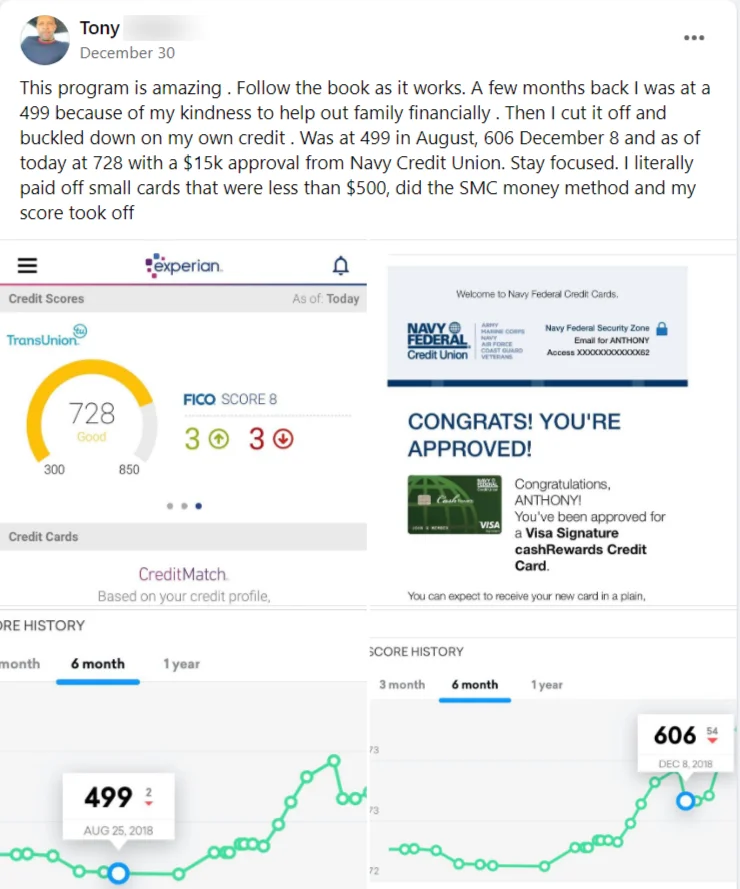

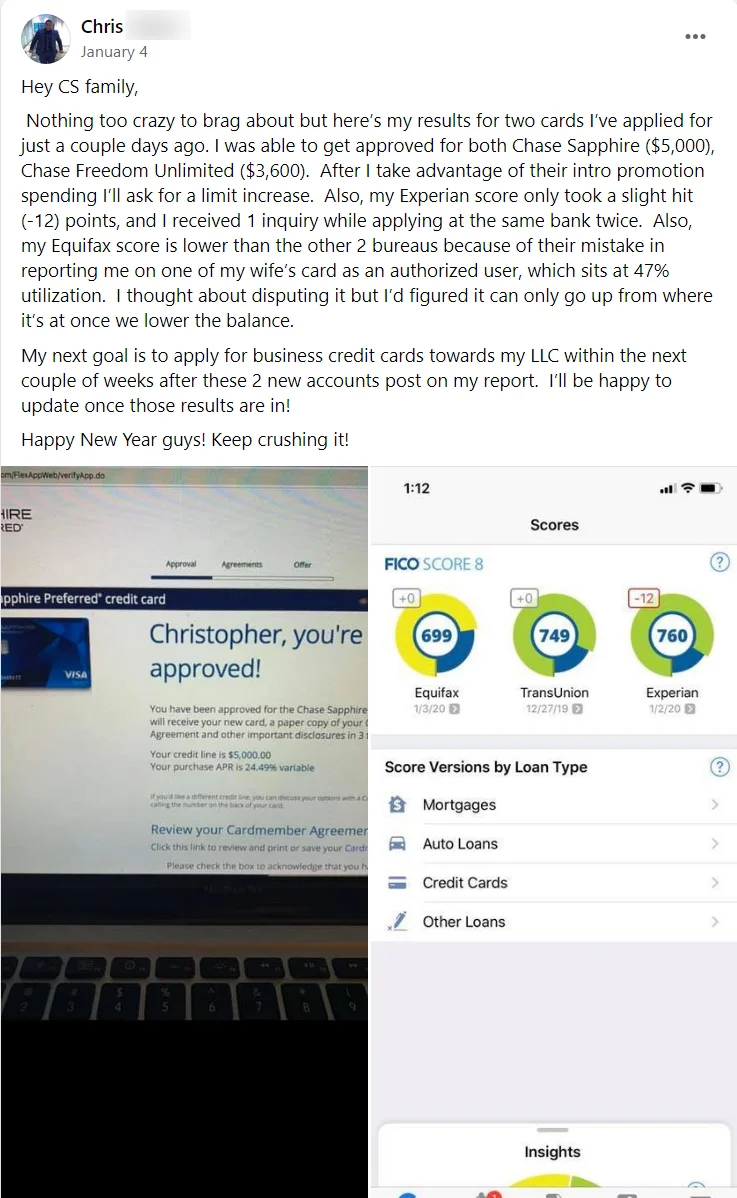

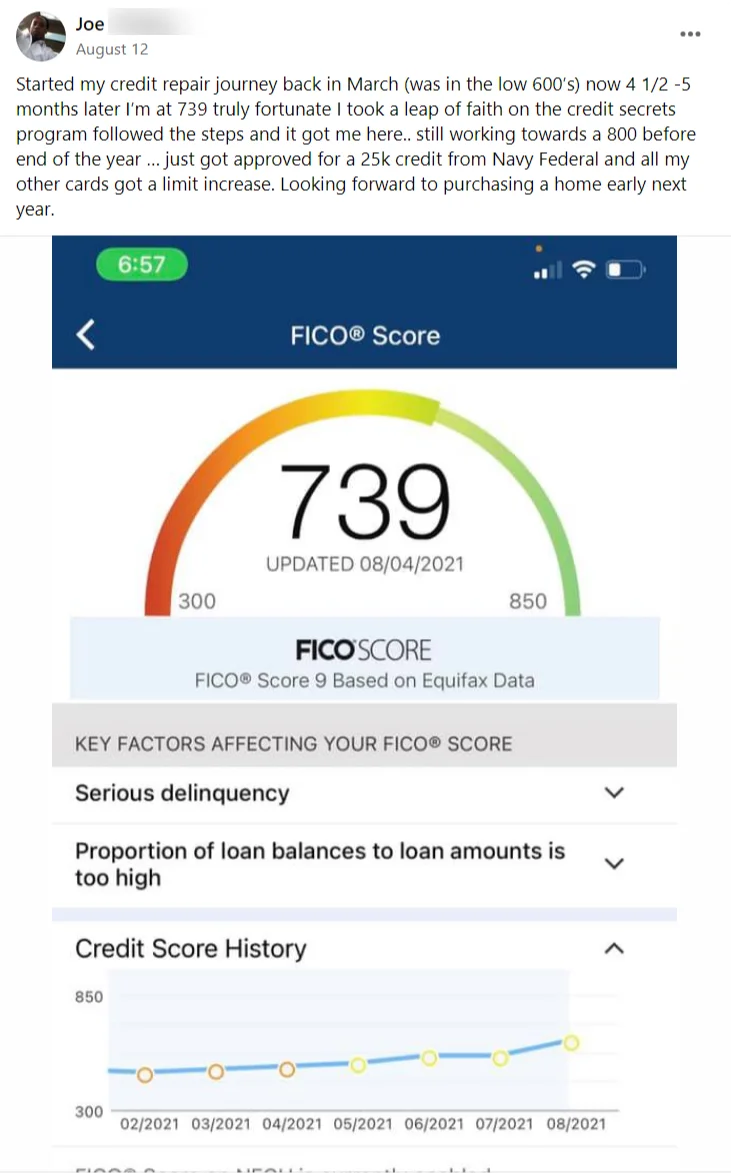

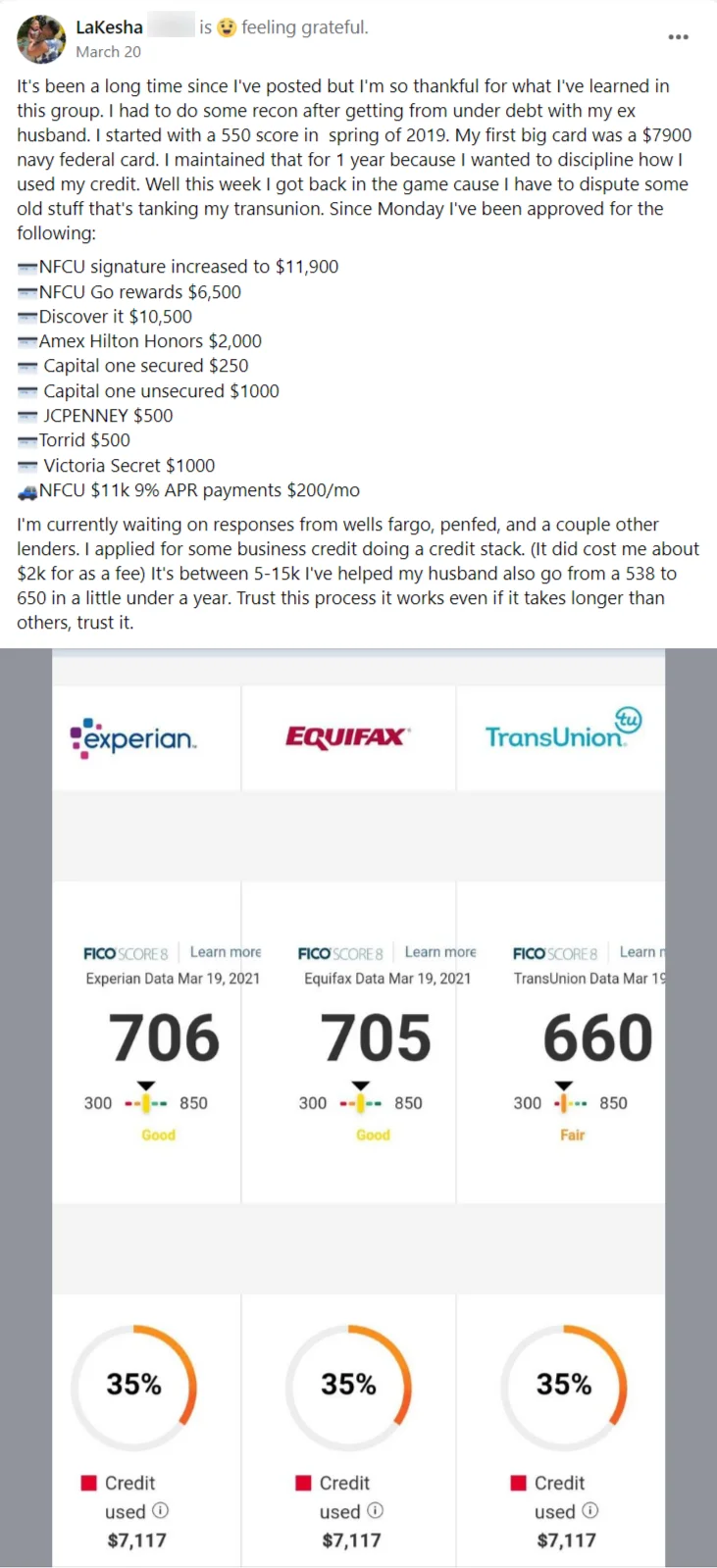

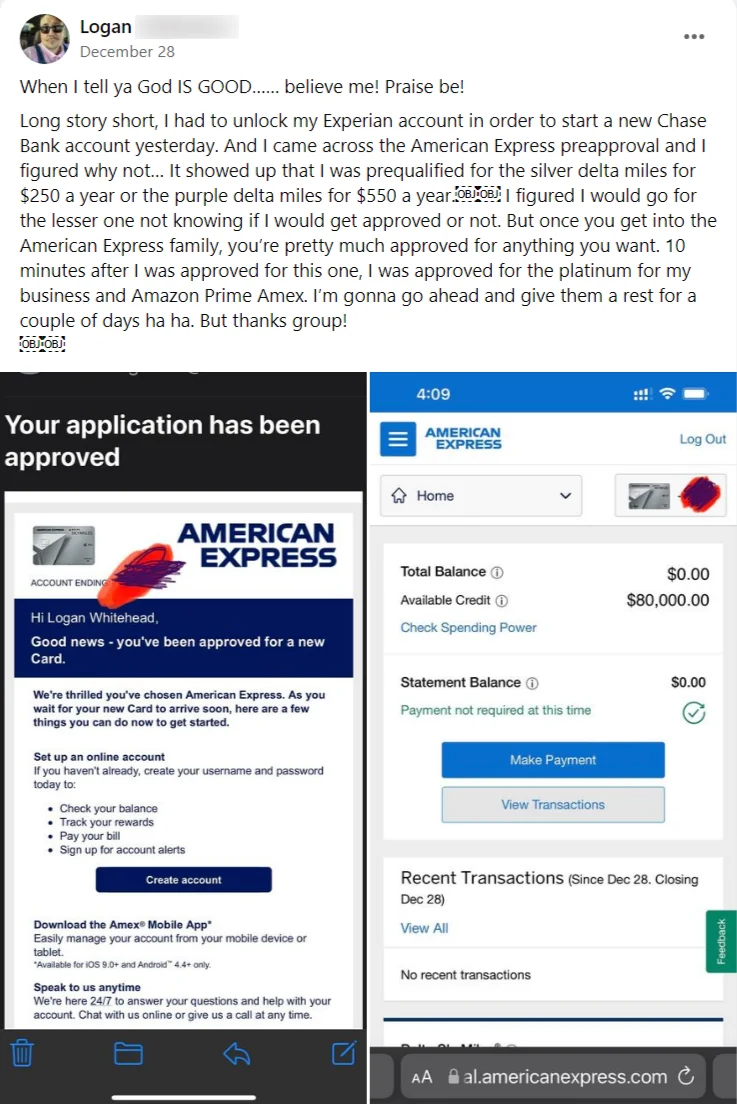

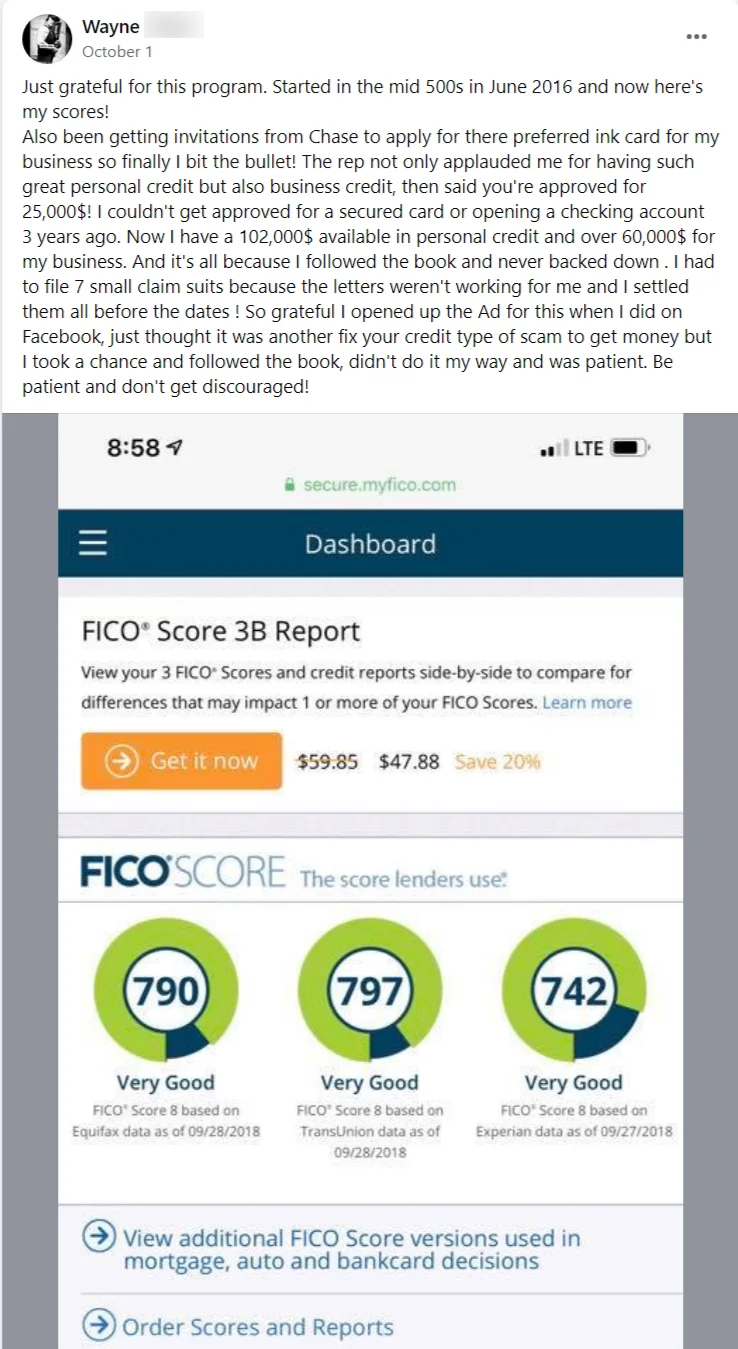

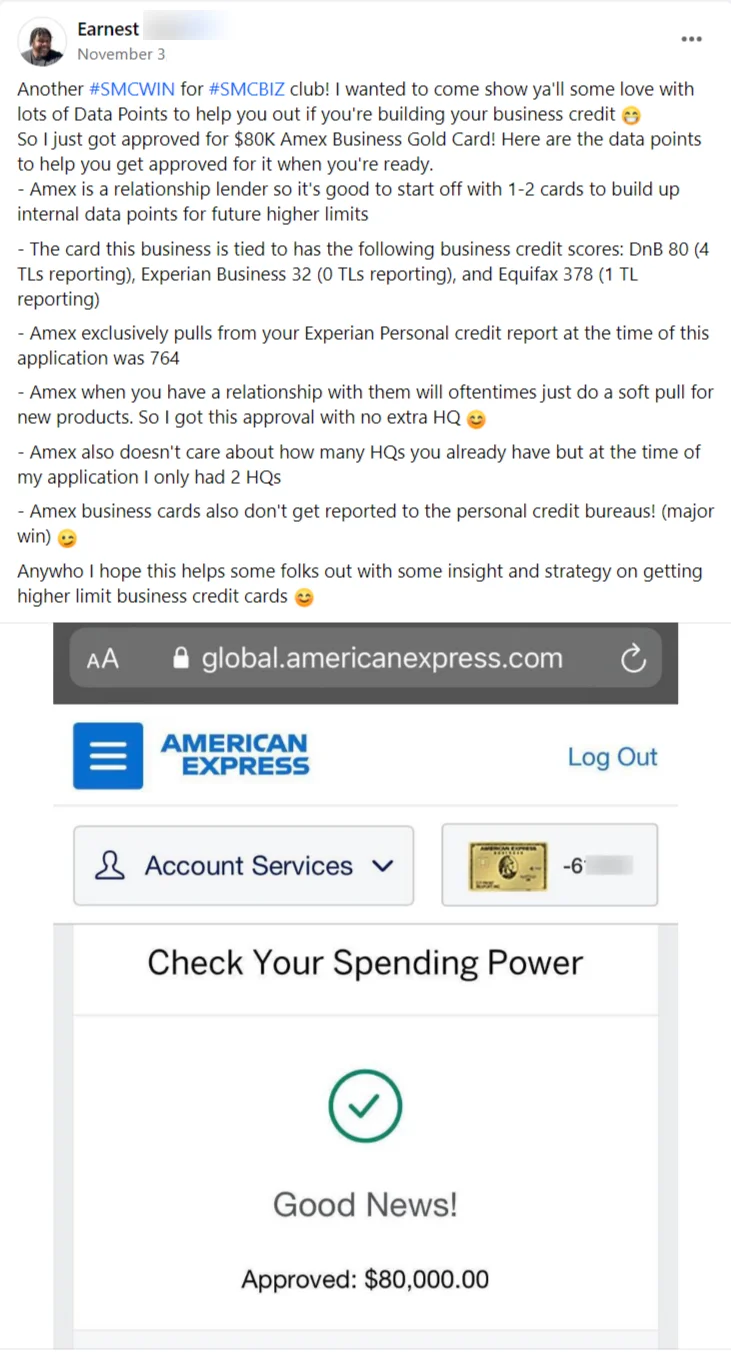

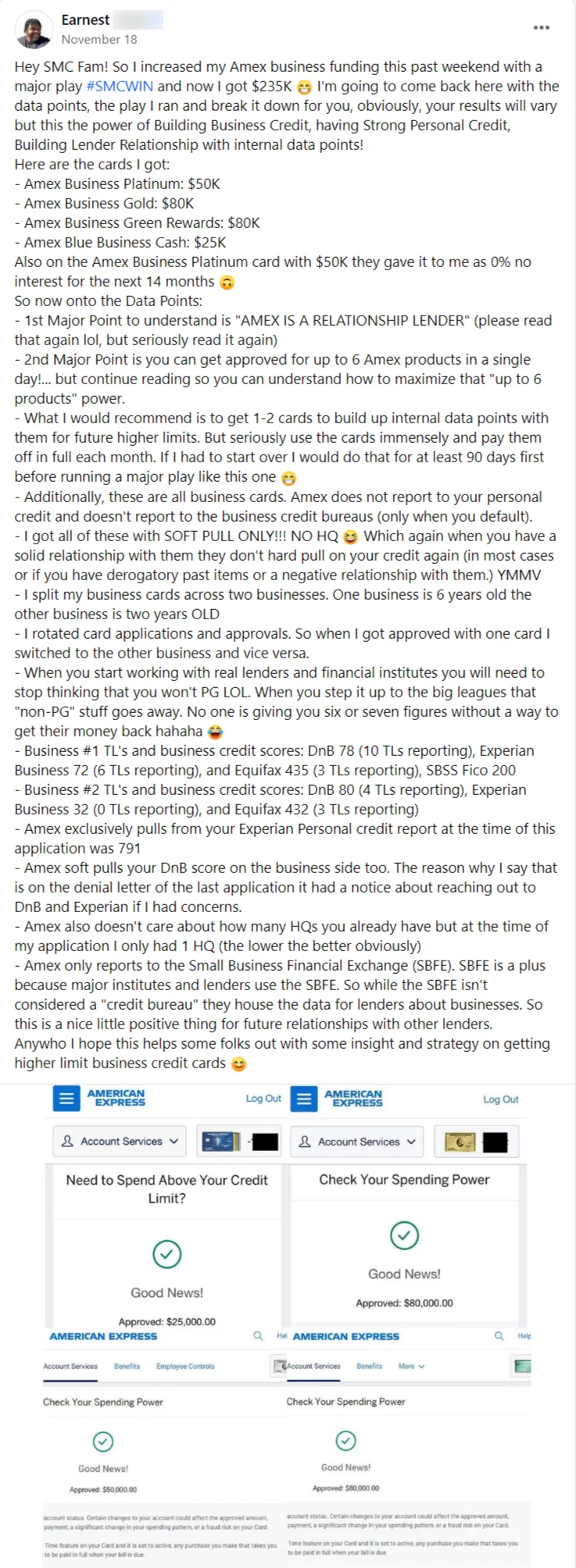

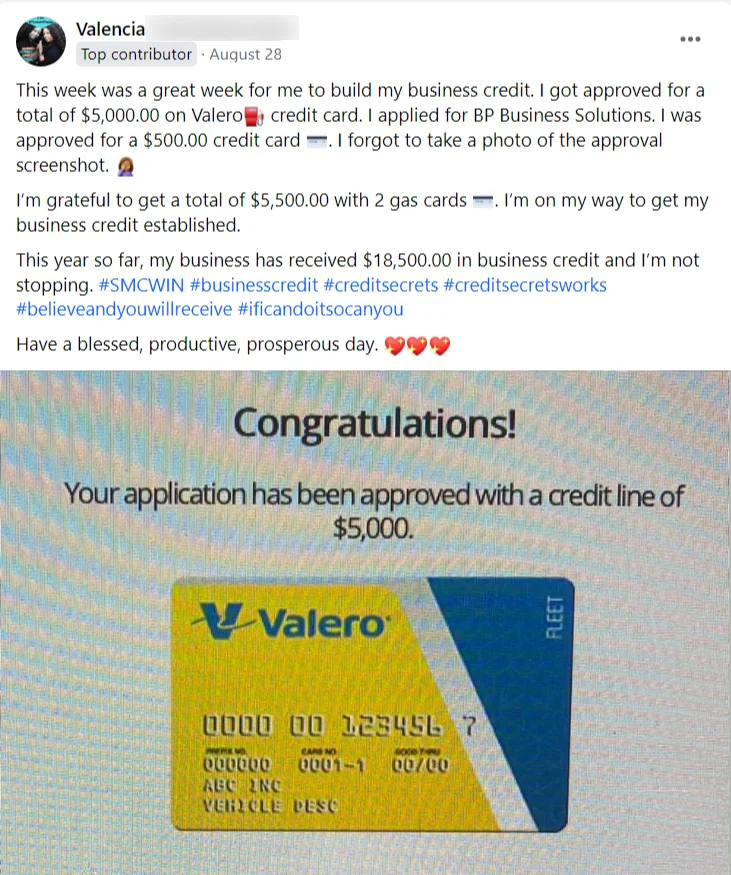

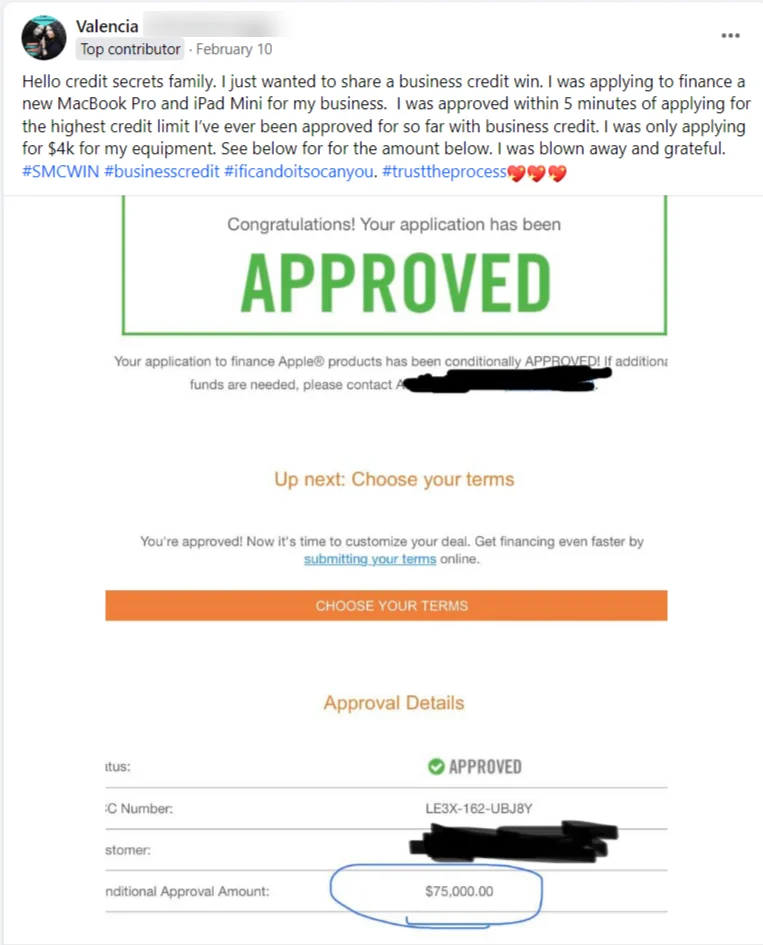

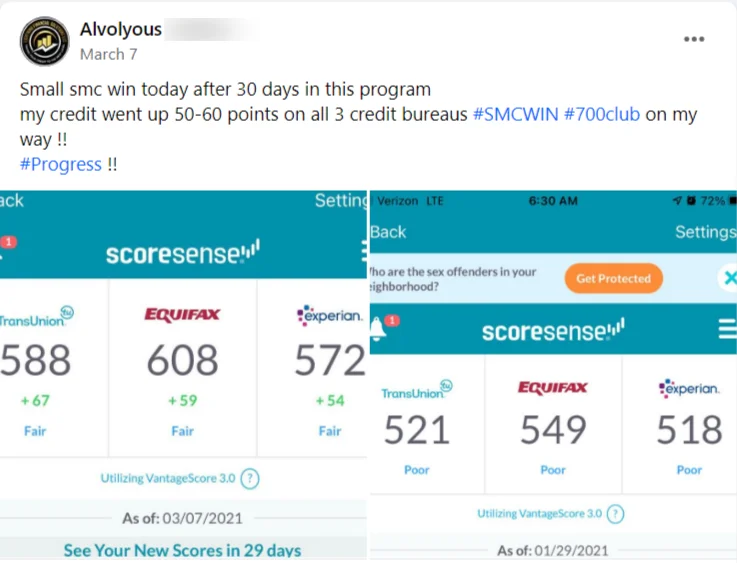

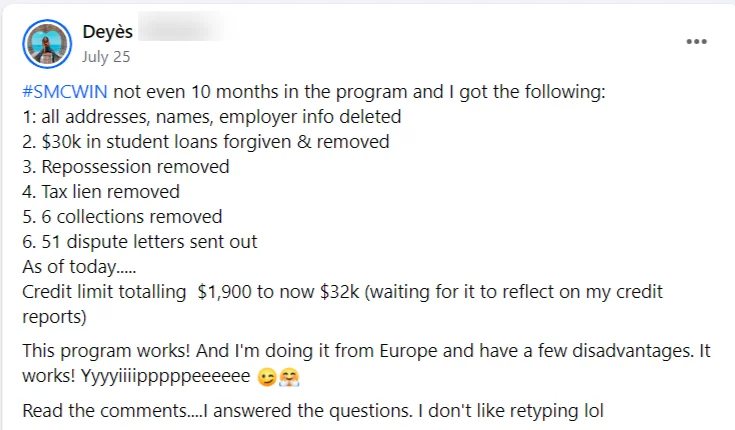

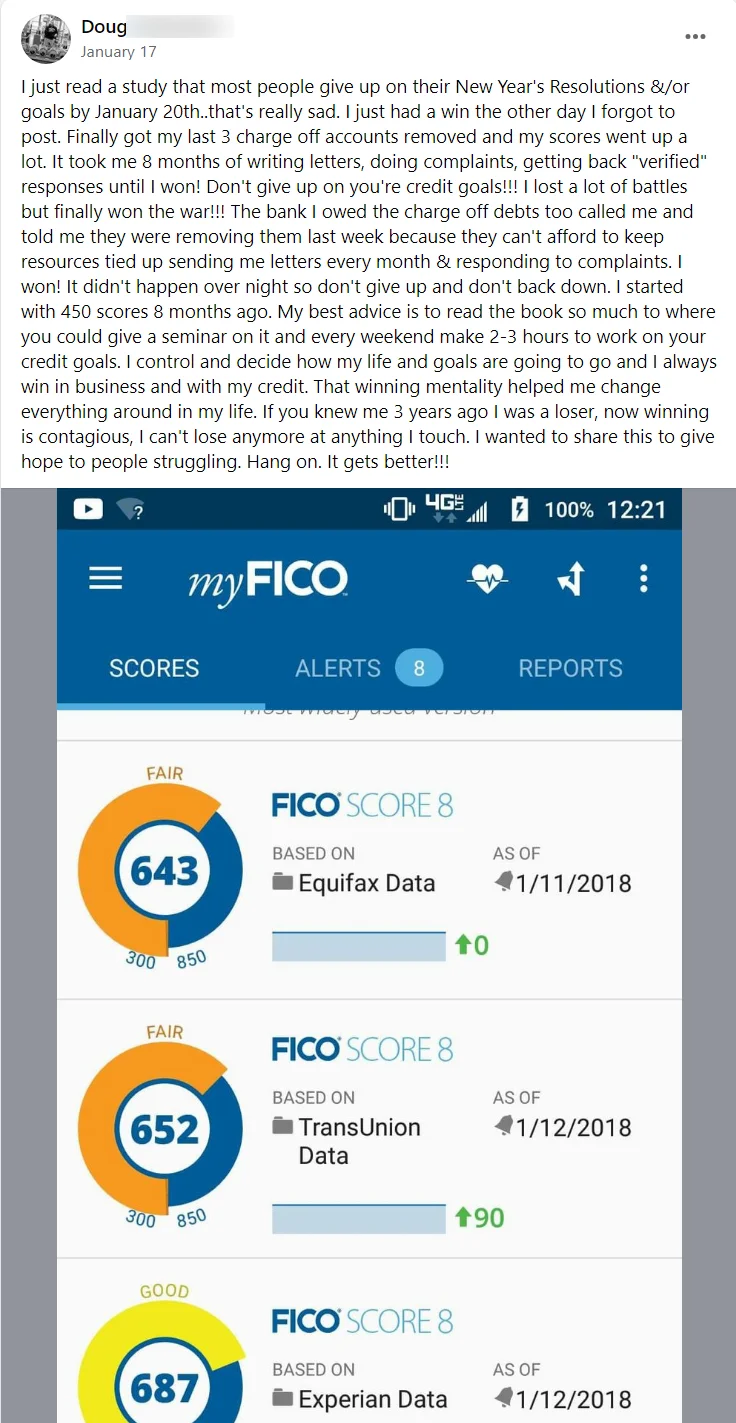

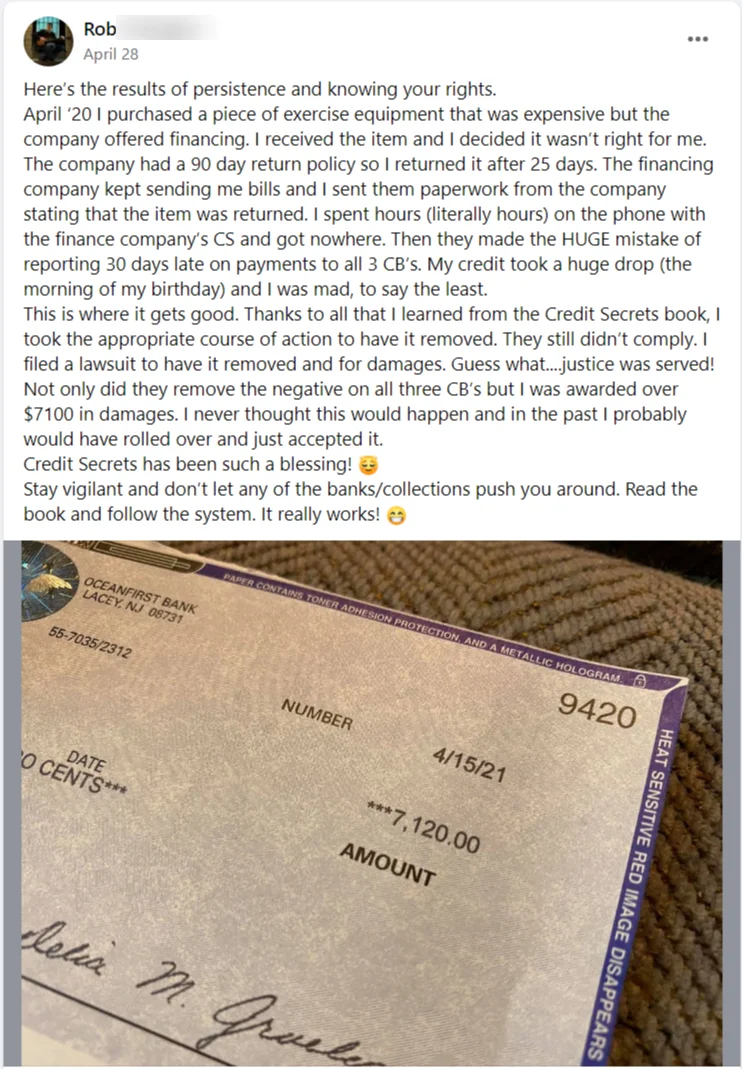

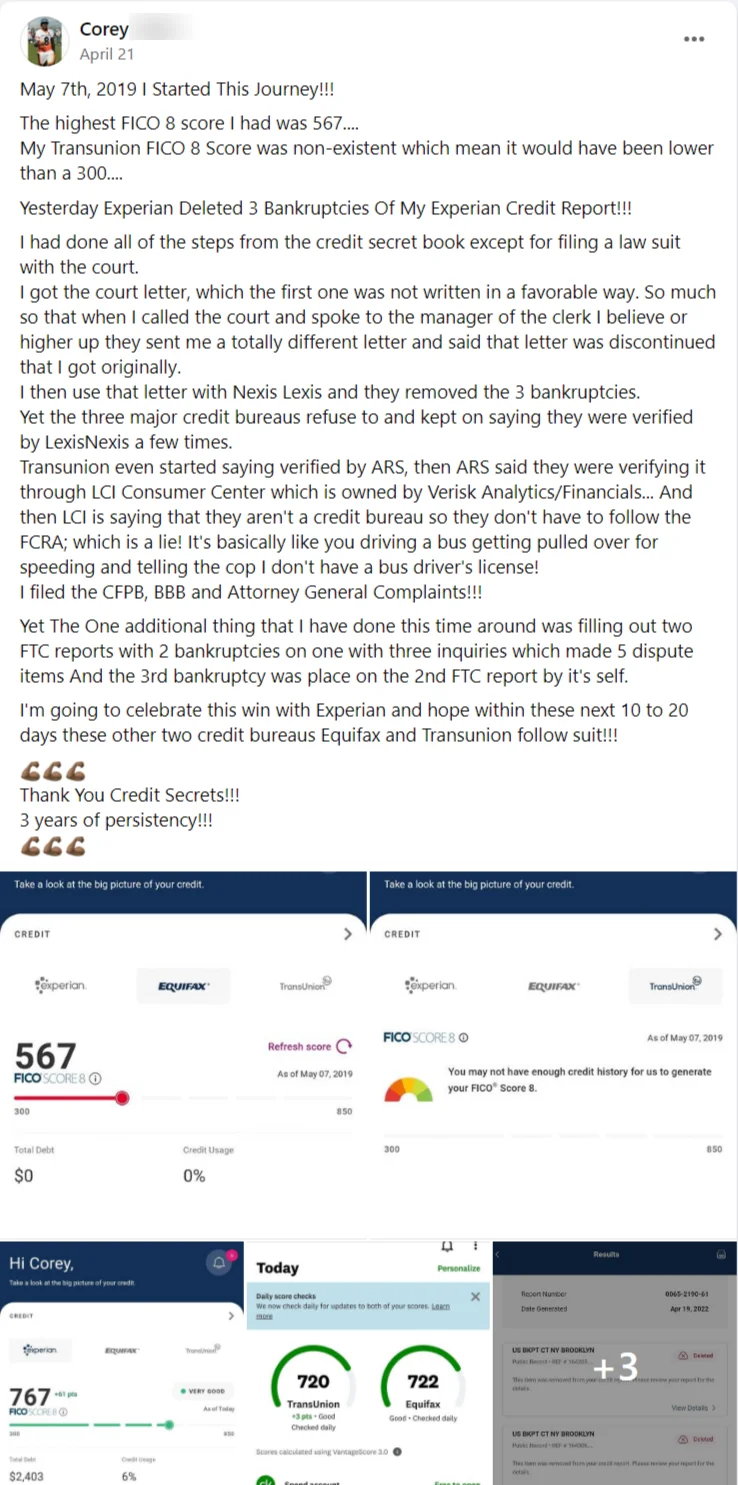

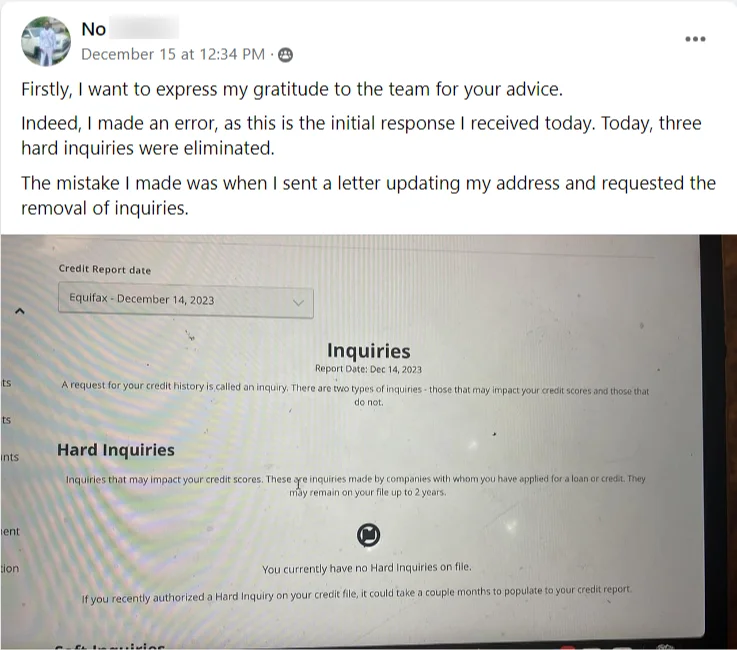

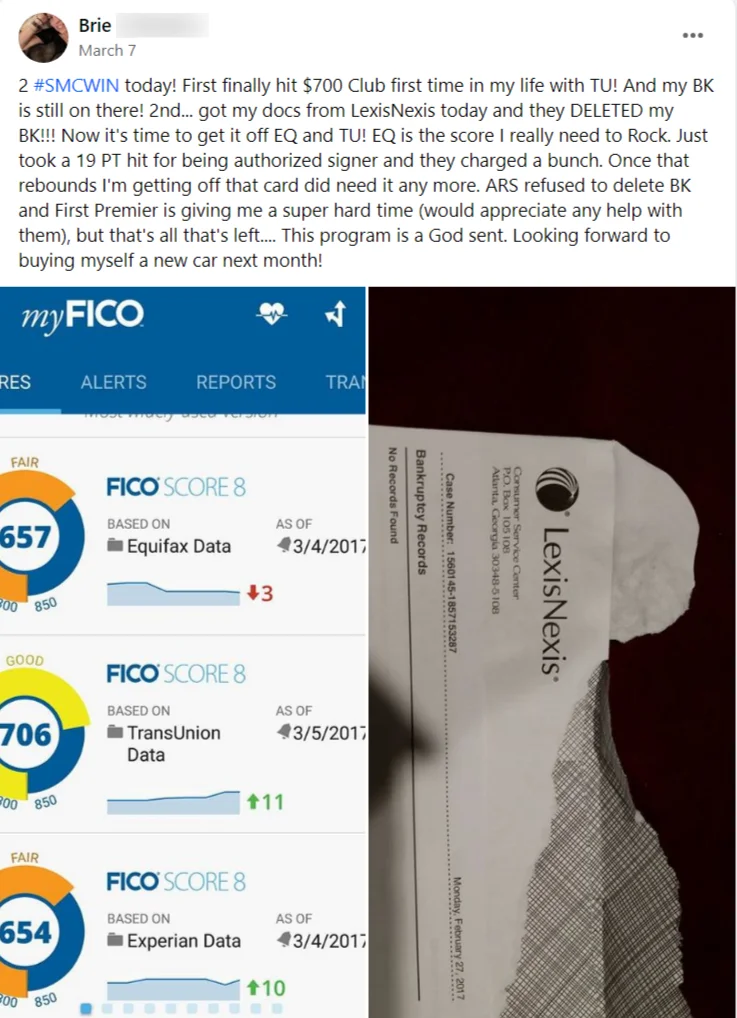

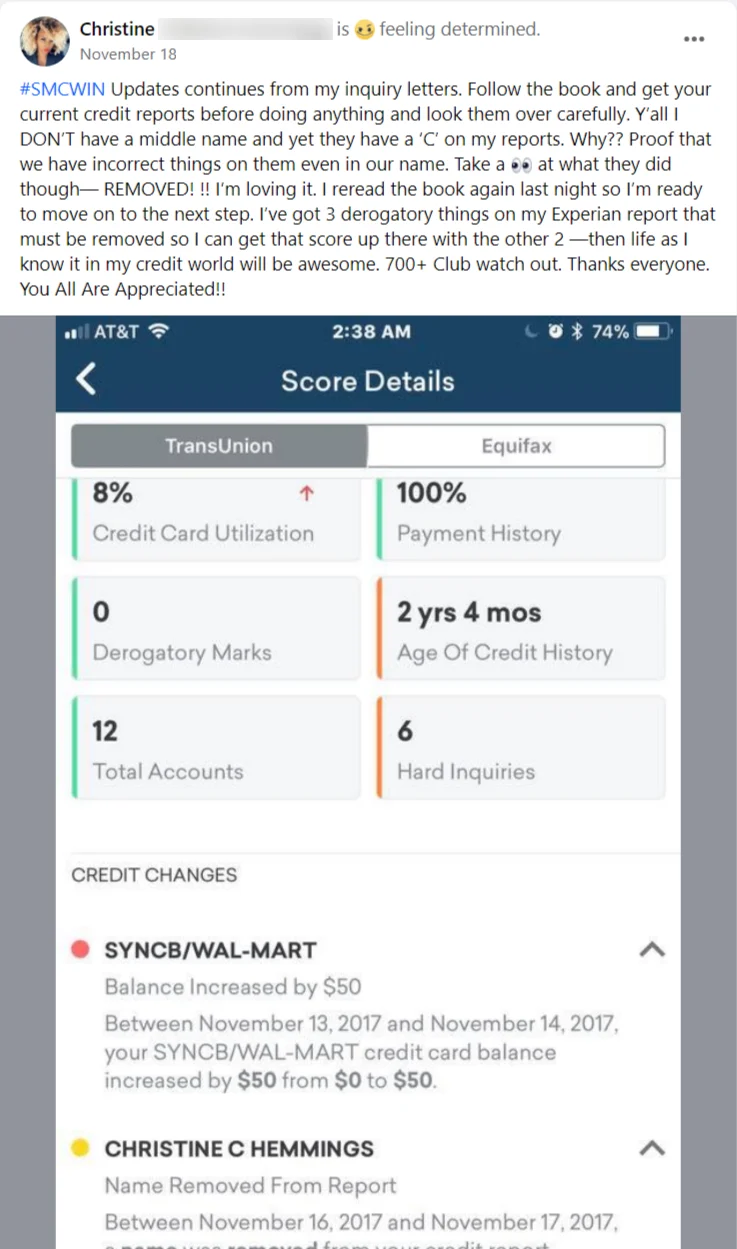

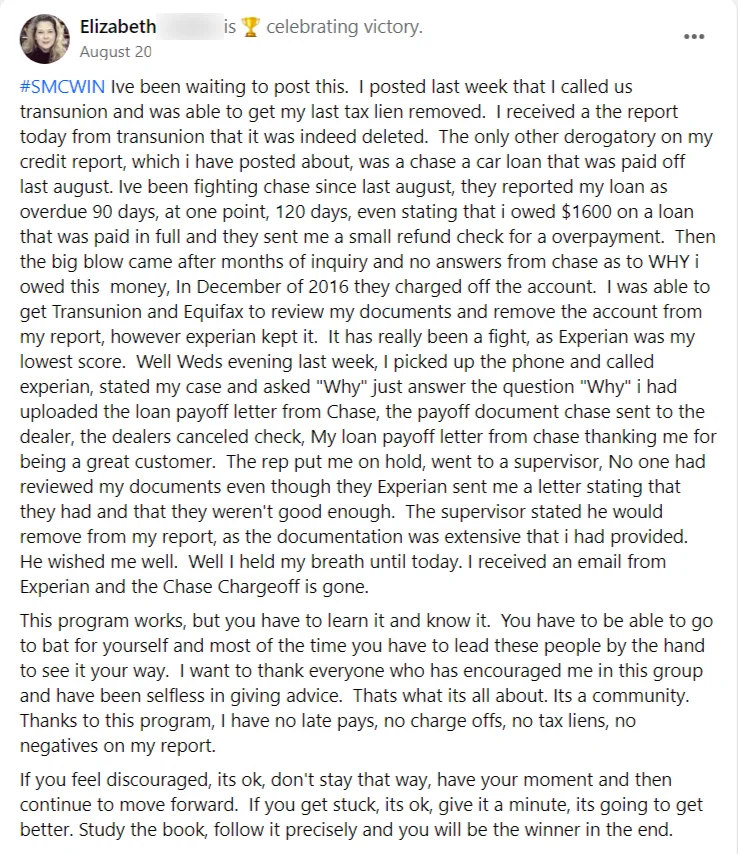

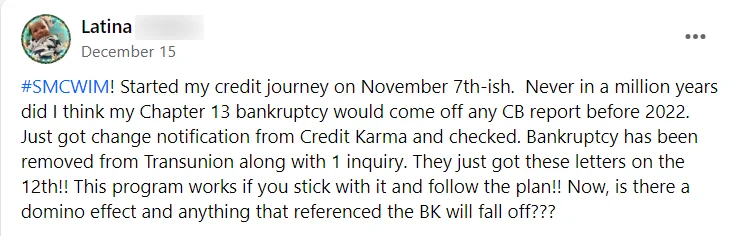

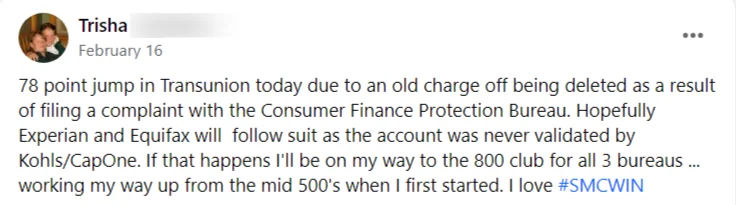

Hear From Real Customers

Discover The Program Now Helping Over 1 Million Americans Finally Get the Credit Scores They Deserve...

Unlock your financial future now!