First-Time Credit Card Applications: Everything You Need to Know

First-time credit card applications are the first milestone in your financial journey. Typically, the first time someone is applying for credit, they’re young adults just starting to gain financial independence. However, there are also people who believe cash is king until they realize credit is necessary for some major purchases.

It’s important to figure out how to manage your finances and credit. Because these initial decisions will lay the foundation for your long-term financial health. Credit scores serve as a reflection of an individual’s financial responsibility.

It’s like your report card: a higher number means great chances of achieving better things.

One wrong financial decision can cause terrible consequences. You should choose an appropriate credit card for your financial needs. But how do you qualify for a credit card? How can you find which credit card is suitable for you?

If your mind is full of these questions, then don’t worry. In this article, we’ll discuss all of these points. So read this till the end.

Understanding Credit Scores and Credit Cards

The first thing you should know about credit cards is your credit score. It’s a three-digit number that indicates the creditworthiness of an individual. It ranges from 300 to 850. It is calculated based on five critical factors.

- Payment history

- Credit utilization

- Length of credit history

- Types of credit accounts

- New credit inquiries.

Lenders assess the risk of extending credit to an individual based on the credit score. A student with high marks gets the most awards and additional benefits. Likewise, high credit scores increase the likelihood of being approved for a credit card. You might get approval with favorable terms such as a lower interest rate and high credit limits. Meanwhile, a lower credit score means less favorable terms and sometimes credit card application rejection.

Your credit history is reflected on your credit report. It is another crucial factor for credit card eligibility and approval. It tells lenders about a detailed record of an individual’s past credit-related activities, such as payments.

Positive credit history = Timely payment + Low credit utilization → Approval

Negative credit history = Missed payments + Defaults → Rejections

Focusing on taking the right steps that will lead to financial stability is important. That’s why we have compiled all the effective strategies, tips, and information in the Credit Secrets book. It’ll help you lay all the groundwork to achieve overall financial well-being and understand the ins and outs of applying for credit for the first time.

Choosing the Right First Credit Card

Selecting the first credit card can be a difficult process. What factors should you note? Which one’s the most suitable option? How do you apply for a credit card for the first time?

If you’re confused, then focus on these factors.

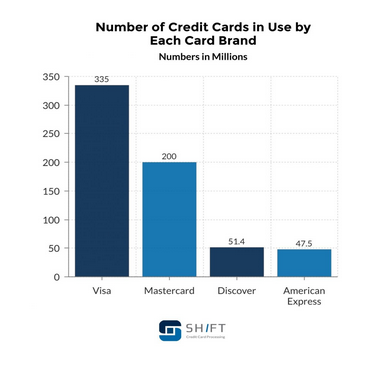

Source: shiftprocessing

The first thing you should know is there are different types of cards, known as secured and unsecured cards.

With secured cards, you are required to make a security deposit. This aspect makes it accessible to individuals with poor credit history. The security deposit is typically equal to the credit limit which, for lender, reduces their risk.

Secured cards are usually for people with no credit to low credit scores.

Meanwhile, unsecured cards don’t require any deposit. However, you’ll get approval only if your credit score is good.

The next factor is interest rates or annual percentage rates that various credit cards offer. Low interest is extremely beneficial because it saves you money on additional charges.

Another aspect is whether the credit card offers rewards.

Some credit cards provide travel or shopping rewards or cashback benefits. Analyze your spending habits and choose the card accordingly.

Here are some starter credit cards you might find helpful.

Student credit cards: These are basically for students with limited or no credit history. It offers benefits and rewards specifically for students.

Retail credit cards: These are retail store credit cards like Macy’s, Nordstrom, etc. But where can you use them?

The answer is simply with that specific retailer or their affiliated stores. Discounts are offered for shopping. But be cautious because the interest rate might be high. Entry-level credit cards are for individuals with limited credit history. The credit limit is low, with fewer rewards than other credit card holders.

Applying for Your First Credit Card

Now that you’ve clarity about credit cards, it’s time to focus on the most important part. Applying for your first credit card. Here’s a step-by-step process on how to get your first credit card. It also explains how to qualify for a credit card.

Steps in the Credit Card Application Process

- Gathering Necessary Documentation: Credit card applications require proof of income. It can be your recent pay slip or tax returns. Moreover, your identification, such as a driver’s license or passport, is also needed. Before applying, gather all these documents and organize them accordingly to complete the application accurately.

- Understanding the Approval Process: The issuer will assess your creditworthiness after you apply for a credit card. Based on that, they might approve, deny, or put your application status on pending. There’s also a possibility of being pre-approved, which is just another way to determine if you qualify for a credit card. This happens when the issuer determines that applicants meet the lender’s specific criteria and have a high chance of approval.

- Next Steps After Application: In some cases, applicants receive immediate approval for their credit card application. However, you might receive a denial notification, which can be due to poor credit history, negative marks on credit reports, or insufficient income. If this happens, you should contact the issuer for clarification. Find the issue, i.e., if it’s a poor credit score, implement strategies to improve it. You can also consider alternative options such as secured credit cards or credit-builder loans. Sometimes, the issuer also requests additional information to evaluate your application and credit score for your first credit card.

Building Good Credit Habits

Now you have a credit card. So, what’s next?

The primary aspect is maintaining good credit habits. Become a responsible credit card user.

Make timely payments for credit card balls. Avoid late payments or negative fees on your credit report. Don’t carry high balances on your credit card, because this impacts your credit utilization and it negatively impacts your credit score.

To make the process smooth, keep track of your overall credit utilization ratio. Ensure that it’s far below 30%. As in, 30% is too high! Never let your utilization reach double digits. But what’s the benefit of this?

It has immense long-term benefits. It shows great money management skills and that you’re not a financial risk. When you consistently adopt healthy financial habits, your credit score improves. Getting loans, renting a home, and securing a new car becomes easier with favorable terms. You can qualify for financial products and services easily.

Navigating Credit Card Rewards and Benefits

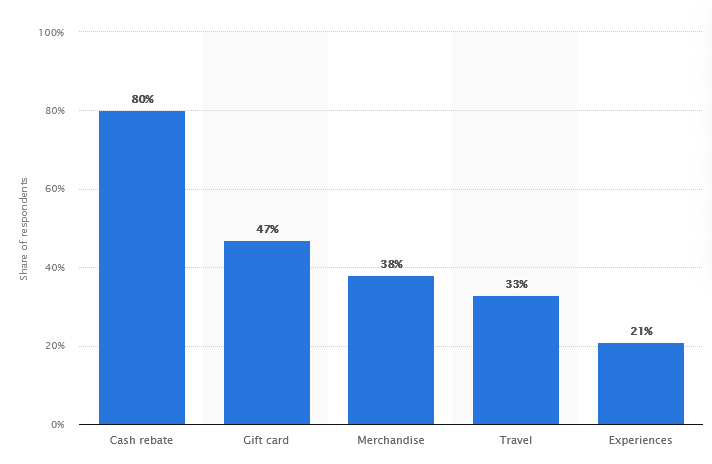

According to stats, here’s a representation of what rewards people love the most. Now that you know how to apply for a credit card for the first time, you should be one step ahead. Explore and learn how to get your first credit card and how it works. Only then you’ll be able to unlock its benefits.

Understand credit card rewards programs and the incentives they offer. Often, every purchase earns you a specific number of reward points. It might give you the temptation to overspend.

To avoid that, create a budget and stick to it. Understand cashback and travel-related rewards and measure how spending impacts your financial condition. Some credit cards offer introductory APR. It’s around 0% per purchase or balance transfer within a limited time. You should utilize these offers to save money on interest charges. But remember to read the fine print on how long you have to pay off balance transfer loans.

Avoiding Common First-Time Credit Card Mistakes

Being a first-time cardholder is an exciting journey. But many individuals make terrible mistakes that cost them credit wise. Some of them are as below.

- Not making on-time payments.

- Spending more than you can pay back.

- Ignoring reading the card agreement.

To avoid these mistakes, you should create a reminder. It should tell you about your next payment date and makes you well-prepared. Monitor your spending and the amount you should save to build an emergency fund.

Conclusion

In a nutshell, every first-time credit card holder should know about their credit reports, scores and personal finances.

Understand all the terms, rewards, and incentives that credit cards offer.

Your credit score for your first credit card is also crucial. All these aspects make choosing which card to make your first-time credit card easier.

But there’s something you can do which will make this journey better. What is it?

It’s getting help from experts. Our team of experts can assist you in understanding how to build your credit and obtain the first credit card of your dreams!