Get the Car of Your Dreams with Better Credit Scores

How Your Credit Score Influences Your Auto Loan Options

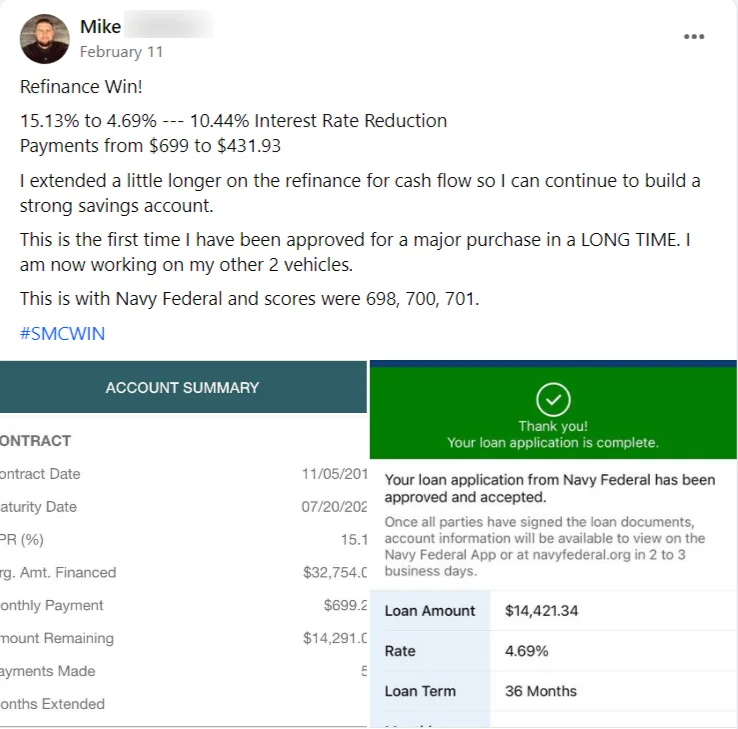

A higher score can lead to lower interest rates, which means more affordable monthly payments and significant savings over the life of your loan. It can also mean the difference of being approved for the amount you need or not.

Conversely, a lower score often results in higher interest rates and potentially larger down payments. This score also determines your access to various mortgage products; higher scores typically unlock a broader range of options with more favorable terms.

A Real Life Example

Emily and Jordan are both in the process of buying a car and are trying to secure an auto loan under vastly different credit circumstances.

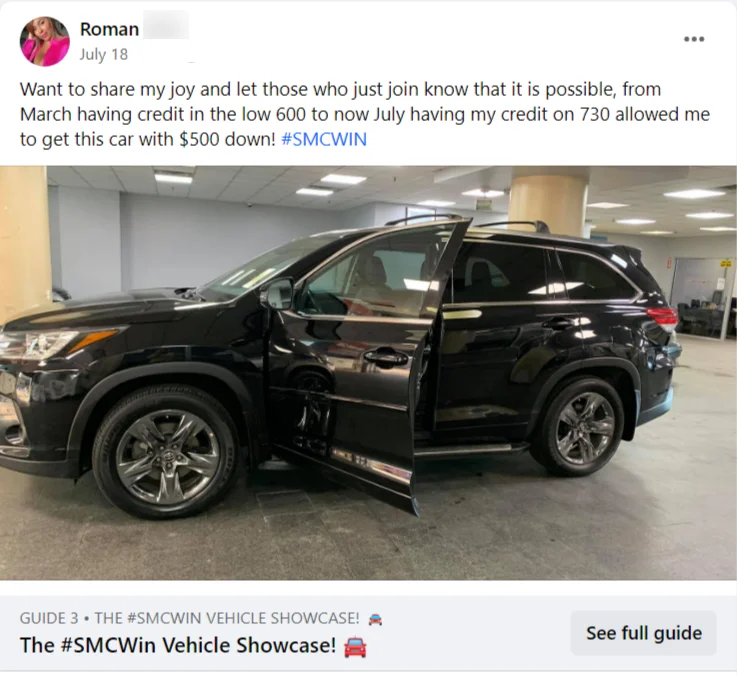

Emily, with a strong credit score of 730, applied for an auto loan and qualified for an attractive interest rate of 6.5% on a five-year term. This favorable rate meant lower monthly payments, making the financing of her dream car both affordable and straightforward.

On the other side, Jordan, holding a credit score of 630, encountered hurdles when he applied for his auto loan. The best offer he initially received came with a higher interest rate of 9.5%, significantly inflating his monthly payments and the total cost of financing his vehicle.

Determined to improve his situation, Jordan focused on enhancing his credit score. He paid down existing debts, committed to a consistent payment history, and corrected any errors found on his credit report. His efforts paid off, and within six months, Jordan’s credit score rose to 700.

With this improved score, Jordan reapplied for his auto loan and was pleasantly surprised to receive a much better interest rate, closely mirroring the advantageous terms Emily had secured from the outset. This improvement meant lower monthly payments for Jordan, making his car purchase more budget-friendly and sustainable over the term of the loan.

Both Emily and Jordan successfully navigated the auto loan process, albeit from different starting points, to achieve their goal of purchasing a car—the impact of credit scores on loan terms and the value of credit improvement.

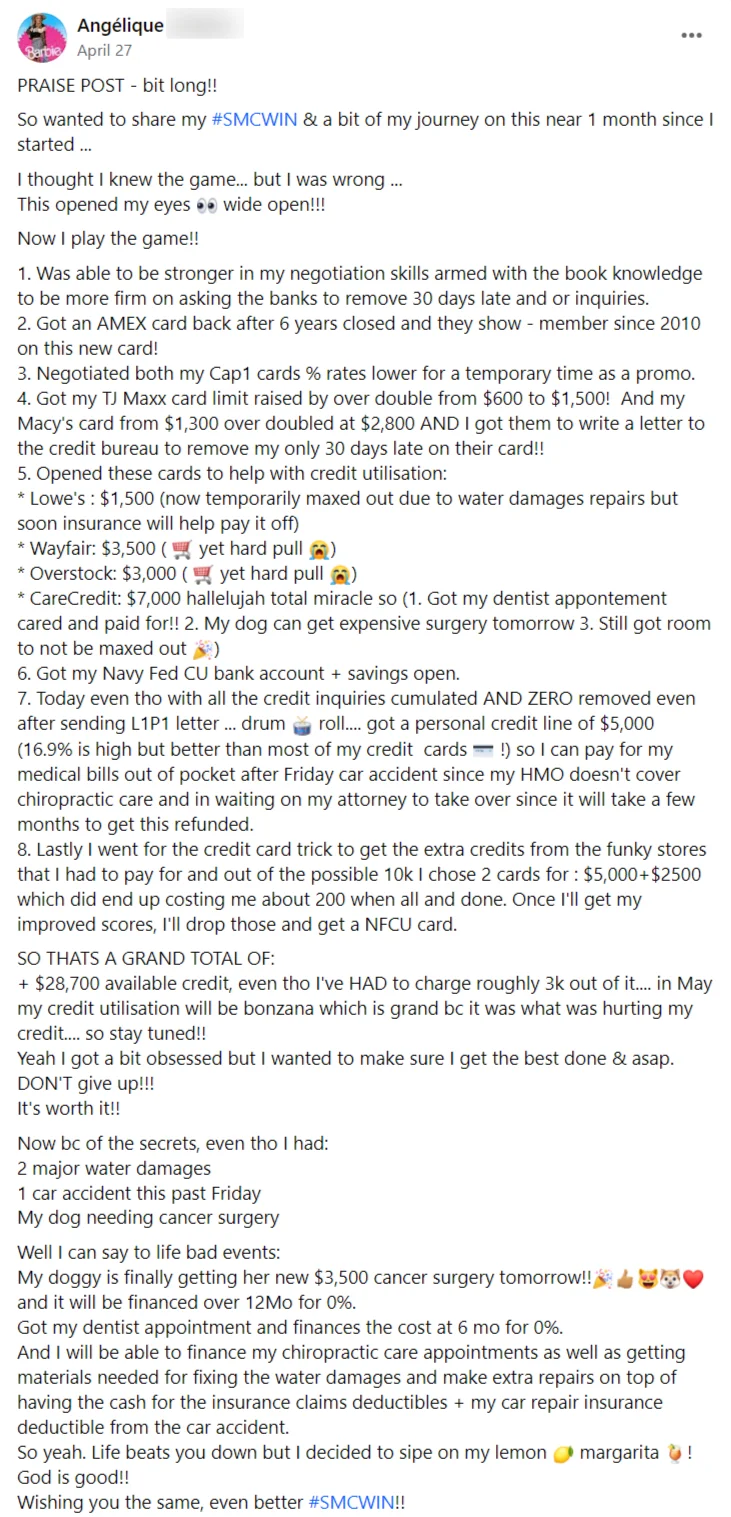

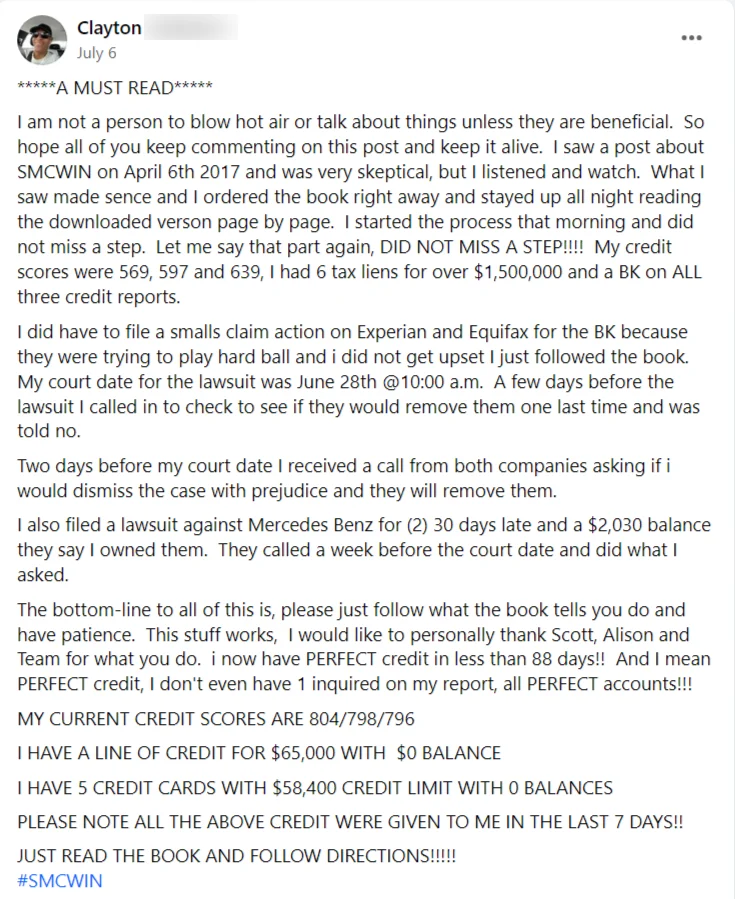

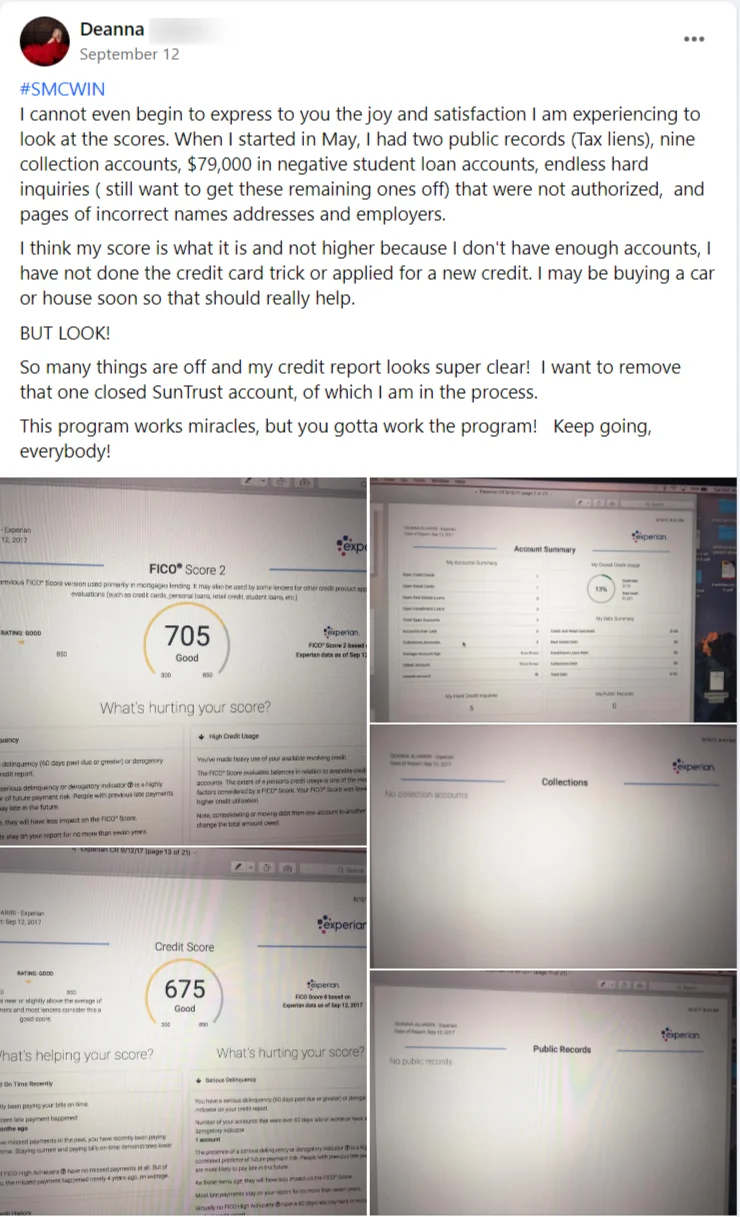

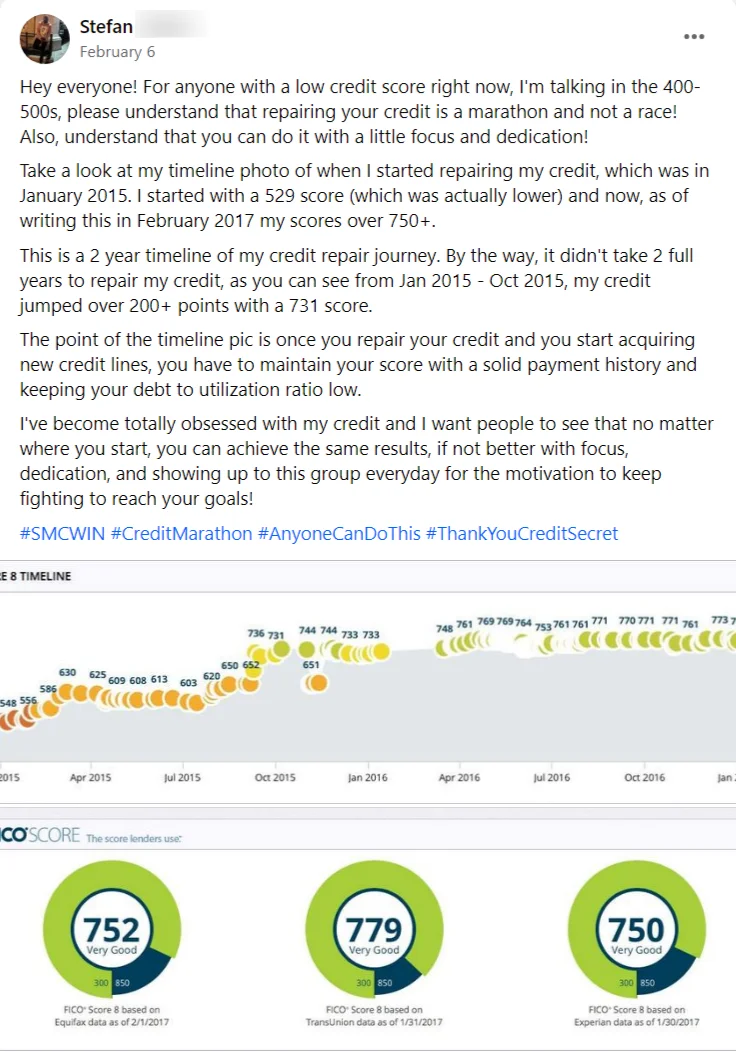

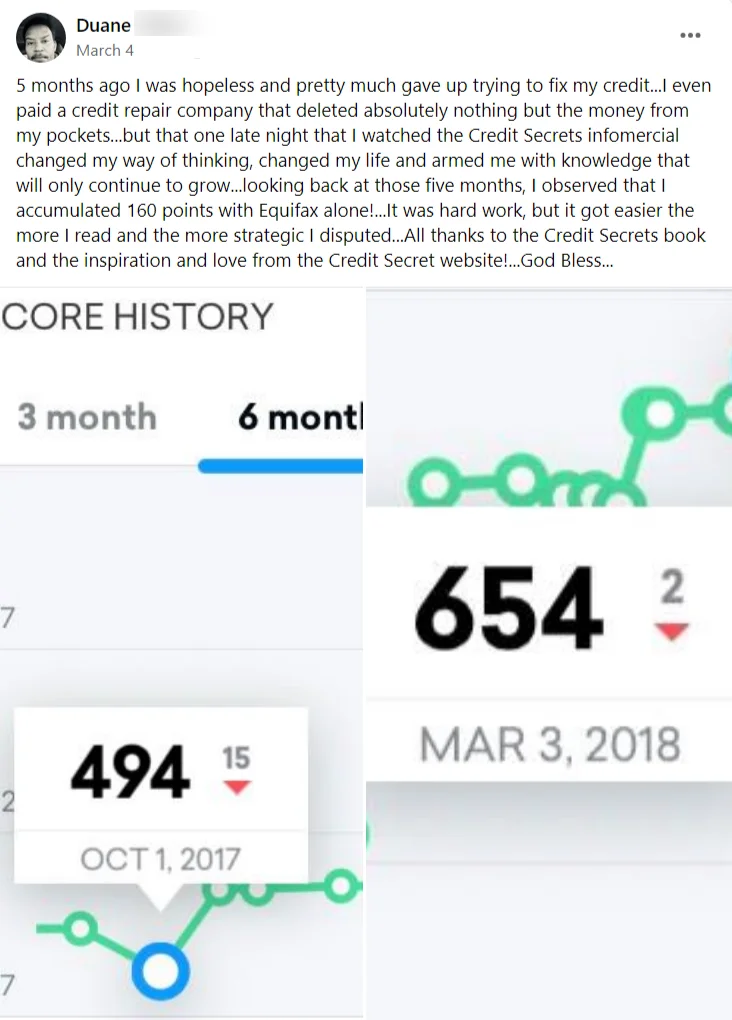

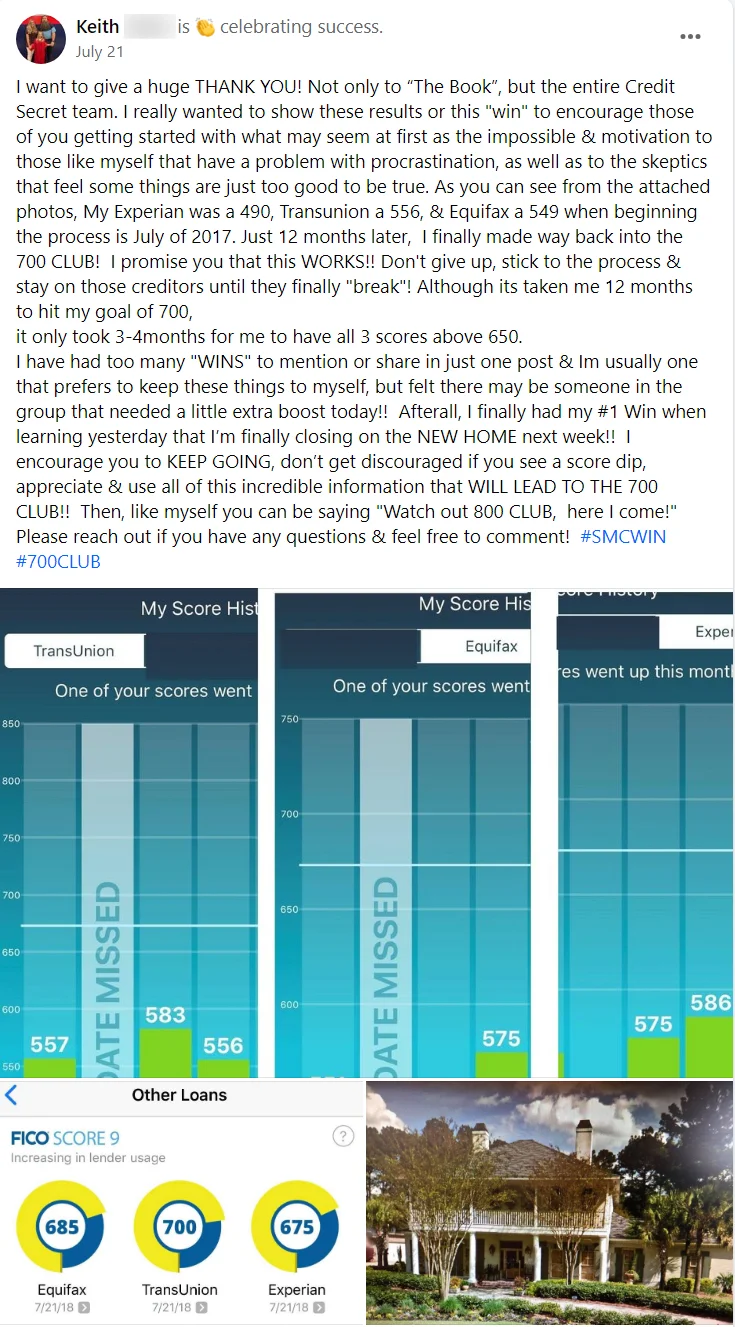

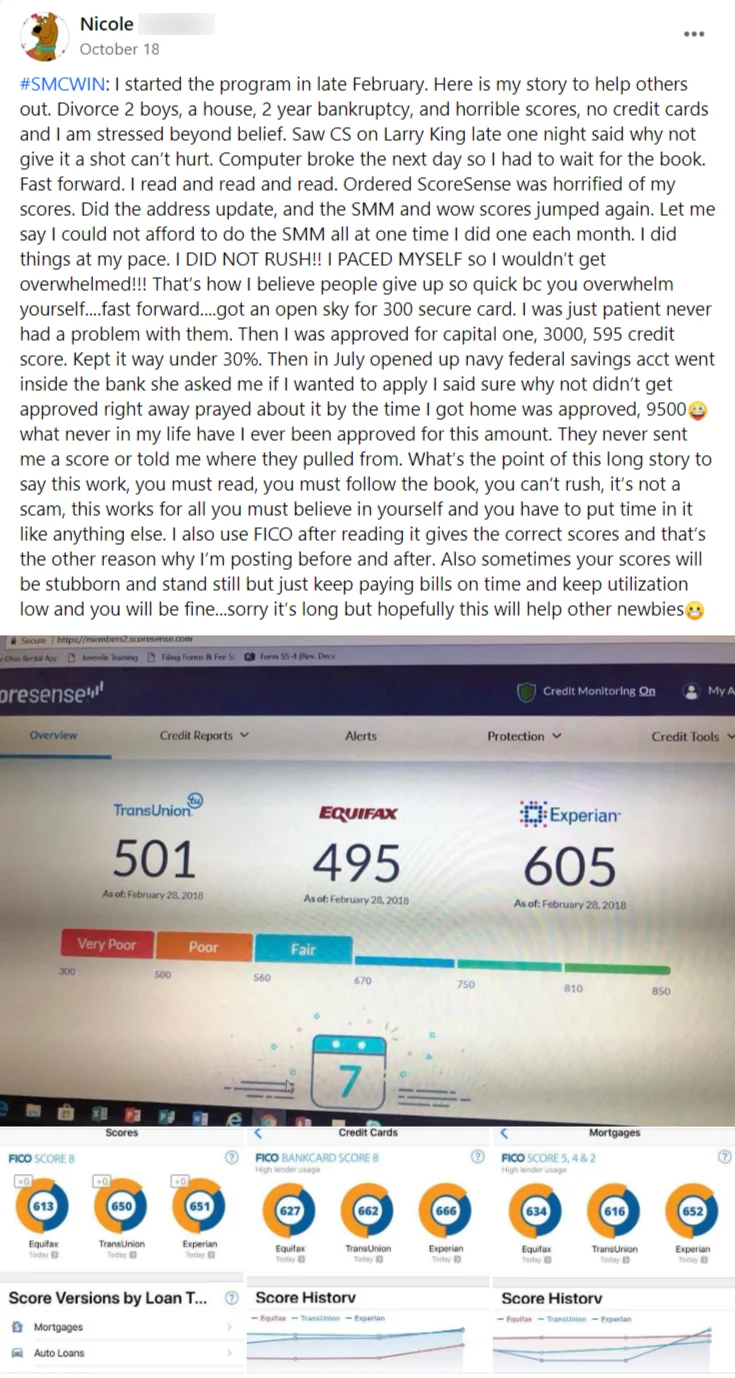

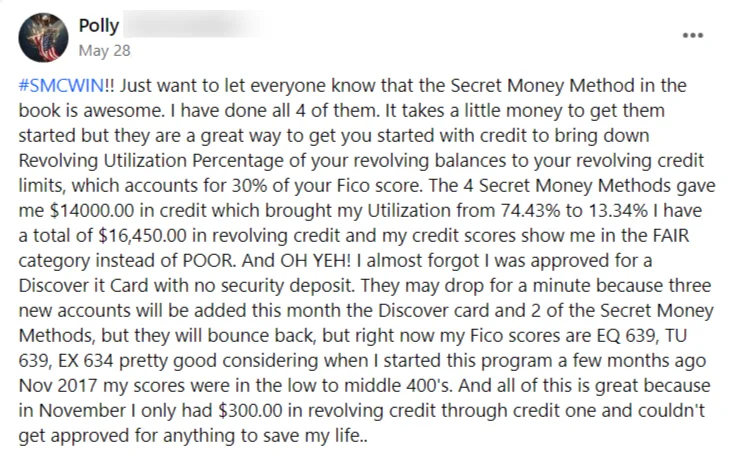

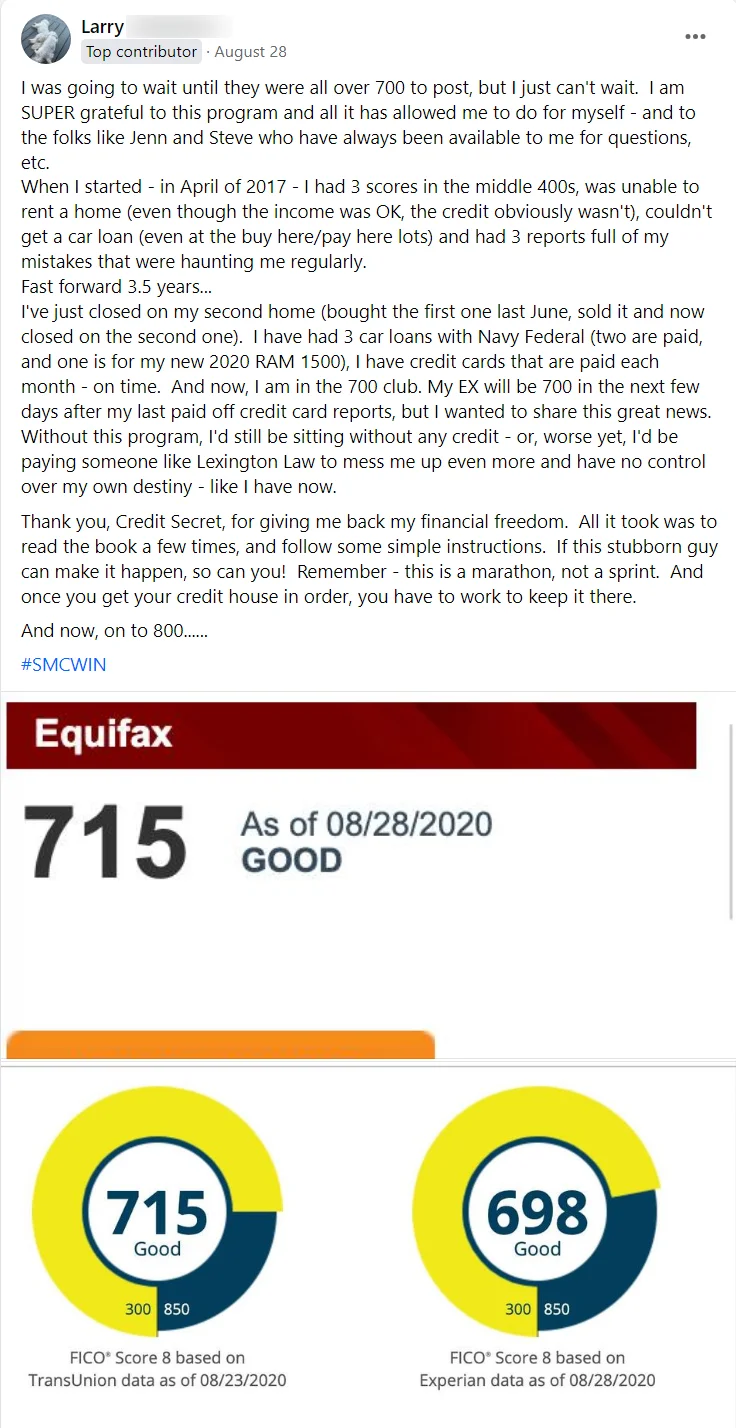

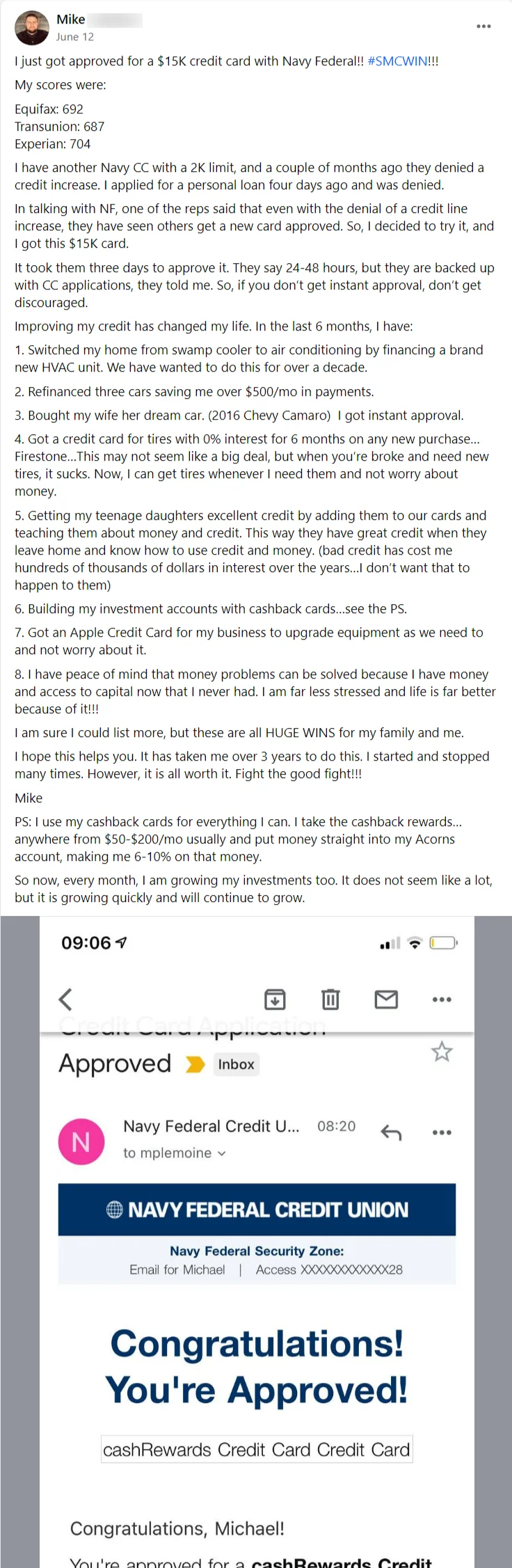

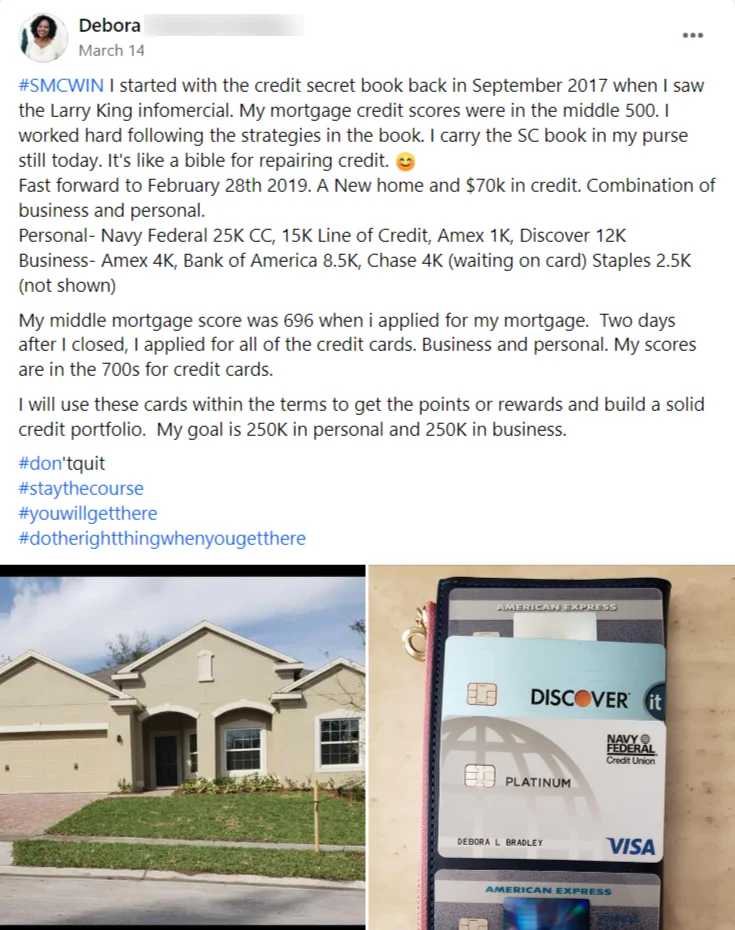

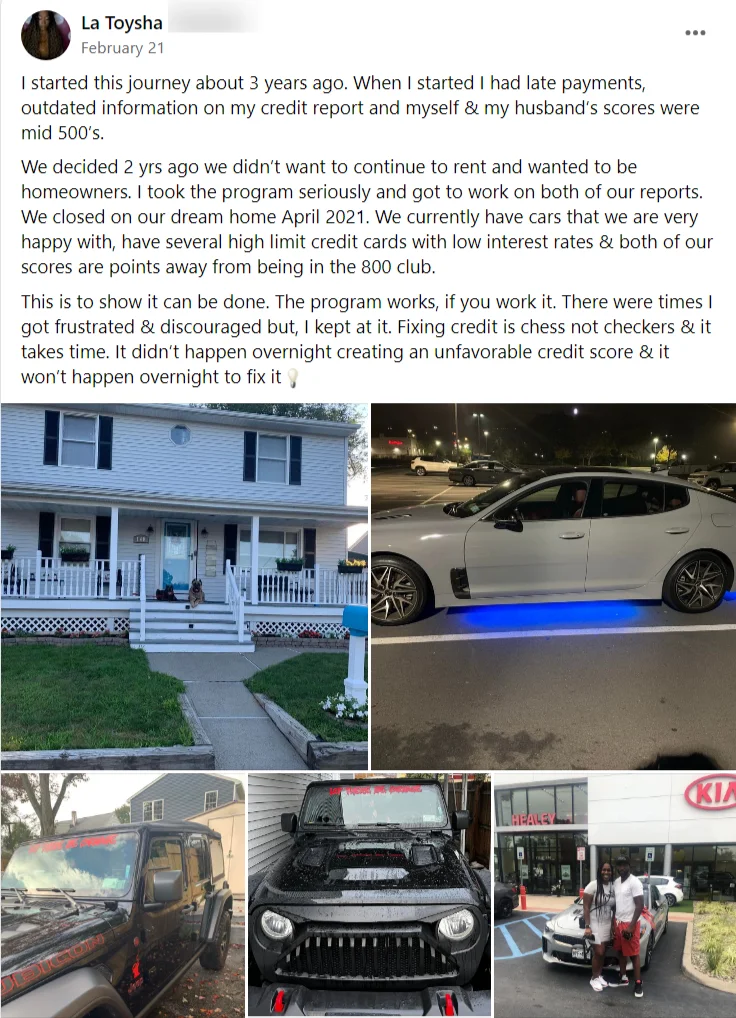

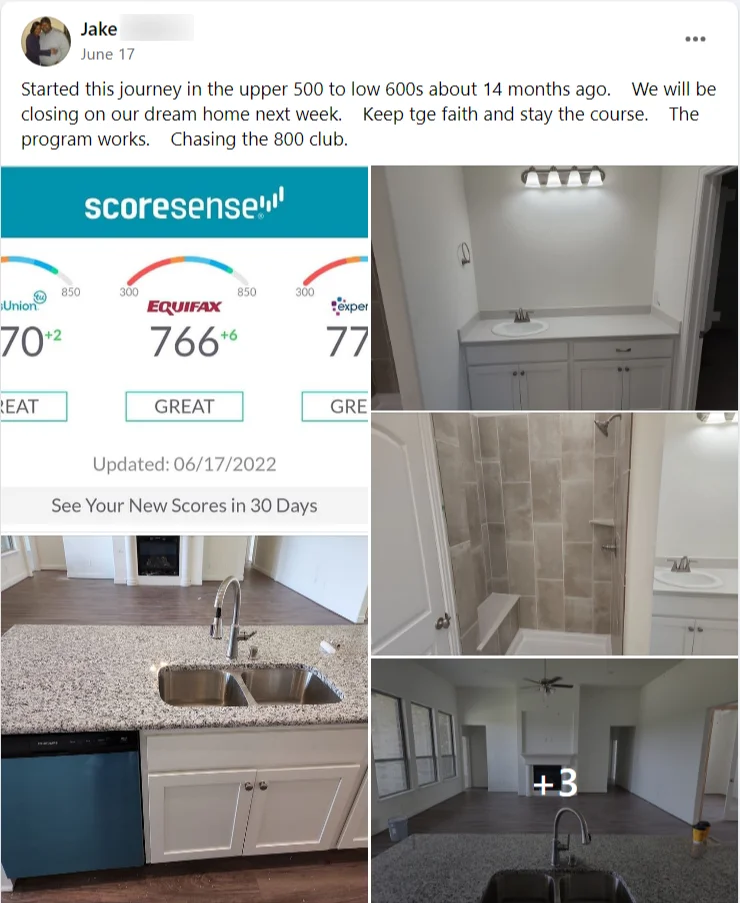

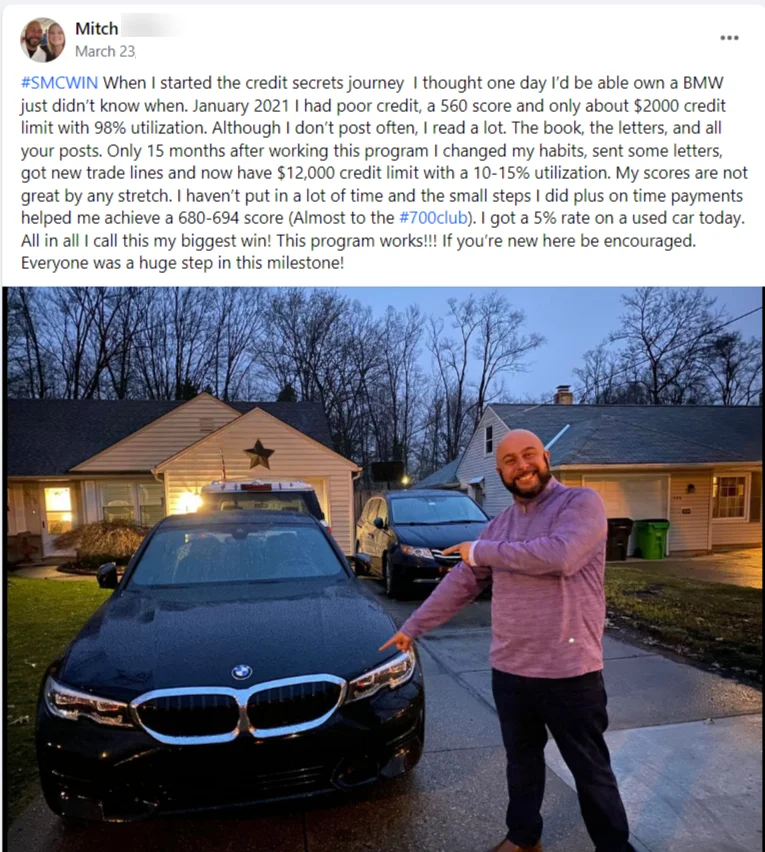

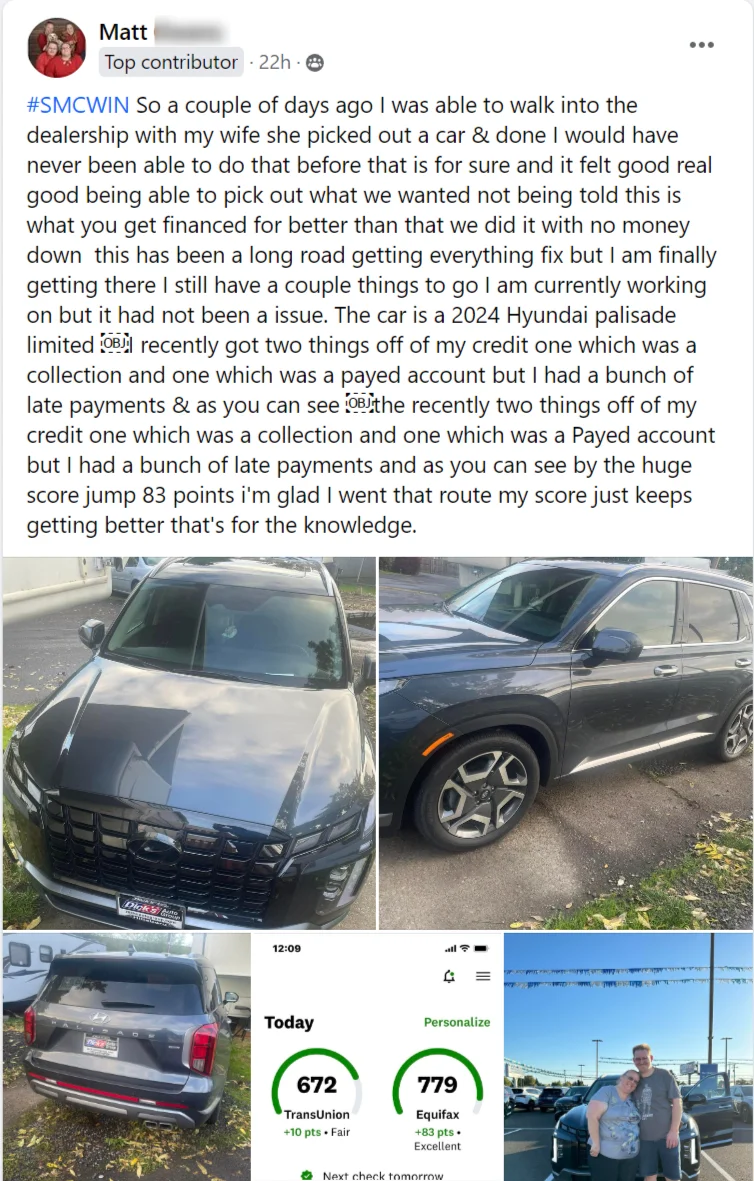

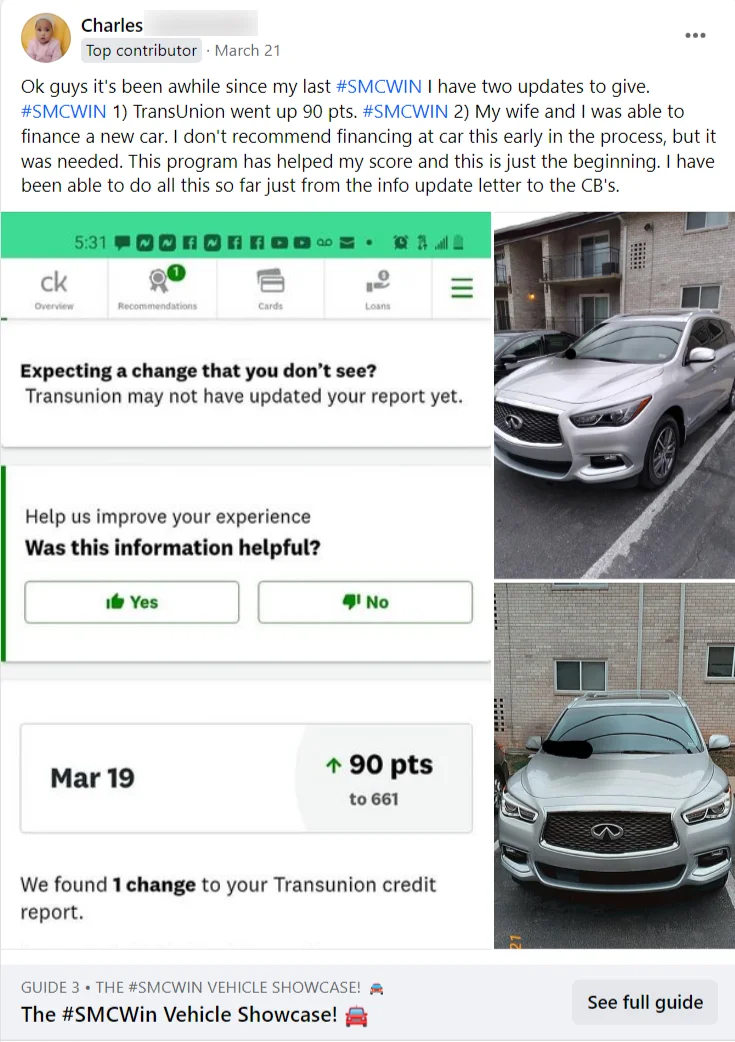

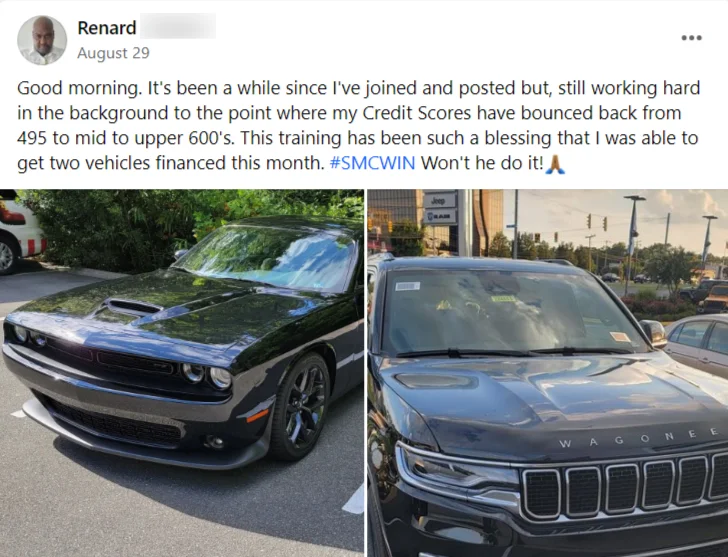

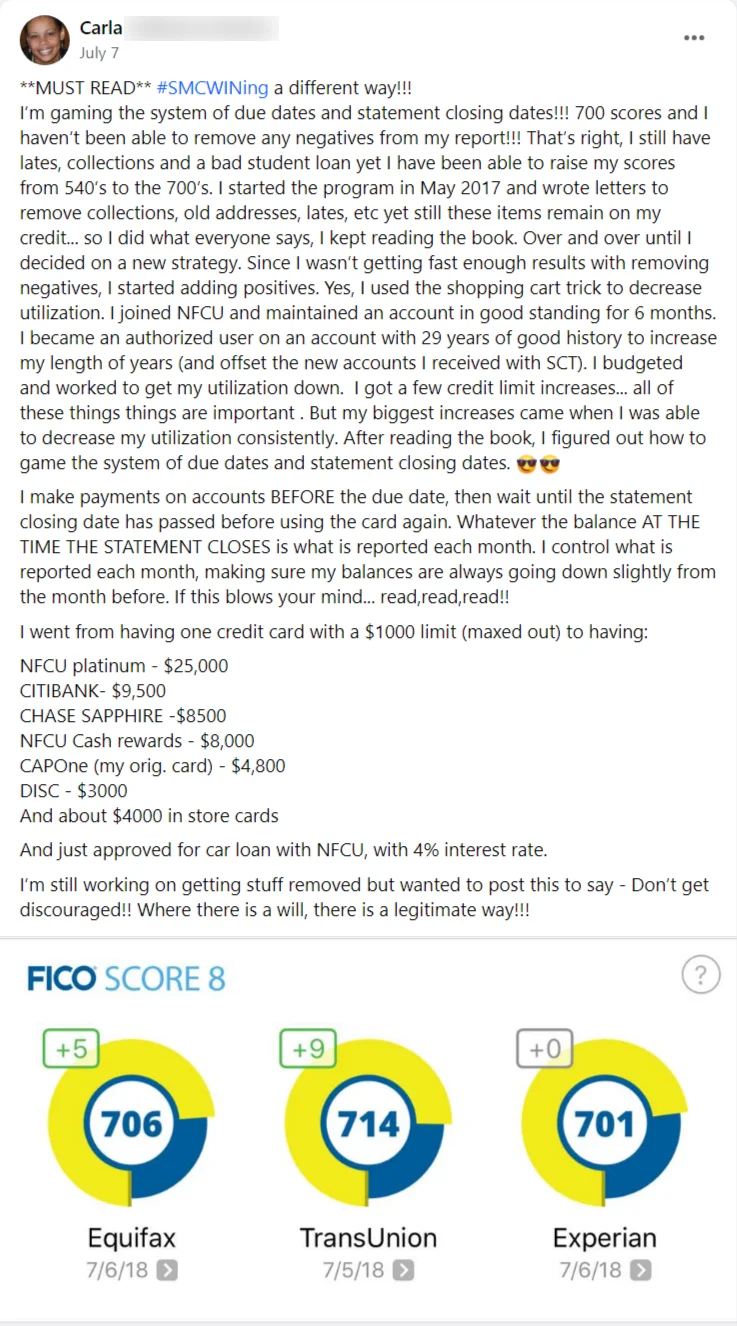

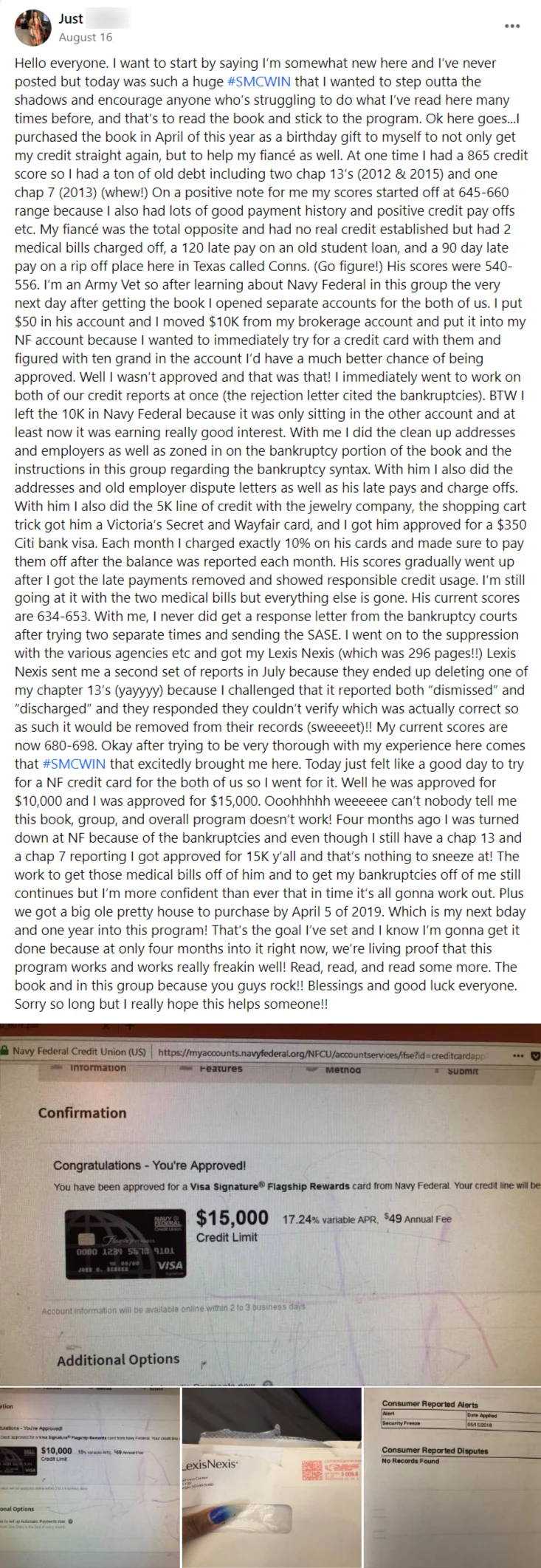

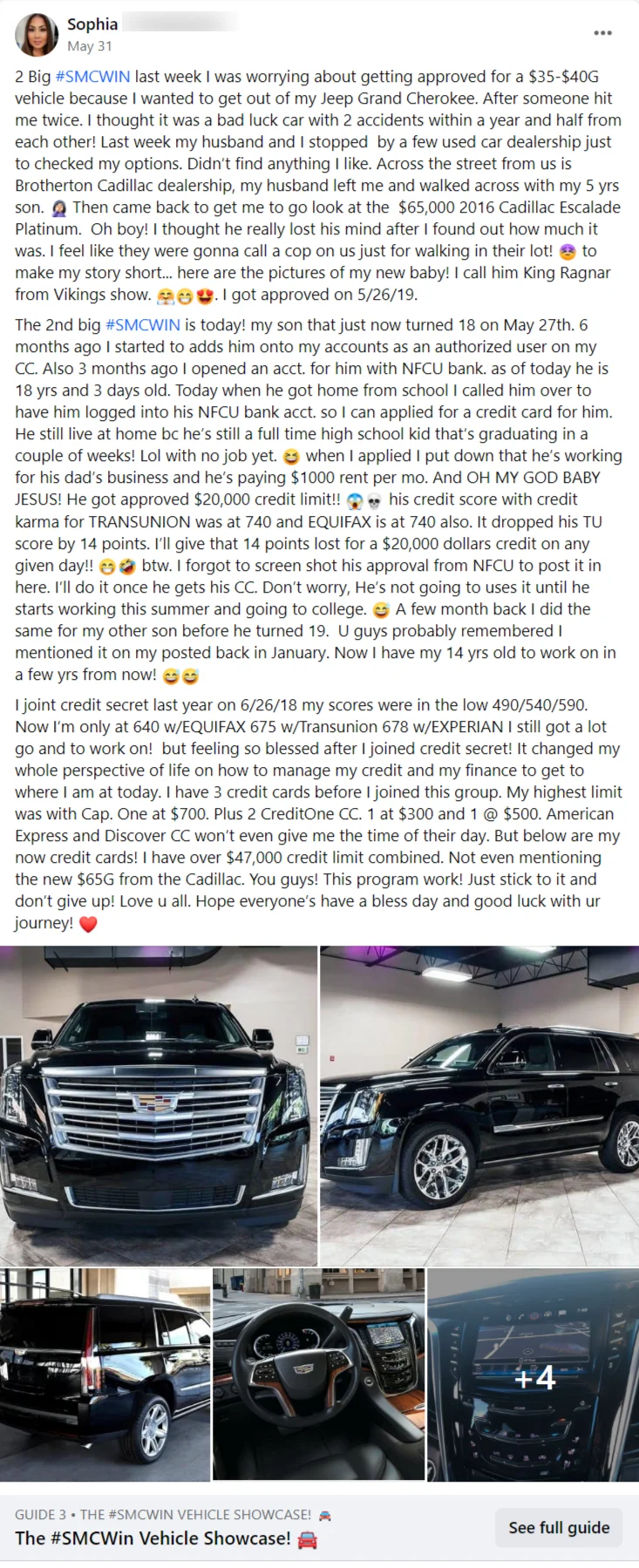

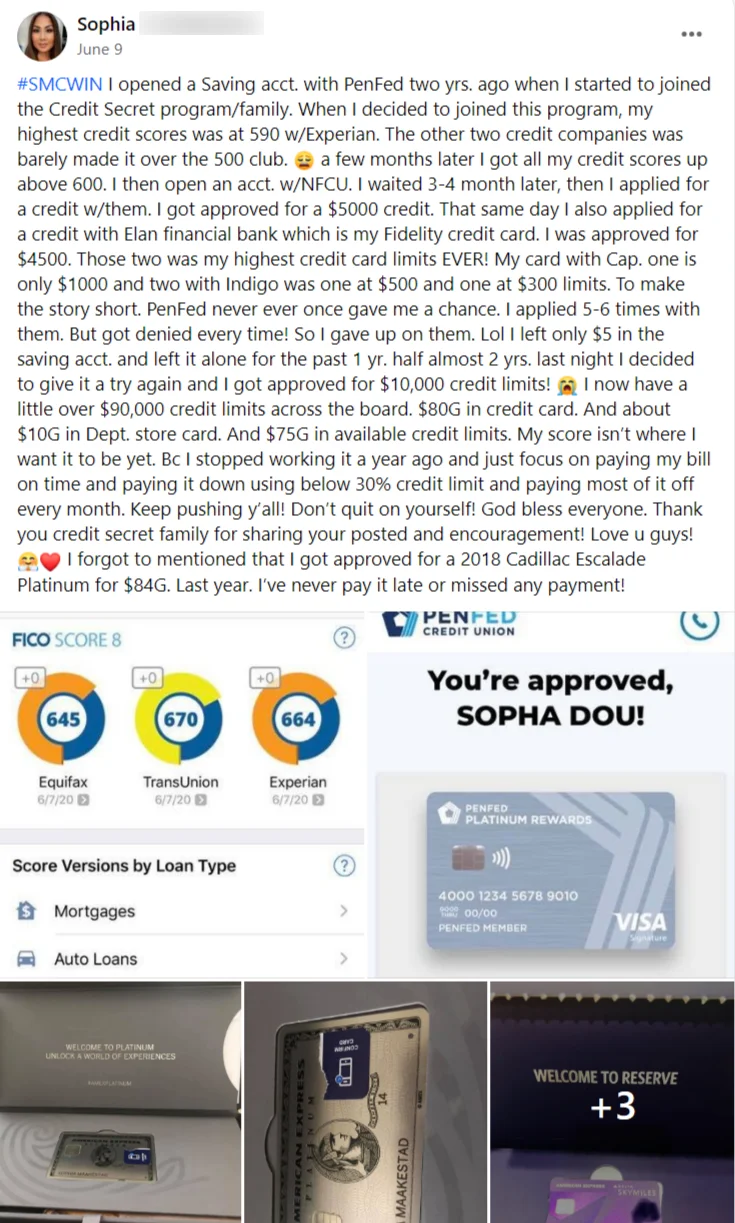

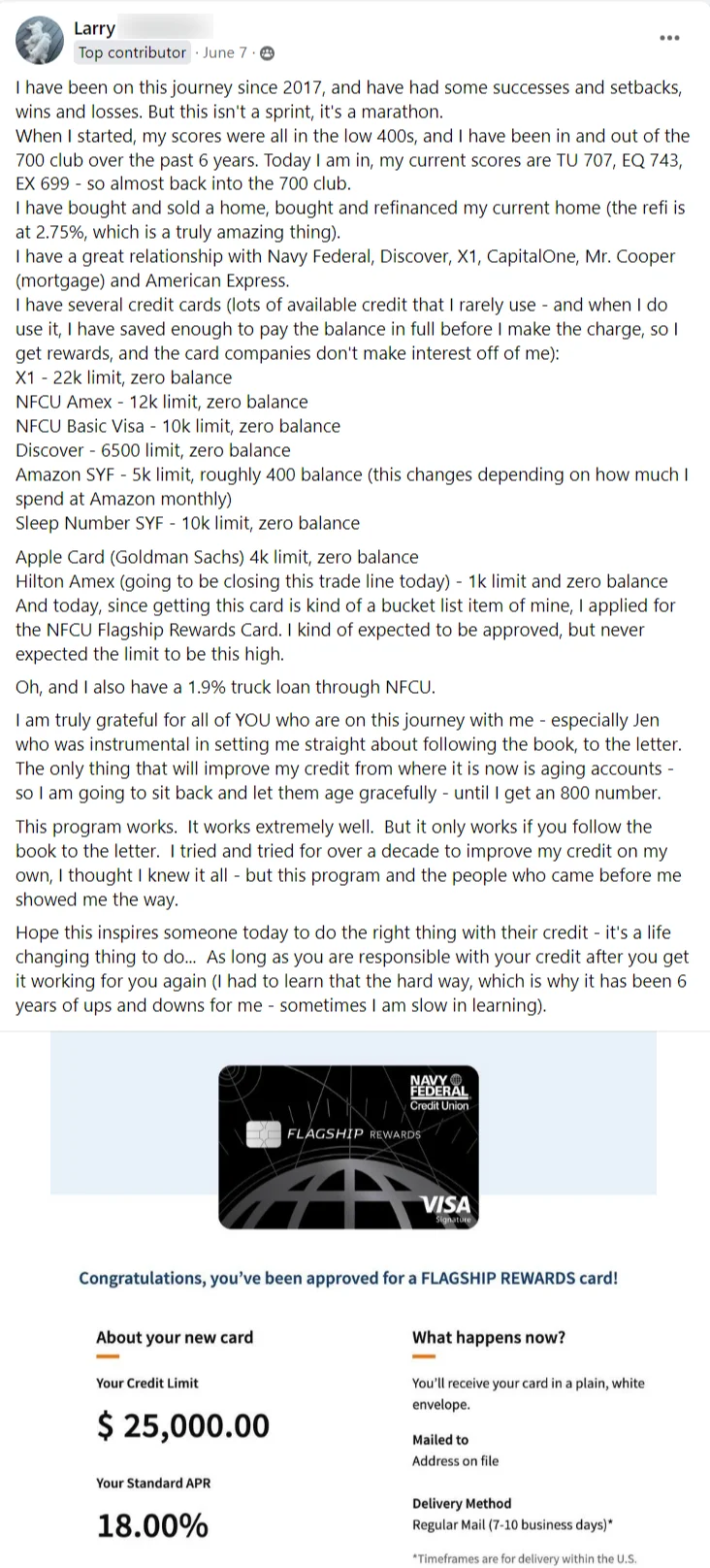

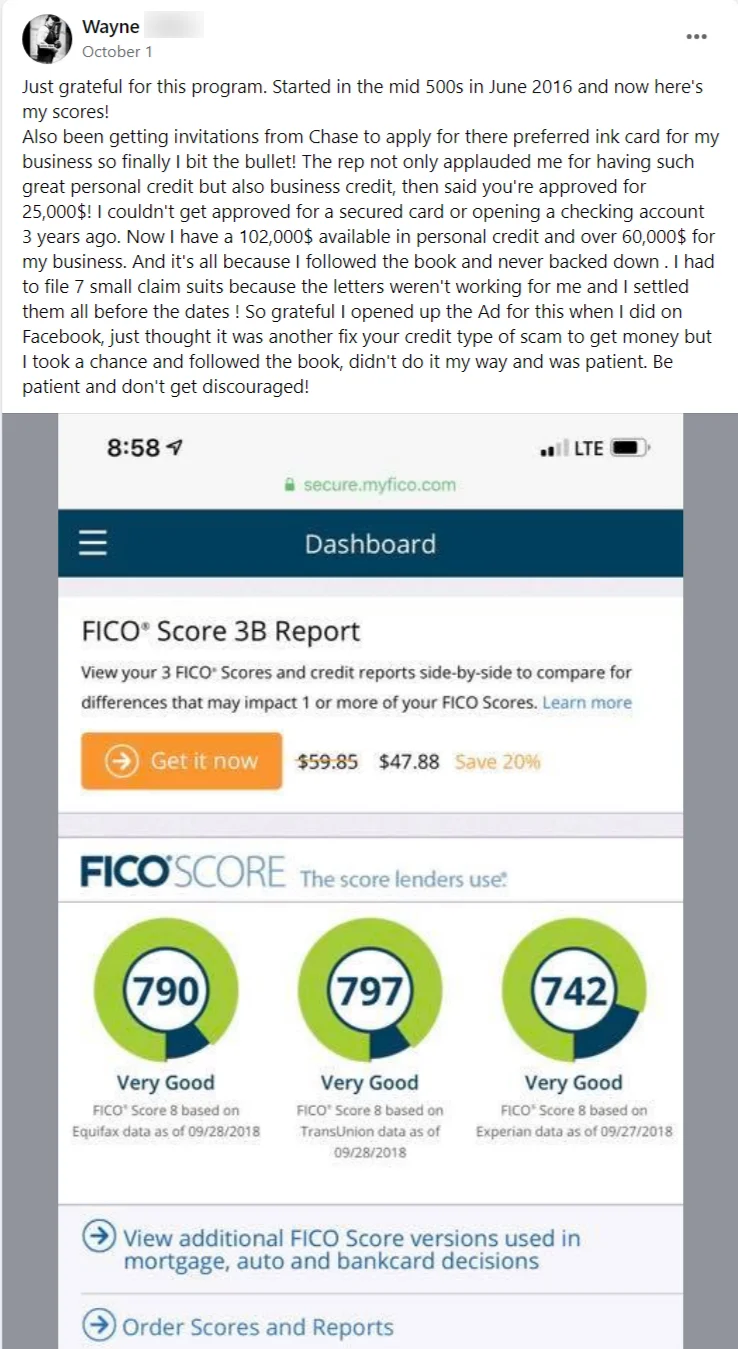

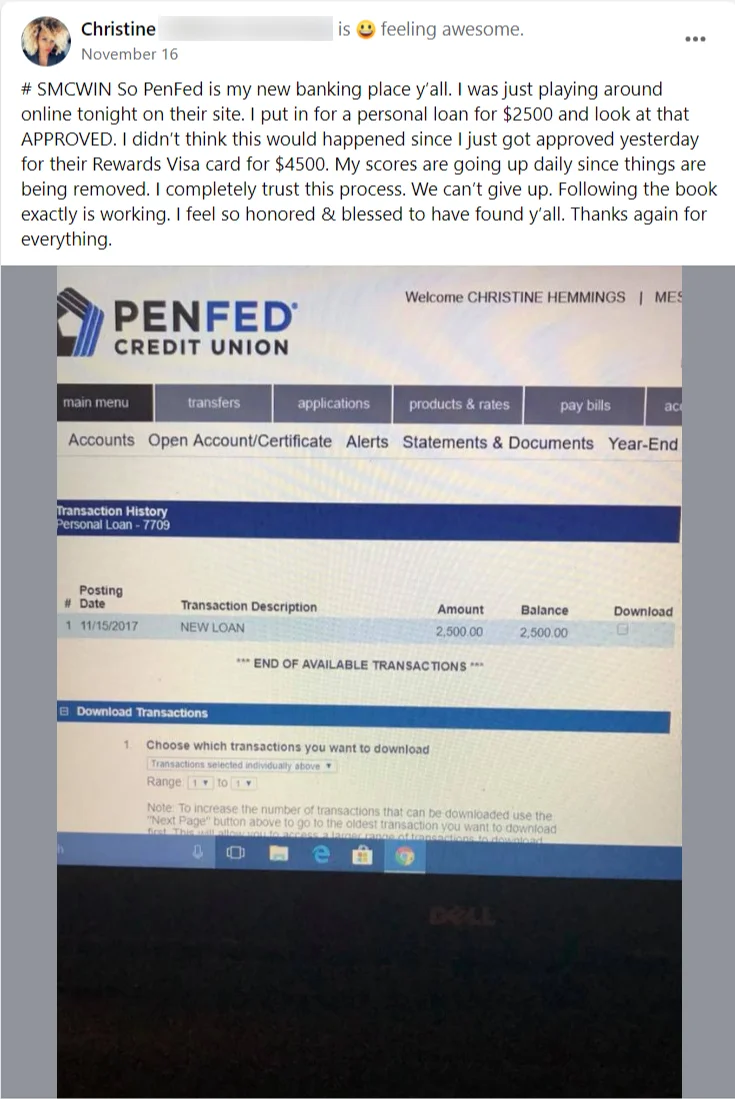

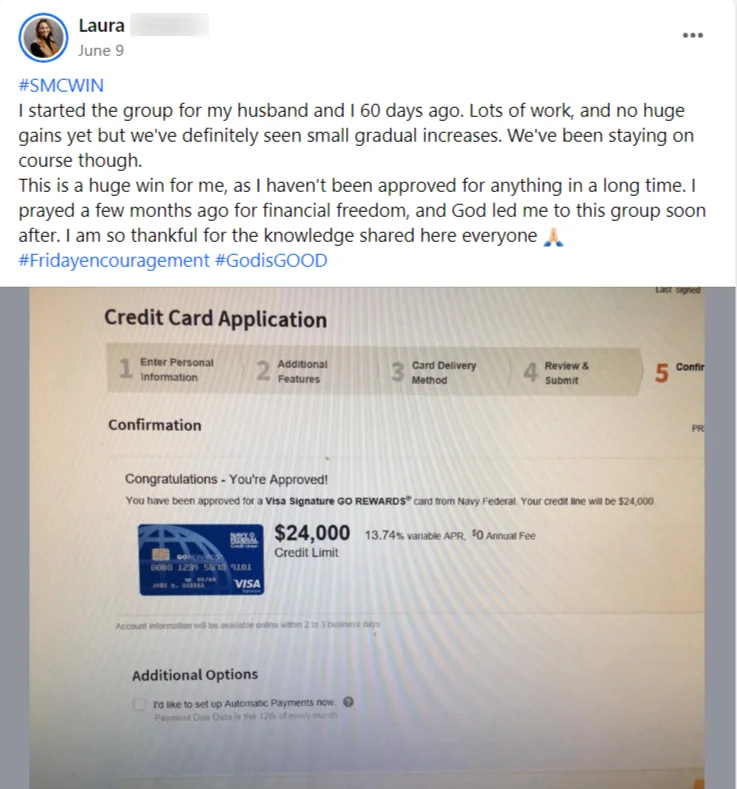

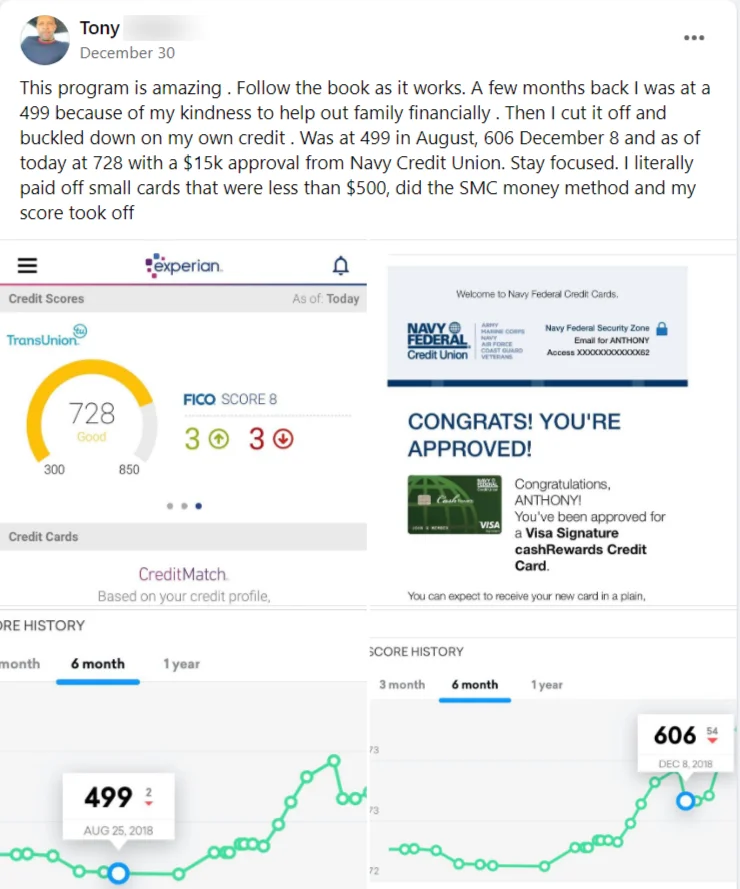

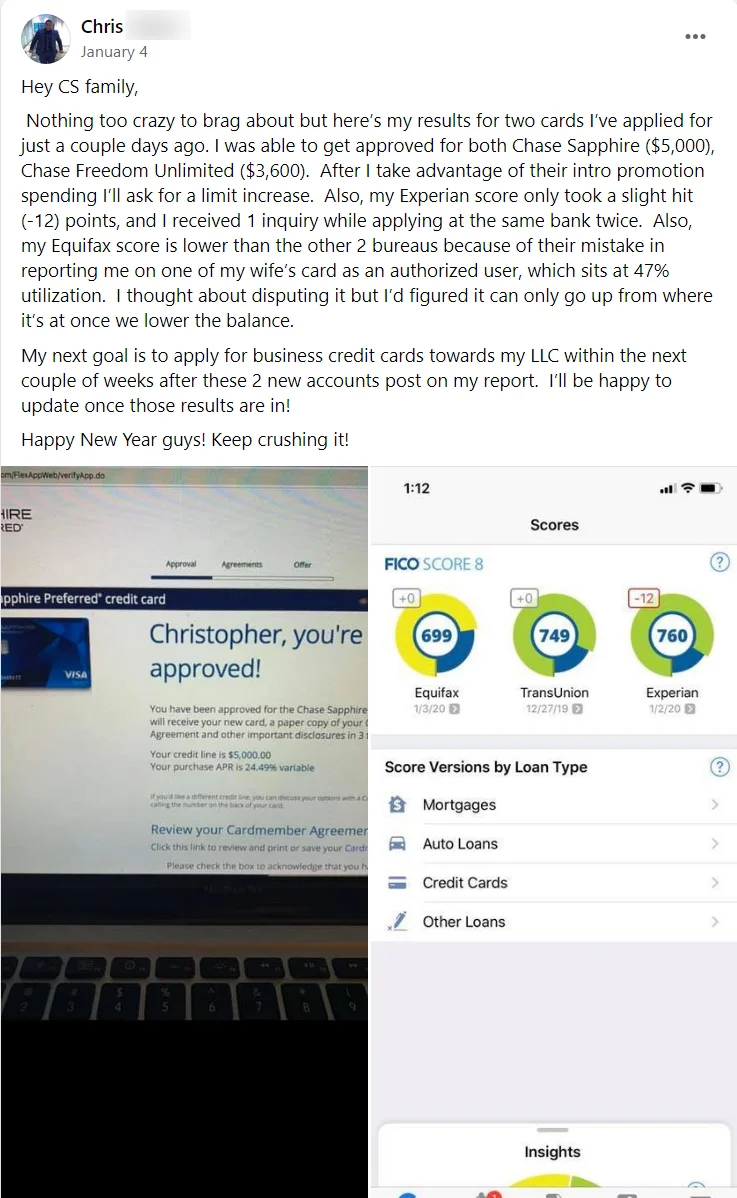

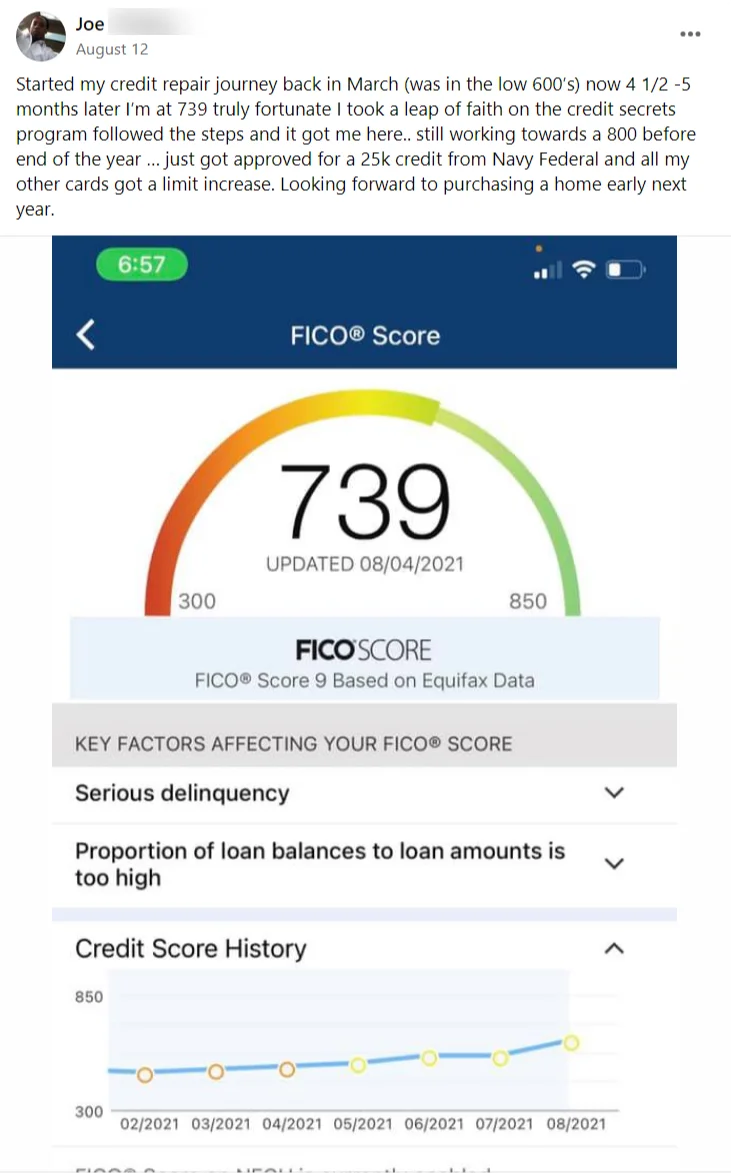

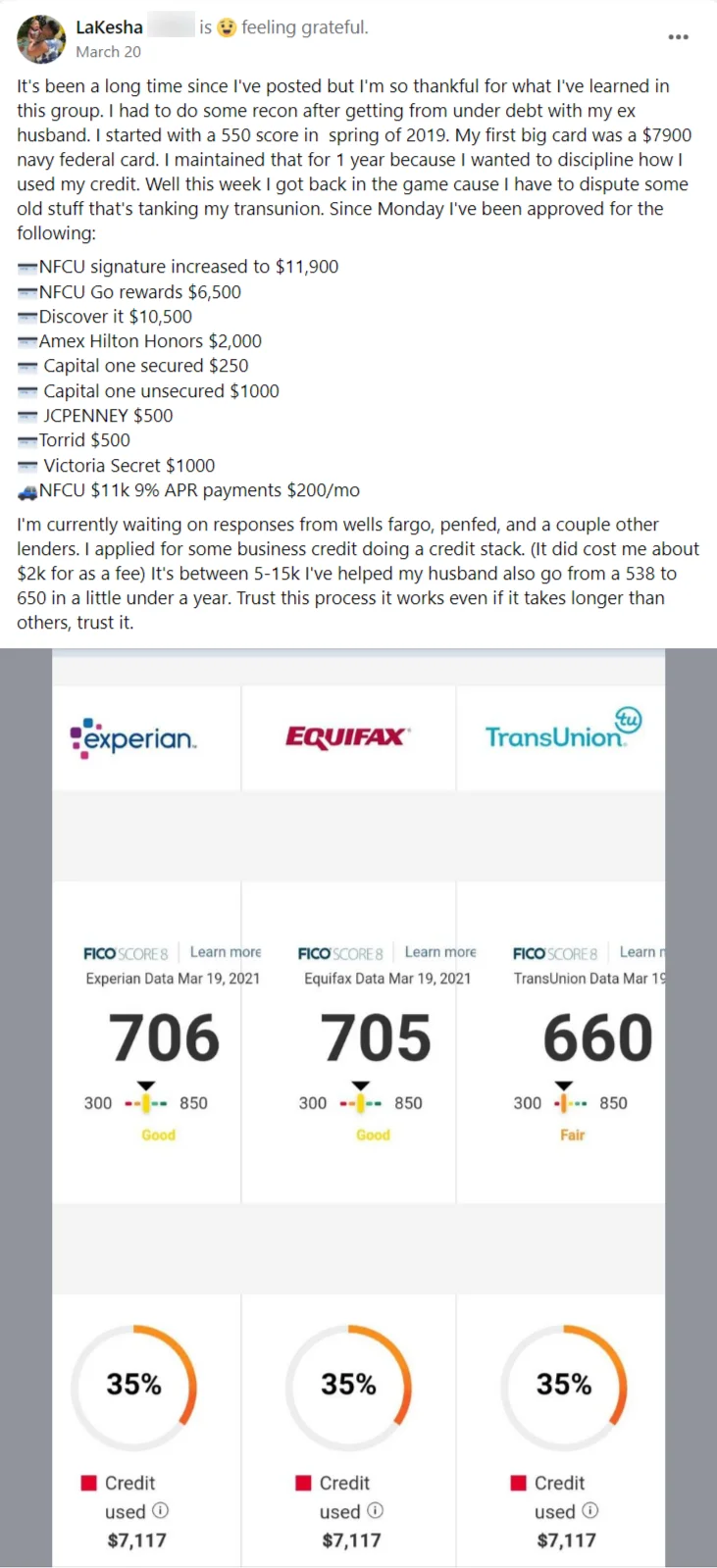

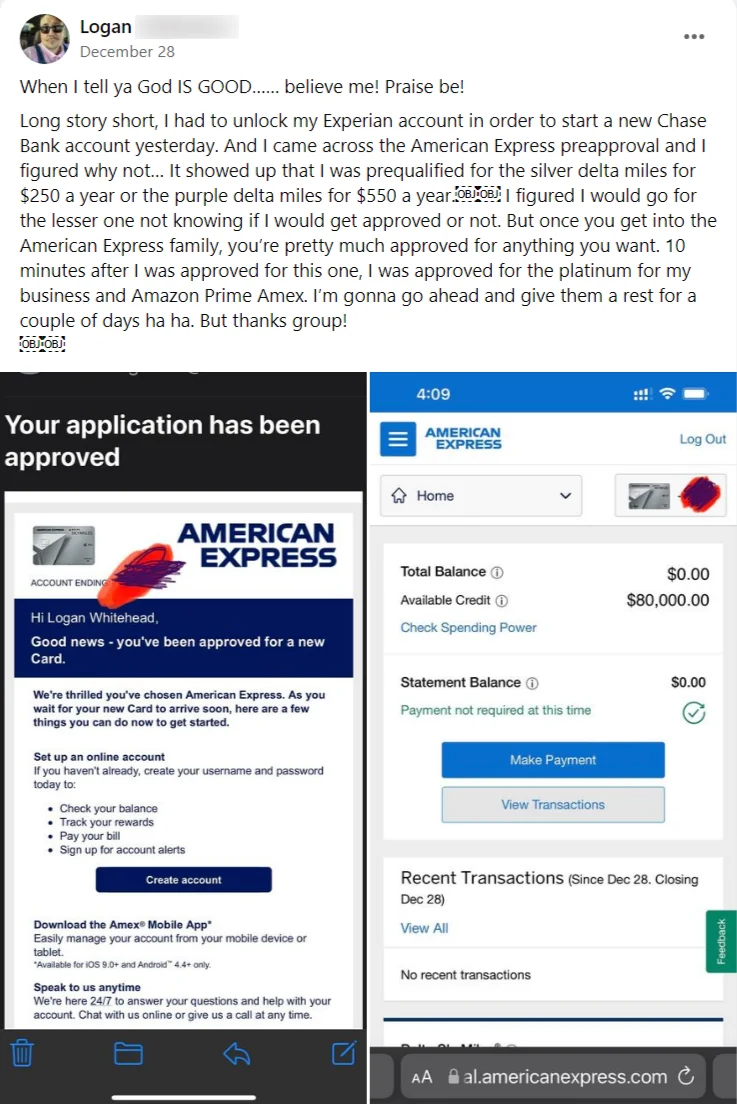

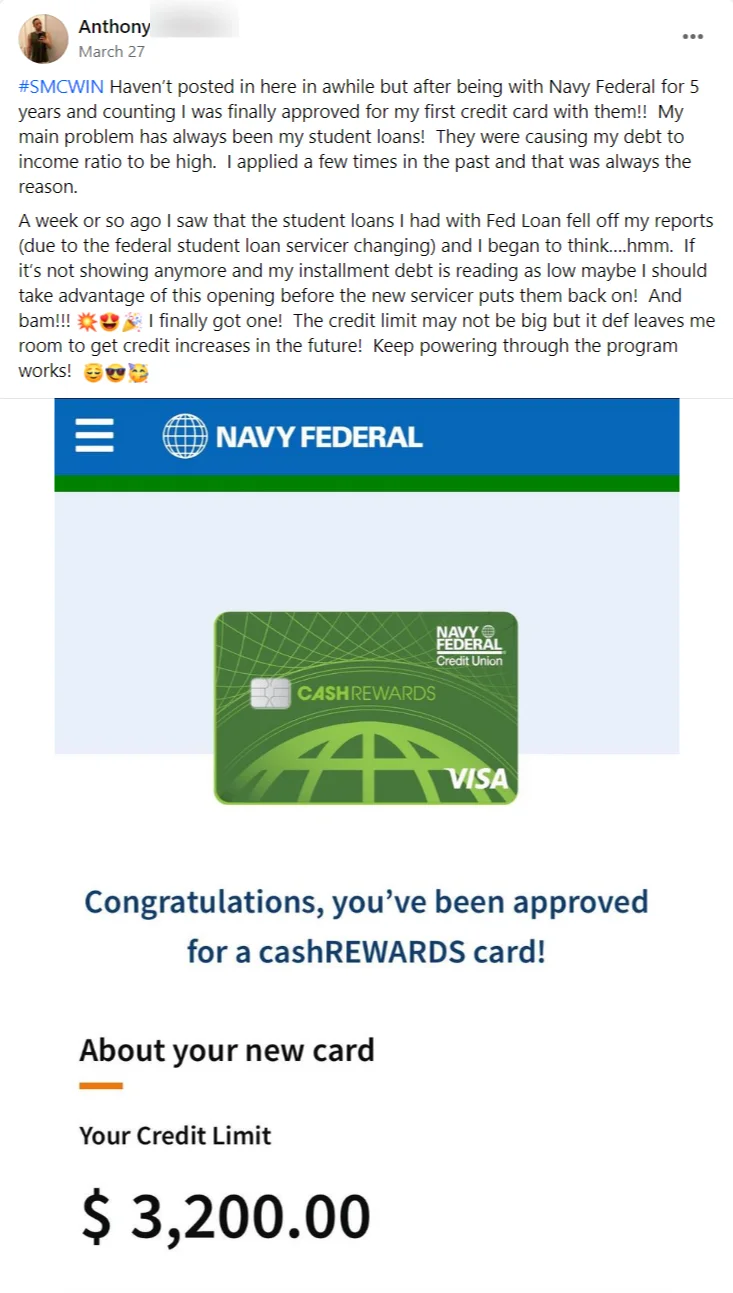

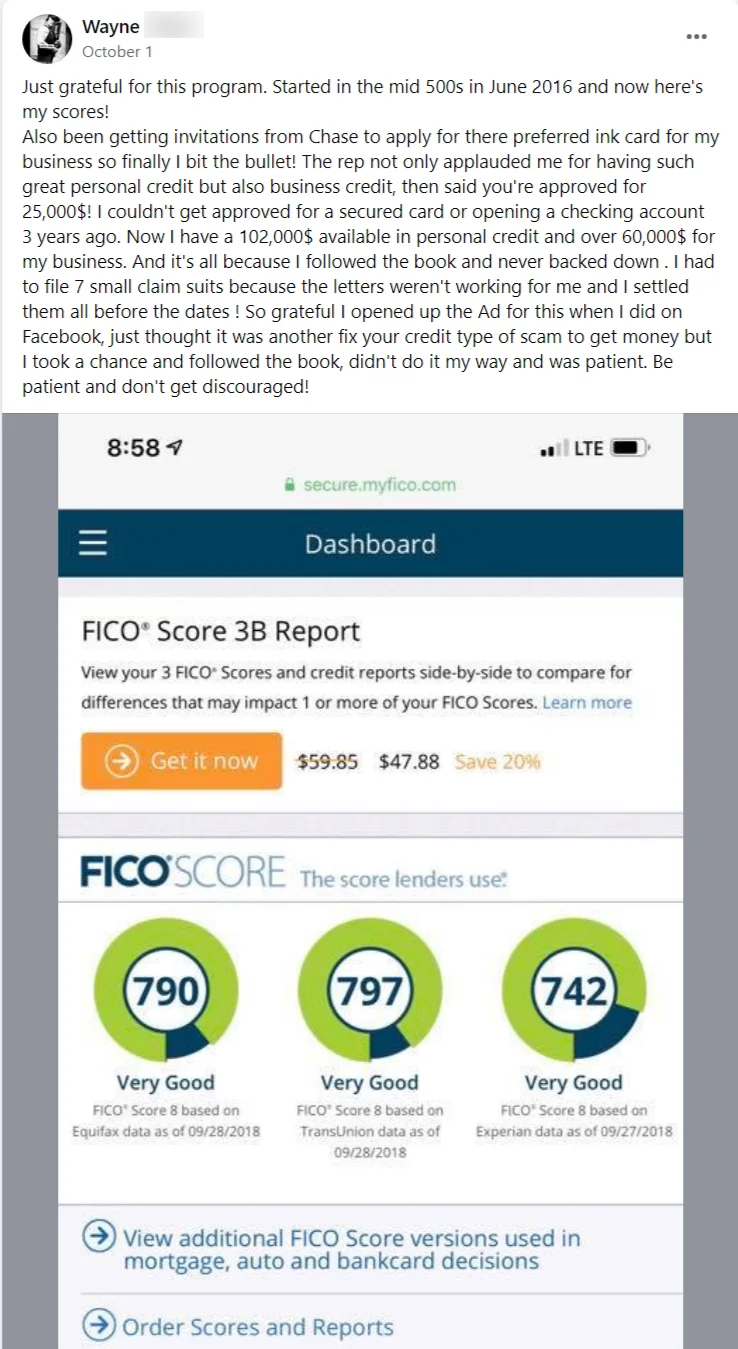

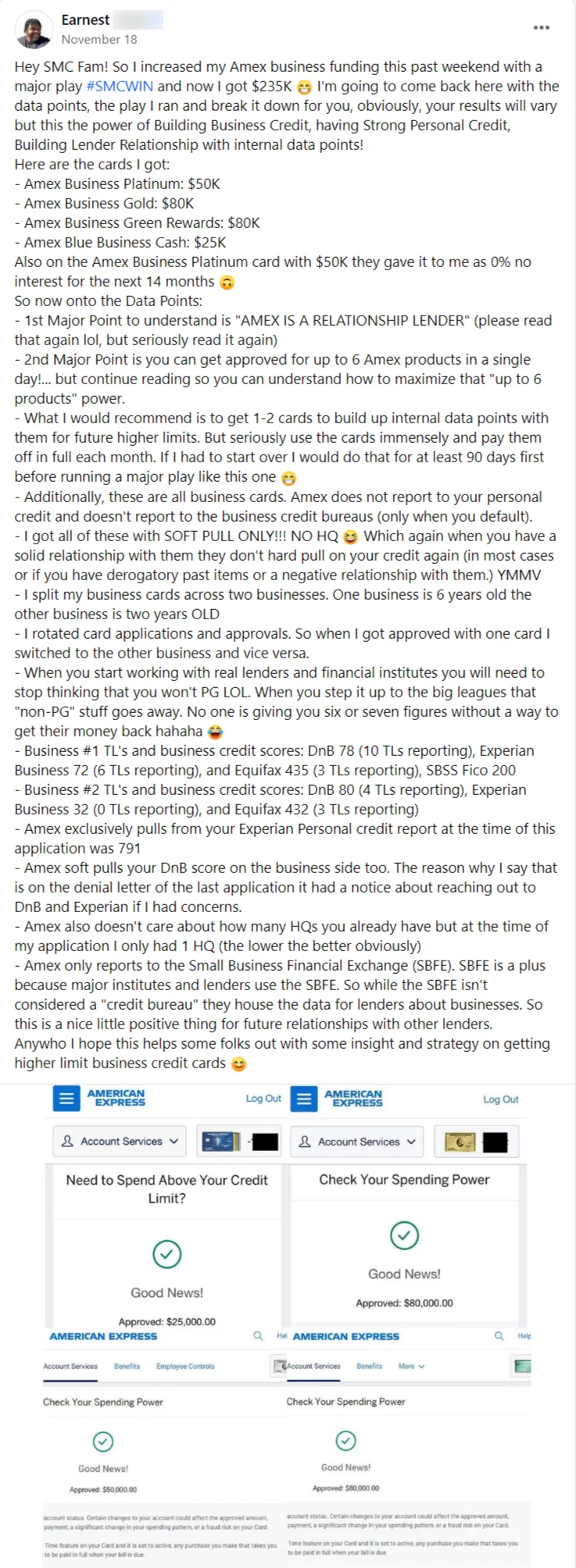

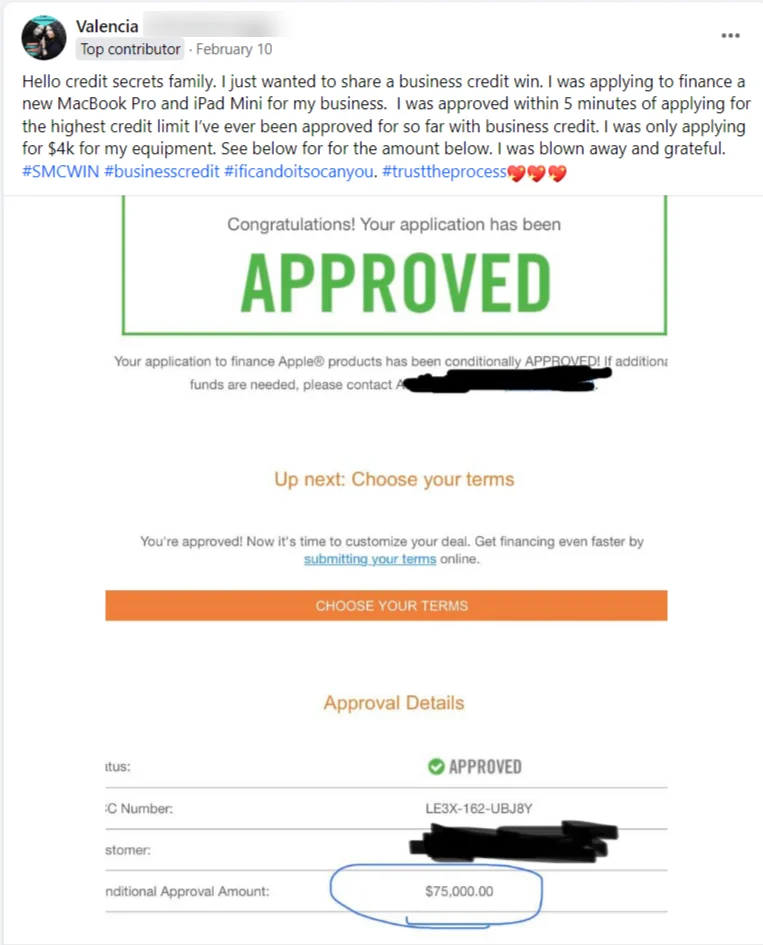

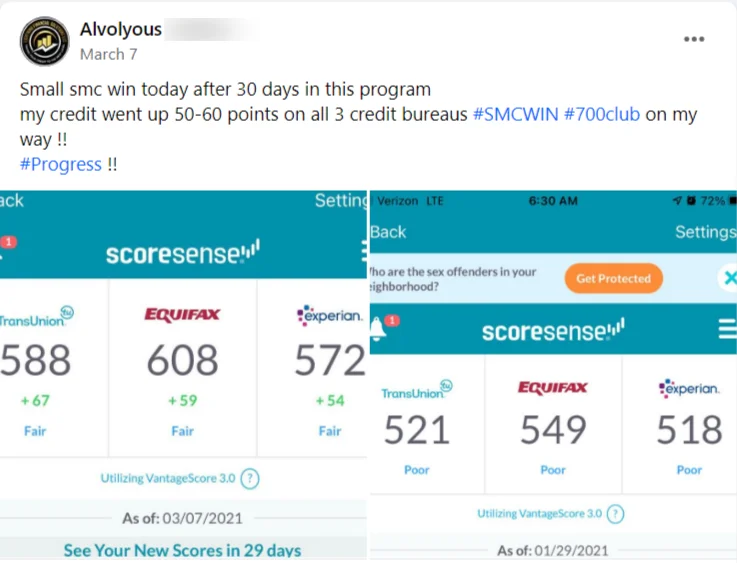

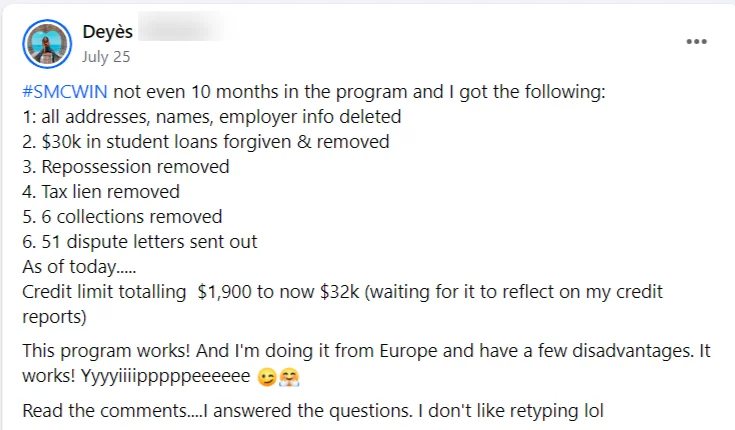

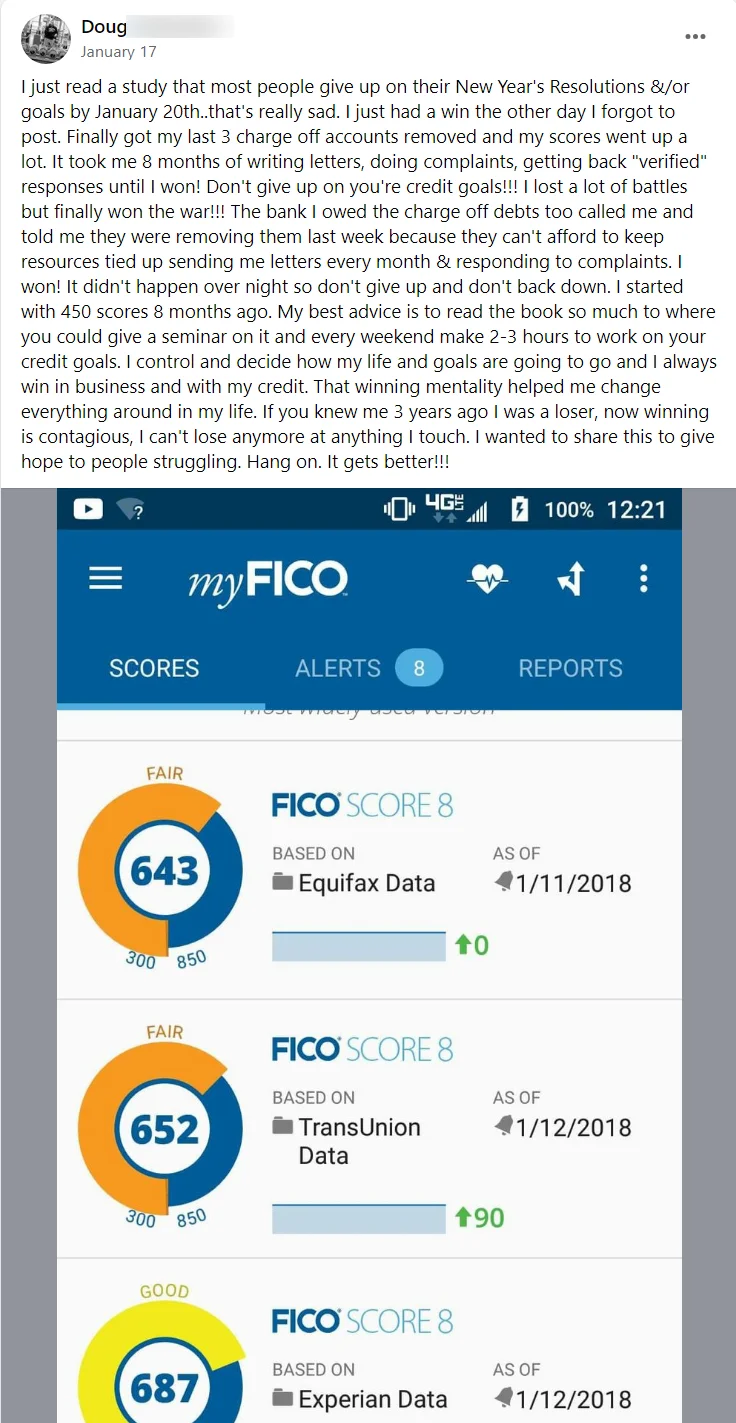

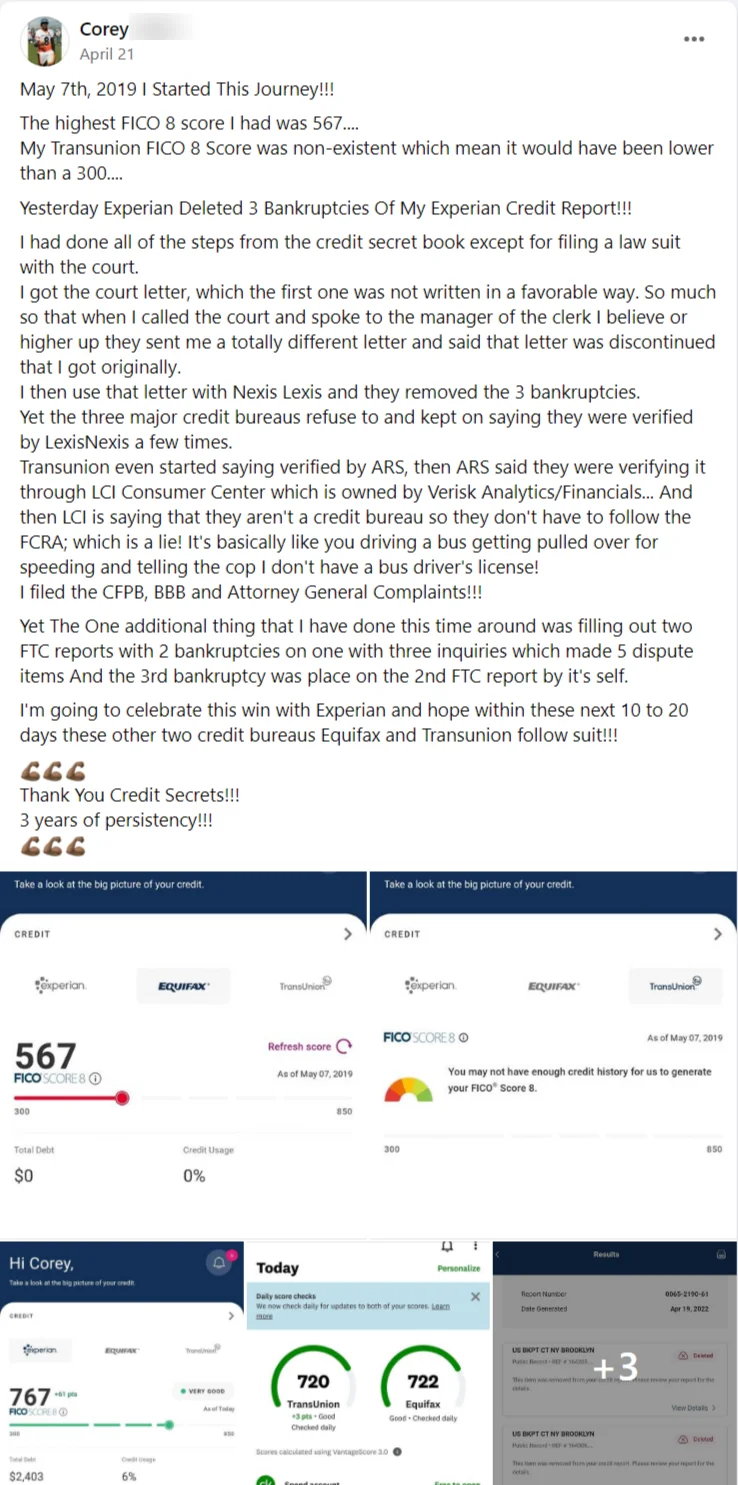

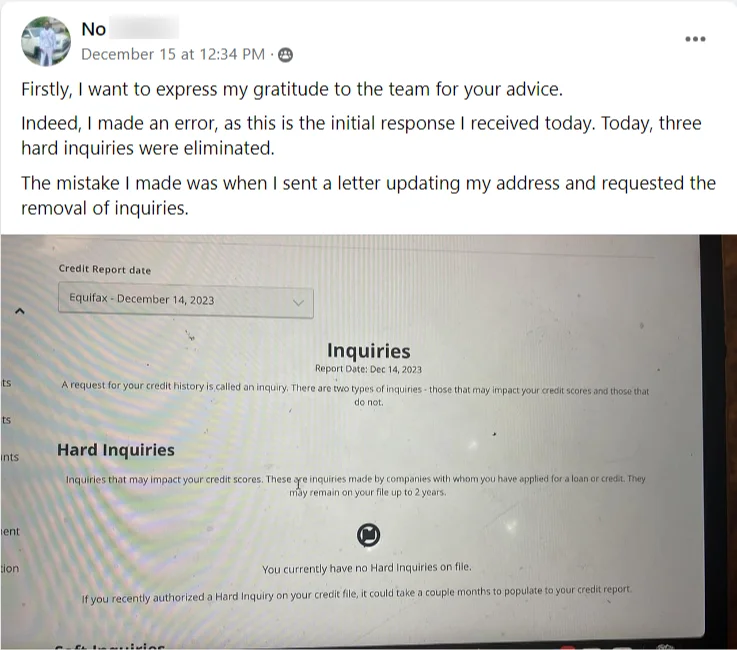

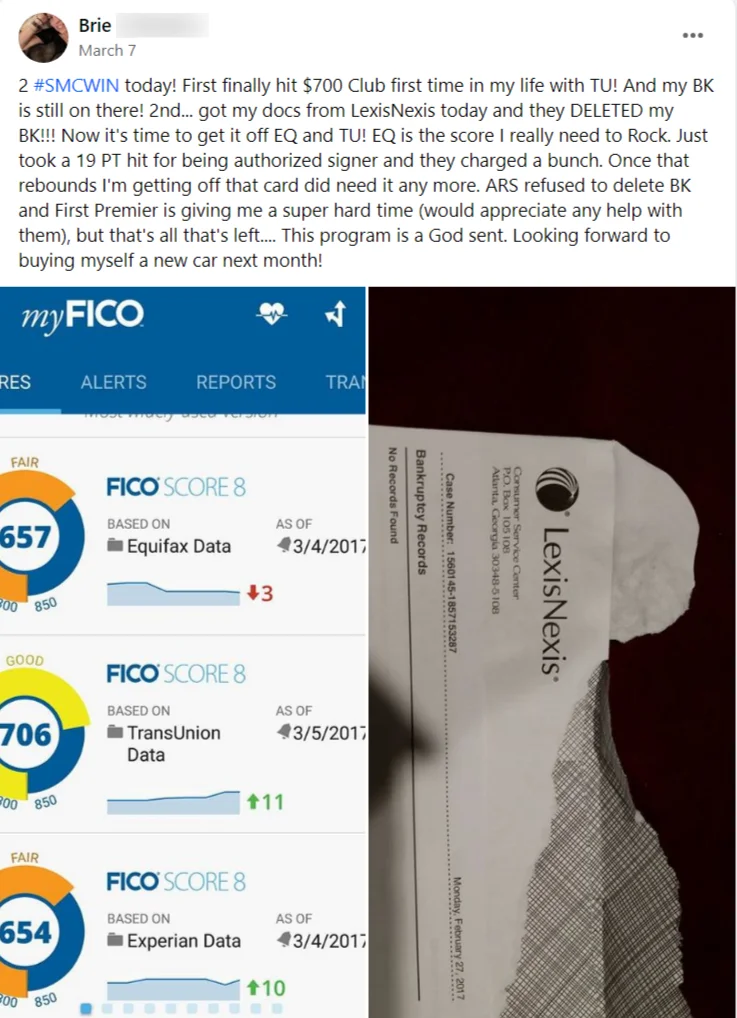

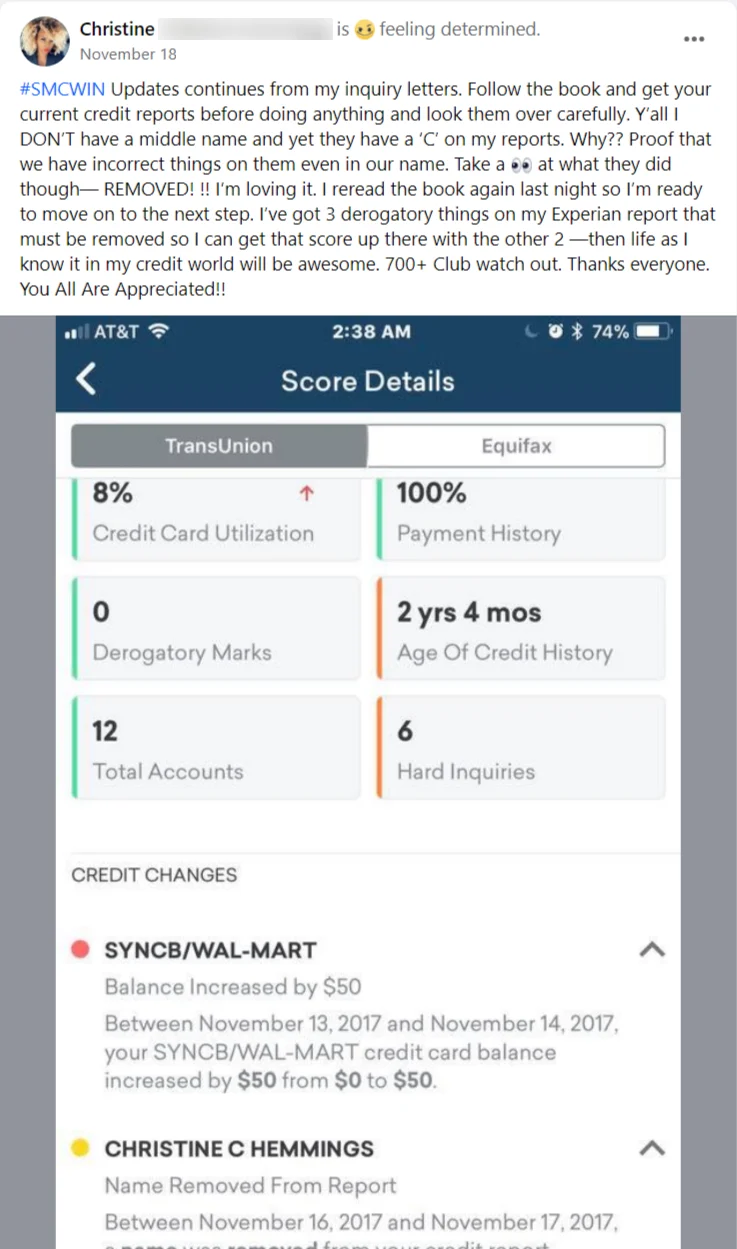

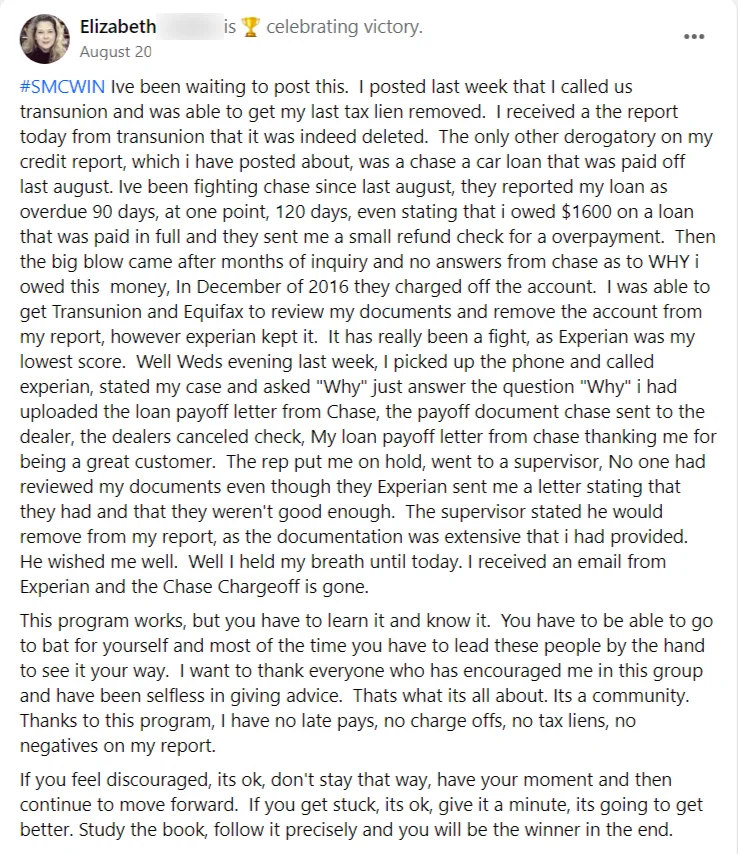

Hear From Real Customers

Discover The Program Now Helping Over 1 Million Americans Finally Get the Credit Scores They Deserve...

Unlock your financial future now!