Your Personal Credit Impacts Your Business Loans

How Your Credit History Might Impact Your Business

Demonstrating responsible credit management by maintaining a low balance on your personal accounts relative to your credit limits can lead to more favorable loan terms. This practice could result in lower interest rates, reducing your monthly loan payments and potentially saving you a significant amount of money over the life of the loan.

A strong personal credit profile is crucial in securing the loan amount you seek for your business. On the flip side, if your personal credit utilization is high, it might lead to less attractive loan terms. This could mean higher interest rates and might even require additional collateral or a higher deposit for secured loans.

Your personal credit utilization rate is a key factor that lenders consider; a lower rate generally opens the door to a wider array of loan options with more advantageous terms. For many entrepreneurs, managing personal debt efficiently is essential in maintaining a healthy credit score, which in turn significantly affects their business financing options.

A Real Life Example

John Doe’s entrepreneurial journey began with a vision to open his own café. Armed with a solid business plan, he approached several banks for a loan. Unfortunately, John’s personal credit score stood at a dismal 580, deeply affected by high credit card utilization and a history of late payments. As a result, his loan applications were met with skepticism. The few loan offers he did receive came with prohibitive interest rates and terms, demanding collateral that put his financial stability at risk.

Determined to turn his dream into reality, John embarked on a mission to rehabilitate his credit. He meticulously focused on paying down his credit card debt, ensuring timely payments on all his bills, and avoiding new debt. John sought the advice of a financial advisor to help devise a plan to improve his credit score systematically. Through consistent effort and disciplined financial management, John witnessed a remarkable improvement in his credit score, which climbed to 720 over the course of a year.

With his improved credit score, John’s second attempt at securing a business loan was met with enthusiasm from lenders. His application attracted offers with significantly lower interest rates and flexible repayment schedules. The transformation from a credit score of 580 to 720 not only showcased John’s commitment to financial responsibility but also considerably lowered the risk profile perceived by lenders. He was finally approved for a business loan under terms that supported the sustainable growth and success of his café.

John’s café opened its doors six months later, quickly becoming a beloved spot in the community. His experience highlighted the critical impact of personal credit on securing business financing. John’s journey from a poor credit score to a healthy financial standing illustrates the importance of credit management for entrepreneurs. It serves as an inspiring example of how dedication to improving one’s financial health can pave the way for business success and stability.

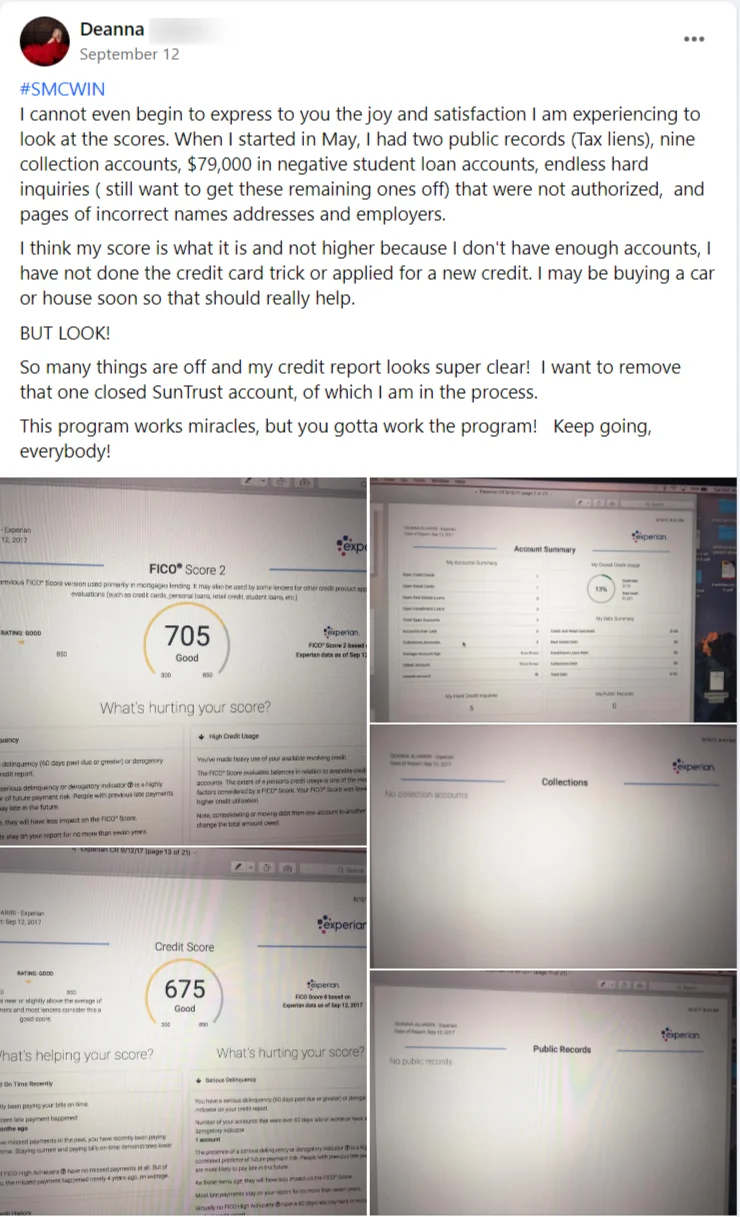

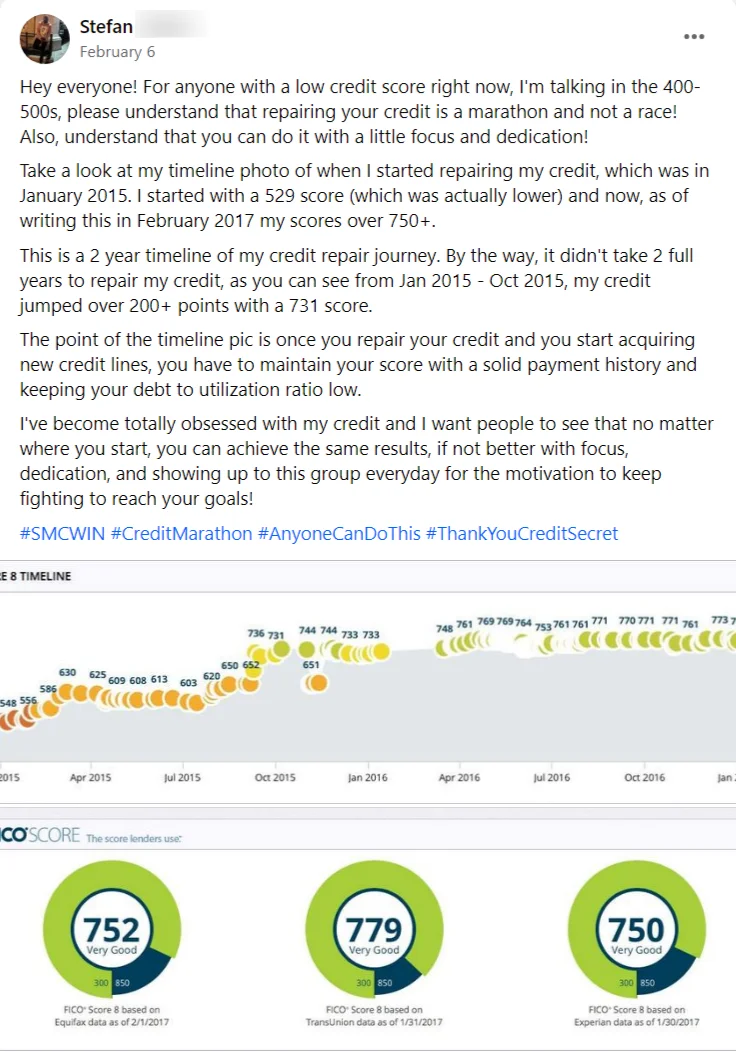

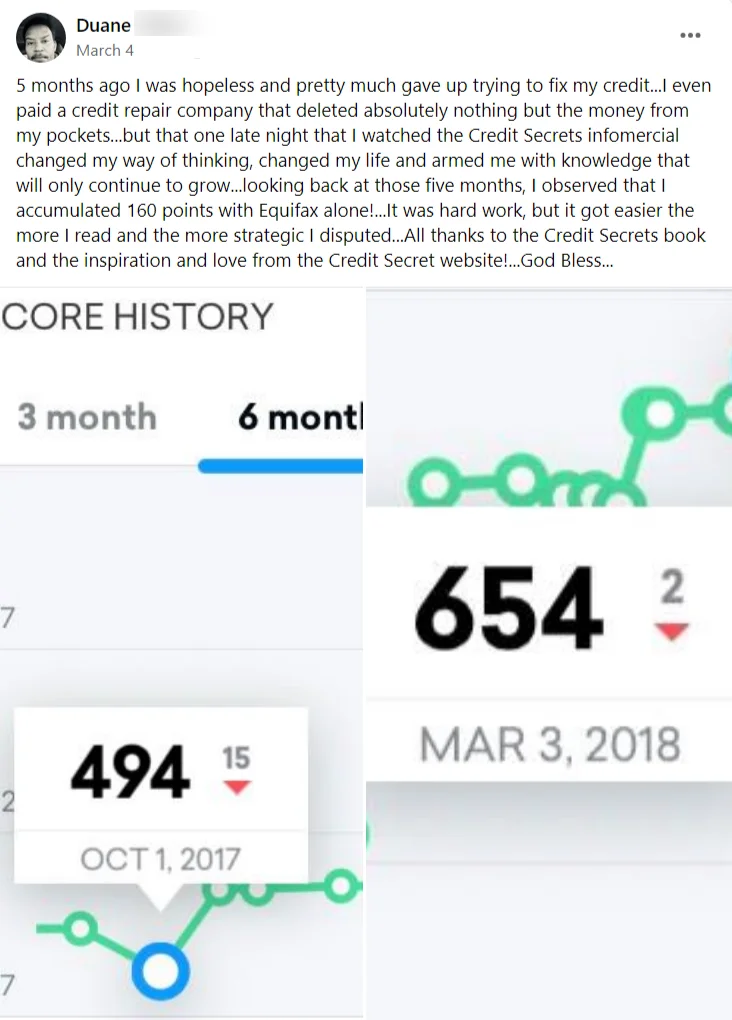

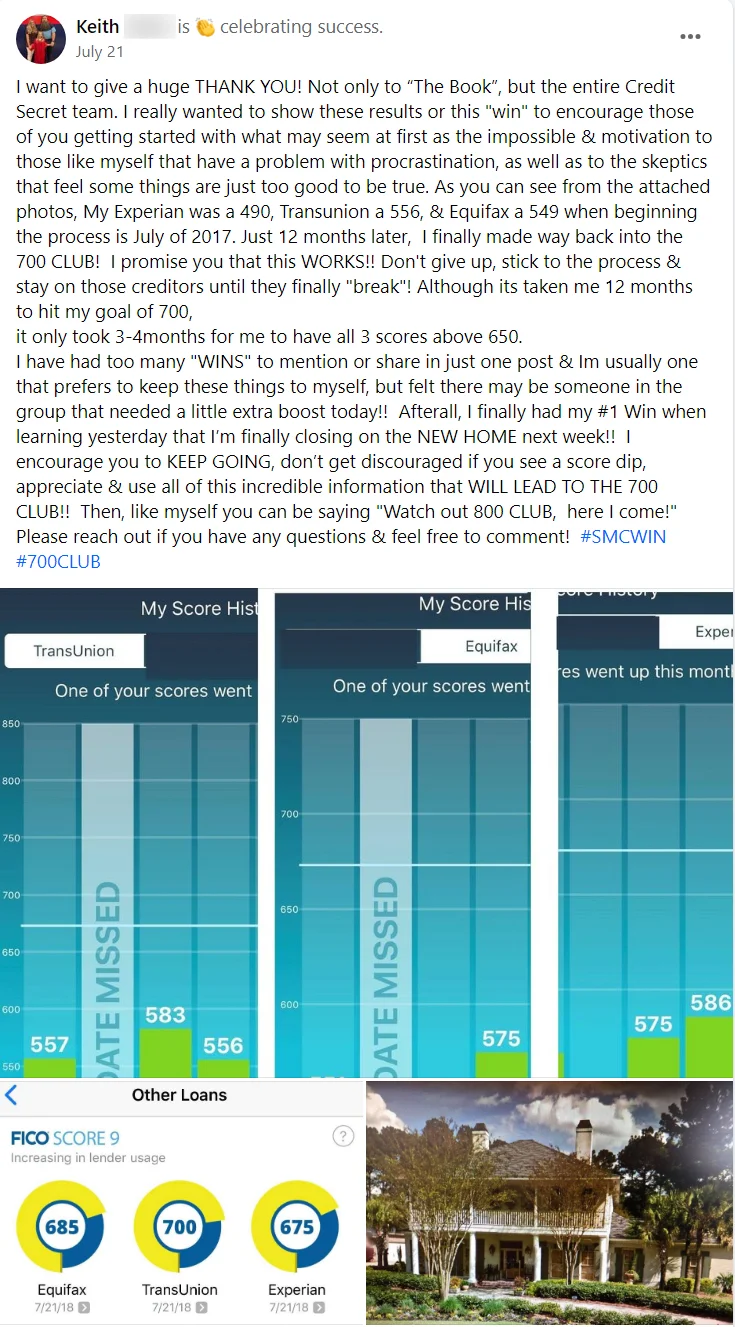

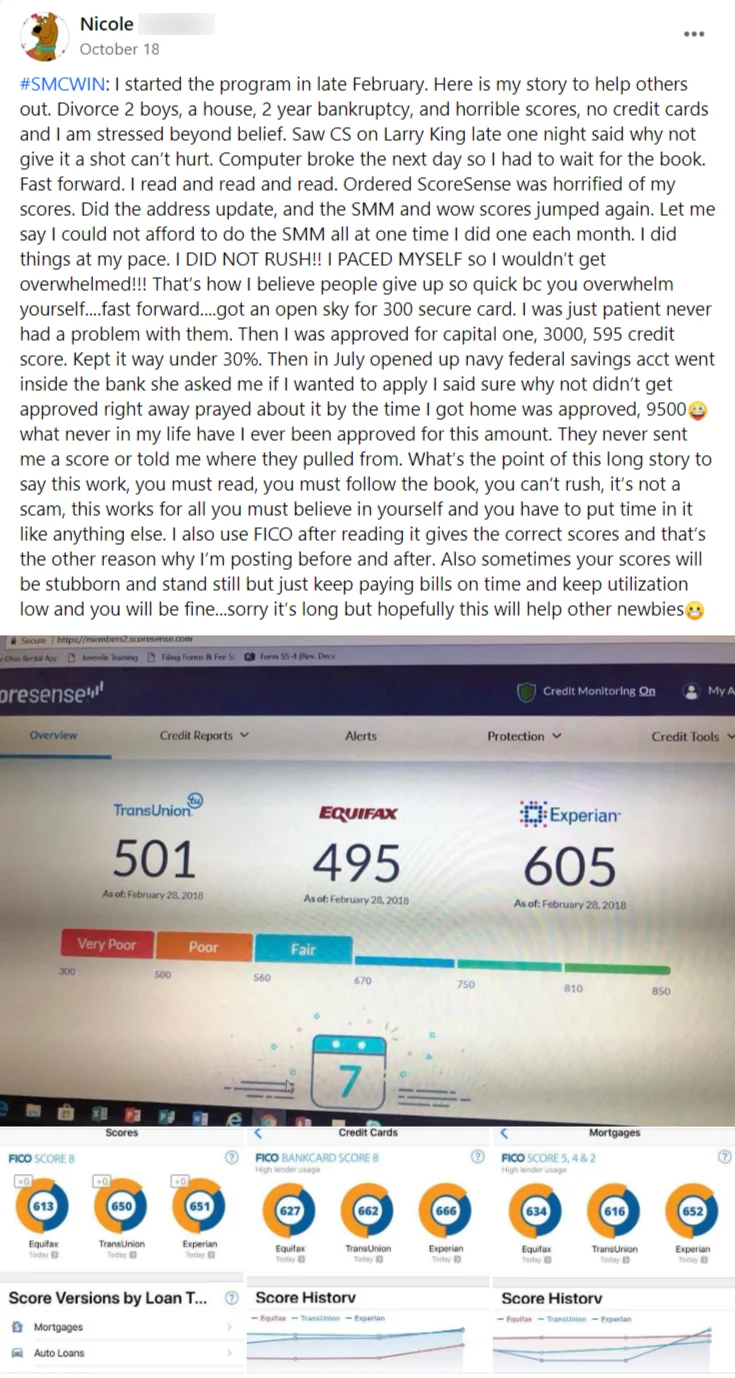

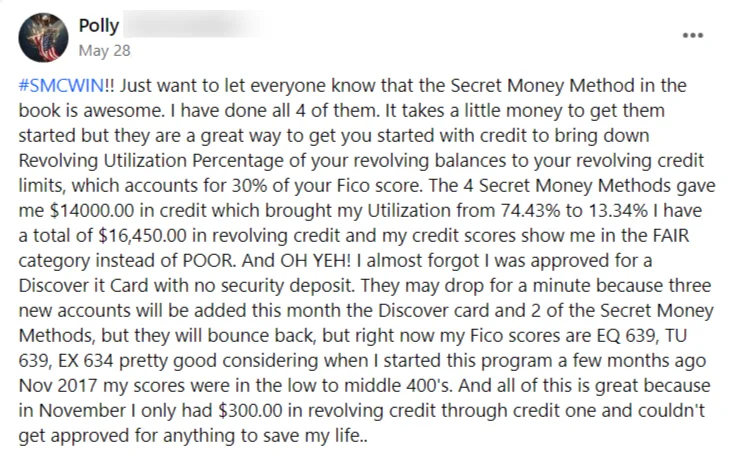

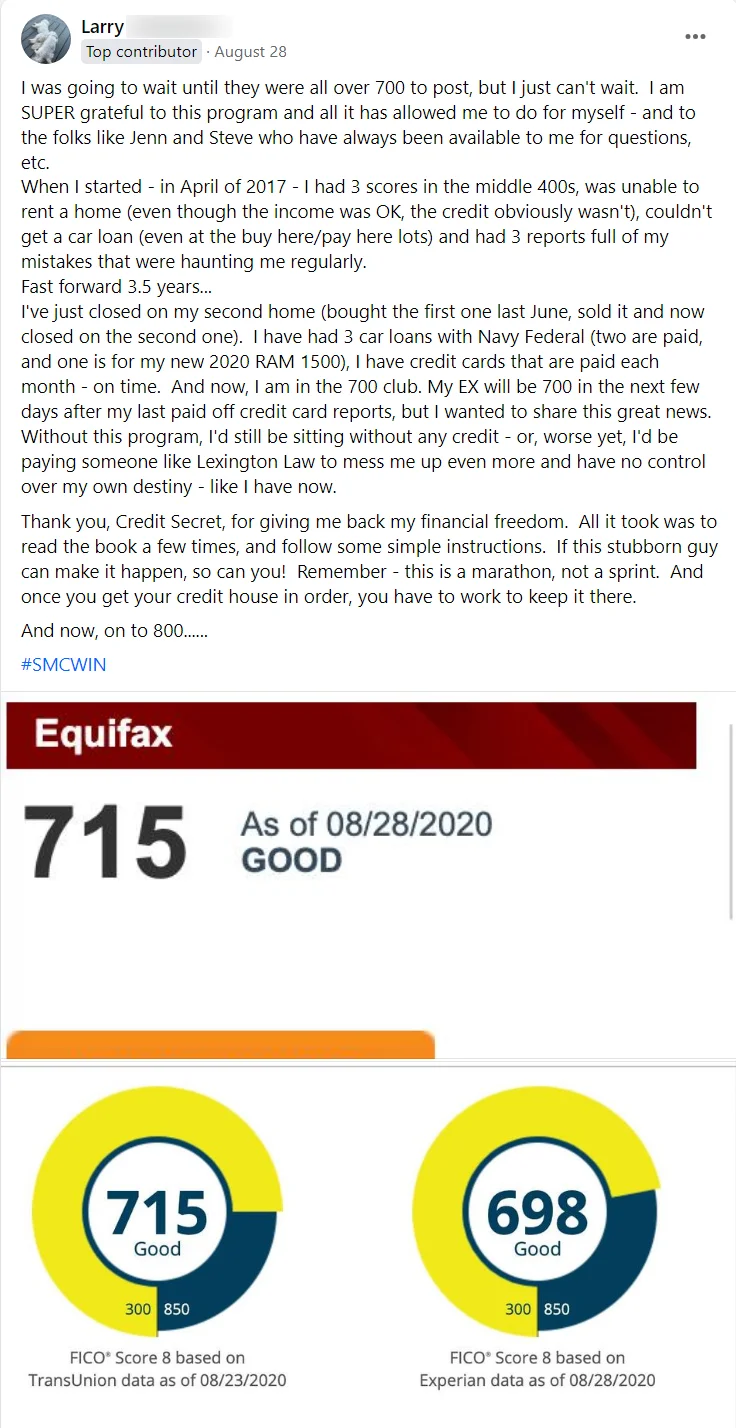

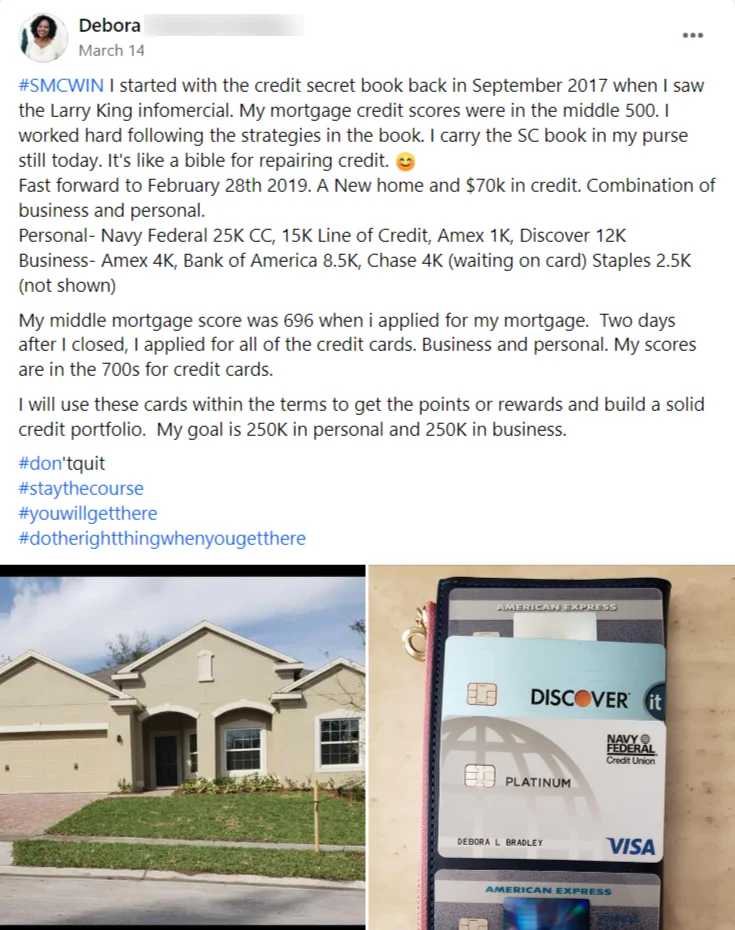

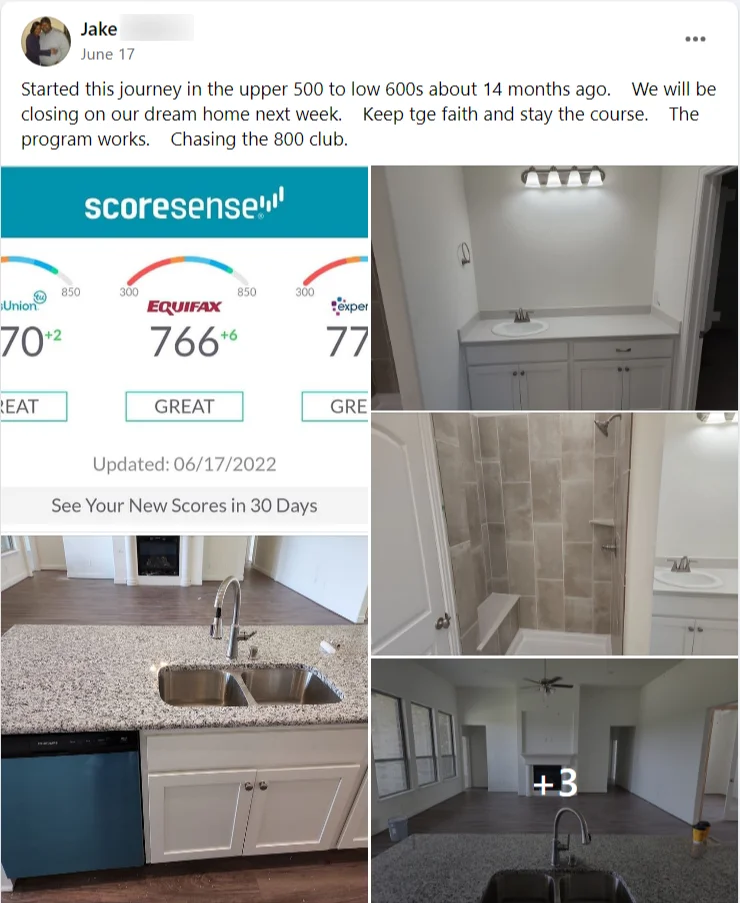

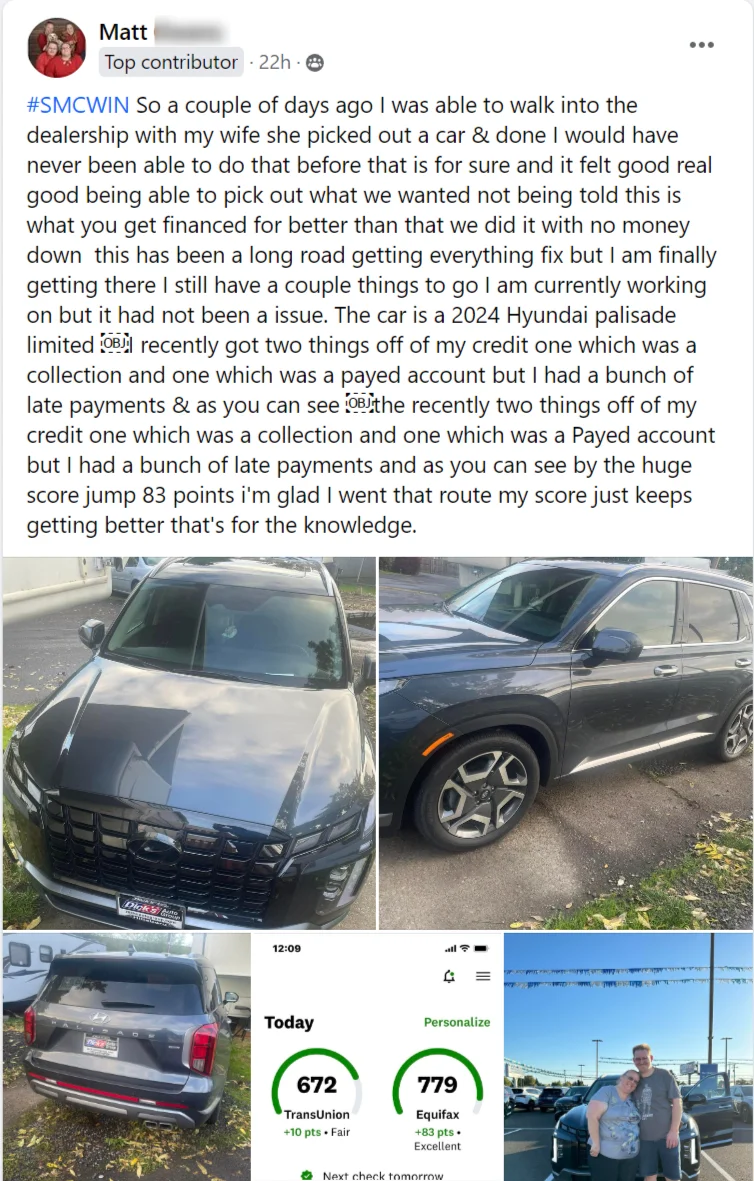

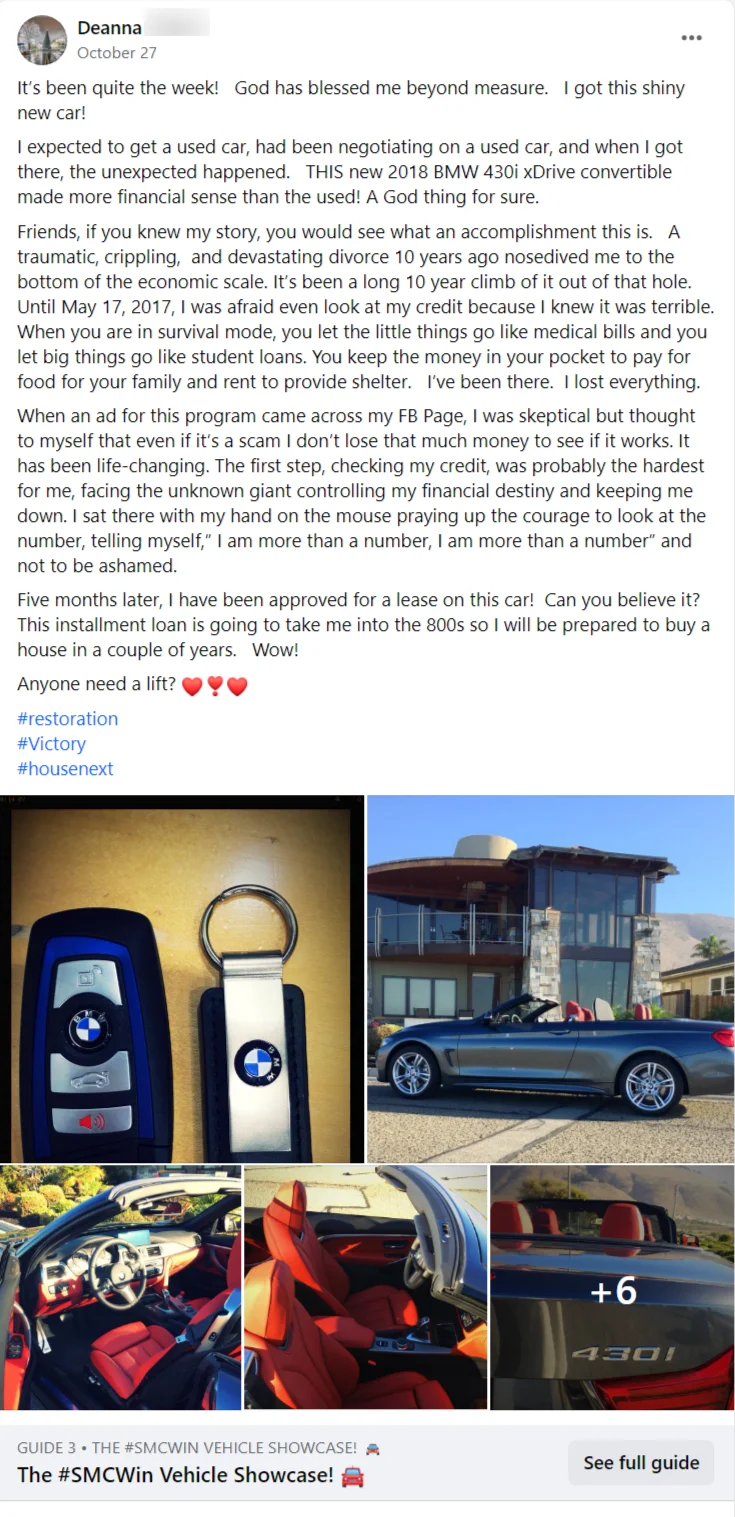

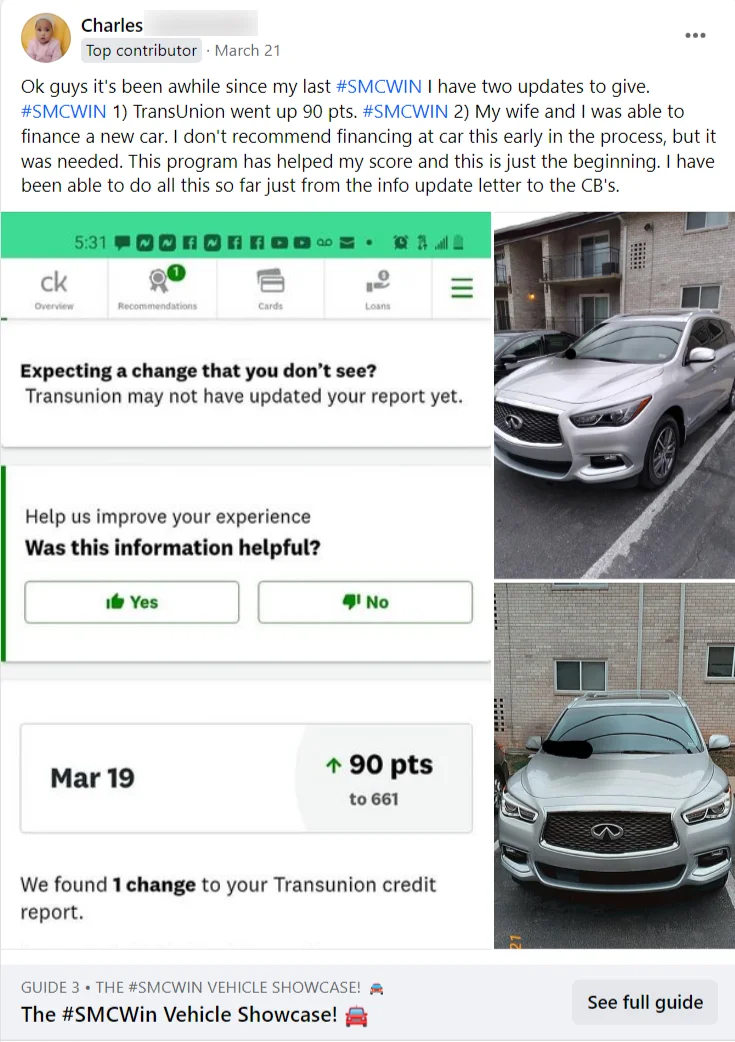

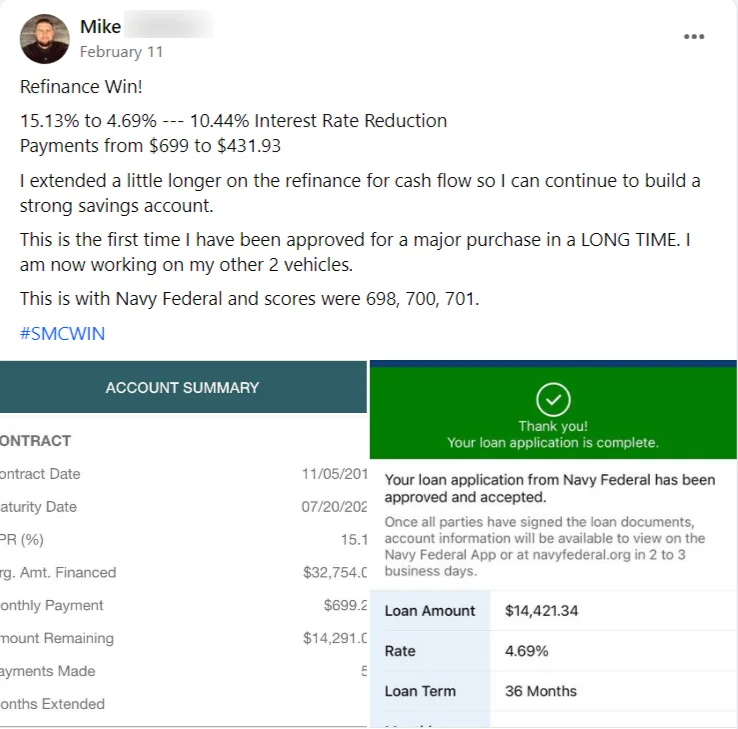

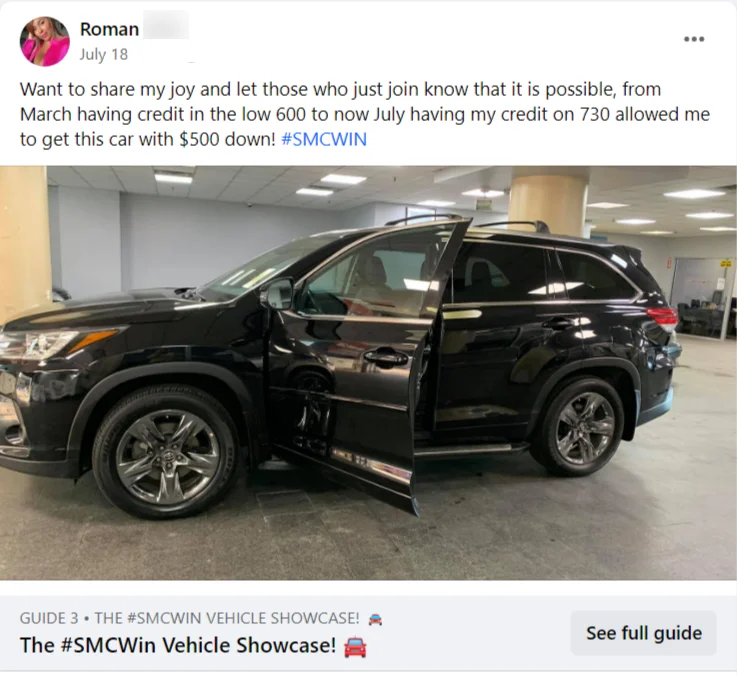

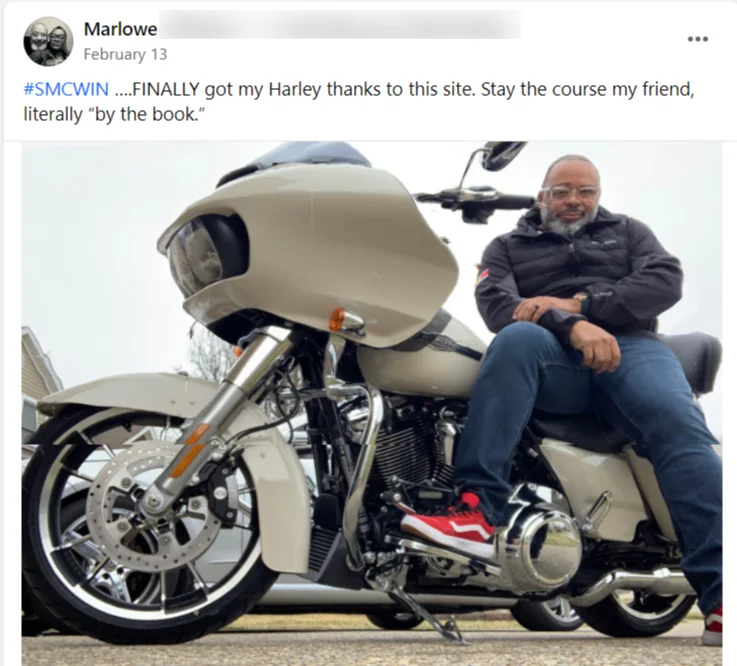

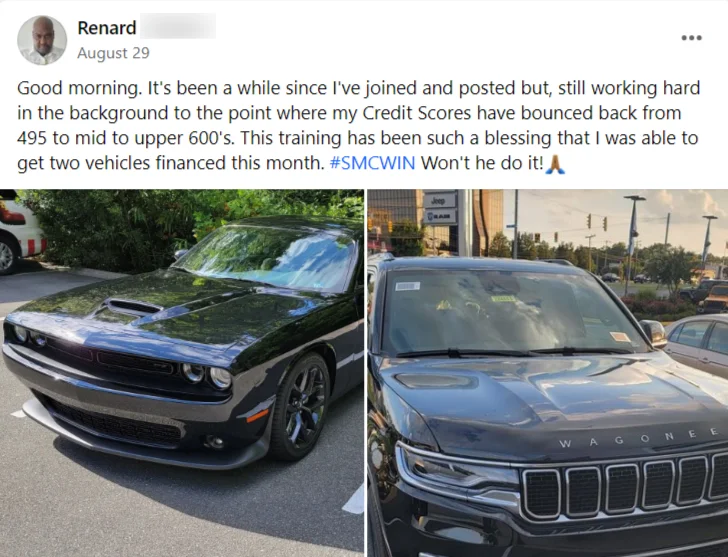

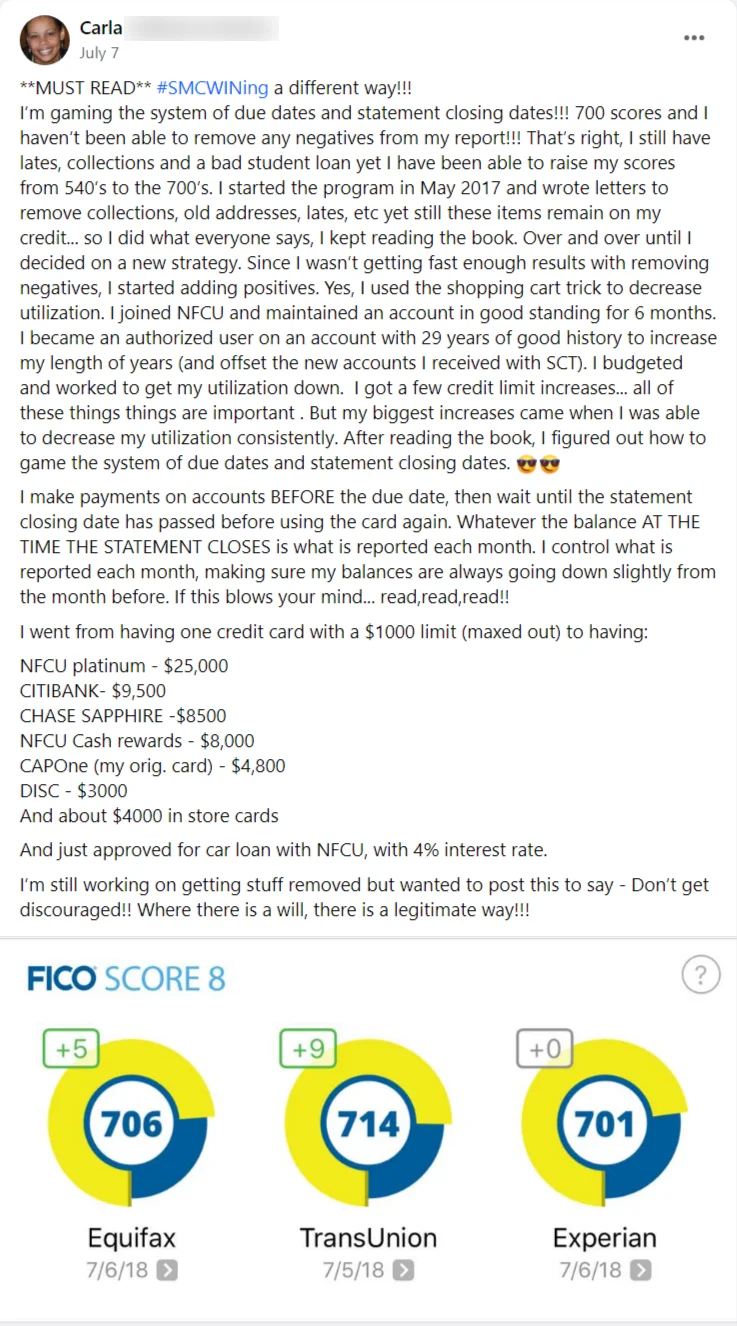

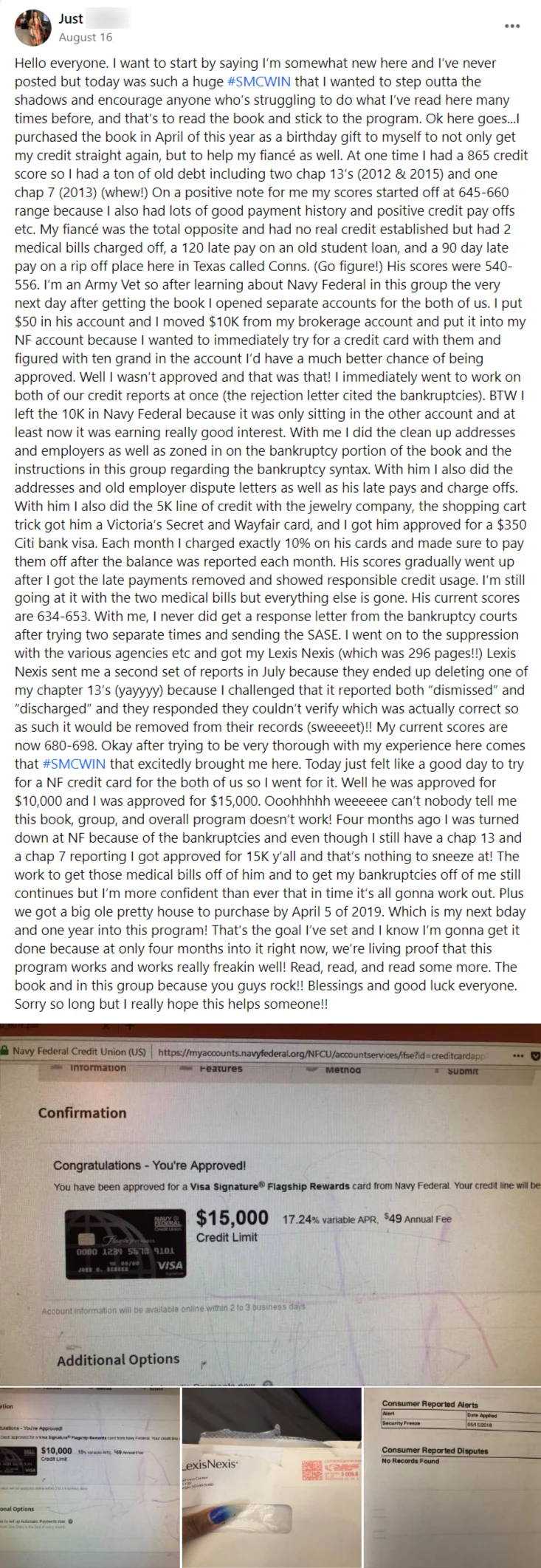

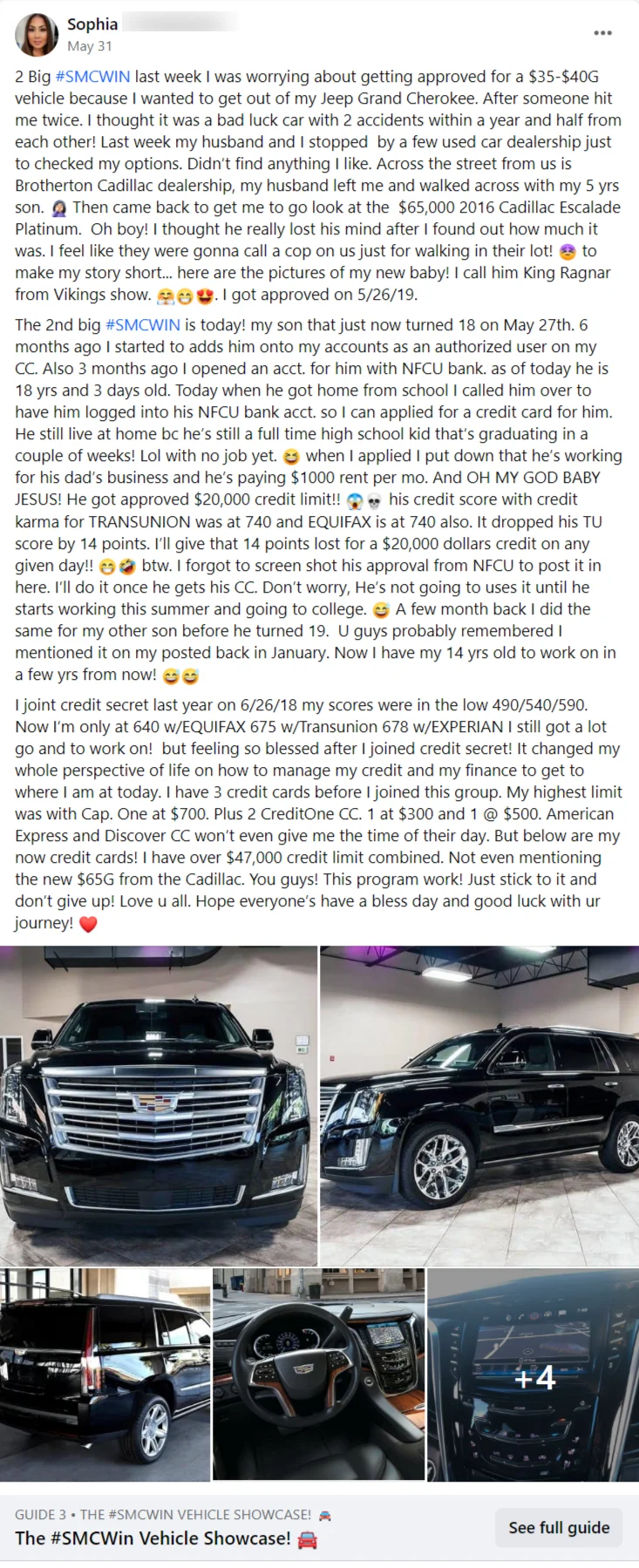

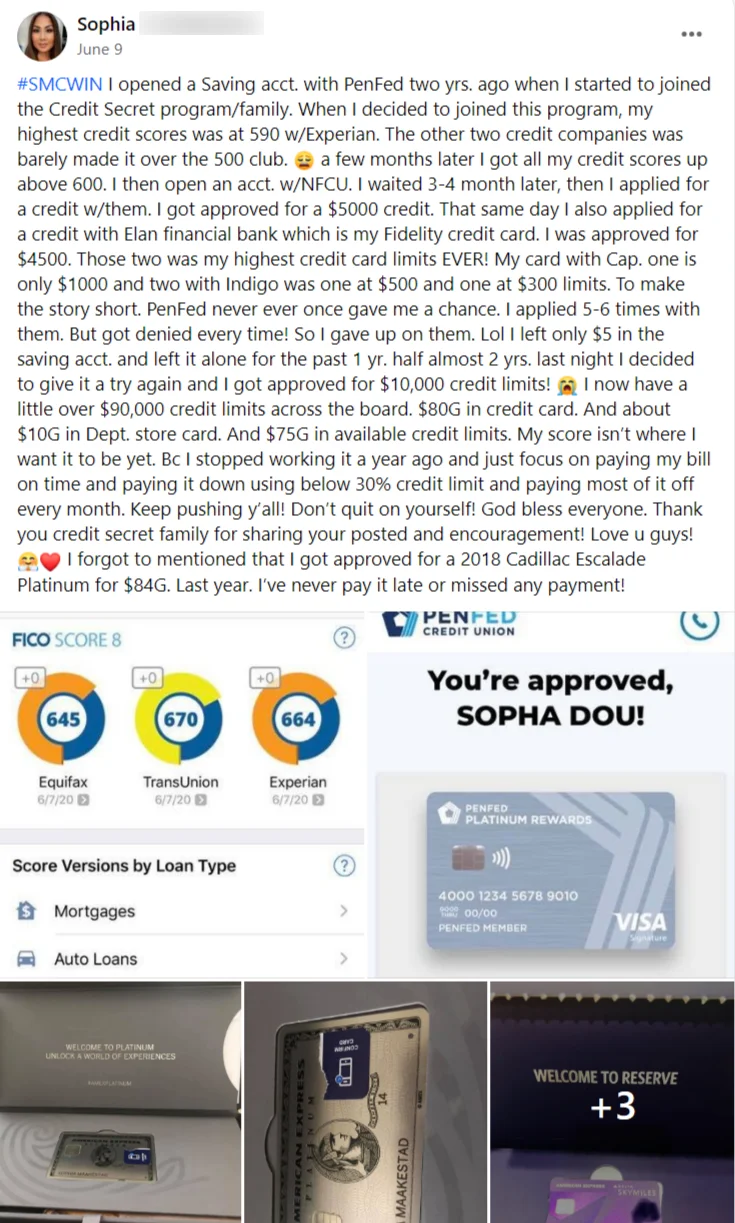

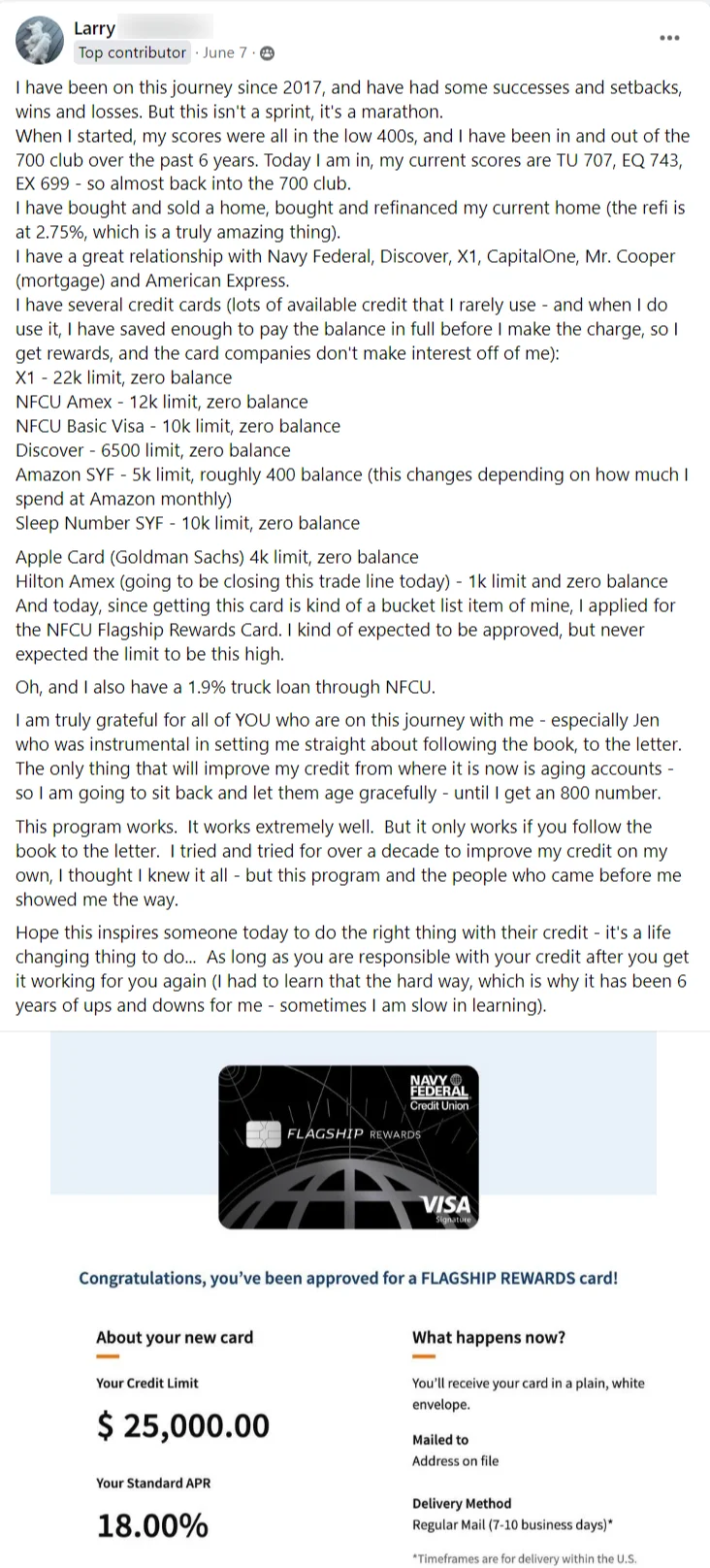

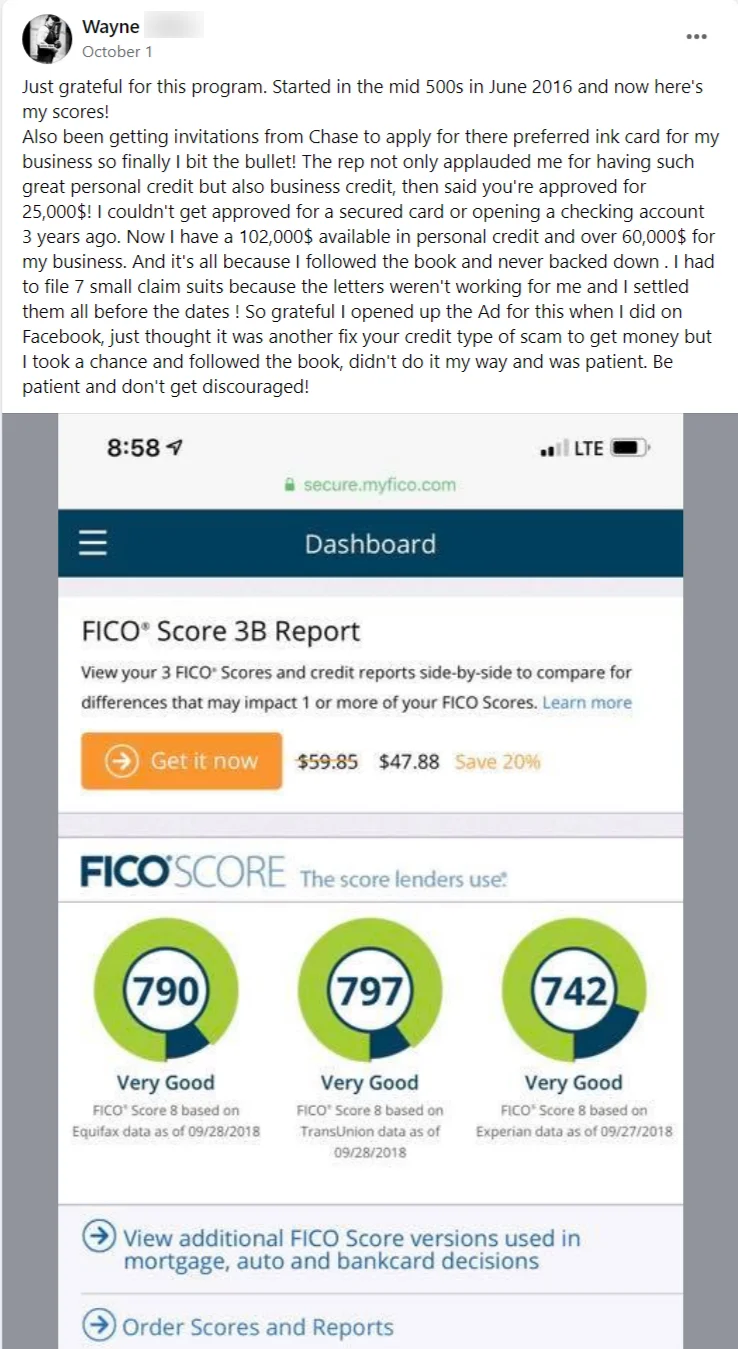

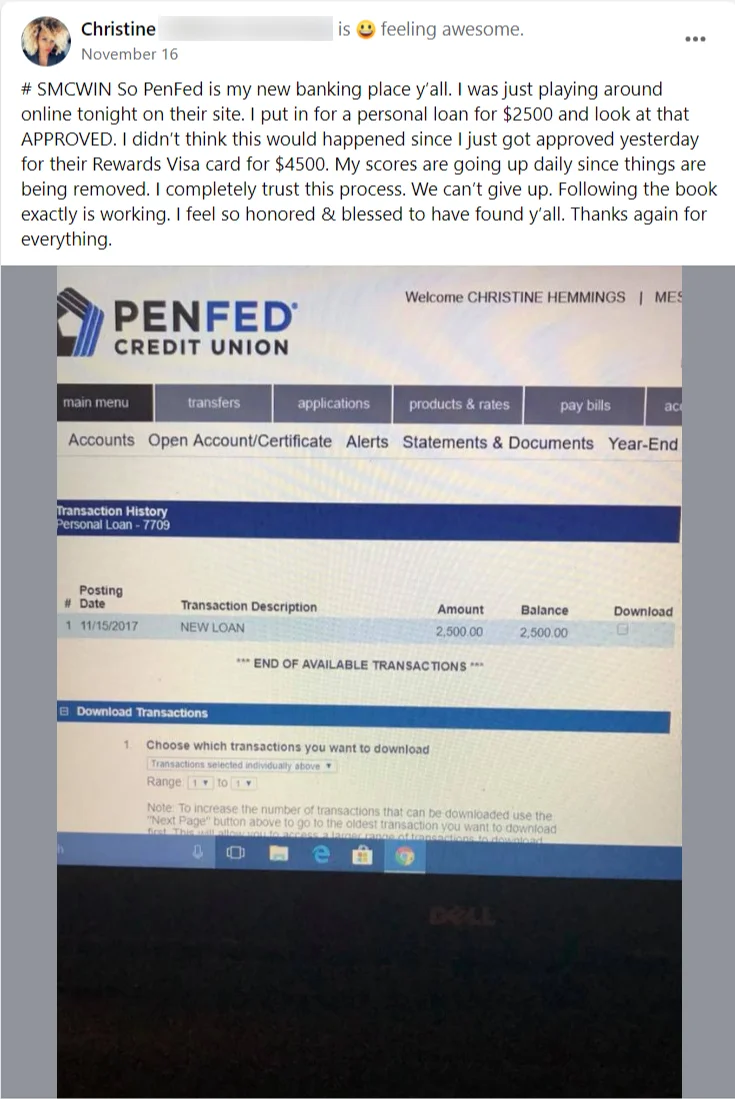

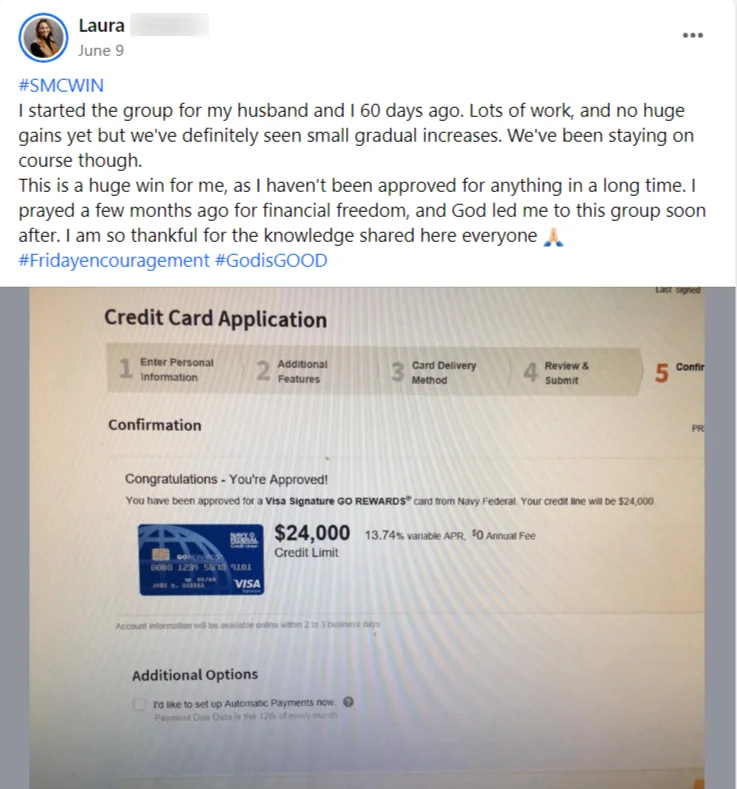

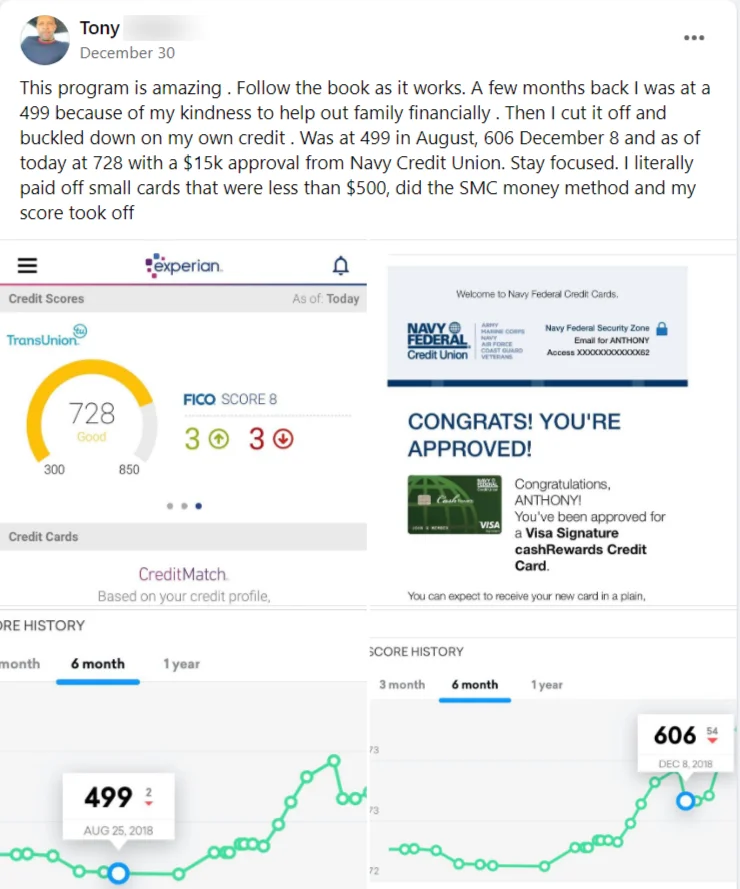

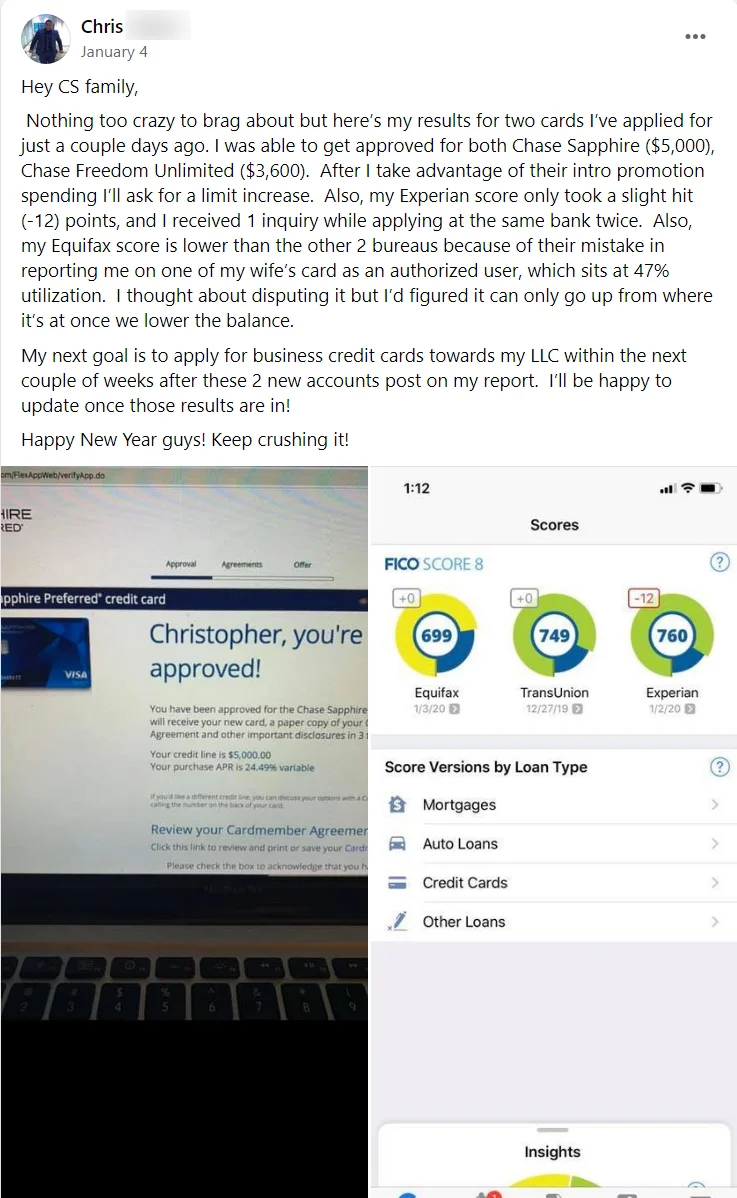

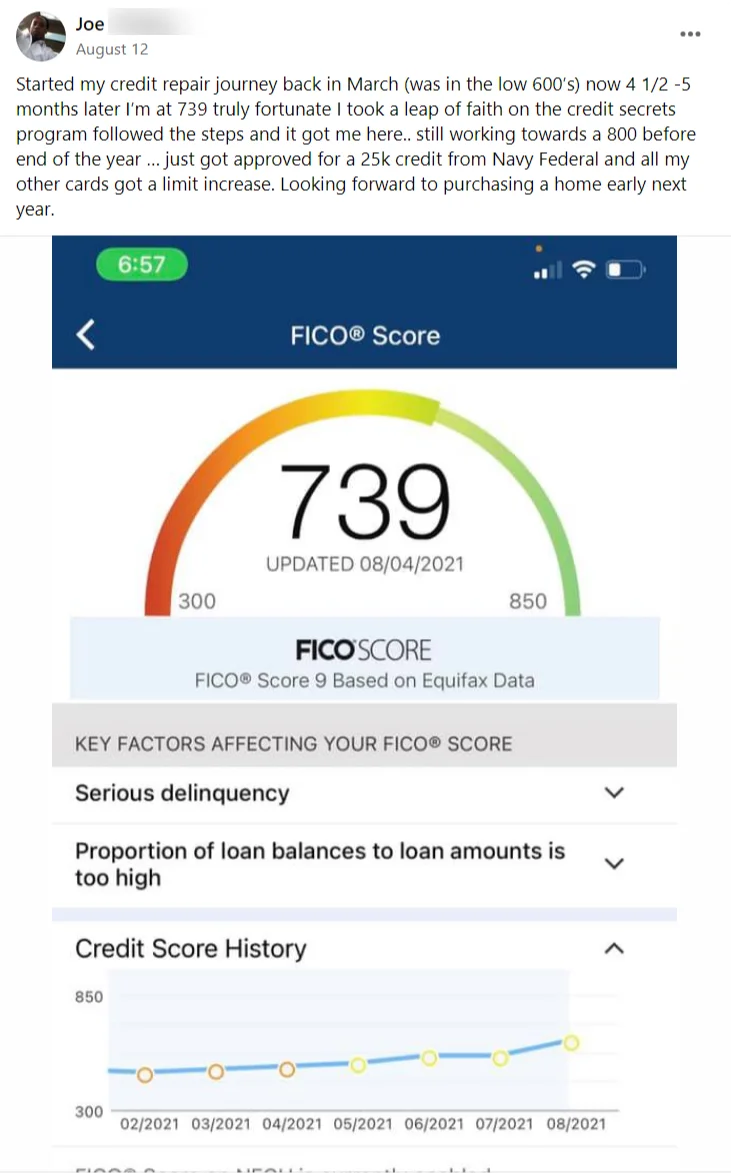

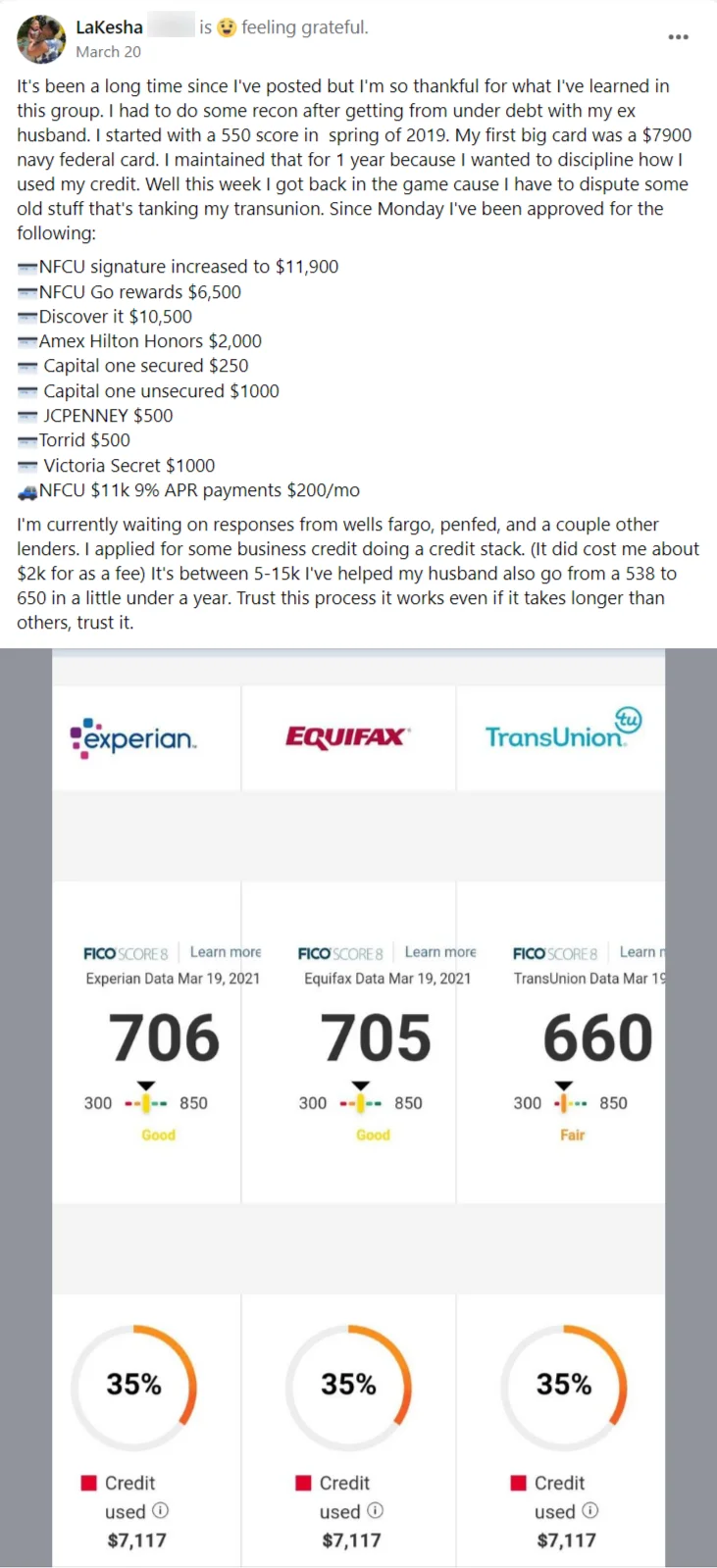

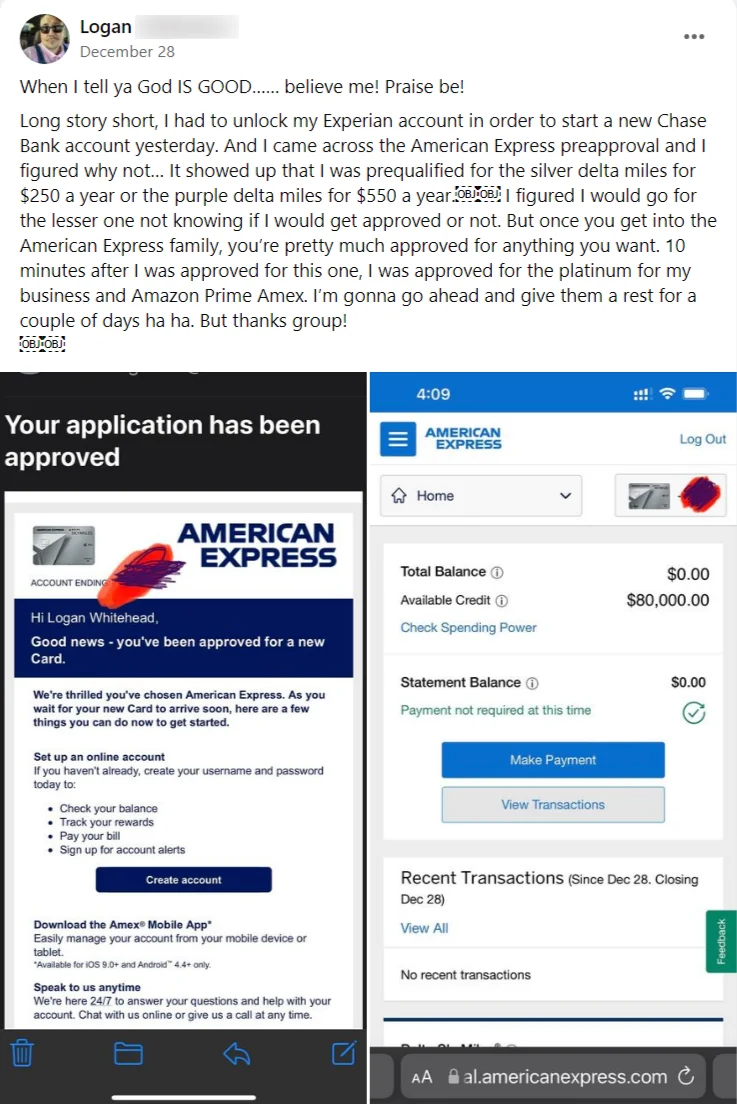

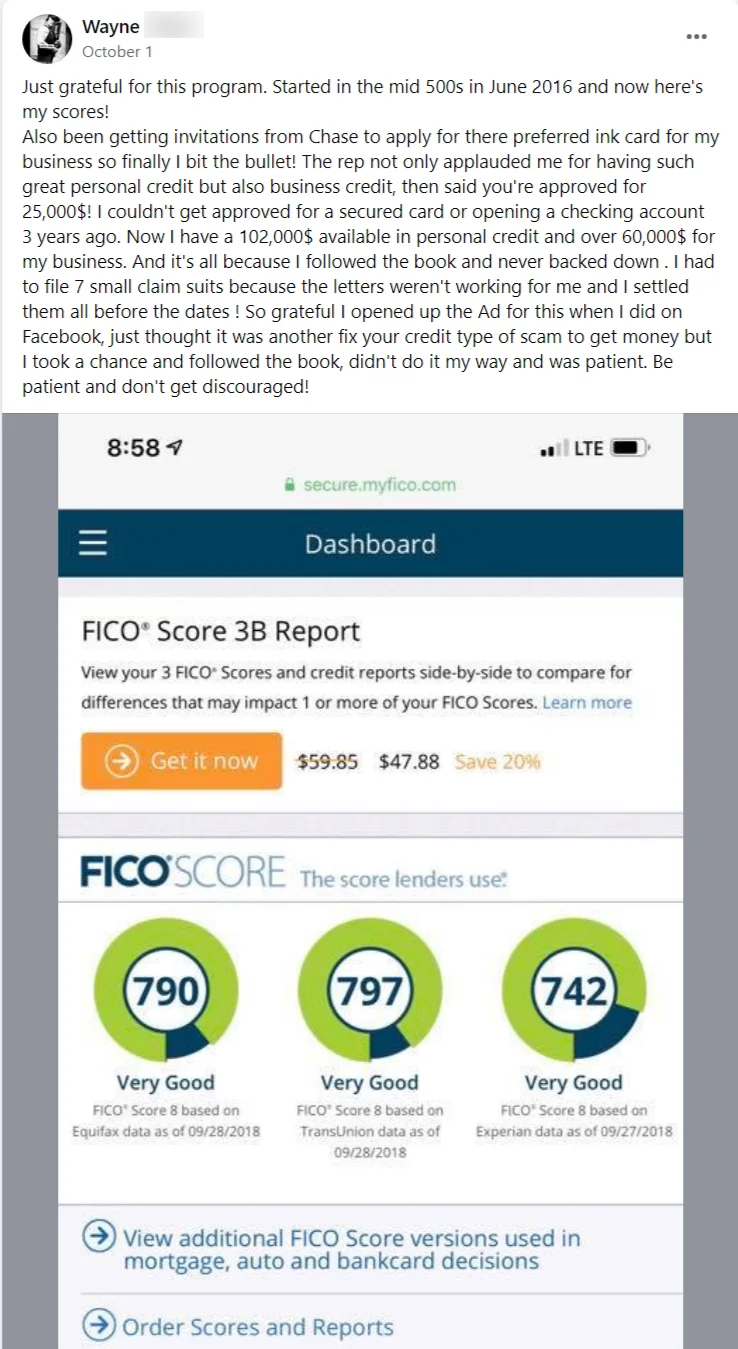

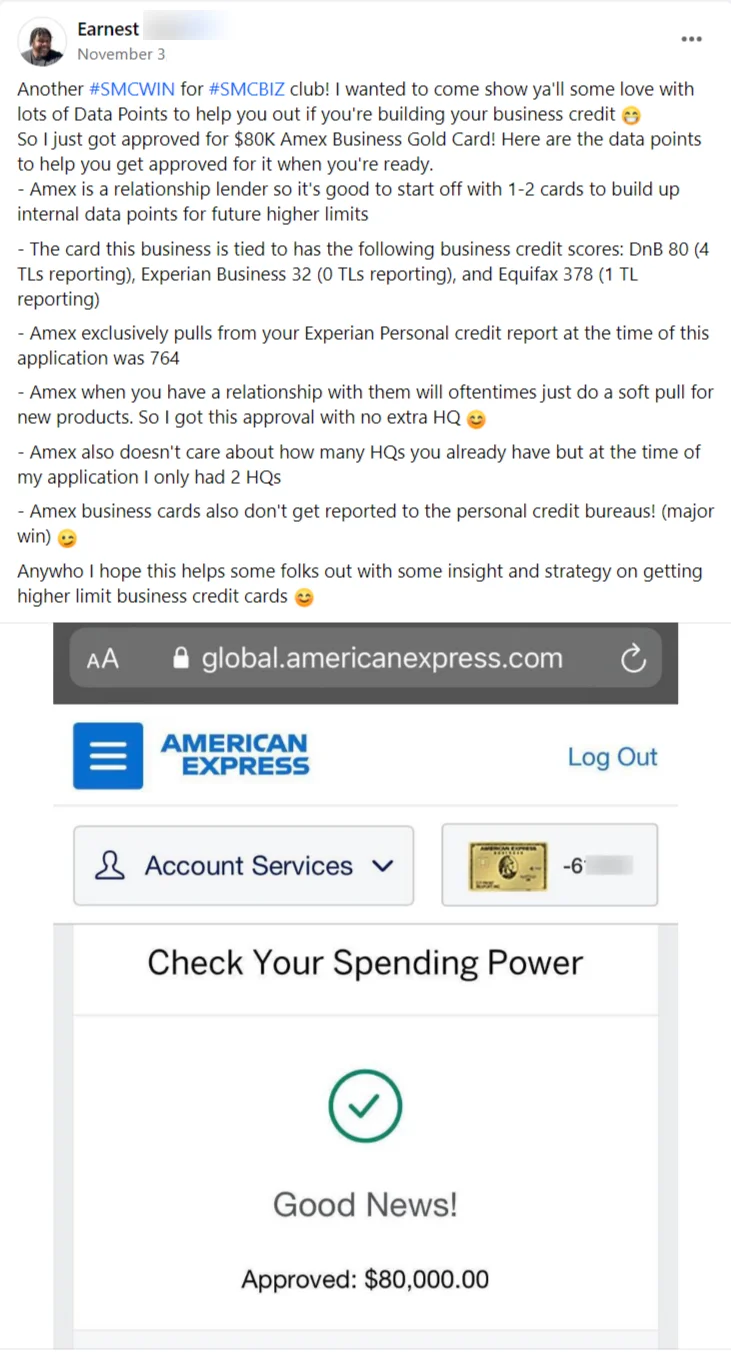

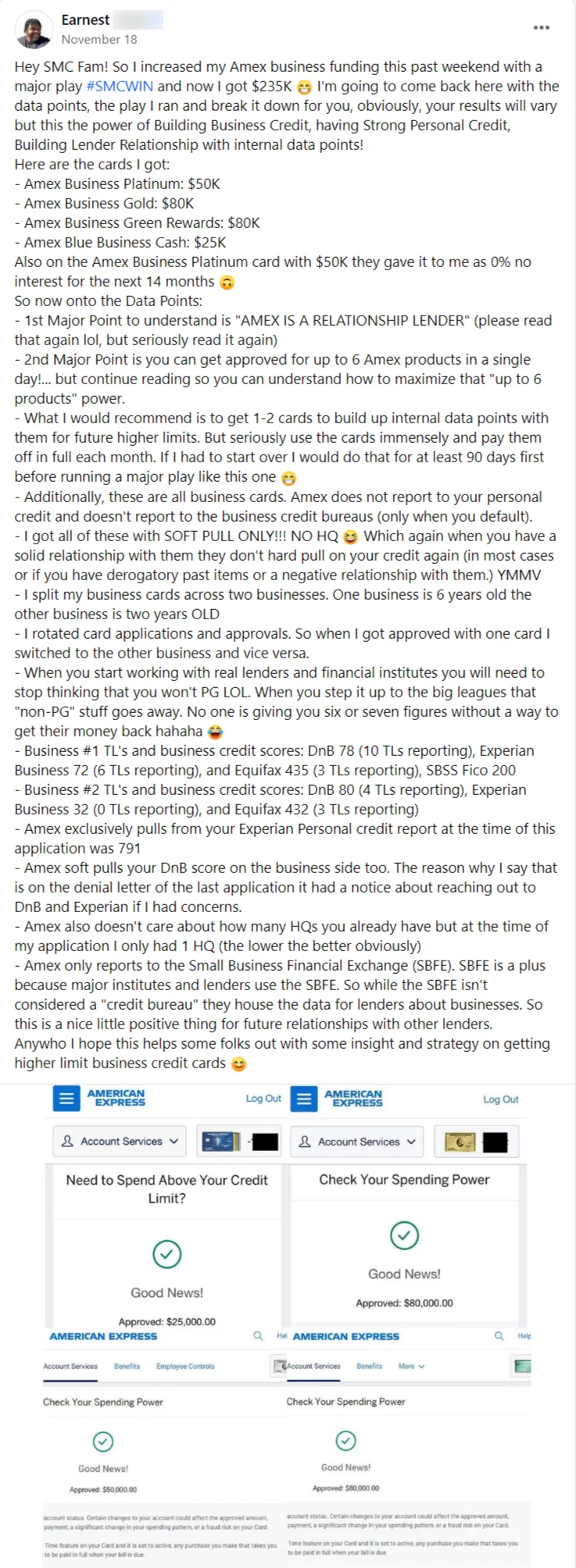

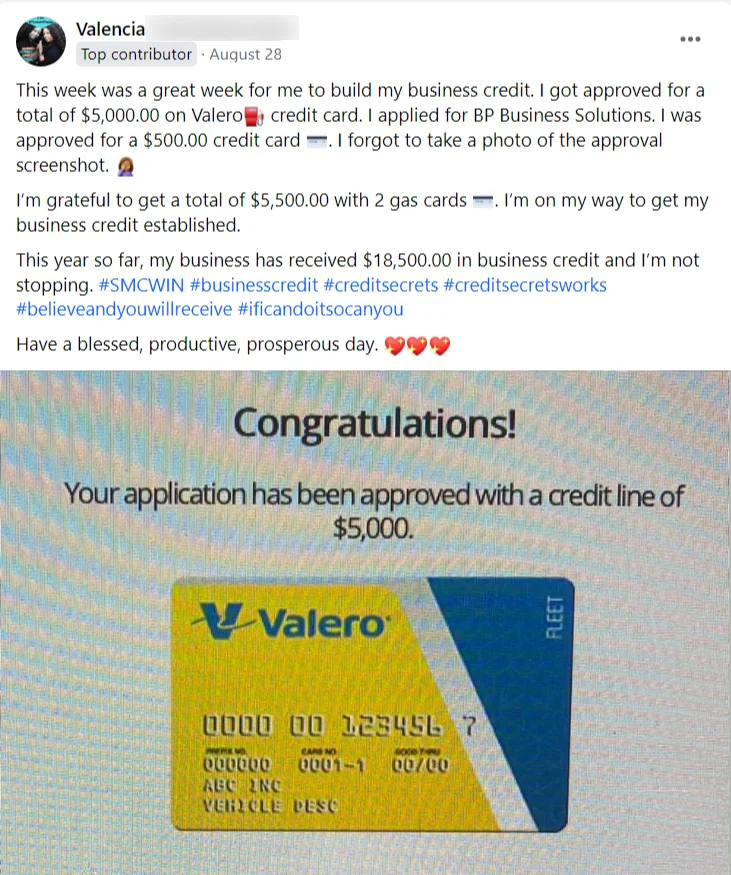

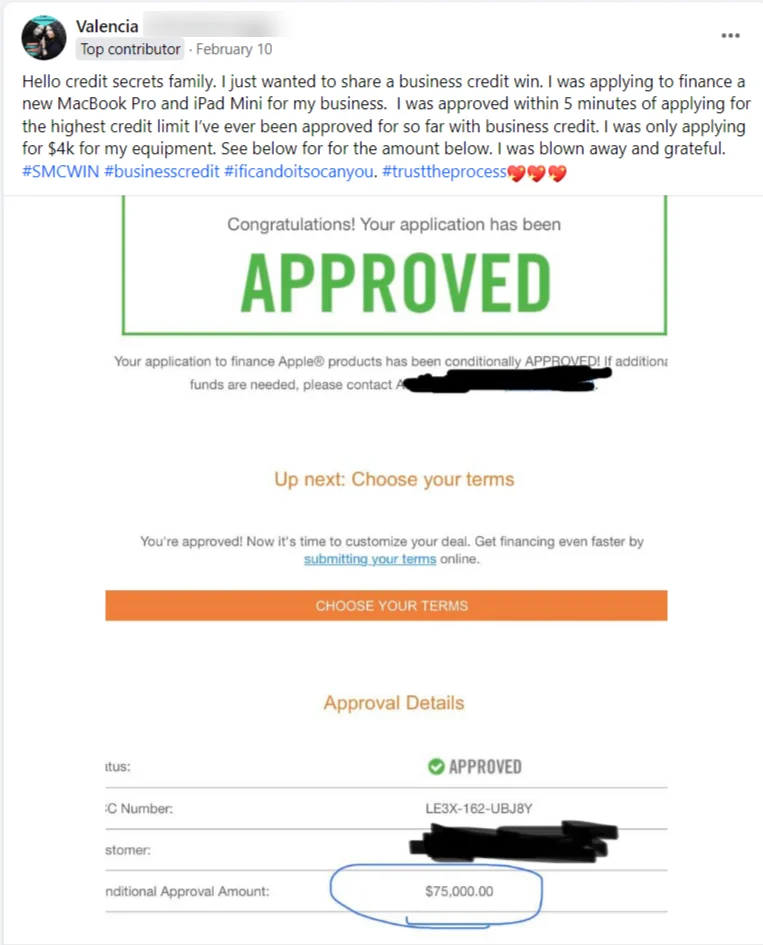

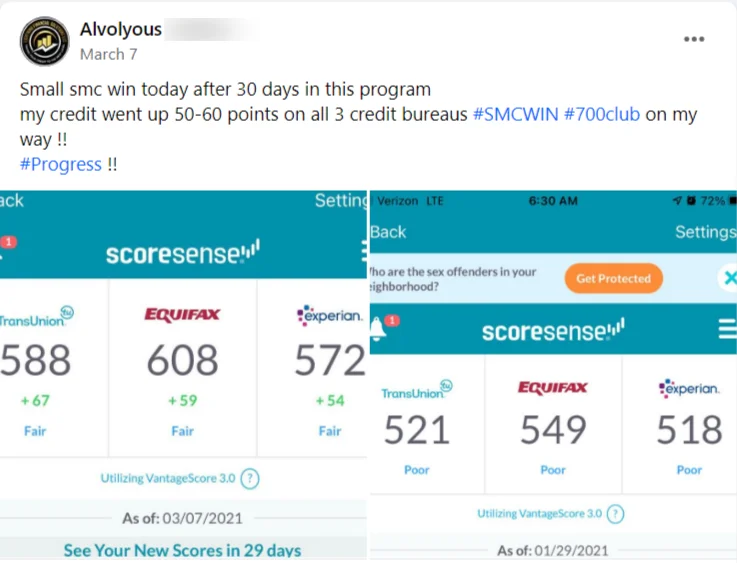

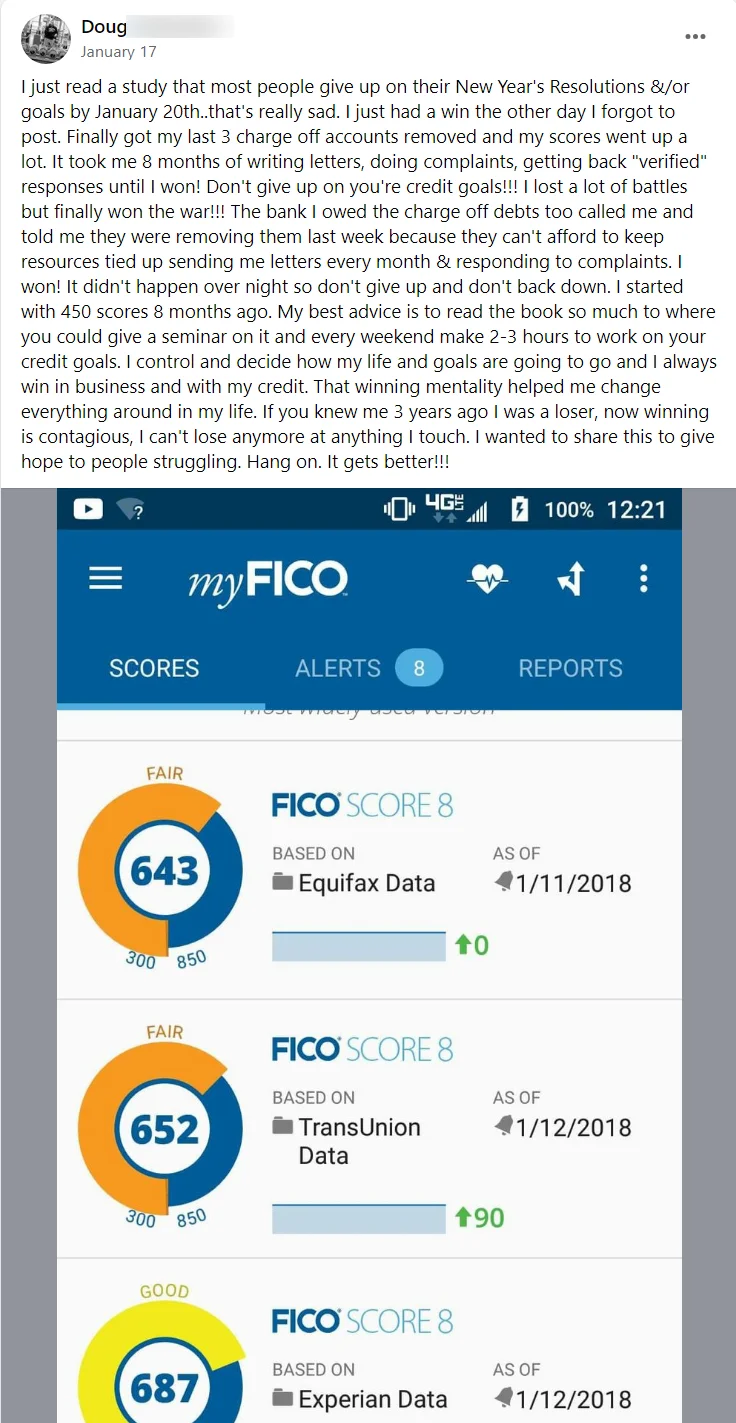

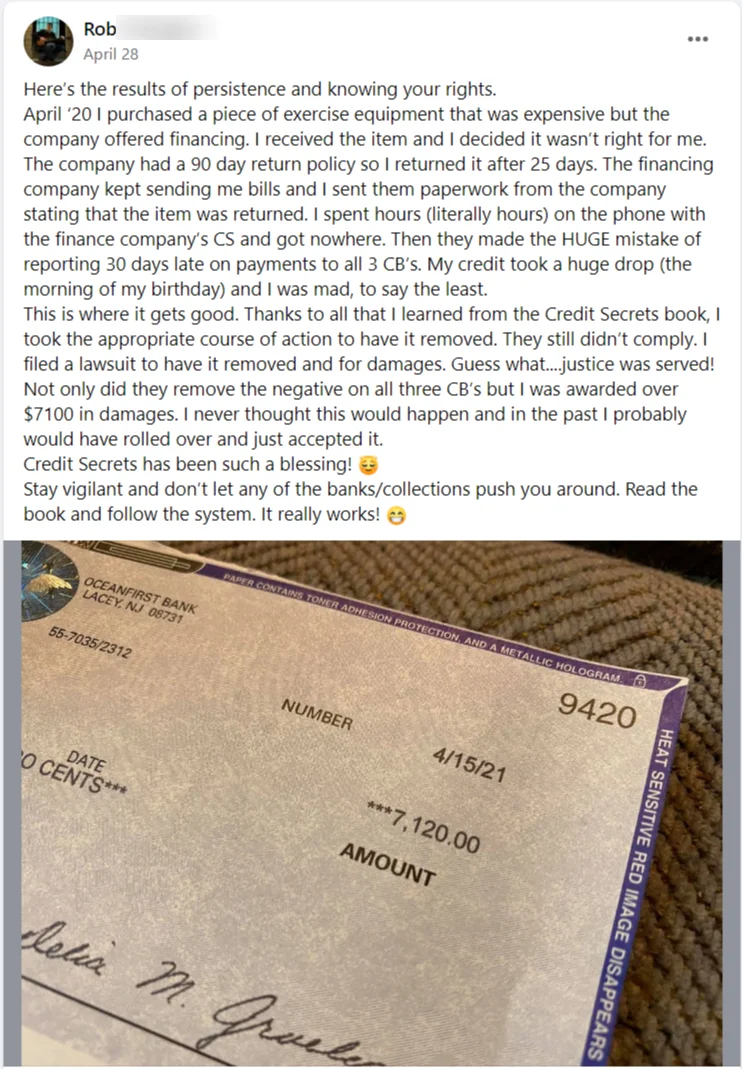

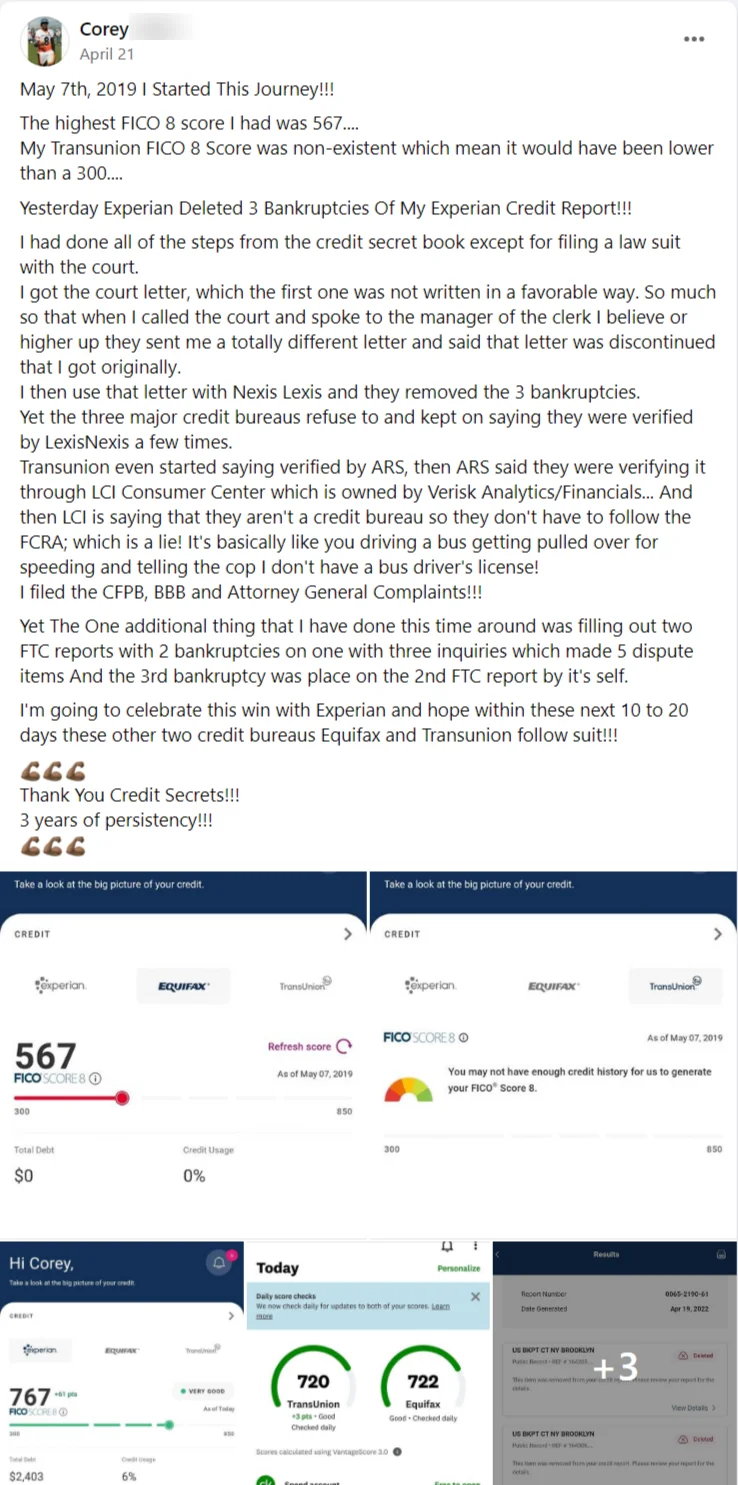

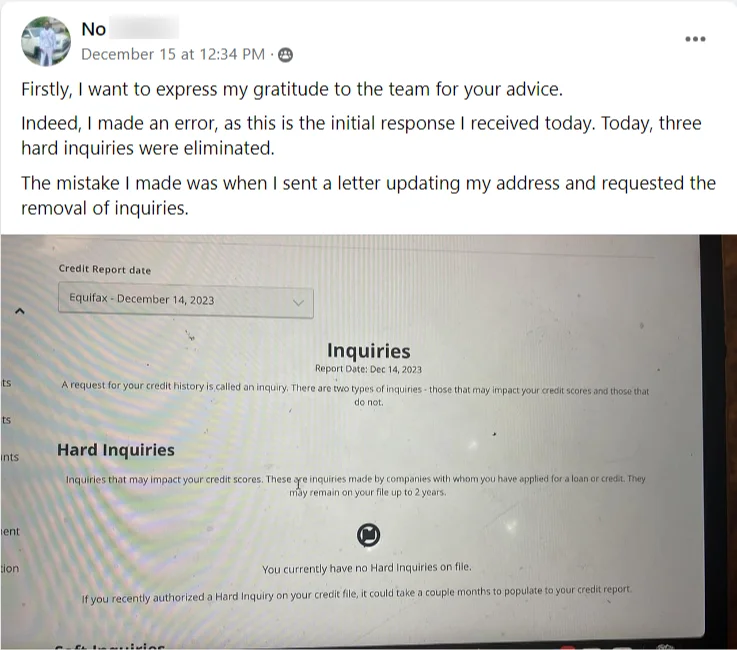

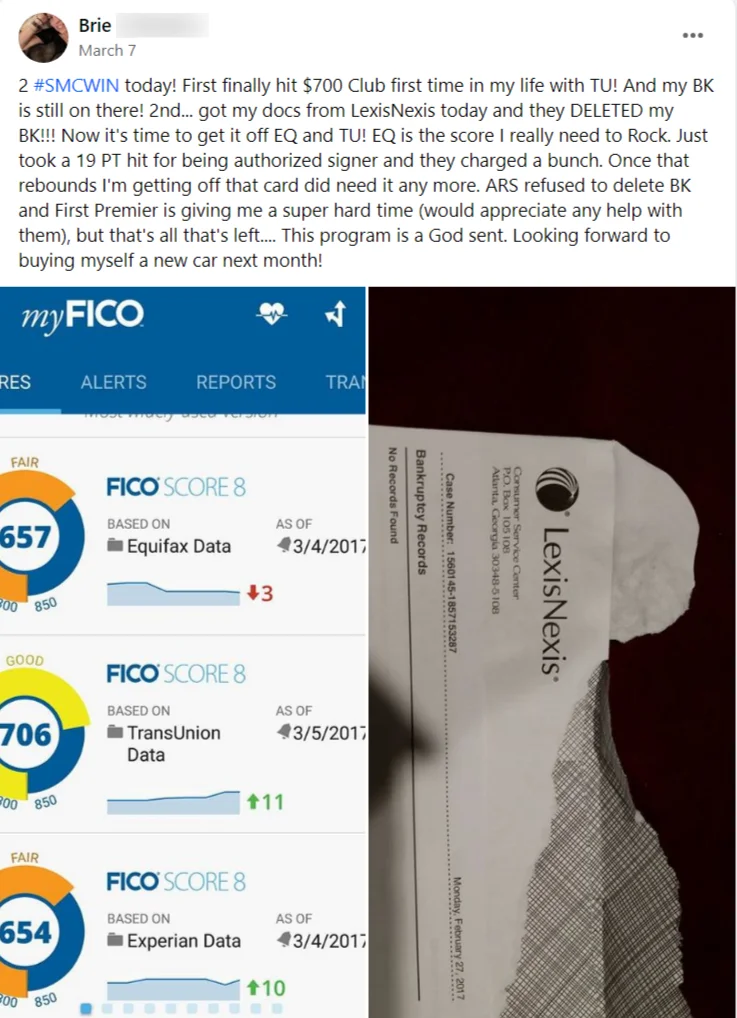

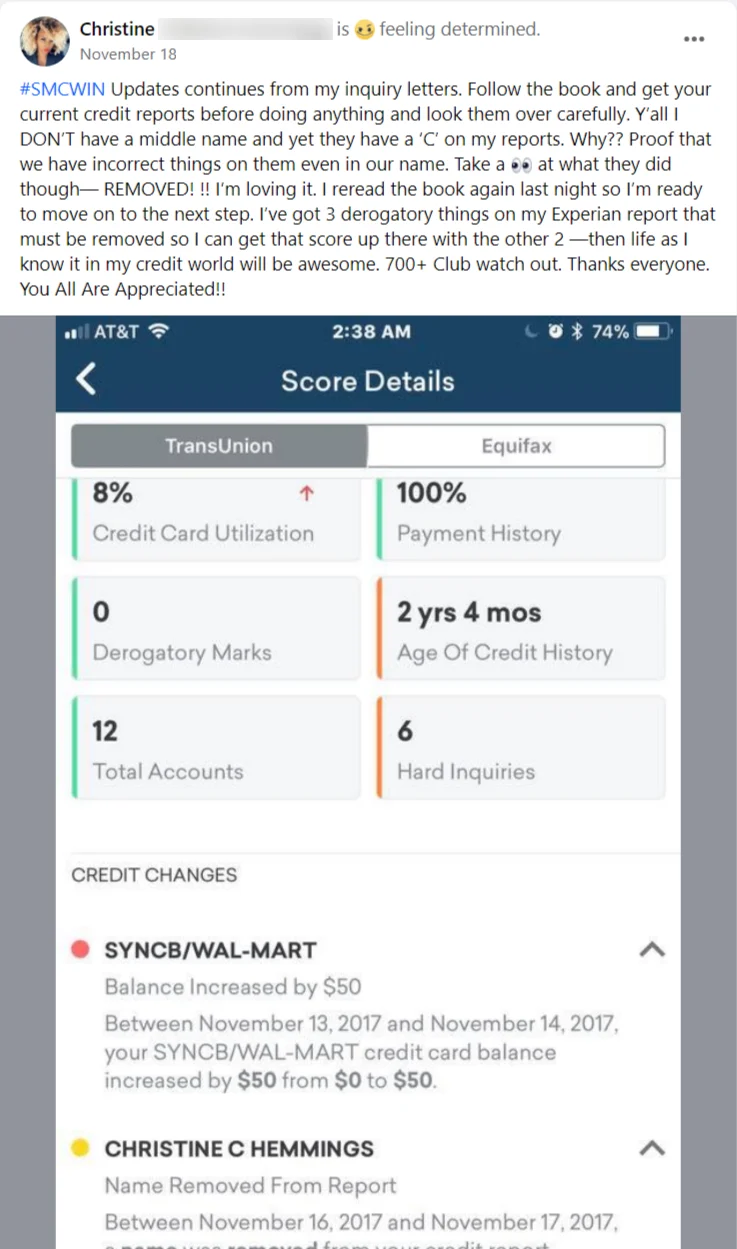

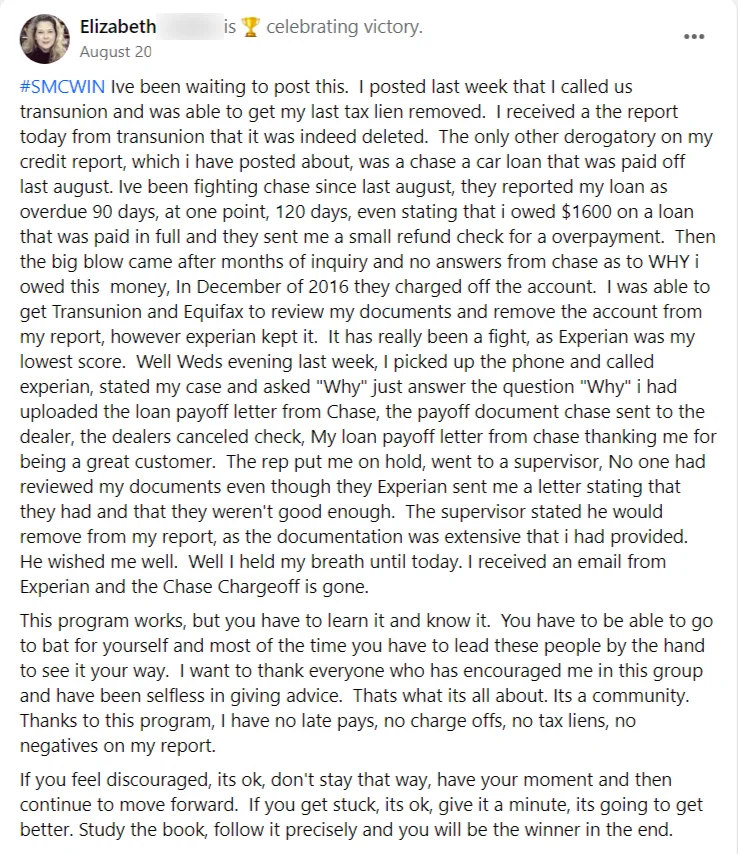

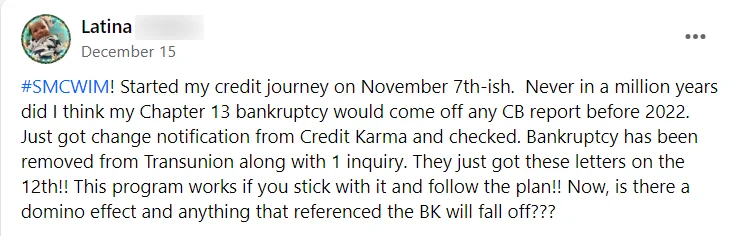

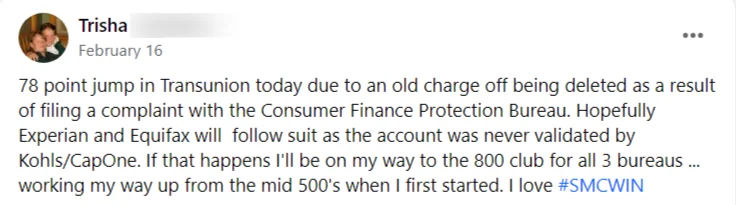

Hear From Real Customers

Discover The Program Now Helping Over 1 Million Americans Finally Get the Credit Scores They Deserve...

Unlock your financial future now!