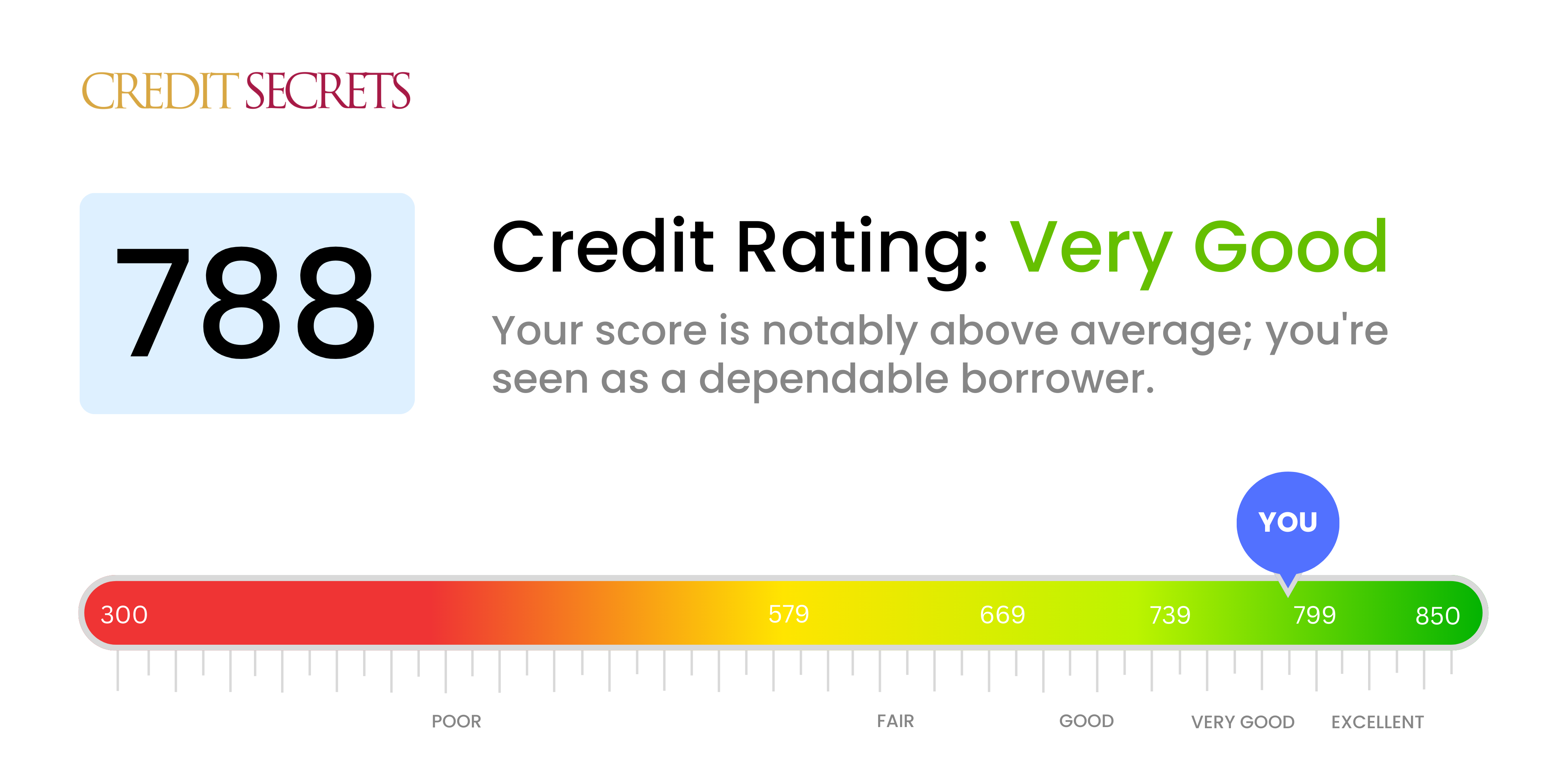

Is 788 a good credit score?

Your credit score of 788 is considered to be very good, placing you in a healthy position when it comes to creditworthiness. With this score, you are likely to find that most lenders view you as a reliable borrower, and you can expect to be offered favorable terms and conditions for loans, credit cards, or mortgages.

Although your credit score is not in the excellent range, you're just a few points away. By continuing to pay your bills on time, keeping your credit balances low, and monitoring your credit report for errors, you can hope to push your score towards the excellent category. Remember, achieving an excellent credit score isn't a sprint, but a marathon, and with your current standing, you're well on your way.

Can I Get a Mortgage with a 788 Credit Score?

With a credit score of 788, you are in an excellent position to be approved for a mortgage. This score is well above the minimum that most lenders require, indicating a history of responsible credit use and timely payments. Your good credit standing reflects positively on your financial discipline and reliability.

You can expect lenders to view your mortgage application favorably, which may streamline the approval process. However, it's important to remember that while a high credit score increases your chances of approval, other factors like income and existing debts also play a role. Having a score of 788 may also help you qualify for competitive interest rates. This can save you a significant amount of money over the life of your loan. Remain diligent with your financial habits to uphold your strong credit standing as you proceed through the mortgage application process.

Can I Get a Credit Card with a 788 Credit Score?

With a credit score of 788, you are in a strong position to be approved for a credit card. This score indicates responsible financial management and reliable repayment habits, qualities creditors highly appreciate. This status yields a higher probability of receiving approval for various types of credit cards.

Given your high score, you are likely eligible for some of the best credit cards in the market. Premium travel cards, with their lucrative rewards and travel benefits, could be a good fit for you, particularly if you often travel for work or leisure. Alternatively, you could also consider cash-back cards that offer you a percentage back on your purchases. Aside from the impressive perks, such cards typically come with reasonable interest rates, reflecting the lower risk you pose to lenders. So, carefully explore your options and choose a card that meets your lifestyle and spending habits in the most rewarding way.

With a credit score of 788, you stand in a very favorable position to be approved for a personal loan. This score is well within the range that traditional lenders consider as low risk. Therefore, you can expect the potential of being offered more competitive rates for loans, reflecting the confidence a lender has in your ability to repay the loan promptly.

During your personal loan application process, it's likely that lenders will view your credit background positively due to your high credit score. It's important to remember, however, that while a high score greatly improves your chances, approval isn't guaranteed. Lenders look at other factors such as your income and existing debt. The good news is, compared to those with lower scores, your high credit score can possibly secure you lower interest rates, making your loan more affordable in the long run.

Can I Get a Car Loan with a 788 Credit Score?

A credit score of 788 is generally considered very good, which puts you in a strong position to be approved for a car loan. A credit score at this level indicates a history of responsible money management and regular, timely repayment of debts. Lenders cherish applicants that reflect such financial stability because it reduces their risk of non-repayment. This, consequently, makes you a desirable candidate for most forms of lending, including car loans.

Notably, having such an impressive score could likely open the door to better financing terms when making your car purchase. You may avail of lower interest rates and more flexible repayment terms. Remember, lenders want to incentivize reliable borrowers like you. However, your credit score is just one piece of the puzzle. Lenders also consider other factors like income and debt-to-income ratio. Hence, make sure you explore all terms of your car loan thoroughly before making any commitment. Even with a high score, it pays to be attentive and discerning.

What Factors Most Impact a 788 Credit Score?

Understanding your credit score of 788 deeply is pivotal for continuous financial progress. By analyzing the elements that have influenced your score, you can take steps to further enhance it. Each financial journey is personally tailored, filled with unique insights and expansive growth.

Payment Consistency

Consistent, punctual payments have likely played a big part in your impressive credit score. Regular payments boost this number significantly.

How to Check: Investigate your credit history for consistent bill payments. Consider the timing for settling debts; on-time payments keep your score healthy.

Credit Utilization Ratio

A good credit score like yours suggests a low credit utilization ratio. This number reflects the percentage of your credit limit that you’re currently using, and it influences your overall score.

How to Check: Evaluate your credit card statements. If your balances are significantly lower than your limits, your credit utilization ratio is healthy.

Age of Credit Accounts

A longer credit history likely contributes to your high score. The age of your earliest account, the age of your latest account, and the mean age of all your accounts are factors in this calculation.

How to Check: Scrutinize your credit report, focusing on the length of your credit history. If your credit account is aged, you're on the right path.

Credit Mix

It's likely you have a diversified mix of credit types. A good variety of credit cards, retail accounts, installment loans, and mortgage loans are beneficial for a high score.

How to Check: Review your list of outstanding loans and credit cards. A diverse mix of credit types demonstrates responsible credit management.

Negative Records

Your score suggests you likely have few or no negative records. These can entail items like bankruptcies or tax liens, which can substantially lower your score.

How to Check: Look through your credit report for any negative records. Work toward resolving any that might exist as soon as possible.

How Do I Improve my 788 Credit Score?

Boasting a credit score of 788 places you firmly in the ‘Excellent’ category. Despite this high score, you can still improve. Here’re some immediate and effective steps concerning your current credit situation:

1. Maintain Low Credit Utilization Ratios

Even with your stellar score, it’s crucial to keep your credit card balances well below the card’s limit. Keeping your utilization ratio under 30%, and ideally under 10%, positively impacts your creditworthiness. Strive to pay off your balances each month.

2. Consistently Review Your Credit Reports

To hold on to your terrific score, regular review of your credit reports is essential. Ensure there are no inaccuracies or fraudulent activities that could dent your credit standing.

3. Keep Credit Accounts Open

Long-term credit relationships reflect well on your credit history. It may be tempting to close unused credit card accounts, but doing so could hurt your credit score. Keep them open and use them occasionally to keep them active.

4. Linear Credit Growth

Resist the urge to apply for multiple new credit lines as they result in hard inquiries, which can drop your score even if temporarily. By focusing instead on managing your existing credit well, your score will grow linearly.

5. Diversify Credit

If you don’t have an array of credit types – mortgage, auto loan, credit cards – consider diversifying. This doesn’t mean taking unnecessary debt; but should you need a loan, opting for a different credit type could diversify your credit mix, showing you can handle varied credit, thereby adding few more points to your score.