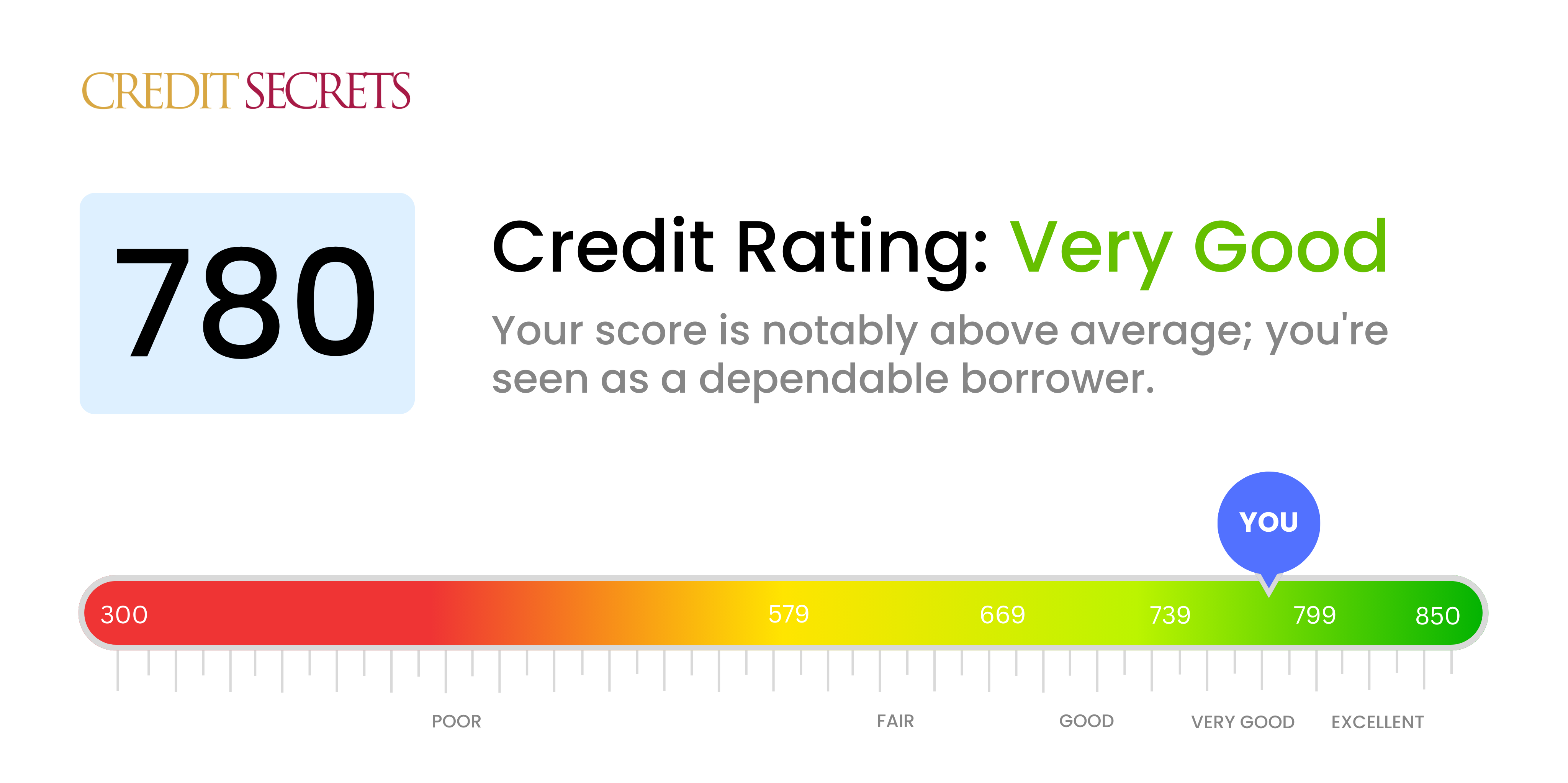

Is 780 a good credit score?

Your score of 780 is indeed a very good credit score. Being in this range indicates that you've managed your credit responsibly, making you an attractive borrower to lenders. You can likely expect to receive lower interest rates and more favorable terms on loans and credit cards.

With such a score, securing mortgages or auto loans will likely be a smooth experience. Creditors may see you as a low-risk borrower, increasing your chances of approval. Keep maintaining good financial habits to further boost your score towards the excellent range.

Can I Get a Mortgage with a 780 Credit Score?

Holding a credit score of 780 puts you in a favorable position, especially when looking to apply for a mortgage. This score is significantly above the average and indicates a history of responsible and consistent credit management. Therefore, you are highly likely to be approved for a mortgage by most lenders.

With this impressive score, you should experience a smooth journey throughout the mortgage approval process. Good credit scores often receive lower interest rates because lenders deem you less risky to default on a loan. Therefore, you can expect more favorable interest rates on your mortgage. However, remember that mortgage approval does not solely rely on credit scores. Lenders will also examine other financial factors such as your debt-to-income ratio and employment history. Keep managing your credit usage wisely as it's an essential piece of your financial health.

Can I Get a Credit Card with a 780 Credit Score?

Having a credit score of 780 indicates a strong credit history. It expresses financial responsibility and discipline to potential lenders. This score, placed in the 'excellent' credit range, highly increases your chances of approval when applying for a credit card. It's a hard-earned testament to your conscientious management of finances.

With a credit score as healthy as 780, a wider range of credit card options are available. High reward, premium credit cards often require excellent credit scores to qualify - they come with perks such as travel rewards, cash back, and low-interest rates. However, it's still essential to compare cards, looking closely at the terms and benefits of each one. Regardless of the appealing rewards offered, choosing a card that suits your lifestyle and spending habits is vital. Remember, good credit not only unlocks more opportunities but also brings financial benefits in the shape of lower interest rates and better terms.

If your credit score sits around the 780 mark, you are in an excellent spot in terms of creditworthiness. This score speaks volumes about your financial health, and more often than not, lenders view it as an indicator of a low-risk borrower. Should you choose to apply for a personal loan, you stand a high likelihood of approval based on this credit score alone.

Digging a bit deeper into this topic, such an impressive credit score not only makes it probable for you to get approved for a personal loan, but it also can positively impact your loan terms. A higher credit score generally comes with lower interest rates and more favorable loan terms, making your borrowing cost effective. When you initiate the application process for a loan, remember, your 780 credit score is a significant advantage, and can help you secure the best possible loan conditions.

Can I Get a Car Loan with a 780 Credit Score?

With a credit score of 780, navigating your way through a car loan approval process should be relatively effortless. This high score marks you as a trustworthy borrower in the eyes of most lenders. Usually, they seek a score above 660 for favorable terms and under 600 is often seen as subprime. But your score of 780 is superlative, positioning you well for regaining control of your financial situation.

Your excellent score likely opens doors to lower interest rates and favorable repayment terms. This is due to lenders perceiving you as a substantially lower risk than someone with a lower credit score. They believe that your 780 score signifies a strong history of prudent borrowing and on-time repayments. In terms of the car purchasing process, this essentially smooths the way for less hassle and more economical options. Nonetheless, it's still crucial to carefully read and investigate all terms and conditions before agreeing to any loan.

What Factors Most Impact a 780 Credit Score?

An impressive credit score of 780 suggests strong financial habits and prudent choices. If you're here, you already understand the importance of maintaining a good score, which involves a few key factors.

Credit Utilization

Your credit utilization ratio—the percentage of your available credit you're using—should be low. If it isn't, it's time to carefully manage and reduce your utilization.

How to Check: All you need to do is review your credit card statements. Aim to use no more than 30% of your total credit limit across all cards.

Payment History

Even with a score as high as 780, it's essential to ensure all payments are made on time. A single late payment can affect your score.

How to Check: Evaluate your payment habits. Remember, even a single late payment can impact your credit score.

Length of Credit History

An extended credit history offering a detailed account of consistency would have positively impacted your high score.

How to Check: Look at your credit report's age to gauge the duration of your credit history. Focus on maintaining long-standing accounts.

Types of Credit Used

A mix of different types of credit like mortgage loans, credit cards, and retail accounts might be contributing to your healthy score.

How to Check: Assess your credit types to see if a variety is present. A diversity in credit types could be beneficial for your credit health.

Hard Inquiries

A high score like 780 often indicates sparing use of hard inquiries, such as when applying for a new line of credit, which can temporarily lower your score. Keeping these to a minimum has likely helped you achieve a robust score.

How to Check: To review the volume of hard inquiries, closely examine your credit report. Aim to apply for new credit sparingly.

How Do I Improve my 780 Credit Score?

With a credit score of 780, you’re on the path to outstanding financial health. However, there are still effective steps you can take to reach your credit score’s full potential:

1. Keep Low Card Balances

Keeping your credit card balances low can aid in boosting your credit. Strive to maintain your usage below 10% of your credit limit, even if you’ve previously successfully managed higher percentages.

2. Limit Hard Inquiries

Avoid unnecessary credit applications which could lead to multiple hard inquiries on your report. Too many hard inquiries within a short span may negatively impact your score, so exercise caution.

3. Maintain Old Credit Accounts

Prolonged credit history can be beneficial. Try not to close old credit accounts, even if they’re not in frequent use, as long as there are no costs associated with keeping them open.

4. Regularly Monitor Credit Reports

Regularly inspect your credit report for any errors or inconsistencies. Swift detection and rectification of such issues can prevent potential undesired impacts on your high credit score.

5. Diversify Credit Portfolio

While careful, explore the possibility of diversifying the forms of credit you use. A balanced mix of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans can enhance your credit profile.