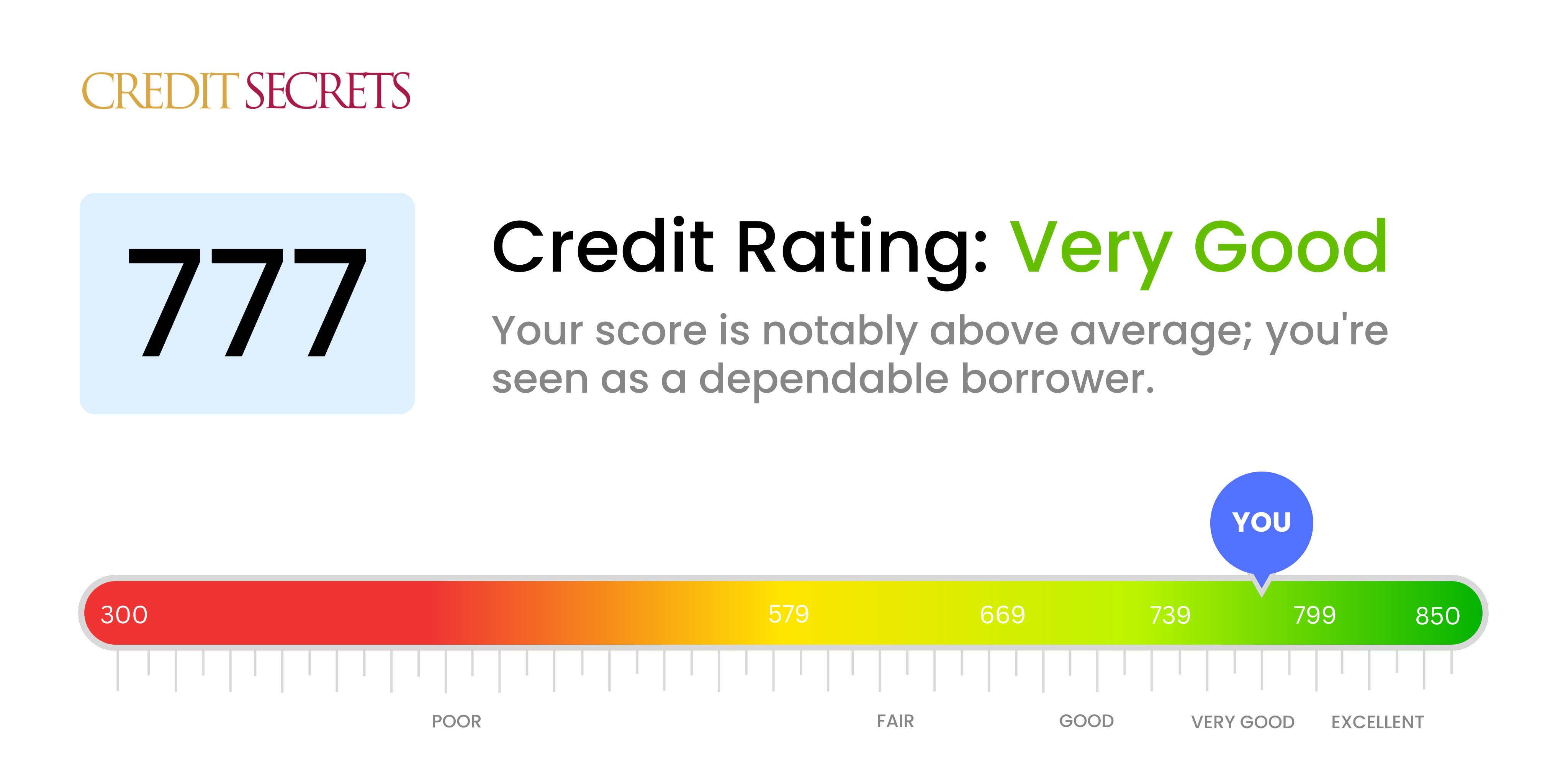

Is 777 a good credit score?

Your score of 777 places you within the 'Very Good' range and that's certainly a positive place to be in. With such a credit score, you can typically expect more favorable loan terms and interest rates, enhancing your financial flexibility and making major purchases, such as a new home or car, more attainable.

Remember, although having a 'Very good' credit score is indeed encouraging, continue to practice good credit management habits like making payments on time and keeping your credit card balances low to maintain or even improve your credit score further. Your road to achieving financial success is well on its way with that credit score.

Can I Get a Mortgage with a 777 Credit Score?

With a credit score of 777, you are in a great position to be approved for a mortgage. This score is well above the minimum requirement most lenders seek, signaling you’ve demonstrated responsible financial behaviors. However, having a strong credit score doesn't guarantee approval. Lenders will weigh other factors such as your income, debts, and employment history. It’s always a good practice to maintain your financial stability during the loan approval process.

Regarding the mortgage process, lenders will offer you interest rates based on your credit score. A high score like 777 could open doors to more favorable rates. This means you might be paying less over the life of the loan. However, it’s also important not to rush into a commitment without shopping around. Obtaining loan estimates from several lenders will ensure you get the best deal possible. Remember, make sure to understand the terms before signing anything. A mortgage is a significant obligation - make it work in your favor.

Can I Get a Credit Card with a 777 Credit Score?

With a score of 777, your chances of being approved for a credit card are notably high. Lenders view this as a favorable score, indicating a history of responsible credit use and dependability. There's no doubt that this is encouraging news, as it reflects careful and efficient financial practices. Understanding your credit status is key to maintaining this success, as it can influence decisions around credit card choices.

In consideration of this healthy score, you may want to look into various premium credit card opportunities. These could include cards offering high reward rates for travel, dining, and other categories. Secured and starter cards are not typically required for those with such scores. Remember, however, as always, it is important to weigh the benefits against the potential costs. Keep an eye out for cards with low interest rates and avoid those with high annual fees. Even with a high credit score, it's crucial to maintain responsible and prudent financial habits. It's a testament to your hard work and discipline that you find yourself in this position.

Having a credit score of 777 is an excellent indication of your financial responsibility. This score sits well within the range that lenders consider 'good' and it signifies that you have been diligent in managing your debts. Traditionally, a score like this implies a lower risk for lenders and thus, it's highly likely you will be approved when you apply for a personal loan.

As you navigate your personal loan application process, you can anticipate smooth sailing, thanks to your impressive credit score. Lenders may offer you loans with more attractive interest rates, reflective of the lower risk you pose. Applying and approval processes will probably be quicker and simpler for you, compared to someone with a lower credit score. However, remember every lending institution has its own set of policies, so it's essential to read the fine print and understand the terms of the loan before signing your agreement.

Can I Get a Car Loan with a 777 Credit Score?

With a credit score of 777, chances are high that a car loan application will be met with approval. Financial institutions generally view scores above 700 as excellent, and a credit score of 777 clearly falls into that category. Responsible financial behavior has helped you build this stellar score, and it signals to lenders that you are a reliable borrower.

When it comes to the car purchasing process, a high credit score like yours can open up several opportunities. Not only are you likely to be approved for a car loan, but you can also expect favorable loan terms and lower interest rates. Lenders see you as a low-risk borrower because your credit history indicates you're reliable with repayments. Therefore, they are typically willing to offer loans at lower interest rates. This can lead to significant savings and an easier repayment process, making your car purchase a more enjoyable and less stressful experience.

What Factors Most Impact a 777 Credit Score?

Grasping the implications of a 777 credit score is key to taking control of your financial life. Let's dive into the elements that have likely impacted this score, and illuminate a path for financial elevation.

Non-Major Negative Factors

With a score of 777, major negative factors such as bankruptcy or late payments are likely not affecting your score. Instead, non-major factors like hard inquiries from applying for new credit and age of accounts could be the leading contributors.

How to Check: Review your credit report for any recent hard inquiries. Assess the age of your accounts- are they relatively new?

Average Account Age

A shorter account history may have an impact on your score. Even if you've never missed a payment, if you're relatively new to credit, it could be holding your score back.

How to Check: Look at your credit report to determine the age of your oldest and most recent credit accounts, as well as the average age of all your accounts.

Balance Percentage

How close you are to using your total available credit can affect your score. Even if you pay off your credit cards every month, high utilization could be lowering your score.

How to Check: Look at your credit card statements. Is your balance close to your credit limit? Working to keep balances lower in comparison to your limit is valuable.

New Credit Inquiries

Applying for new credit frequently can impact your credit score. Even if you are approved, the hard inquiries can lower your score slightly.

How to Check: Examine your credit report for recent inquiries. Consider if you have applied for new credit recently, and if so, how frequently.

How Do I Improve my 777 Credit Score?

A credit score of 777 is considered very good, and it shows that you have been fairly responsible in managing your finances. But, don’t rest on your laurels – you can still fine-tune your financial habits and aim towards an excellent score. Here are a few steps you can take:

1. Maintain Your Credit Utilization Ratio

One of the key components of your credit score is your credit utilization ratio. Since you’ve reached a healthy score, it’s likely you’ve done a good job in this area. Keep your ratio under 30%, and strive for an even lower percentage, as this can positively influence your credit score.

2. Keep the Oldies Goldies

The length of your credit history plays a significant role in your credit score. So, avoid closing old credit card accounts unless it’s absolutely necessary. Maintaining old credit cards that are in a good standing bolsters your credit history and affects your score positively.

3. Opt for Different Types of Credit

Having a variety of credit types can boost your credit score. A mix of installment loans, retail accounts, credit cards, and mortgage loans reflects your ability to manage different types of credit responsibly.

4. Regular Credit Reports Check

Regularly check your credit reports for any errors. Reporting and getting errors corrected can give your score a quick boost. As a consumer, you have the right to a free credit report from each of the three major credit bureaus once per year.

5. On-Time Payments

As you are already consistent with your payments, make sure you continue this pattern. Payment history is a significant factor in determining your score. Keep your accounts current for an eventual bump to the higher end of the excellent category.