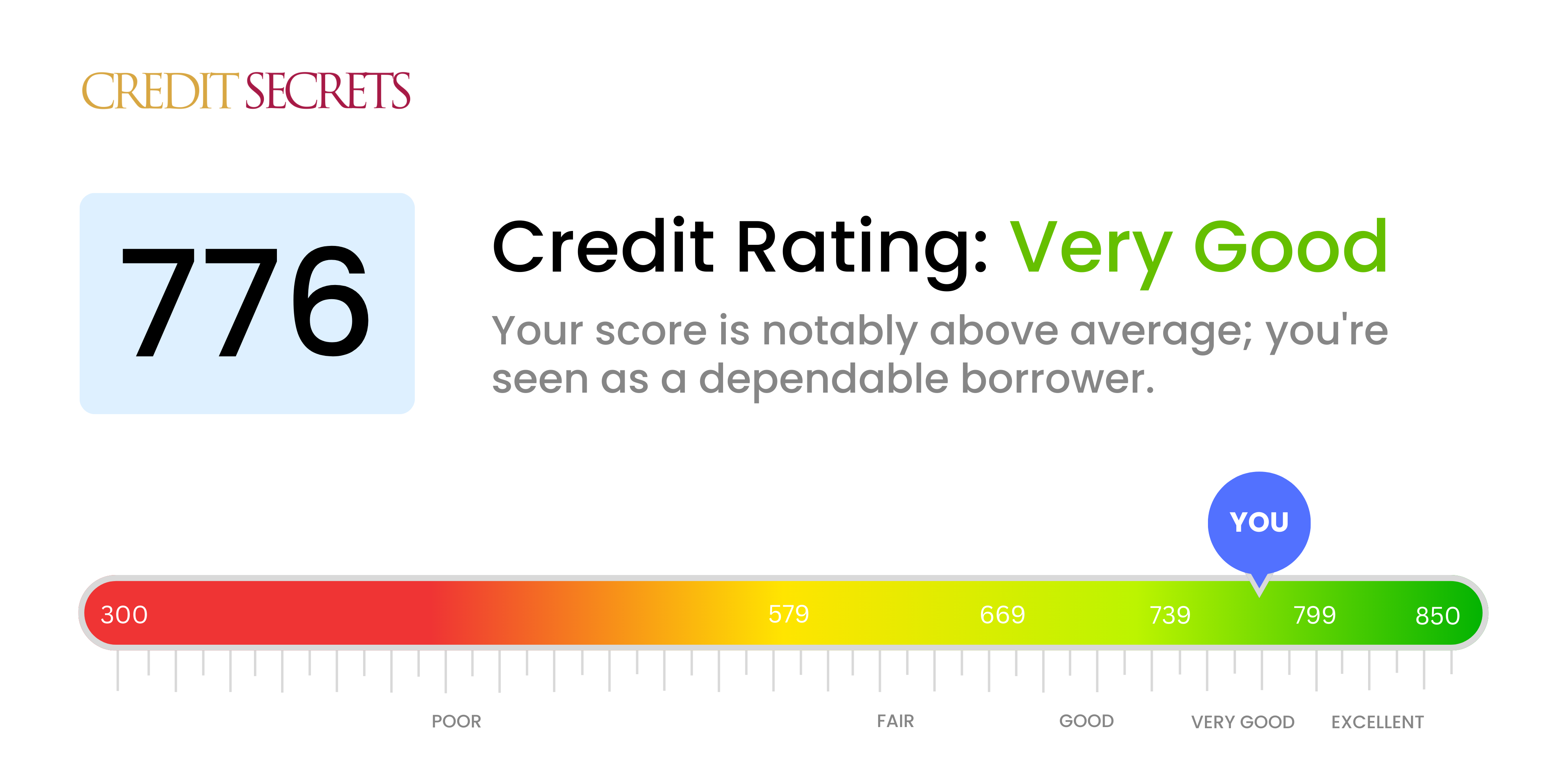

Is 776 a good credit score?

Your credit score of 776 falls into the 'Very Good' category. This means you'll likely have better access to more favorable interest rates, terms of credit, and higher approval chances for most loans and credit cards compared to those with lower scores. You've shown commendable financial responsibility, but there's always room to aim for a even higher credit status.

Remember, though, that while a higher score can pave the way for many financial opportunities, sustaining it will require continued discipline and smart credit management. Maintaining timely payments, keeping low credit balances, and not applying for unnecessary credit will help maintain your impressive score. It may not be easy, but your effort towards financial prudence is bound to pay off, helping you to reach an even higher credit rating.

Can I Get a Mortgage with a 776 Credit Score?

With a score of 776, your credit standing is well above average, increasing your chances of mortgage approval. This score reflects a disciplined financial history, showcasing a pattern of timely payments and responsible use of credit, which is favourable to lenders.

Approval, of course, is only the initial step in getting a mortgage. Once approved, be prepared for the underwriting process, which includes verifying your income, assessing your debt-to-income ratio, and assessing your ability to manage the proposed mortgage payments. Moreover, with a high credit score like yours, chances for securing a favorable interest rate are very high. It's important to bear in mind that while a high credit score increases your chances of approval and favorable terms, the final decision also takes into account other factors - such as your employment history, income level, and current debts.

Can I Get a Credit Card with a 776 Credit Score?

Having a credit score of 776 is excellent and demonstrates a commendable history of managing finances responsibly. This is a reassuring indicator for potential lenders, who view such a score as evidence of creditworthiness. While this is significant progress, remember to maintain a realistic and serious outlook going forward.

With a score this high, a wide variety of credit cards become accessible. Options can range from starter cards to premium travel cards. If you travel often, a travel rewards card might prove beneficial. Alternatively, if you spend significantly on everyday expenses, a cash back card could provide extra value. Interest rates for individuals with such scores tend to be lower due to the decreased risk perceived by lenders. However, it's crucial to regularly review terms and ensure timely repayments to maintain such a high credit score. Selecting the right credit card is an important step in maintaining a strong financial standing, so consider choices carefully.

With a credit score of 776, your chances of being approved for a personal loan look promising. This score is well above the average and is seen in a positive light by most lenders. Your strong credit history not only makes you a likely candidate for loan approval, but will also potentially grant you the benefit of competitive interest rates. This favorable score signifies to lenders that you represent a low risk of default, demonstrating your ability to manage credit responsibly.

While a good credit score such as 776 can make the personal loan application process smoother, it doesn't guarantee approval. Lenders may also consider other factors such as income and employment stability. However, with your impressive credit score, you can anticipate better loan terms, lower interests rates, and a wider range of loan options. Yet, it is important to understand the full terms of any loan before accepting to ensure it aligns with your financial goals.

Can I Get a Car Loan with a 776 Credit Score?

With a credit score of 776, you are well-positioned to secure a car loan. This high score typically displays a strong history of appropriate credit management to potential lenders, which may increase your chances of loan approval. Lenders often deem higher credit scores as less risky, enabling customers with these advantageous scores to enjoy more favorable terms.

As you navigate the car purchasing process, you can expect the possibility of obtaining loans with potentially lower interest rates. Your strong credit score of 776 places you in a strong bargaining position, which is highly beneficial when negotiating loan terms. The overall process from loan application to approval might be smoother, as many lenders prefer working with customers who have high credit scores. Keep in mind, while your chances are strong, approval also depends on other factors such as income and employment history.

What Factors Most Impact a 776 Credit Score?

Interpreting a score of 776 is essential for maintaining your exceptional financial health. Contemplating the probable factors contributing to this excellent score can guide you towards sustaining it or even further improving it. Remember, your financial journey is individual and filled with opportunities for continued success.

Total Amounts Owed

With a credit score of 776, you are likely managing your credit utilization ratio well. This suggests you owe relatively low amounts compared to your total credit limit.

How to Check: Review your credit card balances. Identifying any recent and significant increases in balances is essential. Keeping balances low in relation to your total credit limit is a good target.

Account History

A healthy account history is a likely factor contributing to your high score. This means consistently making credit card payments and loan installments on time.

How to Check: Review your credit report. Take note of your payment history and the consistency of timely payments, which directly impact your score.

Length of Credit History

Having a long credit history may have positively influenced your score. This reflects a longer duration of managing credit responsibly.

How to Check: Review your credit report for the opening dates of your accounts and find the average age, keeping in mind that older accounts generally have a positive effect on your score.

Credit Inquiry

With few credit inquiries, your score is undamaged by excessive new credit applications.

How to Check: Scan your credit report to see the total number of inquiries made recently.

Public Records

Most likely, you have no public records like bankruptcies or judgments, which significantly boost your score.

How to Check: Review any public records on your credit report. These have a vast impact on your score, aiming for zero is ideal.

How Do I Improve my 776 Credit Score?

With a credit score of 776, you’re doing great. Your credit is already considered to be excellent, but there are always ways to continue improving. Here are the key next steps for you:

1. Maintain On-Time Payments

Having a history of on-time payments is critical in maintaining your high score. Ensure you’re not missing any due dates by setting up automatic payments or reminders for each bill cycle.

2. Review Your Credit Report

With a solid score like yours, it’s a good idea to regularly review your credit report. Ensure that all your personal information is accurate, and there aren’t any unexpected changes that could be hurting your score. If you find errors, dispute them promptly.

3. Keep Your Credit Utilization Low

Strive to keep your credit card balances low. Even though you manage your finances well, try to keep your money usage below 20% of your credit limit. This small action can make a positive impact on your score.

4. Limit Hard Inquiries

Hard inquiries can temporarily lower your score, so limit them unless necessary. Before you apply for new credit, make sure it’s a strategic move that benefits your financial health.

5. Diversify Credit

Consider diversifying the types of credit you use, if appropriate. Having a mix of credit cards, retail accounts, installment loans, and a mortgage can show lenders you can handle various types of credit responsibly.