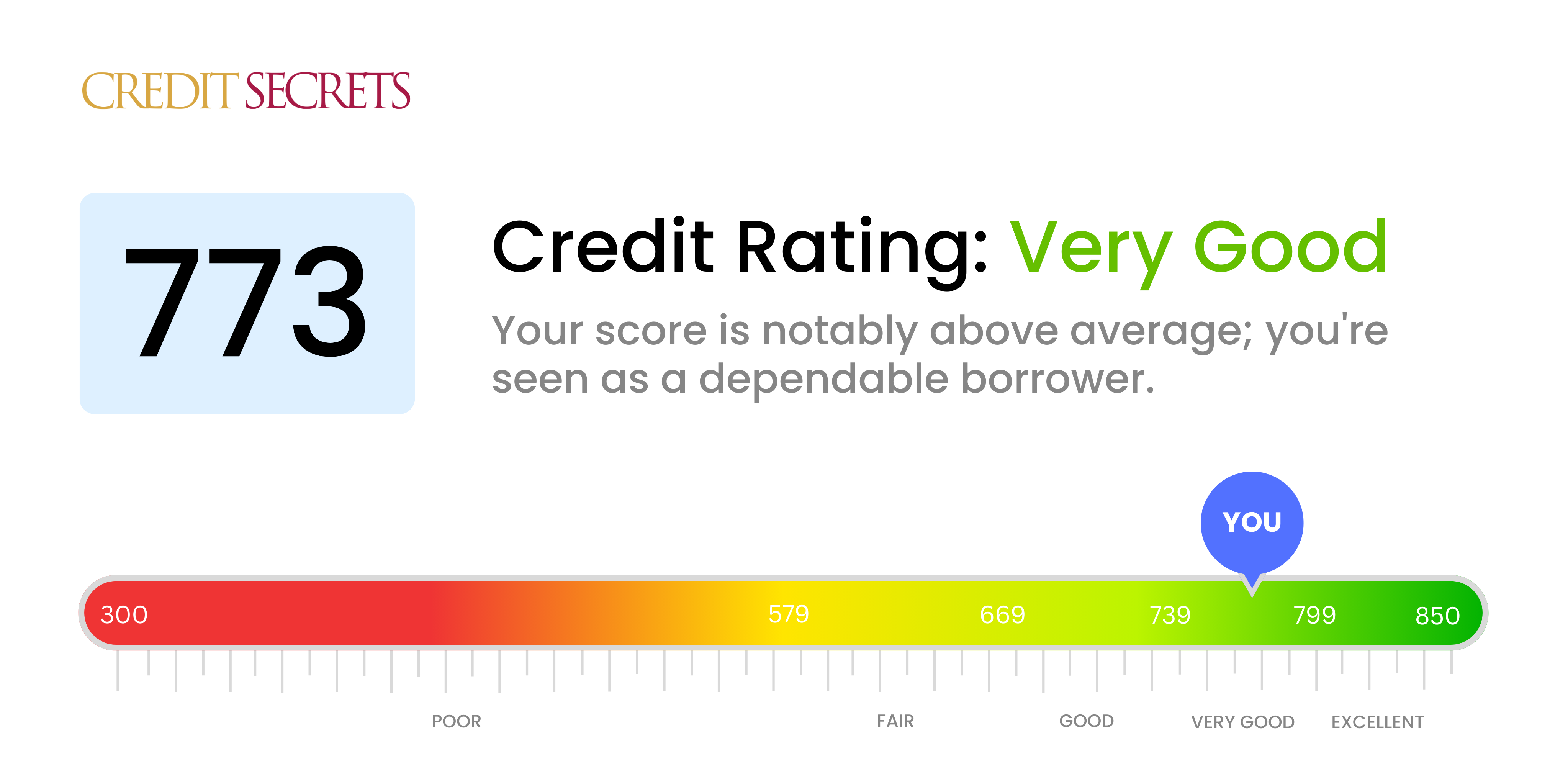

Is 773 a good credit score?

With a credit score of 773, you're in a very good position. This score indicates that you've done a wonderful job maintaining a healthy credit profile and have shown impressive responsibility with handling your finances.

What can you likely expect with a score like this? Well, most lenders view a score in the 'Very Good' range as quite appealing, which typically translates into easier approval for various forms of credit, as well as favorable interest rates and terms. You're on a solid path towards achieving excellent credit, so keep up the good work with your credit habits.

Can I Get a Mortgage with a 773 Credit Score?

A credit score of 773 places you well above the standard threshold for most lenders, indicating a commendable track record of responsible financial management. This positions you in a favourable light when it comes to mortgage approval, as it represents a history of consistently meeting debt obligations.

As part of the mortgage approval process, lenders will review your creditworthiness, assessing not only your score but other factors like employment history and income. However, your high credit score will likely afford you more favorable interest rates, which can translate to significant savings over the life of your mortgage. Although the process may still present some challenges, rest assured that a credit score of 773 will likely give you a head start and could make your journey to homeownership easier.

Can I Get a Credit Card with a 773 Credit Score?

With a credit score of 773, the chances of being approved for a credit card are very high. This score reflects a history of responsible financial management and consistency in repayment of debts. It's a clear sign to potential lenders of a low risk borrower, which is definitely a positive take on your financial health. However, remember that a good score doesn't guarantee approval, as lenders consider other factors as well.

Given your strong credit standing, you have the opportunity to explore various types of credit cards that can benefit your financial situation. Premium rewards cards or cashback cards, for instance, could be excellent options. These cards offer rewards for spending, which can serve as an added advantage for your financial management if used responsibly. Likewise, it is pertinent to mention that your interest rates on these cards are likely to be low due to your high credit score. This is a great reflection of how your diligent financial management pays off.

With a credit score of 773, you're certainly in a strong position when it comes to applying for a personal loan. This score is well above the average and most lenders would consider it a good to excellent range. Decisions regarding loan approval aren't solely about credit scores, but in general, the higher your score, the more likely you are to get approved for a loan at competitive interest rates.

In preparation for your loan application process, it's essential to remember that institutions will not only reference your high credit score but also consider your overall financial picture. This includes your employment and personal income. While your score of 773 could mean access to better interest rates, nothing is guaranteed until the lender evaluates your application. However, a credit score of 773 is certainly something to be proud of, and it is likely to work in your favor throughout your personal loan application process.

Can I Get a Car Loan with a 773 Credit Score?

A credit score of 773 is excellent and falls well within the desired range for auto loan lenders. With that score, chances are tremendous in getting approved for a car loan. Getting a car loan shouldn't be a worry because this high rating garners trust from lenders. It shows that there's a history of responsible borrowing and timely repayment of debts.

This favorable credit score often presents you with the advantage of negotiating for lower interest rates. Lenders typically reward higher credit scores with less interest as it gives them confidence in your ability to repay the loan. In your car purchasing journey, be prepared for lenders to extend competitive and enticing offers. With care and consideration, it's possible to secure a great car loan with lower interest, thanks to your great credit score.

What Factors Most Impact a 773 Credit Score?

With a credit score of 773, you're in a strong position financially. It's essential to understand the elements that contribute to this high score to maintain and even improve it further.

On-Time Payments

Consistent and timely payments may be a key factor in maintaining your excellent score. Late or missed payments could adversely affect it.

How to Check: Review your credit history to confirm consistent payments. Keeping up with due dates remains crucial.

Credit Usage

An optimal credit utilization ratio, ideally below 30%, could be a significant factor behind your high credit score.

How to Check: View your credit card balances. Keep in mind, keeping utilization low can positively influence your score.

Lengthy Credit History

A long credit history, indicating financial experience and responsibility, might be boosting your score.

How to Check: Assess your credit report to determine your accounts' average age. Avoid opening too many new accounts simultaneously, which could potentially lower your average account age.

Healthy Credit Mix

A diverse blend of credit types - revolving and installment - shows your ability to handle differing credit terms, which might have a positive impact on your score.

How to Check: Look at your credit report and identify the types of credit you have. Aim to maintain a healthy mixture.

Lack of Negative Records

Absence of any derogatory marks such as collections, bankruptcies, or tax liens could be contributing to your high credit score.

How to Check: Check your credit report for any negative entries. Working towards avoiding any negative financial incidents can safeguard your high score.

How Do I Improve my 773 Credit Score?

A credit score of 773 is impressive, and you’re in a strong position. However, maintaining and even improving it will bring more financial opportunities. Here are some strategies specifically tailored for your high credit score level:

1. Continue Timely Payments

Punctuality is essential. Since payment history is a significant part of your credit score, ensuring you make all payments consistently on time will maintain and potentially lift your score even higher.

2. Maintain Low Balances

Keep your credit utilization rate below 10%. This means let the balances on your credit cards remain lower than 10% of your available credit.

3. Limit New Credit Applications

Constantly applying for new credit can result in hard inquiries, which may ding your score. Thoughtfully consider each application and only move forward if necessary.

4. Preserve Old Credit Lines

Don’t be hasty in closing unused credit card accounts. Older credit lines can positively impact your score by lengthening your credit history which is important for a high score.

5. Invest In Different Credit Types

Having a mix of credit types like retail accounts, credit cards, installment loans, and mortgage loans can enhance your credit profile and score. However, it’s crucial to manage these credits responsibly.