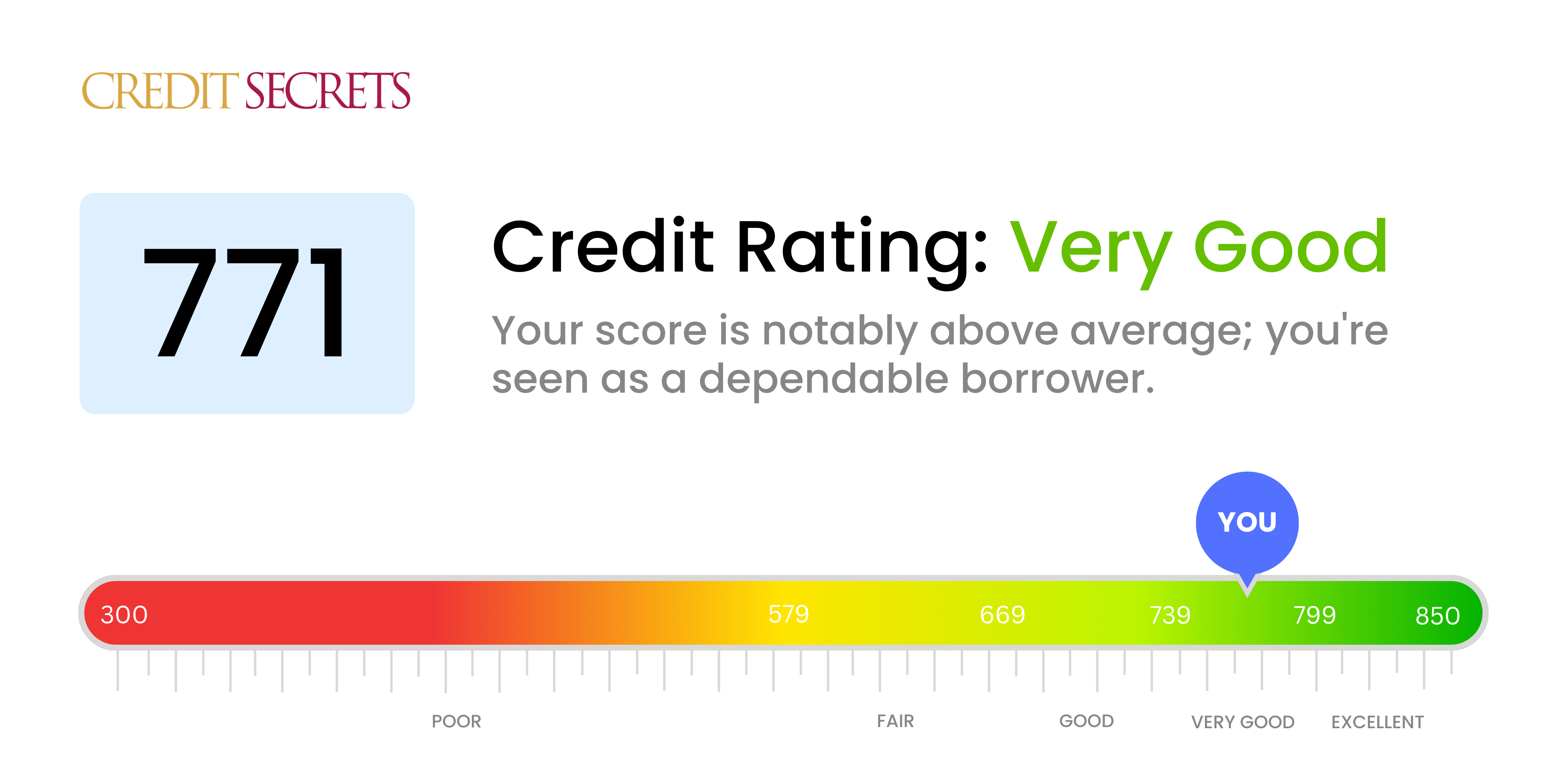

Is 771 a good credit score?

With a score of 771, you're in an admirable position, as this score is seen as 'Very Good' in the world of credit ratings. Likely, lenders and creditors view you as a responsible borrower who is lower-risk, ushering in opportunities like more favourable loan terms and lower interest rates.

While this score is already at a high level, there's still room for growth and improvement. Be sure to maintain good financial habits, like paying bills on time and keeping debt low, to show your reliability and inch towards the 'Excellent' credit score range. Even though a 771 is near the top of the 'Very Good' range, every incremental increase can make a significant difference in your financial journey, opening up even more opportunities and benefits.

Can I Get a Mortgage with a 771 Credit Score?

With a credit score of 771, you are in an excellent position to be approved for a mortgage. This number well surpasses the score most lenders look for, indicating a strong history of financial responsibility and timely repayments. It's clear that you have taken diligent care of your financial health.

In terms of the mortgage approval process, your high credit score will work in your favor. Lenders view applicants with high credit scores as low-risk, making your mortgage application more appealing. Additionally, this score could potentially secure you a lower interest rate, decreasing your overall loan cost over time. Though the process can sometimes feel lengthy, with legal checks and multiple stages of approval, your good credit score should make the journey smoother. Remember, ensuring all your documentation is acquired and up-to-date, will keep the process moving efficiently.

Can I Get a Credit Card with a 771 Credit Score?

With a credit score of 771, you're in an excellent position for credit card approval. Such a high score generally tells lenders that you're a responsible borrower. While this is undoubtedly a relief, it's essential to remain mindful of your financial decisions to maintain this impressive score.

Now, the type of credit card that will work best for you largely depends on your lifestyle and goals. If you love to travel, premium travel cards can reward your wanderlust with points for flights and hotels. Starter cards are a good choice for those looking for a basic, no-frills option. Meanwhile, if you wish to make large purchases and pay them off over time, cards with a low ongoing APR will suit your financial needs. Remember, while your high score makes you a desirable candidate for lenders, always ensure that the benefits of the card match your lifestyle and financial habits.

A credit score of 771 is quite high and typically well-received by lenders. With a score of this caliber, you are likely to be approved for a personal loan. This is because lenders see a high credit score as an indication of reliable financial behaviour. This means that you're less of a risk in their eyes, and more likely to make your repayments in full and on time.

In terms of the personal loan application process, having a credit score of 771 may make things smoother for you. A great credit score like yours can potentially unlock more favorable loan terms, including lower interest rates. However, it's important to remember that while a good credit score can improve your chances, approval isn't guaranteed. Other factors, like your income and debt levels, are also taken into consideration by lenders. Be prepared to provide this information during the application process.

Can I Get a Car Loan with a 771 Credit Score?

With a credit score of 771, you're in a great position when it comes to getting approved for a car loan. This score is well above the average, indicating to lenders that you handle your financial responsibilities seriously. This high score places you in the prime category and lenders often feel confident in approving loans to those with such scores. It presents a favorable, low-risk scenario for them.

Beyond getting approval for the loan, a credit score of 771 can provide additional advantages during the car purchasing process. Due to the low risk you present, you're likely to receive favorable interest rates, which makes the loan less costly over time. It's always a good idea to shop around for the best deal, but knowing that you have a strong credit score can give you confidence during negotiations. Remember your high score is a reflection of your good financial habits and this keeps lenders reassured about their investment with you.

What Factors Most Impact a 771 Credit Score?

To truly leverage a credit score of 771, it's essential to understand the key factors influencing it. Taking time to unpack what contributes to your score can illuminate the path to maintaining or even boosting it. Subsequently, guiding you on your unique financial journey.

Credit Usage

Even with a high score like 771, credit usage is a key contributor. Low usage indicates you're managing credit well.

How to Check: Analyze your credit report or credit card statements. If your balances are low in proportion to your limits, this is a positive sign.

Length and Type of Credit History

The length of your credit history and the variety of credit types can affect your score. A long and diverse credit history is beneficial.

How to Check: Review your credit report for the age and variety of your accounts.

New Credit

While opening new credit judiciously can improve your score, excessive new credit can cause a temporary dip.

How to Check: Review your credit report for recent inquiries or newly opened accounts.

Public Records

At this score range, public records like judgments or liens could significantly affect your score.

How to Check: Consult your credit report for any public records. Correct any inaccuracies promptly and address any listed concerns.

Payment History

A history of on-time payments contributes positively to your score.

How to Check: Inspect your credit report for any late or missed payments. Steady, timely payments reflect well on your financial profile.

How Do I Improve my 771 Credit Score?

With a credit score of 771, you’re well on your way to excellent financial health. However, there are still some measures you can adopt to push your score further up:

1. Maintain Your Account Age

One vital aspect of credit score calculation is the duration of your credit history. Therefore, hold on to your older credit accounts, even if you’re not using them frequently. These accounts indicate a longer credit history and can slightly boost your score.

2. Keep an Eye on Credit Inquiries

When lenders issue a ‘hard inquiry’ for financing, it could reflect negatively on your credit score. So, try limiting the number of loan applications you make in a short time span to avoid unnecessary inquiries uless they are absolutely necessary.

3. Regularly Check Your Credit Report

Despite your commendable score, it’s still important to regularly review your credit report for potential inaccuracies or fraudulent activity. Identifying and rectifying these early can prevent possible damage to your score.

4. Manage Your Debt-to-Income Ratio

Your score isn’t the only consideration lenders look at; your debt-to-income ratio also matters. Try to keep your monthly financial obligations, such as car loans or mortgages, under control relative to your monthly income.

5. Ensure Timely Bill Payments

Continue making timely payments of your bills, including your phone and utility bills. Some credit bureaus now consider such payments in credit score calculations. Plus, this prevents your account from going into collections, which could severely damage your score.