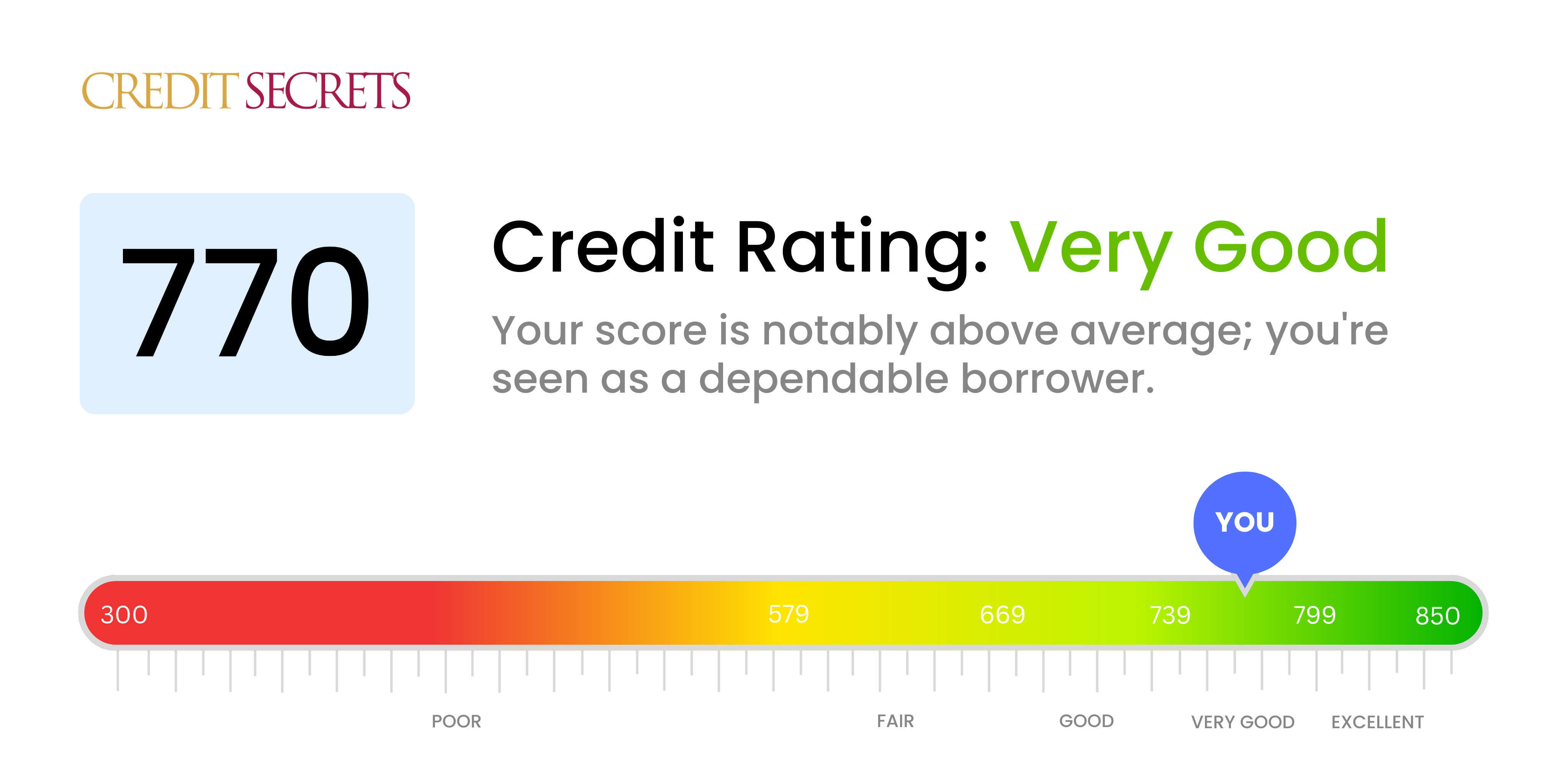

Is 770 a good credit score?

A credit score of 770 is classified as "very good" according to standard credit rating scales. Even though it's not in the highest tier, you're positioned well for lenient lending terms, competitive interest rates, and a wider array of offers from credit card companies and lenders. It's also more likely that rental applications will be approved and you might even enjoy lower insurance premiums. However, there is still some room for improvement to reach the "excellent" credit category.

Moving forward, continue your good habits to further boost your score, such as making payments on time, keeping a low balance on credit cards, and staying away from applying for unnecessary credit. Remember, a robust financial future isn't defined by your credit score alone, but maintaining a high credit score will certainly benefit your financial journey.

Can I Get a Mortgage with a 770 Credit Score?

A credit score of 770 is considered excellent, presenting a strong case for mortgage approval. This score communicates to lenders that you have a history of responsible credit management, making you a low-risk borrower. However, each lender's requirements may vary. Therefore, it is essential that you thoroughly research and compare different lenders and their terms.

Once you start the mortgage application process, be prepared for a meticulous review of your financial circumstances. This includes your income, employment history, debts, and assets. Despite your high credit score, it's important to maintain a healthy debt-to-income ratio and demonstrate a steady income. Interest rates are typically more favorable for borrowers with high credit scores, so you can likely anticipate a competitive rate. Remember, your credit score is an important part of your financial profile but not the only factor that lenders consider. Continue handling credit responsibly to maintain your excellent score.

Can I Get a Credit Card with a 770 Credit Score?

With a credit score of 770, the chances of being approved for a credit card are quite high. This score suggests careful management of finances and a successful history of meeting obligations. In short, lenders generally consider individuals with this credit score as lower-risk borrowers. It's certainly taken efforts to reach this score, and that should be recognized. It's a solid base for one's financial future.

Given the strong credit score, a variety of credit card options could be a good fit. Premium rewards cards, which offer benefits like travel rewards or cash back, could well be within reach. Additionally, low interest rate cards might be an option, which could provide more favorable terms in case of carrying a balance. Remember, even though credit can be easily accessed, it's crucial to continue the same responsible habits that led to such a desirable credit score. Keeping a low balance, making payments on time, and managing credit judiciously will help to maintain and even improve the credit score over time.

Having a credit score of 770 is considered excellent by most lending institutions. On this basis, it's highly probable that you can qualify for a personal loan, thanks to this strong credit ranking. Lenders perceive this score as a strong indication of your proven track record of managing debt responsibly. This, coupled with the likelihood of you repaying the debt on time, makes you an ideal candidate for a loan in the eyes of a lender.

The loan application process should be straightforward. Because of your sterling credit score, lenders will likely offer you their most advantageous interest rates. This means potentially saving more money in comparison to someone with a lower credit score. Just remember that while your credit score offers lenders an overview of your credit worthiness, additional factors like your income and employment history may be considered in the loan approval process.

Can I Get a Car Loan with a 770 Credit Score?

Having a credit score of 770 puts you among the top tier of borrowers. This is considered excellent credit. When applying for a car loan, you're very likely to be approved as your fantastic score signals to lenders that you have a history of diligently paying off your debts and carrying them responsibly. This strong track record reassures lenders of your great likelihood to repay your loan.

As you embark on the car purchasing process, you can anticipate several advantages stemming from your strong credit score. Banks and credit bodies are ready to offer you their best, including optimal interest rates and more favorable loan terms. In essence, better loan conditions will be available to you, which could lessen your car purchasing expenses over time. It's a wonderful testament to your financial reliability and an exciting opportunity to make the most of your hard-earned credit status. Yet, as you've already demonstrated your financial wisdom, remember to thoroughly analyze any terms before signing onto a loan.

What Factors Most Impact a 770 Credit Score?

A score of 770 signifies a strong and successful credit history. Your financial journey may have been filled with abundant wisdom and prudent actions. Let's focus on the elements that greatly influence such a pleasant figure.

Credit Utilization

Keeping your credit utilization low might have played a crucial role in achieving this score. Regular and responsible management of your credit limit has probably maintained your score.

How to Check: Peruse your credit card records. Look for instances of low credit utilization, as this effective handling of credit is likely the reason for your current score.

Aging Credit History

A lengthier credit history can clothe your score in admirable figures. The time you've spent maintaining strong credit habits reflects positively on your score.

How to Check: Check your credit report to decipher the age of your earliest and most recent accounts and the overall average lifespan of all your credit accounts. Taking stock of this can offer a palpable demonstration of your credit history's impact on your score.

Few Hard Inquiries

Limiting the number of hard inquiries on your credit file is beneficial for your credit score. Your restraint from applying for new credit impulsively speaks loudly.

How to Check: Go through your credit report to count your hard inquiries. A small number of these could have buoyed your credit score to its current glory.

Immaculate Public Records

Free of serious public records like bankruptcies and tax liens, your credit history is pristine and robust. This significantly affects your credit score in a positive fashion.

How to Check: Revisit your credit report and check for any records of bankruptcies or liens. An absence of these serious records has likely kept your score robust and strong.

How Do I Improve my 770 Credit Score?

Achieving a credit score of 770 places you well within the excellent range. With a few simple, targeted steps, you can potentially enhance your score even further:

1. Maintain Low Credit Card Balances

Manage your credit card balances diligently, keeping them below 30% of your credit limit. This improves your credit utilization rate, which can have a positive impact on your score. Always aim to pay off your balances in full each month.

2. Retain Old Credit

Longevity is key when it comes to your credit history. Retaining your oldest credit cards, even if you rarely use them, can help lengthen your average credit history and potentially improve your score.

3. Regular Credit Monitoring

Regularly overview your credit reports for discrepancies or unauthorized activity. Errors can impact your credit score negatively, so timely identification and rectification are integral.

4. Diversify Your Credit Portfolio

While your current score suggests responsible credit management, diversifying your credit portfolio can provide further enhancement. Consider taking on various types of credit, such as installment loans, retail accounts, or mortgages, and manage them responsibly.

5. Automate Payments

To avoid late payments that can harm your exceptional credit score, consider setting up automated payments for your bills. This can ensure a steady payment history, which contributes to maintaining a high score.