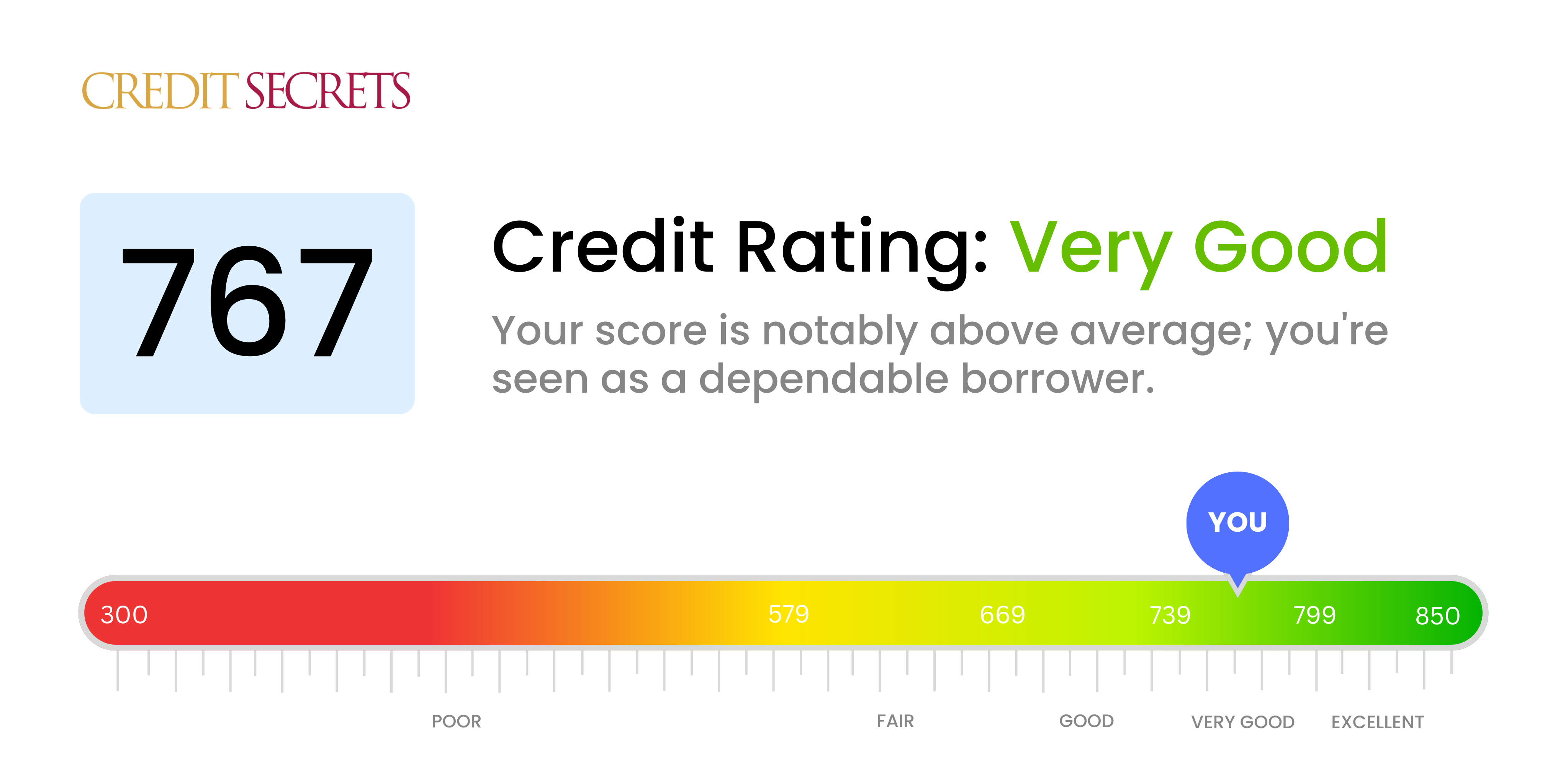

Is 767 a good credit score?

With a credit score of 767, you are situated in the 'very good' category. This shows lenders that you have a strong history of responsible credit management, making you a desirable candidate for loans, credit cards, and possibly more favorable interest rates.

Being in the 'very good' range leaves room for improvement; however, it's a position most people strive to reach. By continuing to make payments on time, maintaining low balances, and avoiding new unnecessary debt, you can continue to sustain and enhance your credit standing.

Can I Get a Mortgage with a 767 Credit Score?

With a credit score of 767, you are very likely to be approved for a mortgage. Your score is in the "good" range, indicating financial responsibility and on-time payments, both of which lenders like to see when approving mortgage applications. This strong financial position is commendable and may give you an advantage during the mortgage approval process.

As you proceed with your mortgage application, remember that a higher credit score can often lead to better mortgage terms, including lower interest rates. Your robust score of 767 might enable you to secure a mortgage with a highly competitive interest rate, effectively saving you money over the life of your loan. It's advisable to continue maintaining your credit health and financial wellness as you navigate through the mortgage application process. Remember, strong financial habits empower you to shape a secure future.

Can I Get a Credit Card with a 767 Credit Score?

Having a 767 credit score increases your chances of being approved for a credit card. Lenders see this as an indication of responsible financial management and trustworthy credit behavior. Although each lender has unique criteria when making credit decisions, this score is widely regarded as being excellent, which puts you in a promising situation.

With such a favorable credit score, you might want to consider a variety of credit cards that can offer special benefits. Premium credit cards, for example, often come with perks such as travel rewards or cash back. Despite their usually higher annual fees, these cards could provide considerable value if they align with your spending habits. However, always make sure to read the terms and conditions, including interest rate details, to make the right financial decision. No matter the option, you're well-positioned to take advantage of credit facilities that others may not have access to.

A credit score of 767 is considered to be very good. With such a high score, you're viewed as creditworthy by lenders, thus increasing your likelihood of getting approved for a personal loan. This score reflects your responsible use of credit and your ability to repay borrowed money, which lenders appreciate.

Embarking on the personal loan application process with a credit score of 767 means you can expect more favorable terms and lower interest rates compared to those with lower scores. The application process will likely be straightforward, given your established record of financial reliability. However, it's important to still carefully review all terms and conditions associated with any loan you're considering. Even with a solid credit score, taking on new debt is a significant responsibility that should be approached with caution.

Can I Get a Car Loan with a 767 Credit Score?

With a credit score of 767, you are in an exceptional position to be approved for a car loan. Lenders typically desire scores above 660, implying your score is well within the favorable range. This exceptional score indicates to lenders that you are a low risk candidate and are likely to repay your loan on time.

Experiencing the car purchasing process with such a high credit score offers added advantages. Interest rates tend to be lower for those with excellent credit, which can lead to significant savings over the life of the loan. Still, it never hurts to review the terms of the loan carefully before signing. While having a high credit score doesn't guarantee approval, it does substantially increase your chances. Keep in mind, lenders will also consider other factors such as income and employment stability. However, with a 767 credit score, you can confidently approach the car buying process.

What Factors Most Impact a 767 Credit Score?

Grasping a score of 767 is key in navigating your credit scenario. Realizing factors contributing to this score can make a difference in your financial growth. Your financial path is unique, promising opportunities for improvement.

Credit Utilization

At this score, credit utilization should always be on your radar. By ensuring you're keeping your balances far below your credit limits, you can maintain and even improve your score.

How to Check: Look at your credit card balances in relation to their limits. Keeping balances low compared to overall limits is advantageous.

Length and Quality of Credit History

With a score of 767, a long and consistent credit history is likely. However, aiming for steady and assured growth can further uplift your score.

How to Check: Check your credit report for the tenure and health of your accounts. Longer credit histories with a positive record work in your favor.

Credit Mix

A predetermined mix of credit types demonstrating efficient management can be a significant factor for your score. Holding a healthy variety of credit types is desired.

How to Check: Look at your current credit accounts. A mix, including revolving accounts and installment loans, reflects positively

Hard Inquiries

While you may have been judicious about applying for new credit, too many hard inquiries can slightly pull your score down.

How to Check: Review your report for hard queries. Though each has a small impact, collectively they matter.

How Do I Improve my 767 Credit Score?

Boasting a credit score of 767 places you within the excellent range, according to most metrics. However, there are always ways to move further forward. Let’s consider the most effective, manageable steps you can take at this score level to further bolster your credit:

1. Maintain Low Credit Utilization

Your credit utilization ratio plays a significant role in determining your score. Aim to keep your credit utilization ratio below 10% by routinely paying off or maintaining low balances. Continually monitoring and managing your credit usage can have a positive impact.

2. Continual On-Time Payments

With a spectacular score of 767, you’ve shown a solid history of timely payments. Maintaining this track record is vital to keep your credit score on an upward trajectory. So always prioritize paying bills on or before the due date.

3. Debt Management

Avoid taking on superfluous debt. Be sure to keep the debts you have well-structured and within your capacity to repay in a timely manner. Each interaction with potential lenders should reflect proper debt management.

4. Regular Credit Report Reviews

Regularly review your credit report to ensure it’s correct. Mistakes can occur and go unnoticed, potentially adversely affecting your score. Immediate correction of any discrepancies can prevent unnecessary drops in your credit score.

5. Limit New Account Openings

Avoid frequent credit requests and opening up multiple lines of credit within a short timeframe. Each credit inquiry can lower your score, and multiple requests can suggest to lenders that you’re a high-risk consumer.