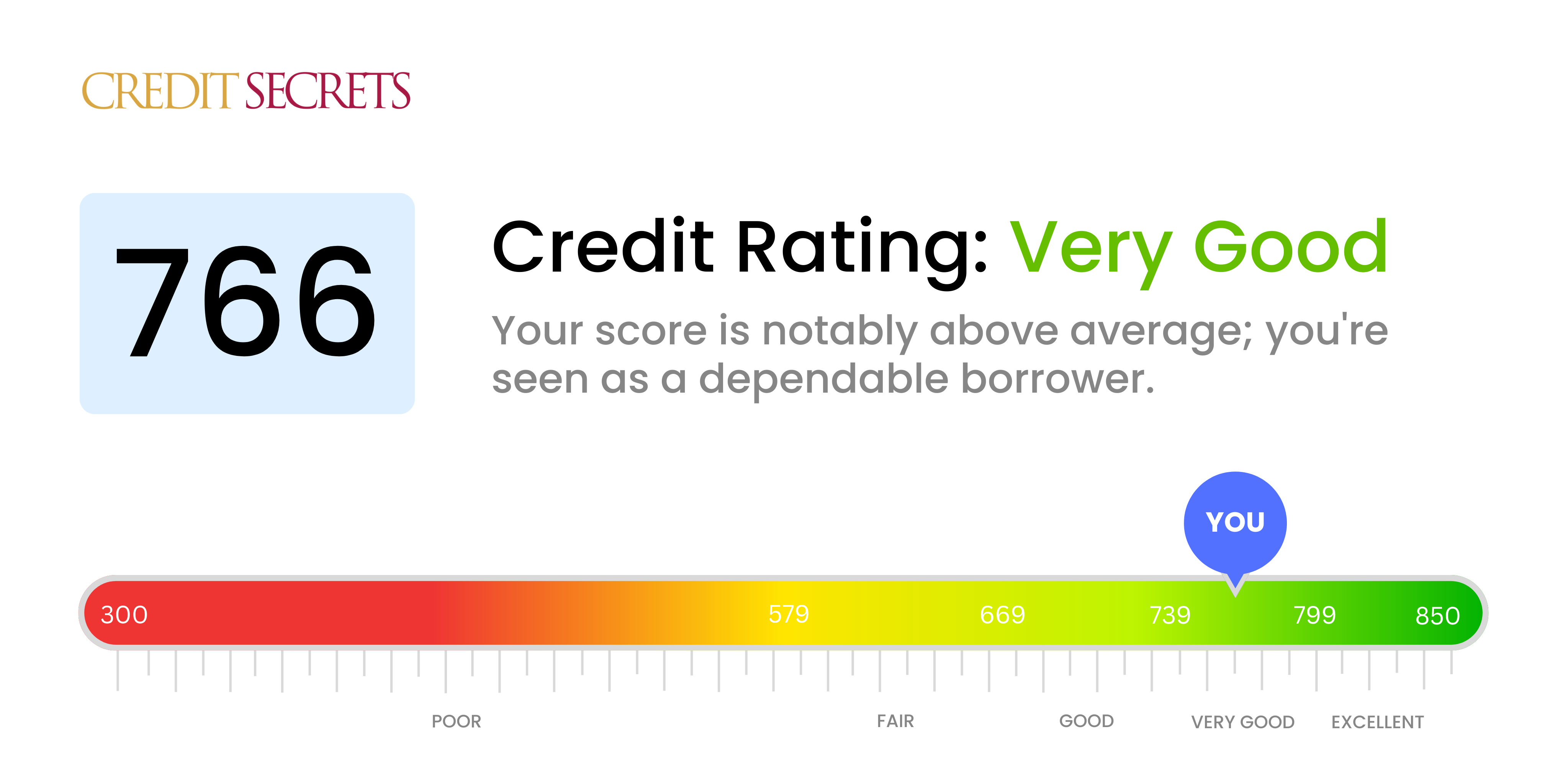

Is 766 a good credit score?

With a score of 766, your credit is actually in the 'Very good' category. This means that you're likely to be perceived positively by lenders, opening up opportunities such as favorable interest rates or broader options when it comes to loans and credit cards.

This score has been achieved through responsible financial management and discipline. However, there's always room for improvement. By continuing to maintain timely payments, avoid high credit utilization, and promptly address any inaccuracies in your credit report, you can guide your score into the 'Excellent' category. Financial success isn't just about the number; it's the habits and behaviors that sustain it.

Can I Get a Mortgage with a 766 Credit Score?

With a credit score of 766, your chances of getting approved for a mortgage are very high. This score communicates to potential lenders that you have a strong history of responsible credit usage and timely repayments. Using a financial product such as a mortgage is a big commitment, however, your impressive credit score will likely serve you well in this endeavor.

Committing to a mortgage loan is an extensive process, which usually involves income verification and a thorough examination of your financial stability. Nonetheless, a credit score of 766 could afford you a lower interest rate compared to someone with a lower score. This is because lenders tend to offer better rates to those who demonstrate lower credit risks. While the precise interest rate will vary based on a range of factors, it is important to remember that a high credit score puts you in a strong position to negotiate better terms.

Can I Get a Credit Card with a 766 Credit Score?

Having a credit score of 766 puts you in a strong position when applying for a credit card. This score shows lenders that you've been responsible with your credit in the past and they'll likely see you as a low-risk borrower, which can open doors to a range of credit card options. It's important to grasp your credit standing as it can seriously affect your financial journey. Always know that your financial history doesn't bind your financial future.

With a credit score of 766, you're not just limited to basic credit cards. You might qualify for premium travel cards, rewards cards, or even cards with lower interest rates. These cards often come with attractive benefits like high rewards rates, significant sign-on bonuses, or extensive travel perks. Keep in mind, though, that the best card for you will depend on your spending habits, lifestyle, and personal financial goals. While navigating this process may feel challenging, remember this is a good problem to have. You're in control of your financial life, and that's something to feel proud of.

With a credit score of 766, you are well within the range that most lenders consider good. In general, lenders perceive such a high credit score as a positive indication of creditworthiness. As such, likelihood of getting approval for a personal loan is significantly high with this score. Your dependable credit history with diligent payments shows your responsibility, dedication, and lack of credit risk for lenders, making them more inclined to grant you a loan.

Attached to your high credit score are more than just good odds of loan approval, it also provides potential access to preferable interest rates. Typically, lenders reserve their best rates for those with the highest credit scores. In your case, being in a top-tier credit score range may help negotiate lower interest rates on personal loans. Through the application process, your high credit score will be a significant advantage, leading to potential savings on interest over the loan's term. Remember – always be sure you understand the terms and conditions before accepting a loan offer.

Can I Get a Car Loan with a 766 Credit Score?

With a credit score of 766, you are in a strong position to be approved for a car loan. This credit score reflects a strong financial record and typically signifies reliability to potential lenders. Expansive opportunity awaits, as your impressive credit history makes you a less risky prospect to work with.

In the car purchasing process, a high credit score like 766 often opens the door to lower interest rates and more favorable loan terms. Lenders look at this score and see a safe bet. They trust that you will make repayments on time, and in full. Because of this trust and security, you may have the capacity to negotiate better terms for your auto loan. Keep in mind, though, it's not just about getting the loan, it's about securing a deal that works best for your fiscal future.

What Factors Most Impact a 766 Credit Score?

Achieving a credit score of 766 demonstrates that you are on solid financial footing. However, understanding the variables that can impact this score will help keep you there and potentially improve it. Let's explore the factors most relevant to your current standing.

Payment Faithfulness

Though you likely have a strong record of on-time payments to maintain such a credit score, confirming that your payment past is free of negatives like late payments or missed ones will reassure your financial health.

How to Check: Look into your credit report, make sure there's no record of overdue payments.

Credit Card Balances

Even with a good score like yours, keeping a low balance on your credit cards can provide a favourable impact on your score.

How to Check: Regularly review your credit card statements to ensure your balances aren't nearing their limit.

Credit Lifespan

The longer your history of managing credit responsibly, the more stable your score is.

How to Check: Scrutinize your credit report for the age of your accounts, consider the time passed since your most recent account opening.

Types Of Credit

Managing various types of credits (Credit cards, loans, etc) efficiently can positively impact your score.

How to Check: Evaluate your variety of credit by reviewing your credit report, remember keep the applications for new credit minimal.

Public Records

While public records such as bankruptcies could significantly affect your score, at your current rating, it is unlikely that this applies to you.

How to Check: Check your credit report for public records, if found, work towards resolving them.

How Do I Improve my 766 Credit Score?

A credit score of 766 indicates you’re handling your credit well. However, to elevate it even more, here are some specific steps tailored to your current situation:

1. Continue On-Time Payments

Maintaining a consistent track record of timely payments is crucial. Make use of reminders or automatic payments to avoid missing due dates, as even one late payment can impact this high score negatively.

2. Maintain Low Credit Balances

You likely already keep your credit utilization low, but aim to diminish it further. Target reducing the balances to beneath 10% of your credit limit, which can terrify even a high credit score.

3. Stick with Old Credit

The length of your credit history also matters. Stick with your old credit cards, assuming they don’t carry high fees. The longer you’ve shown you can manage credit, the better for your score.

4. Strategically Apply for New Credit

Applying for new credit may cause a minor drop in your score. But if done deliberately, a new credit account can enhance your credit mix and demonstrate your ability to manage different types of credit.

5. Regularly Review Your Credit Report

Ensure that your credit report doesn’t contain any errors by reviewing it frequently. Mistakes on your report can sometimes result in lower scores. Dispute any inaccuracies as soon as you spot them.