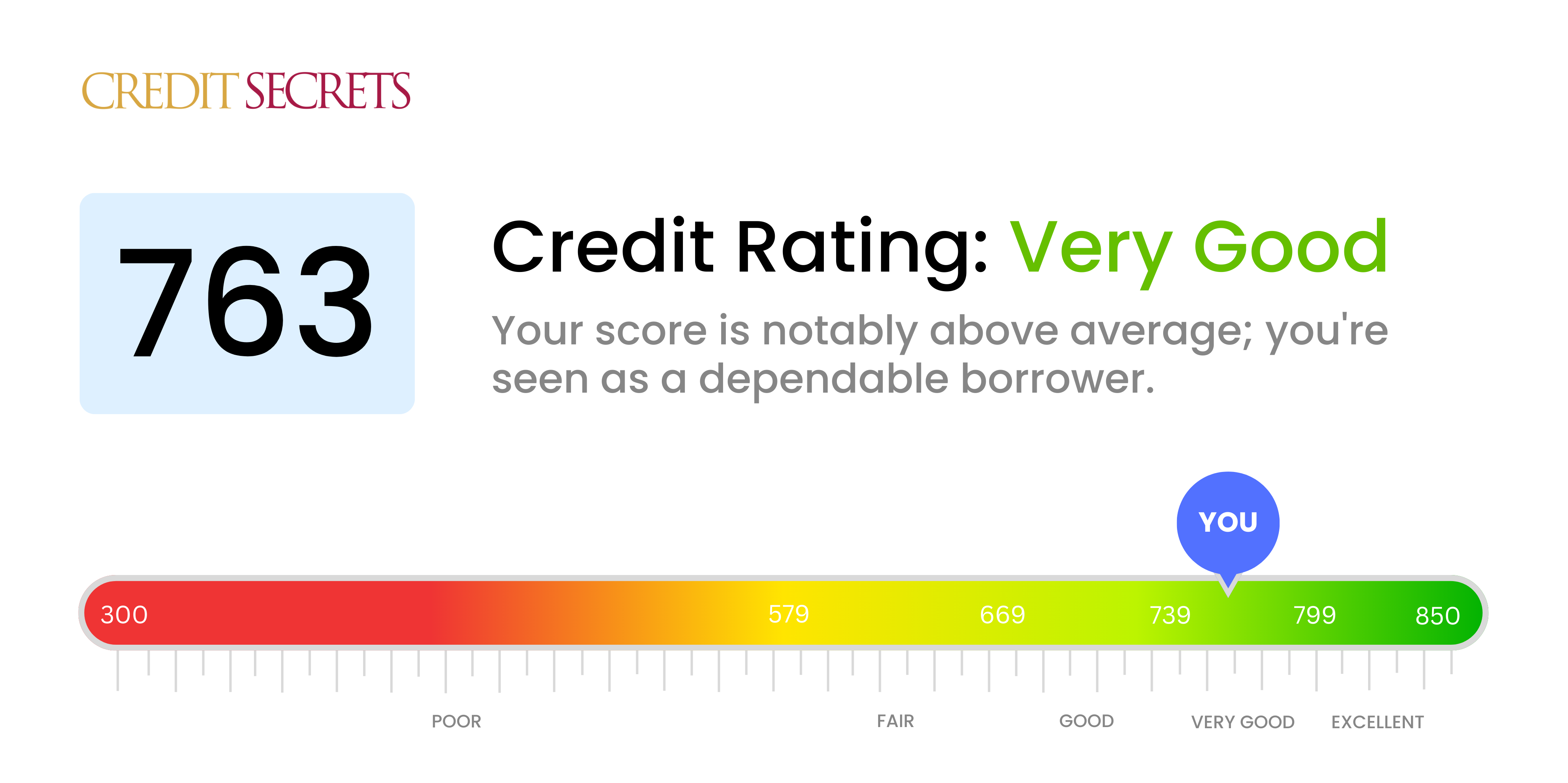

Is 763 a good credit score?

Your credit score of 763 qualifies as a very good score. A score in this range indicates you've managed your credit responsibly, which lenders appreciate, and it generally allows you to access favorable loan terms and interest rates.

With a 763 score, you can look forward to an easier approval process for credit cards and loans, whether for a new home, a car, or a small business. However, keeping it in this range - or even moving it to 'excellent' - still requires careful management of your credit, such as maintaining a low balance, paying bills on time, and checking for errors on your credit report.

Can I Get a Mortgage with a 763 Credit Score?

With a credit score of 763, you are in a strong position to be approved for a mortgage. This number signifies responsible credit use and a reliable repayment history, qualities that lenders appreciate. However, it's important to keep in mind that while your credit score is a significant factor, lenders also consider your income, employment status, and debt-to-income ratio.

In the mortgage approval process, you can expect various steps including pre-approval, home appraisal, and final approval. Once approved, you are likely to secure competitive interest rates as a result of your high credit score. A lower interest rate can save you substantial amounts over the life of your mortgage loan, reinforcing the importance of maintaining a good credit score. However, do balance these potential perks with a careful review of the mortgage contract and terms. Credit is a powerful tool when used responsibly.

Can I Get a Credit Card with a 763 Credit Score?

If you have a credit score of 763, you are in a strong position to get approval for a credit card. This number signifies to lenders that you are a responsible borrower, who handles their financial obligations seriously. This is certainly a positive situation, but remember to keep a sensible approach when dealing with new credit opportunities.

With a high credit score like yours, a wide range of credit card options are available. Consider premium cards that come with generous rewards programs, extremely competitive interest rates or advantageous travel benefits. But, always remember these high-end cards can sometimes carry hefty annual fees. It's essential to balance the rewards against any potential costs. Also, lower interest rates, which are often offered to high credit score individuals like you, can result in considerable savings over the long run. So, study your options carefully. Your strong credit position means you have the luxury of choice, make sure to use it wisely.

A credit score of 763 is quite robust and well above the threshold that many traditional lenders consider beneficial. With such a score, it's highly likely that you would be approved for a personal loan. Lenders see this score as a strong indicator of your reliability and ability to repay the loan in a timely manner. It's a commendable position to be in.

Applying for a personal loan with this credit score may present you several advantages. The loan application process is likely to be smooth and might result in potentially lower interest rates. Lenders often offer favorable loan terms for borrowers with high credit scores, as they are considered less risky. However, each lender has different policies and it's always a good idea to do your due diligence before moving forward with a loan application. Remember, having a strong credit score like 763 boosts your chances and gives you negotiating power when discussing loan terms.

Can I Get a Car Loan with a 763 Credit Score?

An individual boasting a credit score of 763 is in an excellent position to be approved for a car loan. With the lending market often favoring scores starting around 660, your robust score of 763 is well within a range that many lenders view as low risk. This favorable perspective means you're undeniably more likely to secure not just a car loan, but one with advantageous terms.

In the car purchasing process, your high credit score can serve as a strong negotiating tool. It may aid in you securing loans with lower interest rates because lenders view you as a low risk, being that the likelihood of repayment is high from their viewpoint. Remember, however, it's equally as important to carefully review the terms of any loan and ensure you fully understand the commitment you're about to make. With your strong credit score, the road to car ownership looks smooth sailing.

What Factors Most Impact a 763 Credit Score?

With a credit score of 763, it's important to grasp the determining factors that could still improve your score. These factors shed light on what has already shaped your score, as well as potential areas to focus on for better credit health.

Amount Owed

The amount you owe relative to your available credit lines can influence your credit score. It's optimal to maintain a low level of debt.

How to Check: Check your credit statements for cumulative balances. Aiming for a lower overall balance contributes positively to your credit score.

Credit History Length

Long-standing credit accounts and a lengthy credit history can enhance your score. However, recent accounts could have a negative impact.

How to Check: Look over your credit report for the age of your oldest and most recent accounts. Consider the frequency of new accounts opened.

Type of Credit Used

Having a proper balance of various types of credit, such as credit cards, mortgages, or retail accounts, can raise your score.

How to Check: Assess your portfolio of credit accounts. Try to balance between different types of credit, without leaning too much on one kind.

New Credit

Regularly applying for new credit can potentially lower your score. It's essential to limit frequent credit inquiries.

How to Check: Reflect on your recent credit inquiries and applications. Approach new credit cautiously.

Public Records

Public records such as tax liens or bankruptcies can cause a significant dip in your score.

How to Check: Review your credit report for any public records. Make sure these are accurate and handle any discrepancies promptly.

How Do I Improve my 763 Credit Score?

With a credit score of 763, you’re already in a strong position. Your credit score is considered very good and you are typically eligible for a variety of financing opportunities. However, there’s always room for improvement. Here are a few key steps you can take:

1. Maintain On-Time Payments

Continuing consistent, on-time payments is crucial. This factor contributes greatly to your credit score and it’s important to keep it up. Ensure all your outstanding balances are cleared before deadlines.

2. Monitor Your Credit Utilization

Your credit utilization ratio – the amount of credit you’re using relative to your credit limit – can influence your score. Keeping this ratio low, ideally below 30%, can positively impact your credit score.

3. Limit Hard Inquiries

Only apply for new credit when necessary. Excessive hard inquiries can negatively affect your score. Lenders may see it as a sign of financial distress.

4. Diversify Your Credit

While your score is healthy, consider diversifying your credit types. Responsible management of a mix of credit (credit cards, auto loans, mortgages, etc.) can further enhance your profile.

5. Review Your Credit Report Regularly

Even with a good credit score, it’s important to regularly scan your credit report for errors or fraud. Noticing and addressing these issues early on can help to protect your score.