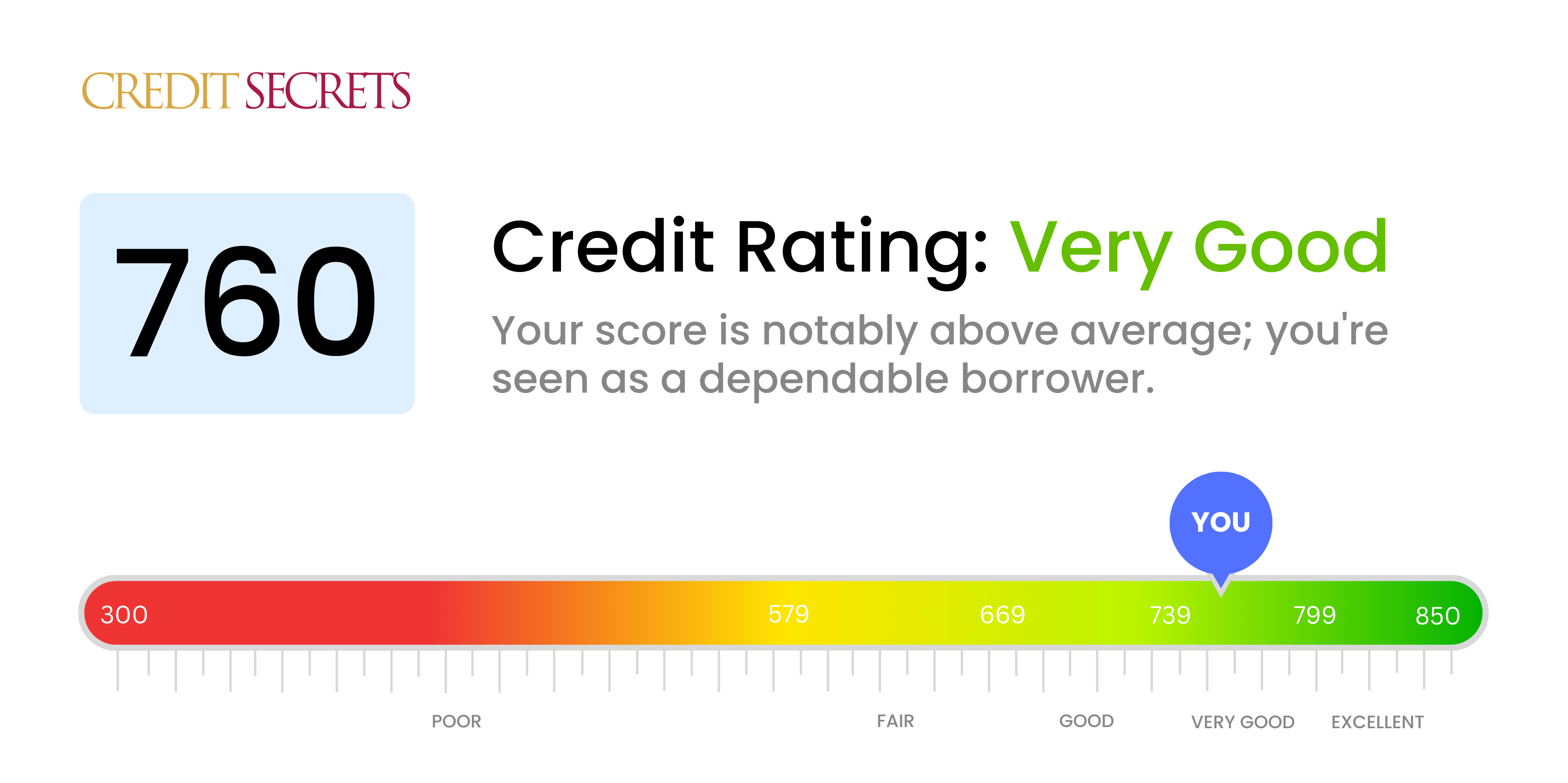

Is 760 a good credit score?

With a credit score of 760, you're clearly doing great in handling your finances. This falls within the 'Very Good' credit range, leaving you a step away from the 'Excellent' category.

Having this score, you can expect favorable terms and lower interest rates on loans and credit cards. Keep up your responsible financial behavior like paying bills on time and keeping your credit utilization low. This way, you can further improve your score and unlock even better financial opportunities.

Can I Get a Mortgage with a 760 Credit Score?

A credit score of 760 is generally viewed as excellent and you are highly likely to be approved for a mortgage. This high rating communicates to lenders that you've demonstrated responsible credit behavior in the past, making you a lower risk candidate.

Mortgage approval, however, involves much more than just your credit score. Lenders will also examine your income, employment stability, and debt-to-income ratio. Despite the broader context, a higher credit score such as yours could potentially lead to a more favorable interest rate, saving you significant amounts over the life of your mortgage. In essence, your impressive credit score is a crucial stepping stone on the path towards your dream home. Use this leverage to your advantage while understanding that every lender is different and rates may vary.

Can I Get a Credit Card with a 760 Credit Score?

Boasting a credit score of 760 situates you well within the 'Excellent' credit range. This fact alone puts you in a favorable position for credit card approval. Creditors often view individuals with such scores as responsible borrowers, which enhances your chances of approval.

Yet, not just any credit card may suit your financial situation. Given your excellent credit score, it might be wise to consider premium travel or rewards cards. These cards typically offer robust rewards programs and exclusive perks. However, they also often carry annual fees and are designed for those who diligently pay off their balances each month to avoid high interest charges. Such credit cards could take advantage of your excellent credit standing and better serve your financial planning if used judiciously. An excellent credit score like 760 also typically secures lower interest rates, indicating lower costs for borrowing. It illustrates to lenders you are less of a risk, but remember a good score isn't a guarantee so always apply wisely.

With a credit score of 760, chances are high that you would be approved for a personal loan. This score is considered excellent and depicts a history of responsible borrowing and timely repayments, which is extremely appealing to lenders. This creditworthiness reassures lenders that you're a reliable borrower.

As you set out on the personal loan application process, your excellent score may give you an advantage. Lenders may offer you lower interest rates due to your solid credit history, possibly saving you a significant amount of money over the duration of your loan. It's important to remember that a high credit score doesn't guarantee approval, as lenders consider other factors too like income and debt-to-income ratio. However, your score of 760 should serve as a strong foundation, putting you in a favorable position to secure a personal loan.

Can I Get a Car Loan with a 760 Credit Score?

With a credit score of 760, you're in a strong position to be approved for a car loan. This is a robust credit score that lenders appreciate because it demonstrates responsible borrowing and repayment habits. It puts you far above the average threshold of good credit, giving you a favorable chance for approval.

Your elevated score can potentially allow for more beneficial loan terms, including lower interest rates. This happens as your score indicates to lenders that you pose a smaller risk, making them more comfortable to extend credit at a more reasonable cost. But remember, getting a car loan isn't just about approval, it's also about securing the most favorable terms. Despite your high score, it's advisable to understand all details of your loan agreement to ensure it aligns with your financial goals and abilities.

What Factors Most Impact a 760 Credit Score?

A score of 760 indicates a great understanding of your financial obligations, but there's always room for improvement. Let's explore some key factors that may impact your already strong credit score.

Timely Payments

Your score suggests an impressive history of on-time payments. Continuity is key here, as even one late payment can knock down a high score.

How to Check: Check your credit report regularly for any discrepancies in payment history. It's vital to reconcile them promptly.

Credit Utilization Rate

A lower utilization rate positively impacts your credit score. Aim to keep your balances on credit cards and other revolving credit accounts significantly lower than the credit limits.

How to Check: Monitor your credit card statement and always aim for a lower balance compared to your limit.

Credit History Age

A longer credit history typically increases your credit score. Your score reflects a fair history length, but expanding it can help.

How to Check: Evaluate your credit report to see the age of your oldest accounts and maintain them well.

Credit Diversity

A mix of credit types can boost your score further. Be sure to manage them responsibly.

How to Check: Evaluate your credit accounts' composition. A blend of credit cards, retail accounts, and loans is ideal.

Hard Inquiries

Excessive hard inquiries could slightly affect your good score. Avoid unnecessary inquiries as much as possible.

How to Check: Your credit report will show all hard inquiries. Aim to limit these to when truly needed.

How Do I Improve my 760 Credit Score?

With a credit score of 760, you’re in good standing, but there are always ways to elevate your credit status. These are the most influential strategies specific to your credit score.

1. Maintain Low Credit Card Balances

Even with an excellent credit score, keeping your credit card utilization low is essential. Aim to keep your balances well below 30% of your cards’ combined credit limits. This signals responsible credit usage to creditors.

2. Check Your Credit Report Regularly

Even with a high credit score, errors can occur on your credit report. Regularly checking ensures that incorrect information isn’t dragging your score down. If you find any errors, dispute them immediately to safeguard your rating.

3. Refrain from Applying for Unnecessary Credit

Each time you apply for a new line of credit, it initiates a hard inquiry on your report, which can lower your score. Only apply for new credit when absolutely necessary to avoid unwanted dips in your rating.

4. Consider Diverse Credit Types

Though you have a high score, diversifying your credit mix can further boost it. This might include a blend of credit cards, retail accounts, installment loans, and mortgage loans.

5. Keep Old Accounts Open

Credit history length plays a role in your score. Even if you don’t use them often, keeping your oldest accounts open can provide a longer credit history and lower your credit utilization ratio.