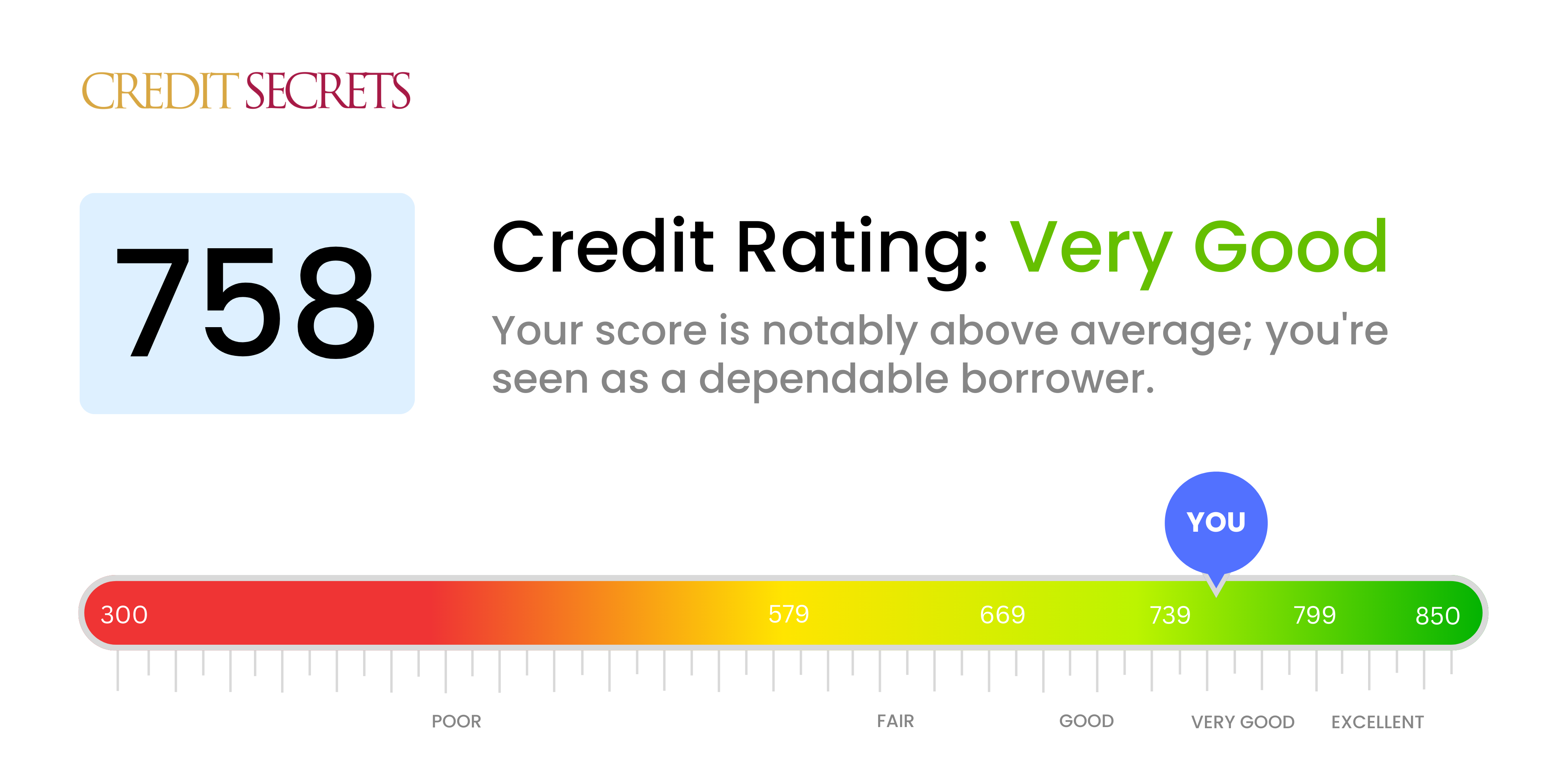

Is 758 a good credit score?

Your credit score of 758 lands squarely in the 'Very Good' range. With patience and responsible credit behavior, you may soon reach the 'Excellent' credit score group.

At this level, lenders see you as a very low-risk borrower, which can translate into more favorable loan terms and interest rates for you. You will likely have higher borrowing limits and be more readily approved for credit applications. Remember, continued good habits like timely payments and not maxing out your credit will help you progress towards an even higher score.

While your score is already impressive, even the little bit of room for growth can help you achieve even better financial outcomes. You're on the right path and credit opportunities are open to you. Keep it up!

Can I Get a Mortgage with a 758 Credit Score?

With a credit score of 758, you're in a strong position when it comes to mortgage approval. This score is comfortably above the average mortgage applicant's score, reflecting a track record of responsible credit use and on-time payments.

You can expect lenders to view your application positively, which means you're likely to receive competitive interest rates and favorable repayment terms. However, remember that your credit score is only one factor in the approval process. Lenders also consider your income, employment history, and debt-to-income ratio. Being prepared and well-informed can help streamline your experience as you move forward towards homeownership.

Can I Get a Credit Card with a 758 Credit Score?

With a credit score of 758, you're likely to get approved for a credit card. Your score is a reflection of responsible financial habits, and it puts you in a good place with lenders. It's not always a comfortable conversation to have, but it's important to have a clear understanding of what your credit score means. Even though this process can be complex and difficult, your 758 credit score shows you're on the right path towards financial stability.

The advantageous position of a 758 score opens the door to several types of credit cards. You could consider premium travel cards which offer rewards and points for traveling. Another option you could explore is cashback cards that provide a percentage of cash return on your purchases. Remember to examine the card details, especially the interest rates, although with a high credit score like yours, it is likely you could have access to lower interest rates compared to one with a lower score. This is a testament to your sound financial judgment thus far. Stay informed and cautious as you further your financial journey.

With a credit score of 758, you are likely to be approved for a personal loan. This score is considered 'good' in the credit spectrum, which means traditionally, lending institutions view you as a low-risk borrower. It showcases you as a responsible borrower who manages their credit efficiently.

As a person with a good credit score, you can expect a smoother loan application process. Lenders are more likely to approve your loan based on your creditworthiness and you can often negotiate for lower interest rates. Lenders are also more willing to discuss flexible repayment terms or loan amounts with applicants who have good credit. However, remember, each lender has varying criteria and policies. Therefore, it's beneficial to research different loan options to find one that best meets your needs and expectations.

Can I Get a Car Loan with a 758 Credit Score?

If you have a credit score of 758, you're in a strong position for obtaining a car loan. Lenders generally consider a score above 700 as good, and your 758 score places you above that threshold. This makes you a more desirable candidate for lenders since it signifies that you have a history of responsibly managing your finances and are a lower risk borrower.

When it comes to the car purchasing process with your credit score, you can expect more favorable terms. With a score of 758, lenders are more likely to offer you lower interest rates, which means you could pay considerably less over the life of your car loan. The entire process might be smoother and faster due to your creditworthiness. The key is to keep up the good work and continue being responsible with your credit usage. You're on the right track.

What Factors Most Impact a 758 Credit Score?

Navigating the financial trail leading to a score of 758 is essential for reinforcing your credit strength. Recognizing and managing the key elements contributing to this score will reinforce your economic resilience. Each financial path is distinct, offering valuable lessons for growth.

Credit History Length

The length of your credit history may have a significant influence on your score. A longer credit history tends to project a positive image to creditors.

How to Check: Analyze your credit report to determine the age of your oldest and latest accounts, as well as the average age of all your accounts. Reflect on whether you have opened new accounts recently.

New Credit Inquiries

Excessive inquiries for new credit can impact your score negatively. If you have recently applied for several new credit lines, this could explain your current score.

How to Check: Scrutinize your credit report for any recent credit inquiries.

Credit Mix

Possessing different types of credit can enhance your score. Reassess if you have a diverse mix of credit lines - this includes credit cards, retail accounts, installment loans, and mortgage loans.

How to Check: Check your credit report to evaluate your assortment of credit types. Examine your credit handling skills.

Public Records

Public records, such as court judgments, foreclosures or levies, can negatively affect your score. If your credit report features any such elements, they could be affecting your score.

How to Check: Review your credit report thoroughly for any public records and seek to rectify any issues, as appropriate.

How Do I Improve my 758 Credit Score?

With a credit score of 758, you’re well on your way to financial health, but there’s always room for improvement. Here are smart steps tailored to your current situation:

1. Maintain Low Credit Card Balances

Your credit utilization rate, the ratio of your credit card balance to your credit limit, can influence your score. Make a plan to maintain your credit card balances at or below 30% of your credit limit. Even better, aim for 10%.

2. Pay Bills on Time

Paying your bills on time is essential at every credit score level, impacting 35% of your score. Ensure to pay not only your credit card bills, but also rent, utilities, and even library fines on time.

3. Maintain Longstanding Accounts

The length of your credit history contributes to your score. Keep your oldest credit accounts open, use them occasionally and pay them off in full.

4. Monitor Your Credit Reports

Regularly review your credit reports for errors or discrepancies. If you find any, dispute them with the credit bureau to ensure your score accurately reflects your credit behavior.

5. Diversify Your Credit

A mix of different types of credit can boost your score. If they make sense for you and you can afford them, consider adding an installment loan or a retail credit card into your credit mix, while managing these new accounts responsibly.