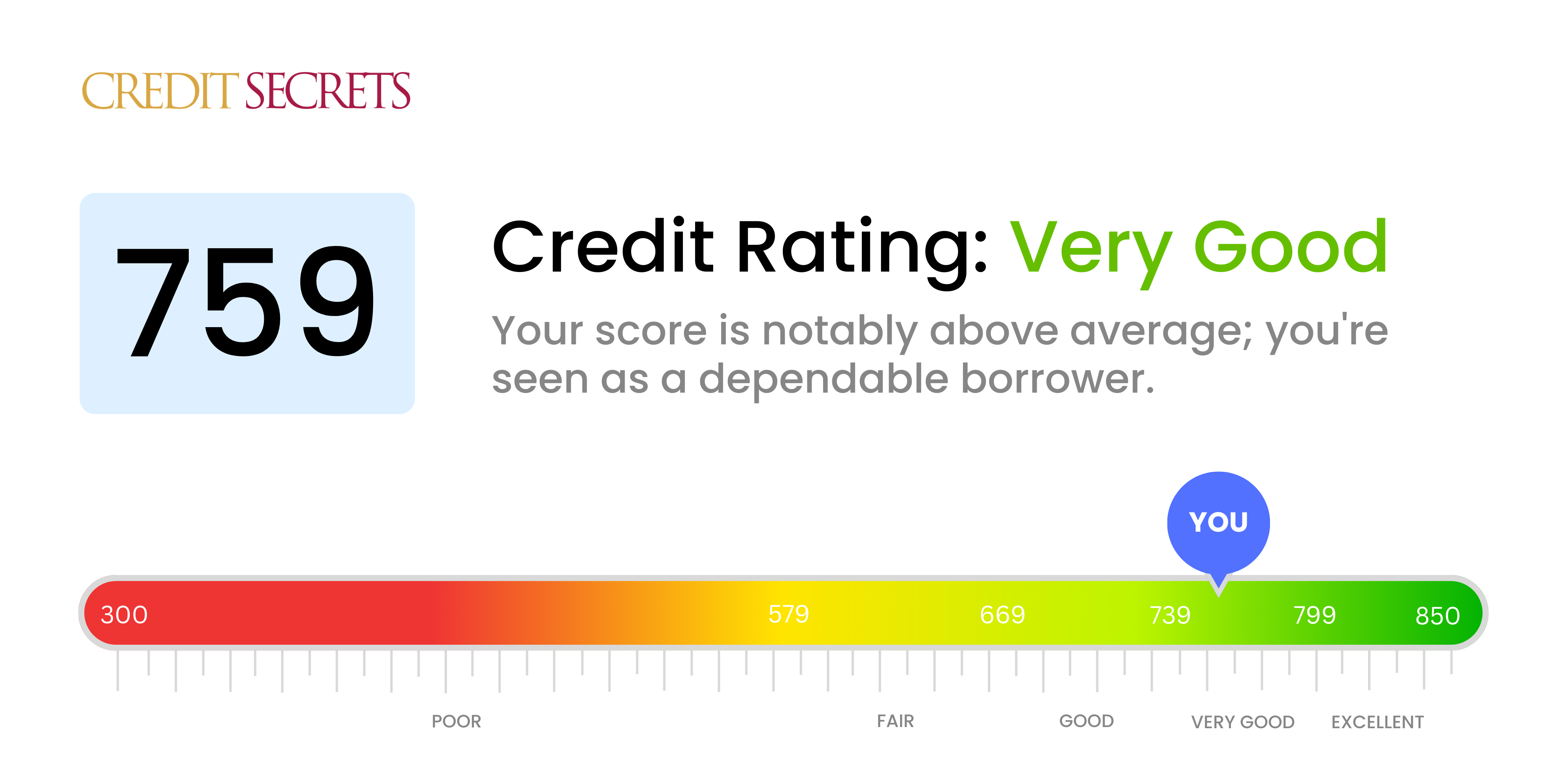

Is 759 a good credit score?

Your credit score of 759 is considered very good. With such a score, you're likely to be viewed favorably by potential lenders, making it easier for you to receive lower interest rates on loans and credit cards, and opening up the possibility of securing bigger loans for things like a home or car.

Remember, maintaining your credit score in the 'very good' range requires continued financial responsibility. Be proactive about paying your bills on time and keeping your debt levels low to ensure your credit score stays strong. With care, your score could even climb into the 'excellent' range, giving you even more financial options and benefits.

Can I Get a Mortgage with a 759 Credit Score?

With a credit score of 759, you're likely in a strong position for mortgage approval. This score is seen by lenders as a reflection of a responsible borrower who handles their finances well, making you a low-risk candidate. However, remember that credit score is just one aspect that lenders look at. They also consider your income, employment stability, and current debts.

The mortgage approval process typically involves an examination of your complete financial history, your current income, and the amount you have in savings. This helps the lenders decide how much they can safely lend you and at what interest rate. With a credit score of 759, you're likely to get comparatively lower interest rates which means a lowered cost of borrowing. Always remember, while a good credit score increases your chances, approval is not guaranteed and varies based on individual lender's policies. Continue to show financial responsibility for the best outcomes.

Can I Get a Credit Card with a 759 Credit Score?

Holding a credit score of 759 is truly impressive. This indicates stability and responsibility in managing your finances – both of which are qualities that lenders typically respect and reward. Thus, acquiring a credit card with your present score is relatively straightforward and you can confidently anticipate approval for most types of cards.

Having a credit score in this range open various doors. You stand a good chance for premium cards that offer benefits such as travel points and cashback. There are credit cards tailored for specific reward types or those with more general rewards, either of them could be a great fit for you. It's also important to remember that even though your score is high, the interest rates still matter. Ensure to choose a credit card with the lowest possible rate while offering the perks that suit your lifestyle and spending habits. Overall, your credit score speaks volume of your financial discipline - keep up the good work!

With a credit score of 759, you're in a good position for personal loan applications. This score is well above the average threshold set by lenders, making you an appealing candidate for loan approval. Lenders perceive this score as a reflection of your responsible financial habits, making you a lower risk for loan repayment.

When applying for a personal loan with this credit score, you can often expect a smoother lending process. There's a good chance you will be rewarded with lower interest rates due to your high credit score. This is because lenders are more willing to offer competitive rates to those who present less credit risk. However, other factors such as income and debt-to-income ratio can also influence the final terms of your loan. While your favorable credit score may not guarantee approval, it potentially helps pave a smoother path to secure that personal loan you desire.

Can I Get a Car Loan with a 759 Credit Score?

With a credit score of 759, the outlook for securing a car loan is quite positive. Lenders typically seek scores above 660 to offer favorable terms, and your score exceeds this benchmark with some room to spare. A credit score of 759 usually signifies financial responsibility, having managed previous credit situations wisely.

This score may provide you an edge when it comes to interest rates. Because lenders perceive you to be low risk—to repay the loan without a hitch—they are more likely to offer lower interest rates. While the car-purchasing process may be complex, having a healthy credit score as you have can help make the terms much more comfortable. Be sure to thoroughly read the terms of any loan before agreeing to it and bear in mind that the best interest rates are typically only available to those with excellent credit. Your score puts you in a strong position though, so be confident when starting your car purchasing journey.

What Factors Most Impact a 759 Credit Score?

Unraveling the intricacies of a 759 credit score is essential to your financial journey. Possible factors could be affecting this score and understanding them can open doors to a stronger financial footing. Remember, every financial path is unique, filled with areas for improvement and development.

Credit Card Balances

Credit card balances, even those that are seemingly reasonable, can impact a 759 credit score. Instantly reducing these balances can result in improvements.

How to Check: Take time to go through your credit card statements. Do you notice high balances? Try to lower your balances to see a positive effect on your score.

Frequency of Credit Applications

Applying for new credit too frequently can affect your credit score. It's important to manage your credit requests in a responsible manner.

How to Check: Look over your credit report for recent applications. If you've applied for multiple credit lines in a short span, reconsider such decisions in the future.

Debt-to-Income Ratio

Your debt-to-income ratio could be affecting a 759 credit score. If your debts significantly outweigh your income, it could be impacting your score.

How to Check: Review your total debt in relation to your income. If your debts are overshadowing your income, aim to adjust this balance.

Mix of Credit

Having a balanced mix of credit is beneficial for your score. Managing different credit types responsibly can have a positive influence.

How to Check: Evaluate your credit report for a mix of credit types like credit cards, mortgages and personal loans. Attempt to diversify and maintain your credit types successfully.

How Do I Improve my 759 Credit Score?

A credit score of 759 is deemed as an excellent score. However, if you’re striving to push your credit standing even higher, here are a few crucial steps you can take specific to your scenario:

1. Maintain Low Revolving Credit Utilization

A vital aspect that can affect your credit score is your credit utilization ratio. Aim to keep this rate under 10%. Even though you may have high credit limits, it’s crucial to keep your balances low and continue making full payments each month.

2. Keep Old Accounts Open

Length of credit history can significantly impact your credit score. If you have older credit accounts, consider keeping them open, even if you don’t use them regularly, to extend the average account age on your credit profile.

3. Regularly Monitor Your Credit

Ensure to check your credit reports frequently for any errors or discrepancies that may hurt your score. Correcting these promptly can help maintain a good credit standing.

4. Continue Making Payments On-Time

A substantial factor in credit score determination is payment history. Continue to make all your payments on time, as even one late payment can affect your excellent score.

5. Consider Installment Loans

Having a good mix of credit types can improve your score. If you have mostly revolving credit, like credit cards, adding an installment loan such as a auto, student, or personal loan, can boost your credit score.