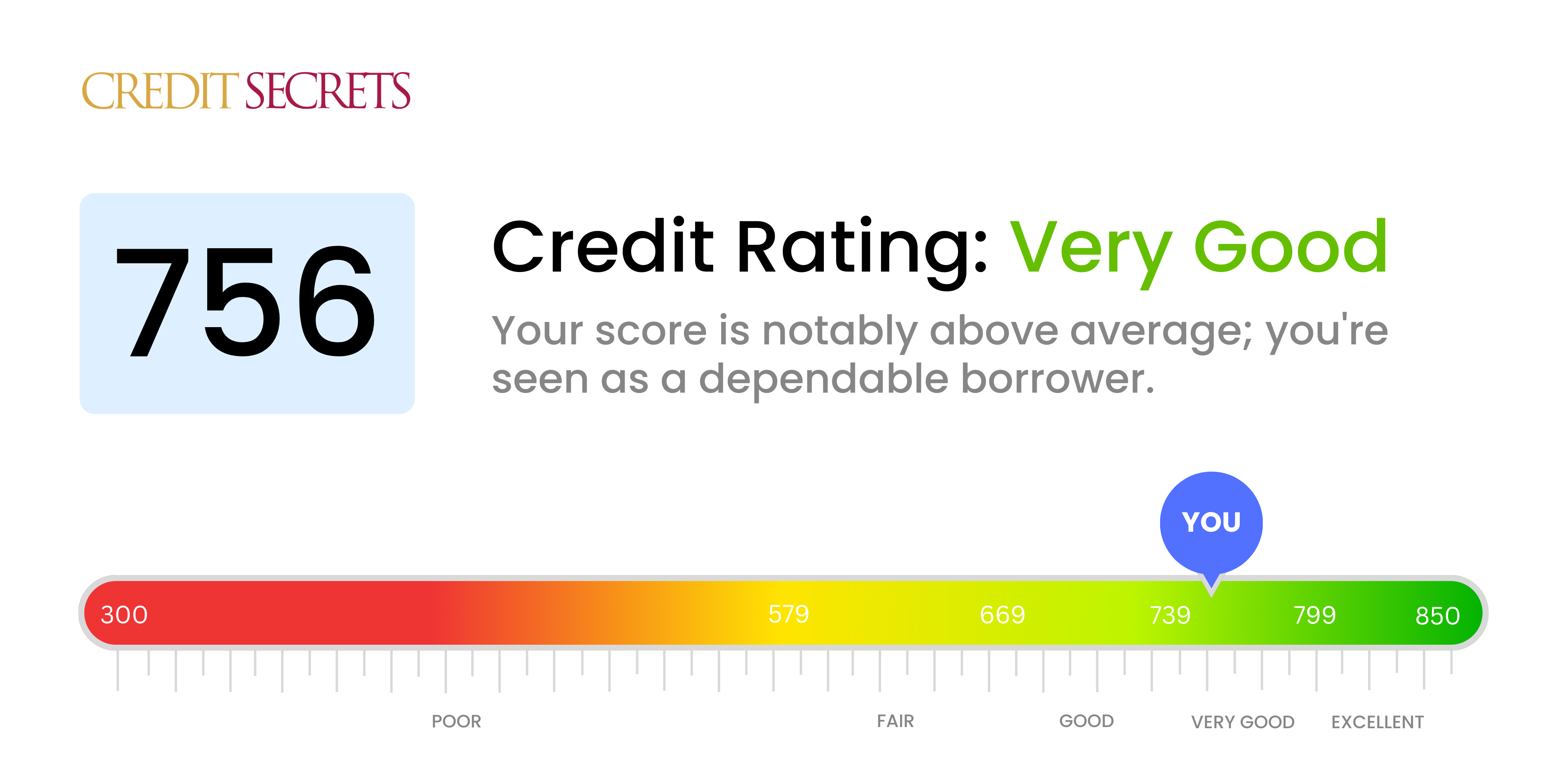

Is 756 a good credit score?

With a credit score of 756, you're in the 'Very good' range. You've handled your credit responsibly, demonstrating to potential lenders that you're a reliable borrower, enhancing your chances of securing financial products at favorable rates.

Although there's always room for improvement to reach 'Excellent', keep in mind that being in the 'Very good' bracket is still an impressive achievement. Continue using credit wisely and maintaining timely repayments to boost your score even higher, opening up additional opportunities for lower interest rates and premiums in the future.

Can I Get a Mortgage with a 756 Credit Score?

With a credit score of 756, you are in a solid position to be approved for a mortgage. This score is well above the average range and suggests a responsible history of managing your debts. Mortgage lenders consider this score strong evidence of your reliability as a borrower.

The mortgage approval process can vary, but typically it involves a comprehensive check of your financial situation, including income, debts, and credit history. Expect thorough discussions about your financial capacity to ensure that the mortgage repayment won't strain your finances. With a credit score of 756, you are likely to qualify for lower interest rates which can save you thousands of dollars over the lifespan of your loan. Keep in mind, while a good credit score enhances your appeal to lenders, it's just one piece of your entire financial picture. It's also crucial to have a stable income and a manageable debt-to-income ratio.

Can I Get a Credit Card with a 756 Credit Score?

Having a credit score of 756 is considered very good and usually indicates sound financial habits. This means that, in most cases, yes, you are likely to be approved for a credit card. This is because lenders see a score like this as low-risk, suggesting a history of consistent, timely repayments and responsible credit use. It reflects positively on your financial management, even if you've been through some rocky patches in the past.

With a score of 756, you may qualify for a variety of credit cards, including those with more substantial rewards and benefits. For instance, you could potentially obtain premium travel cards, cash back cards, or even higher-tier reward cards that offer excellent benefits. Remember, interest rates will vary, but with this score, you're likely to get a more competitive rate. However, always make sure to carefully consider the terms and feasibility of the card before making a decision. Remember, the best card isn't always the one with the most rewards; it's the one that suits your financial habits and goals best.

A credit score of 756 is in the exceptional range, which, in most circumstances, signifies that you stand a high chance of being approved for a personal loan. With such a high score, you've clearly demonstrated responsible credit behavior consistently, something that lenders appreciate. This could potentially lead to a more streamlined application process and a more favorable interest rate as your credit score reflects a low risk to the lender.

Remember, your credit score is a major factor determining the interest rate on your loan. Lenders, seeing your score of 756, are likely to offer you competitive, possibly lower interest rates. This is because your exceptional score means you're less likely to default on the loan, reducing their risk. However, keep in mind that lenders also consider other factors such as income and debt-to-income ratio. Despite your credit score strength, it's important to maintain sound financial habits and revisit your credit report regularly.

Can I Get a Car Loan with a 756 Credit Score?

If you have a credit score of 756, the likelihood of securing approval for a car loan is quite high. Generally, lenders prefer a score of 660 or above as it indicates a lower risk. With your score surpassing this benchmark comfortably, you're viewed as a reliable borrower by loan providers. This, in turn, makes lending to you a safer venture.

As a result of your impressive credit score, you can expect relatively favorable terms when it comes to the car purchasing process. For instance, lenders are likely to offer you lower interest rates, meaning the cost of your loan over time will be less. You should be able to negotiate for the best loan terms, including the duration of the loan and the offered interest rate, when applying for your car loan. Consequently, a credit score of 756 positions you strongly when venturing into the car buying journey.

What Factors Most Impact a 756 Credit Score?

Deciphering your credit score of 756 is a significant stride toward sharpening your financial aptitude. It's essential to comprehend and tackle the elements influencing this score for a robust financial future. Remember, each person's financial journey is distinctive and instructive.

Payment Consistency

Regular, on-time payments positively influence your credit score. If payments are consistently made on time, it could be a primary factor for achieving your score.

How to Verify: Check your credit report for consistency in timely payments. Reflect on your habits of settling bills promptly, as this would be instrumental in maintaining your score.

Credit Card Balances

Keeping your credit card balances low advocates for a healthier credit score. If your credit card balances are far from their limits, it means you're managing your credit well.

How to Confirm: Review your credit card declarations. Is there a substantial distance between balances and their limits? Striving to maintain minimal balance amounts is advisable.

Credit Experience

Having a diverse credit history over a significant duration helps your credit. A long-standing credit history could be a positive factor.

How to Validate: Look over your credit report to assess the duration of your oldest, newest, and average age of all your accounts. Ponder if you've been maintaining longstanding accounts.

Credit Product Variety

Managing diverse types of credit responsibly boosts your credit score. A varied credit mix could have contributed positively to your score.

How to Ascertain: Evaluate your blend of credit accounts: credit cards, retailing accounts, installment loans, and mortgage loans. Assess if you're conscientiously managing diverse credit products.

Public Record Cleanliness

Your score benefits from a clean public record. Absence of public records like bankruptcies or tax liens will enhance your credit score.

How to Investigate: Examine your credit report for absence of public records. Address any listed items that need attention.

How Do I Improve my 756 Credit Score?

A credit score of 756 is considered good, and just a few fine-tunes can make it even better. Here are some practical and potent steps you can take to enhance your score further:

1. Maintain a Mix of Credit Types

Diversifying your credit portfolio can positively impact your credit score. Ensure you have a mix of installment loans such as mortgages, auto loans and revolving credit, like credit cards. But remember, it’s not just about opening various credit lines; it’s about managing them effectively.

2. Keep Credit Utilization Low

Credit utilization plays a significant role in your score. Aim to keep your balances low compared to your overall credit limit, preferably below 10%. This shows lenders that you manage your credit responsibly, and you are not living off borrowed money.

3. Monitor Your Credit Reports Regularly

Stay vigilant and regularly check your credit reports for any errors. Even with a solid score like 756, mistakes can creep in and lower it. Dispute any discrepancies promptly to ensure your score accurately reflects your credit performance.

4. Stick to Timely Bill Payments

A habit of timely bill payments goes a long way. With your score, it’s already an indication of this positive habit. Make sure to keep it that way. Remember, even an inadvertent missed payment can cause a significant dip in the score.

5. Limit New Credit Requests

Each time you apply for new credit, an inquiry is made, which can slightly lower your score. Be cognizant of this, and limit new credit applications unless absolutely necessary. Furthermore, displaying patience with credit can tip the scales in favor of a higher score.