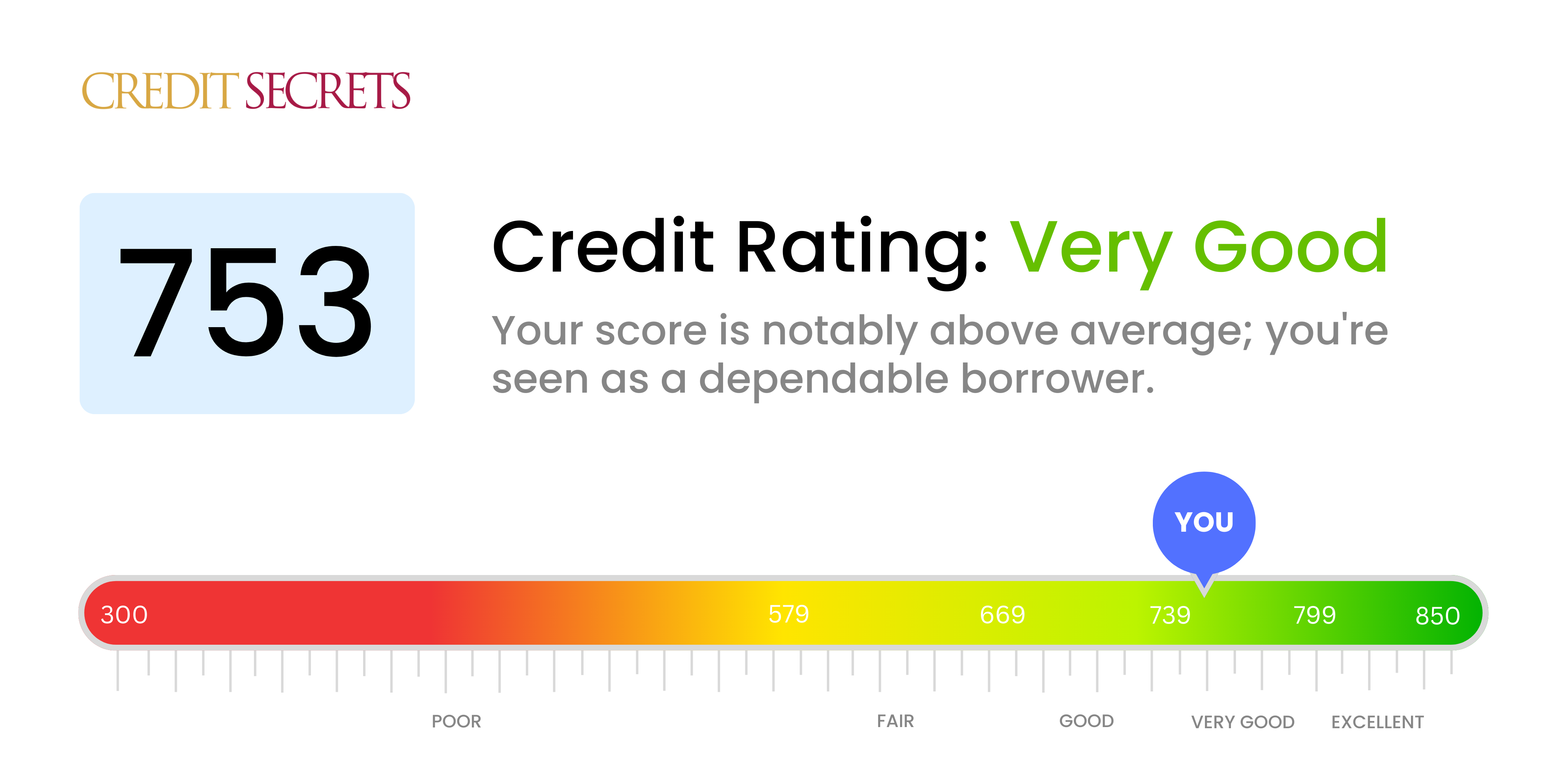

Is 753 a good credit score?

Having a credit score of 753 is indeed very good. Being in this grade on the credit scale tells potential lenders that you are creditworthy, and it's likely that when you apply for a credit card, mortgage, or a loan, chances are high for your loan application to be approved, and you might also access better interest rates.

Continue to use good habits, such as making on-time payments, keeping credit card balances low, and managing your debts responsibly. This way, you can maintain or even improve your already favorable credit score. Remember, a higher credit score opens the door for even more financial opportunities and benefits.

Can I Get a Mortgage with a 753 Credit Score?

With a credit score of 753, you have a good chance of being approved for a mortgage. Lenders consider this score to indicate responsible financial behavior, making you a low risk borrower. This likelihood, however, doesn't guarantee approval as there are additional factors that mortgage lenders consider, such as your income and debt-to-income ratio.

During the mortgage approval process, your prospective lender will assess these other factors in consideration of your loan application. A good credit score like yours might also qualify you for better interest rates, saving you a significant amount of money in the long-run. The process can be complex and time-consuming, so patience and diligence will be your best assets. Remember, having a strong credit score is just the first step, but it bodes well for your journey towards homeownership.

Can I Get a Credit Card with a 753 Credit Score?

With a credit score of 753, you're in a strong place to be approved for a credit card. Banks and lenders will see this as evidence of responsible financial behavior. It's understandable if your score isn't where you want it to be, but remember, a score of 753 indicates a good credit history.

Since your score is in the high range, this opens up the possibility of some premium card options. For instance, travel cards with generous rewards could work well for your situation. But don't forget, even with a high score like yours, it's vital to consider interest rates and potential fees before deciding on a card. Choosing the right credit card means considering what will work best for your financial situation in the long run. After all, responsibly managing your credit and finances is a journey, not a destination. Stay diligent and continue to make smart decisions to maintain and potentially even improve your credit score.

With a credit score of 453, obtaining a personal loan through traditional banks or lending institutions may be difficult. Unfortunately, for these lenders, a lower score depicts a high level of credit risk. It's not the news you want to hear, but understanding the implications of your current credit score is a crucial step in moving towards brighter financial possibilities.

Once traditional loan avenues close, alternative lending opportunities can open up, such as secured loans requiring collateral, co-signed loans with someone having a stronger credit profile, or even turning to peer-to-peer lending options. Remember, though these alternatives can offer immediate relief, they often come with higher interest rates and may not offer the same level of protection as standard loans. They reflect the inherent risk that the lender takes on due to your lower credit score. As you navigate these alternatives, it's essential to be mindful of these variations to set yourself up for financial success in the future.

Can I Get a Car Loan with a 753 Credit Score?

A credit score of 753 is quite impressive and likely to get you approved for a car loan. Lenders typically are on the lookout for scores above 660 for favorable terms. Your score, which is at a sturdy 753, certainly hits this mark. Due to this healthy credit score, you are viewed as less of a risk to lenders, suggesting that you have a history of responsibly repaying borrowed funds.

As you navigate the car purchasing process, having this high credit score will play a beneficial role. Not only do you possess a higher likelihood of car loan approval, but you also stand a good chance of securing a loan with more favorable interest rates. Remember, the higher the credit score, the lower the interest rate can be. This means your credit score of 753 could potentially save you money over the lifespan of your car loan. Good job on ensuring your financial health, keeps keep planning wisely for your future.

What Factors Most Impact a 753 Credit Score?

When evaluating a credit score of 753, it's crucial to understand the key factors that have contributed to this score. A 753 is considered a good score, and it signifies that you've been managing your credit responsibly.

Existing Credit Balance

The balance on your existing credit accounts may affect your credit score. Maintaining a low outstanding balance on multiple cards could have led to this healthy score.

How to Check: Scrutinize your current outstanding balances compared to your credit limits. Maintaining a low credit utilization ratio is a smart strategy.

Diligent Payment Records

Punctual payment of bills is a major factor in maintaining a good credit score. Late or missed payments can negatively affect your score.

How to Check: Review your payment records to ensure that all bills, loans, and credit cards were paid on time.

Credit History Length

Did you know that the age of your credit history matters to lenders? The longer your credit history, the more confident lenders will feel about your creditworthiness. This could have contributed to your current score.

How to Check: Take a look at your credit report to assess the age of your oldest account, the age of your newest account, and the average age of all your accounts. Be cautious of opening new accounts too frequently.

Responsible Management of Credit Types

If you've handled a good mix of credit types responsibly, like credit cards, retail accounts, or installment loans, your credit score may reflect this positive credit mix.

How to Check: Assess your array of credit. Having a healthy mixture of credit is a key step in maintaining a strong credit score.

Public Records

Public records like bankruptcies or tax liens could significantly lower your credit score. However, your score of 753 signifies a clean financial slate.

How to Check: Scan your credit report for any harmful public records. Resolving any issues here can bring about a more secure financial future.

How Do I Improve my 753 Credit Score?

With a credit score of 753, you’re deemed financially responsible, but you can still work towards perfection. Here are a few elements to focus on:

1. Keep a Watchful Eye on Your Credit Utilization Ratio

Maintain your credit card balance at 10% or less of your credit limit. Even though you should stay within 30% limit, lenders treat under 10% utilization more favorably.

2. Timely Payments

Payment history constitutes a significant part of your credit score. To improve it, ensure all bills, not just credit-related, are paid on time. Set up automatic payments to avoid forgetfulness.

3. Monitor Your Credit Report Regularly

Regularly inspect your credit report for any errors or discrepancies. These could adversely affect your score. You are entitled to a free report from each major credit bureau annually. Use this right.

4. Keep Old Credit Cards Active

Don’t close old credit cards, even if you’re not using them, as they can enhance the length of your credit history. However, make sure the cards are free from annual fees.

5. Avoid Frequent Hard Inquiries

Multiple hard inquiries might set off a red flag for lenders, as it may be seen as a symptom of financial stress. So, limit the applications for new credit.

By taking these steps, you can inch your way towards a stellar credit score.