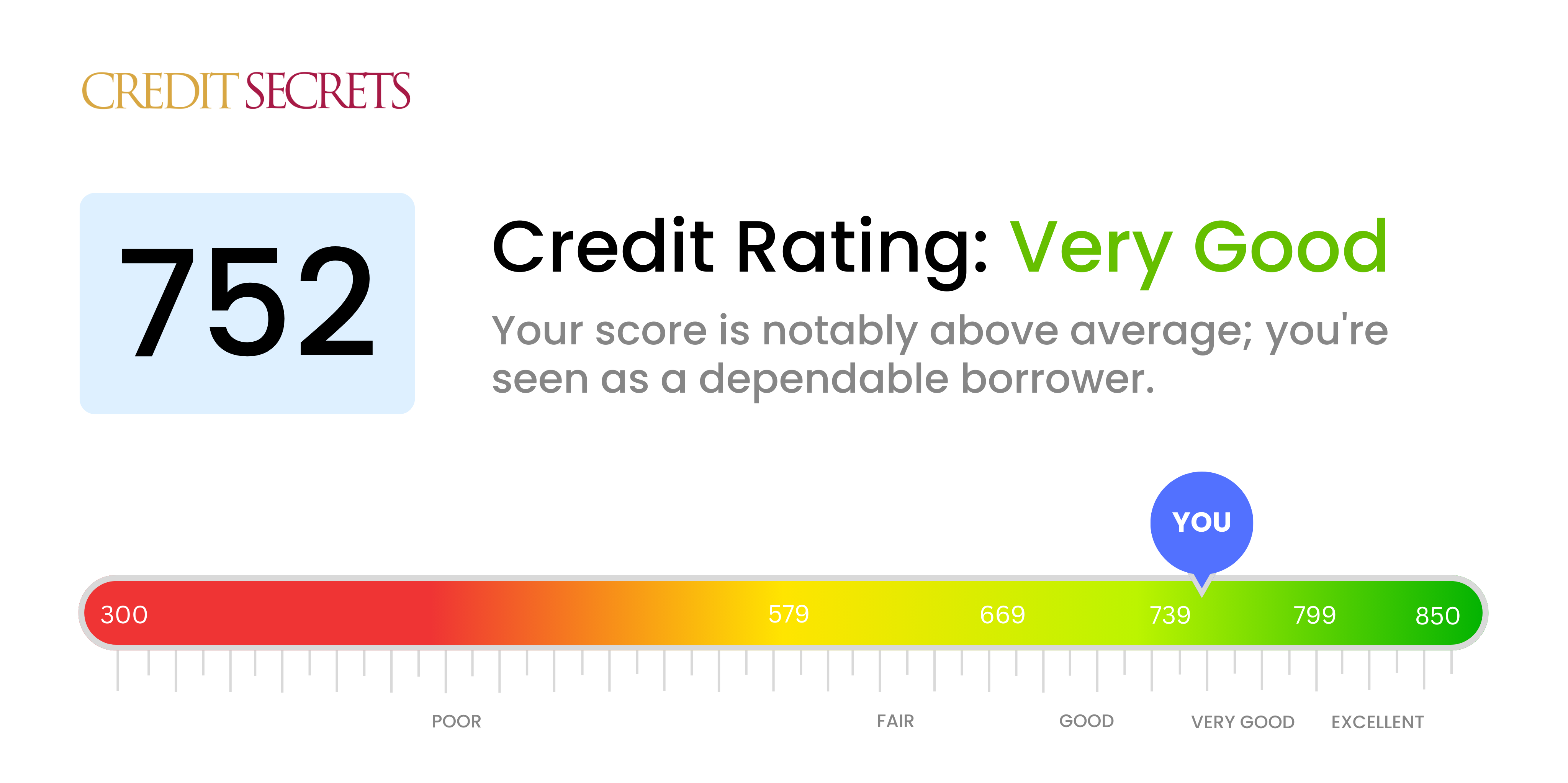

Is 752 a good credit score?

Your credit score of 752 is considered to be very good. This is solid ground to be standing on and will typically allow you to secure favorable interest rates and terms on loans and lines of credit. Bear in mind, there's always room to grow towards an even stronger financial position and aim towards an excellent rating.

With a score in the 'very good' range, you're likely to be seen favorably by lenders and creditors due to the responsibility you've shown in handling your past and current credit commitments. You also demonstrate a significantly lower risk of not making payments on time. However, remember that having a very good credit score doesn't guarantee approval for every credit product, as lenders also consider factors like income and employment stability.

Can I Get a Mortgage with a 752 Credit Score?

Presenting a credit score of 752 practically ensures a strong chance of securing a mortgage approval. This score sits well within the range considered as 'excellent' by most lending institutions, suggesting a record of consistent, responsible credit use and timely payment of debts. Indeed, securing a mortgage with such a score should be relatively straightforward.

The positive impact of having such a credit score doesn't end with the approval; it extends into the terms of the mortgage deal you're likely to be offered. Lenders view applicants with high scores as less risky, and this is often reflected in the interest rates you'll be quoted. With a 752 credit score, you can typically anticipate lower interest rates, which means lower monthly mortgage payments and possibly even a wider range of available mortgage products. However, remember that while a strong credit score significantly improves your chances, approval is never guaranteed, as lenders also consider other factors like employment stability and income level.

Can I Get a Credit Card with a 752 Credit Score?

With a credit score of 752, securing approval for a credit card is highly likely. Lenders often view this score as proof of good credit management, making you a desirable candidate. Although this may be a relief, it's crucial to remember that maintaining and even improving this excellent score requires consistent financial responsibility. Keep in mind, your credit score can always fluctuate, so it's important to make sound financial decisions.

As someone with a strong credit score like 752, you have access to a variety of credit card options. Secured cards, starter cards, and premium travel cards are all within your reach. Secured and starter cards can be great tools for maintaining good credit. A premium travel card, on the hand, might be a smart choice if you're frequently traveling, as they often provide plentiful rewards and travel-related benefits. Do keep in mind, though, regardless of how attractive a credit card offer may be, interest rates and terms should always be considered. Remember, a high credit score provides you with better terms and lower interest rates, so take your time to make an informed decision.

A credit score of 752 can be considered as very good. It's an indication of consistent and responsible financial behavior. Lenders often see this level of credit score as a positive sign, making you a good candidate for a personal loan. It indeed paints the picture of a reliable borrower, which can put you in a favorable position when applying for a loan.

When your credit application is reviewed, the good credit score of 752 might result in not just an approval, but also better terms, including potentially lower interest rates. This is because lenders believe that the risk of you failing to meet your loan obligations is relatively low. It's important to remember, however, that while your credit score plays a significant role, lenders may also consider other factors like income and debt-to-income ratio. Make sure to read all terms carefully before agreeing to a loan.

Can I Get a Car Loan with a 752 Credit Score?

With a credit score of 752, you're in a strong position when it comes to applying for a car loan. Creditors look favorably upon scores that break the 700 threshold, seeing such a number as an indicator of financial reliability. A score of 752 signals a history of consistently meeting financial responsibilities, which enhances your appeal to lenders.

In the car purchasing process, this score will likely open up opportunities for lower interest rates. Lenders use credit scores to help them determine the degree of risk involved in approving a loan. A higher credit score, like 752, represents lower risk for them and therefore, some of the advantages for you might include more negotiation power and attractive loan terms. Remember, while your credit score is a significant factor, lenders also consider other aspects like income and employment history. So, keep up with the responsible handling of your finances to maintain or increase your credit score.

What Factors Most Impact a 752 Credit Score?

Understanding the implications of a credit score of 752 will guide you on the path to further improve your financial stability. Discussing factors that may have influenced your current score is key to maintaining or enhancing it.

Credit Utilization

A moderate or low credit utilization could be a major factor for your score. You've already shown good credit habits by keeping your credit card balances low.

How to Check: Continue to monitor your credit card statements, keeping a watchful eye on your balance-to-limit ratio to ensure it's not exceeding a 30% threshold.

Length of Credit History

Long credit history, probably seen in your report, showcases financial reliability and helps in achieving a 752 score.

How to Check: Still it's essential to look at your credit report to identify the span of your oldest and newest accounts, alongside the average age of all your credit accounts.

Credit Mix

A stable blend of credit types is crucial to maintaining a good score. You're likely using a variety of credit responsibly.

How to Check: Examine your report and analyze your variety of credit accounts like mortgages, store accounts, installment loans, etc.

Payment History

A near flawless payment record has likely played a part in helping achieve your current score.

How to Check: Keep reviewing your credit report and maintain this punctuality for a consistent rise in your score.

New Credit

Infrequent credit inquiries or not opening new credit lines indicates good credit management which likely contributed to your 752 score.

How to Check: Evaluate your credit report to track recent applications for credit and their management.

How Do I Improve my 752 Credit Score?

With a credit score of 752, you’re in good standing, yet there’re ways to progress further. Here are the most beneficial and achievable actions appropriate for your current credit standing:

1. Maintain Timely Payments

Punctuality is key to credit growth. Continue making all your payments on time, as even a single missed or late payment can adversely affect your score. Setting up automatic payments can ensure you never miss a deadline.

2. Lower Your Credit Utilization

Though your credit utilization might already be reasonable, aiming for an even lower rate can help. Consider maintaining your credit usage below 20% of your available credit limit across all cards to further enhance your score.

3. Keep Your Oldest Accounts Open

Length of credit history contributes to your score. If possible, retain your oldest credit accounts, even if you’re not often using them, as long as there aren’t hefty annual fees.

4. Limit New Credit Applications

Avoid moving to new credit too frequently – this can trigger hard inquiries, which can temporarily lower your score. Apply for new credit prudently, and only when necessary.

5. Regularly Monitor Your Credit

Regularly review your credit reports to ensure accuracy. Unnoticed errors can adversely impact your score, so rectify them as soon as possible by disputing them with the credit bureaus.