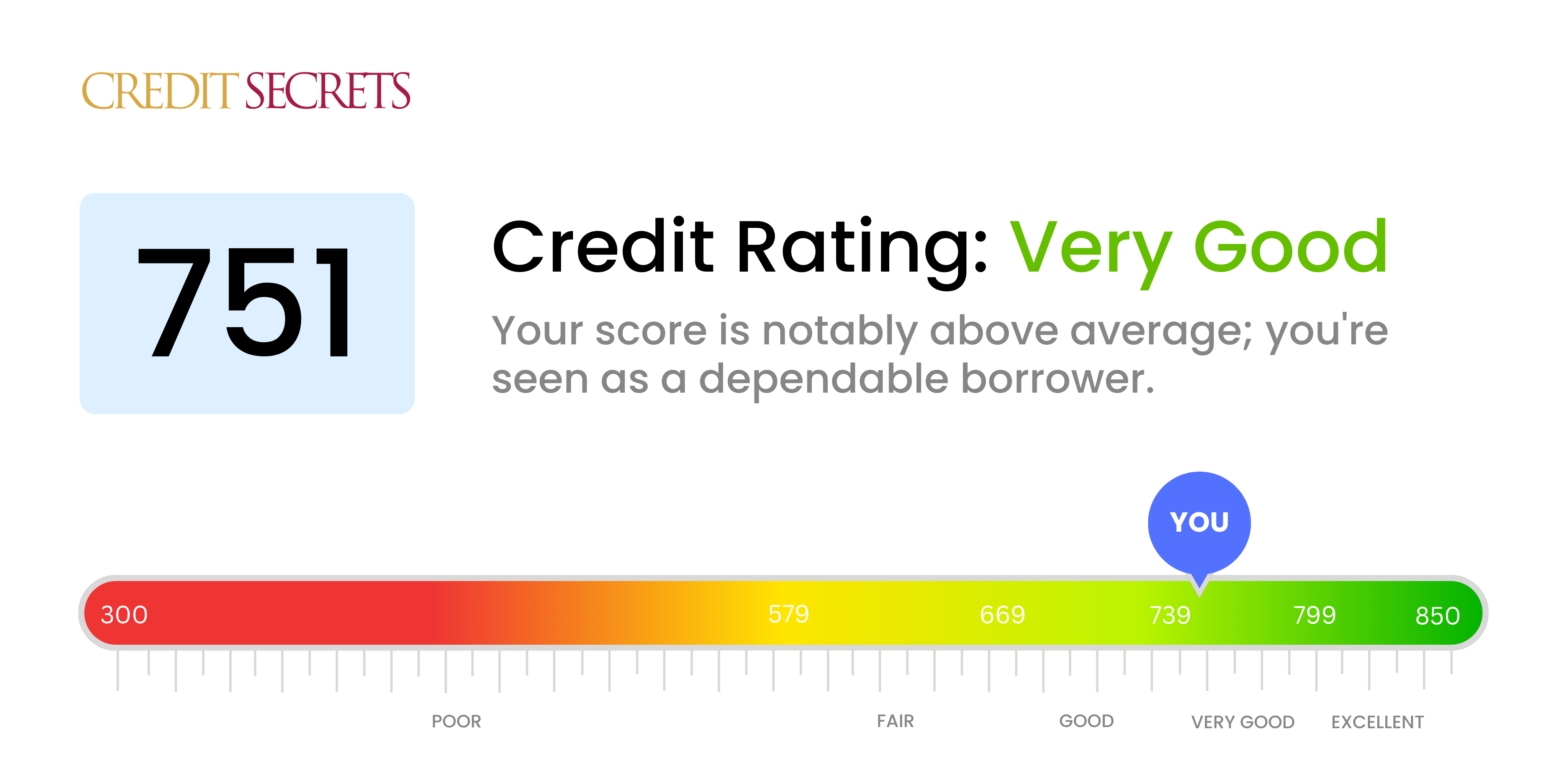

Is 751 a good credit score?

With a credit score of 751, you're in good shape. This falls in the 'Very Good' range, indicating that you've handled your credit responsibly and it's reflected positively on your credit score.

Having a score in this range usually means you'll likely have little trouble when it comes to securing loans or getting approval for credit cards. However, remember that while your score is high it doesn't guarantee approval as lenders also consider other factors. Keep up with your good habits- timely payments, keeping the credit utilization low, and manage your debts wisely to maintain and possibly improve your credit health.

Can I Get a Mortgage with a 751 Credit Score?

With a credit score of 751, you are well-positioned to be approved for a mortgage. This score is within the "good" to "excellent" range, indicating that you have demonstrated responsible credit management, regular repayment of debts, and solid financial habits. Lenders typically view such scores positively and are more likely to offer loan approvals as they consider the risk associated with lending to you to be low.

This approval, however, doesn't mean the process will be a walk in the park. The mortgage approval process is comprehensive and examines more than just your credit score. Lenders will look into your full financial profile, including your income, employment history, and existing debts, if any. Another essential point to note is that while a 751 score can pave the way for mortgage approval, the interest rate offered might vary. Generally, the higher the credit score, the better the interest rate. One should see this score as an advantage and a step closer to owning the home of your dreams.

Can I Get a Credit Card with a 751 Credit Score?

With a credit score of 751, you're in a strong position to be approved for a credit card. This is considered a good score and reflects a history of responsible credit use and debt management. Understandably, it should be a source of tangible relief and motivation for your financial journey moving forward. Your commendable score will not just help you obtain credit with ease; it also implies manageable interest rates.

Given your credit situation, you might have a variety of credit cards to choose from. If you are seeking to maximize your benefits and manage large purchases, you might want to consider premium travel cards or cash back cards. Alternatively, if you're looking to maintain your score or build it even higher, a low-interest card would be a good fit. The key is to choose a card that aligns to your financial habits and goals. Always remember to use your credit wisely - pay off your balances promptly and try to keep your credit utilization low. This will keep your credit score healthy and make future financial endeavours smooth.

A credit score of 751 is generally respected in the financial world. This score is often considered "good" and holds a fairly strong chance of securing approval for a personal loan. With a score like this, lenders tend to see you as a reliable, lower-risk applicant. That said, your credit score isn't the only factor lenders look at, so keep in mind that approval isn't guaranteed. But, with this score, your odds are certainly better.

As you begin your loan application process, be prepared for a smoother experience. Your good score can potentially reduce the need for additional paperwork or extra verification steps, as it already showcases your creditworthiness. Also, you can likely expect competitive interest rates, which can make a significant difference in your loan's overall cost. Still, remember to read the terms of any loan agreement carefully to ensure it aligns with your financial goals and capabilities.

Can I Get a Car Loan with a 751 Credit Score?

A credit score of 751 is seen as a good score by lenders, and you stand a high chance of being approved for a car loan. This score reflects a history of responsible borrowing and timely repayment, making you an attractive candidate to lenders. It's above the 660 mark that lenders often consider as the threshold for good credit. It communicates to lenders that you pose a lower risk, and they are likely to see you as a responsible borrower.

Being approved for a car loan with a credit score of 751 doesn't just mean you'll likely get the loan, it might also benefit you in terms of the loan's terms and conditions. You may be offered a lower interest rate compared to someone with a lower credit score. This can result in a significant cost savings over the duration of your car loan. Keep in mind, factors like your income and your debt-to-income ratio can also influence your loan terms. But with a score of 751, your journey to purchasing a car projects to be smoother and more advantageous.

What Factors Most Impact a 751 Credit Score?

Analyzing a score of 751 can provide insights into how to maintain and even improve this already good credit rating. Credit Secrets is dedicated to helping you identify and enhance the factors contributing to your credit score.

Payment History

Your payment history plays a vital role in your credit score. As a person with a 751 credit score, it's likely that your payment history is mostly positive. However, continue to pay bills on time to maintain this.

How to Check: Review your credit report to confirm your payments are up to date. Identify and address any recent late payments or defaults.

Credit Utilization

With a score of 751, you’re probably managing your credit utilization effectively. Strive to optimize this by not exhausting your credit limit.

How to Check: Examine your credit card statements. Ensure your balances are kept reasonably low compared to your overall limit.

Length of Credit History

Usually, a long track record of good credit contributes to a high score. Maintain your oldest accounts in good standing.

How to Check: Look at your credit report to observe the age of your accounts and confirm they are in good standing.

Credit Mix and Inquiries

A good balance of credit types enhances your score, as does refraining from excessive applications for new credit.

How to Check: Review your mix of credit accounts and limit new credit inquiries to sustain your score.

Public Records

For a score of 751, there are likely no severe public records like bankruptcies or tax liens. Keep it that way by staying vigilant about your financial obligations.

How to Check: Review your credit report for any public records. Resolve any listed items promptly.

How Do I Improve my 751 Credit Score?

A credit score of 751 is already considered good, displaying you’ve made sound financial decisions. Nevertheless, there’s always room for enhancement to place you into excellent-standing territory. Here are strategic routes uniquely tailored for your credit strength:

1. Punctual Payment

Punctuality pays when it comes to reinforcing your credit score. Ensure all your bills, not just credit accounts but also utilities, rent, and even student loans, are consistently paid on time. This projects an image of reliability to creditors, which can boost your score further.

2. Understand Your Credit Utilization Rate

No matter how good your score, cognizance of your credit utilization rate remains crucial. Strive to keep your utilization rate below 30%, and preferably towards 10% if possible. This shows lenders you’re capable of managing your credit limit astutely.

3. Review Your Credit Report

With a score like yours, any slight error on your credit report can inflict unwarranted harm. Therefore, take time to review your credit report routinely, correcting inaccuracies before they affect your score adversely. You have the right to challenge errors you detect.

4. Practice Credit Diversity

Avoid relying on just one type of credit. Diversify with a mix of credit cards, retail accounts, installment loans, or mortgages if you haven’t done so already. This displays your adeptness in juggling varied forms of credit willingly and responsibly.

5. Be Patient

Boosting your credit score from good to excellent doesn’t occur overnight. Understand the importance of patience and persistence in maintaining good financial habits. It’s consistency over time in adhering to these steps that leads to tangible results.