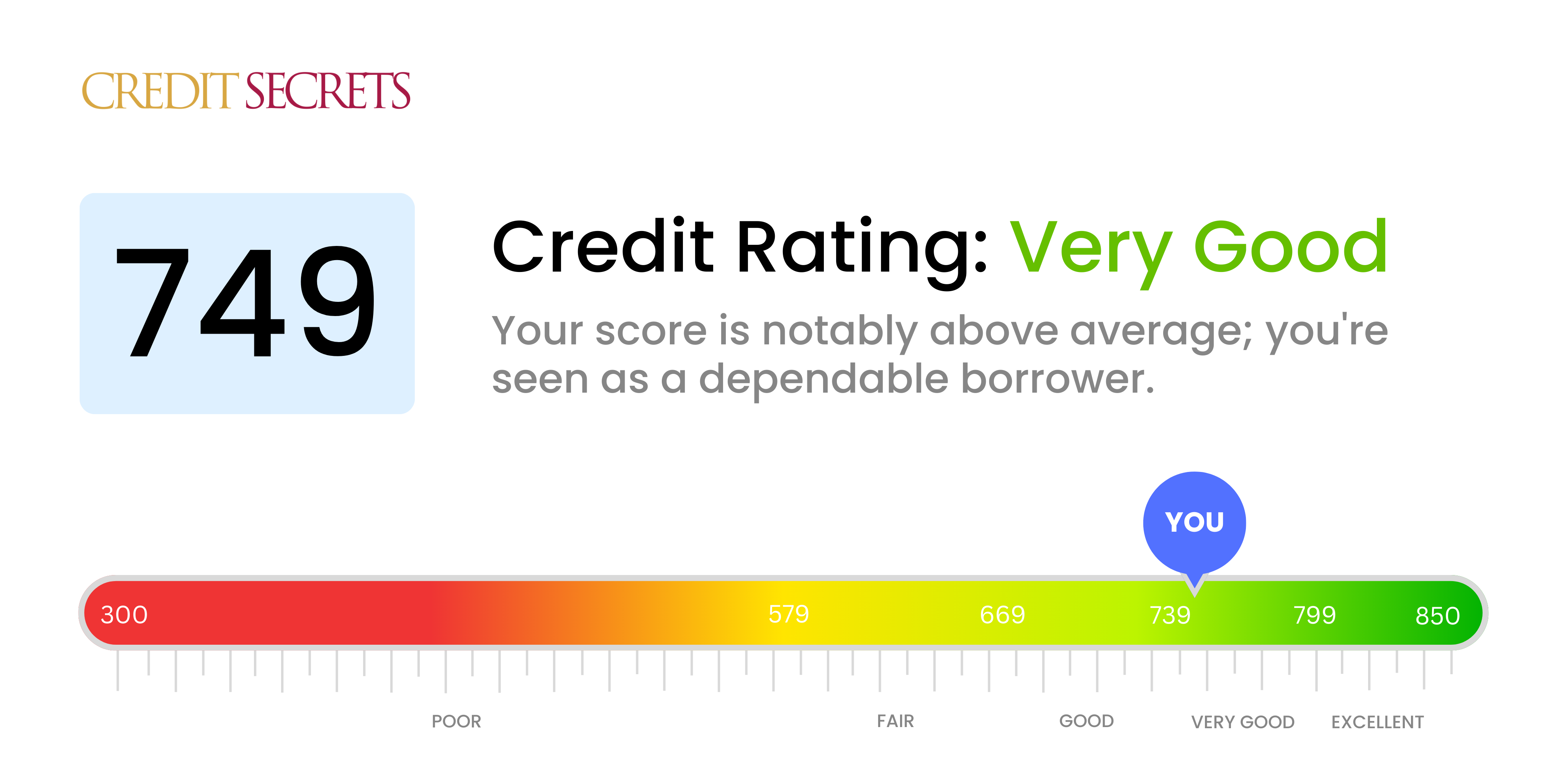

Is 749 a good credit score?

Having a score of 749 places you firmly in the 'very good' category of credit scores. This means that lenders and creditors view you as a reliable borrower, likely resulting in better deals for credit cards, auto loans, mortgages and insurance premiums. Although it's not quite 'excellent', with careful management, it's possible to raise even further.

Typically, a score of this level suggests that you've been consistently managing your credit well, with timely payments and sensible use of credit lines. Continue making good financial decisions, keep an eye on your credit reports to ensure accuracy and your score may rise into the 'excellent' range. You're also less likely to face rejection when applying for credit, although each lender has their own criteria.

Can I Get a Mortgage with a 749 Credit Score?

With a credit score of 749, you are in a good position to be approved for a mortgage. This score is well within the range that most lenders consider good credit, demonstrating a history of positive financial behavior. A score like this shows you've been responsible with your credit and have made your payments on time.

Across the mortgage approval process, you can expect lenders to consider your score as a strong point in your favor. This can potentially lead to favorable interest rates, as lenders view a high score as an indicator of lower risk. However, keep in mind that while a solid credit score is a crucial factor, lenders also assess other facets like your income stability and debt-to-income ratio. Maintaining your credit score and continuing responsible financial habits will help keep your mortgage options open and optimized for the best offers.

Can I Get a Credit Card with a 749 Credit Score?

With your credit score of 749, being approved for a credit card is a probable scenario. This is generally considered a good credit score and can open up opportunities for you. It's a testament to your fiscal responsibility and will likely be viewed favorably by lenders. Remember though, maintaining this credit status requires continuous smart financial decisions.

Considering your healthy credit score, you are likely to qualify for better terms when it comes to credit cards. This includes lower interest rates that can save you money over time, especially if you occasionally carry a balance. Cards with more generous rewards programs, including those for travel or grocery shopping, could also be within your reach. Such cards could help you maximize your spending by earning you points, miles, or cash back on your everyday expenses. Assess which kind of card best suits your lifestyle and spending habits as it can contribute to further improving your financial situation.

With a credit score of 749, you sit well above the average range that most traditional lenders consider both suitable and appealing for approving personal loans. This credit score indicates that you've exhibited a strong history of good financial habits--paying bills on time, maintaining low debt, and making sound decisions. It gives potential lenders confidence in your ability to repay the loan as agreed upon, making it highly likely for you to be approved.

When going through the application process, it's important to understand that while a good credit score can increase your approval chances, it can also positively influence the interest rates offered to you. Lower risk borrowers, like you, are often offered lower interest rates, making the loan more affordable over time. Furthermore, you may enjoy more favorable loan terms, such as higher loan amounts and longer repayment periods. Still, always remember to review any loan offer carefully, ensuring it meets your individual needs and current financial situation.

Can I Get a Car Loan with a 749 Credit Score?

Having a solid credit score of 749 places you in a favorable position when it comes to getting approved for a car loan. It's generally understood that lenders see scores in the 700 range as a positive sign of creditworthiness. It signifies that you've conducted your financial affairs responsibly and are less of a risk.

Being on the higher end of good credit, you can expect to have a more streamlined process while negotiating for a car loan. You are likely to be offered more competitive interest rates due to your credit score. This could potentially save you a significant amount over the life of the loan. That being said, don't forget to read the loan terms carefully and make sure they work for you. Good credit opens up opportunities, but it's still important to make informed decisions.

What Factors Most Impact a 749 Credit Score?

Navigating your financial path with a credit score of 749 can be simpler when you understand what factors contribute to your score. Approaching the following elements with strategic plans can help create a more robust financial future.

Credit Utilization

A credit score of 749 could indicate that your credit utilization is well-managed. Remember, maintaining a low ratio of credit use compared to your overall credit limit is an asset. How to Check: You can review your credit card statements to see how much of your available credit you are using.

Length of Credit-History

The duration of your credit history can be a factor when you have a score of 749. Long-standing lines of credit are more beneficial. How to Check: Inspect your credit report to see the age of your oldest and most recent accounts, along with the average duration of all your credit lines.

New Credit

Having a score of 749 usually demonstrates responsible management of new credit. However, excess credit queries may cause a minor impact. How to Check: View your credit report for recent inquiries or new accounts.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio may be well-balanced with a score of 749. Aligning your overall debt with your income is important. How to Check: You can calculate your DTI ratio by comparing your overall monthly debts to your gross monthly income.

Payment History

With a score of 749, it's most likely that your payment history is strong. Timely payments play a key role in maintaining your score. How to Check: Review your credit report for any late or missing payments that may have crept in unnoticed.

How Do I Improve my 749 Credit Score?

With a credit score of 749, you’re in a good position as your score is considered as a ‘good credit score.’ However, it can always get better, and here are some tailored strategies for your current situation to boost your score:

1. Maintain Low Utilization Ratio

Ensure that your credit card balances are at all times as low as possible, ideally less than 30% of your credit limit. This is known as your credit utilization ratio and impacts your score significantly.

2. Regularly Monitor Your Credit Report

Regularly review your credit report for any errors, discrepancies or fraudulent activity. If found, you should dispute them immediately, as they could be lowering your score unnecessarily.

3. Make Timely Payments

If not already, timely payment of your bills should be your priority. Timely payments showcase your creditworthiness and reflect positively on your credit score.

4. Create a Healthy Credit Mix

If feasible, introduce more diversity in your credit types. Having a balanced mix of installment loans (like car or student loans) and revolving credit (like credit cards) can favorably impact your credit score.

5. Avoid New Debt

Adding new debts can lower your credit score. Applying only for credit that you need can help maintain and further improve your good credit score.

By incorporating these strategies into your financial habits, you can improve your already good credit score to ‘excellent’ ranges and enjoy the benefits.