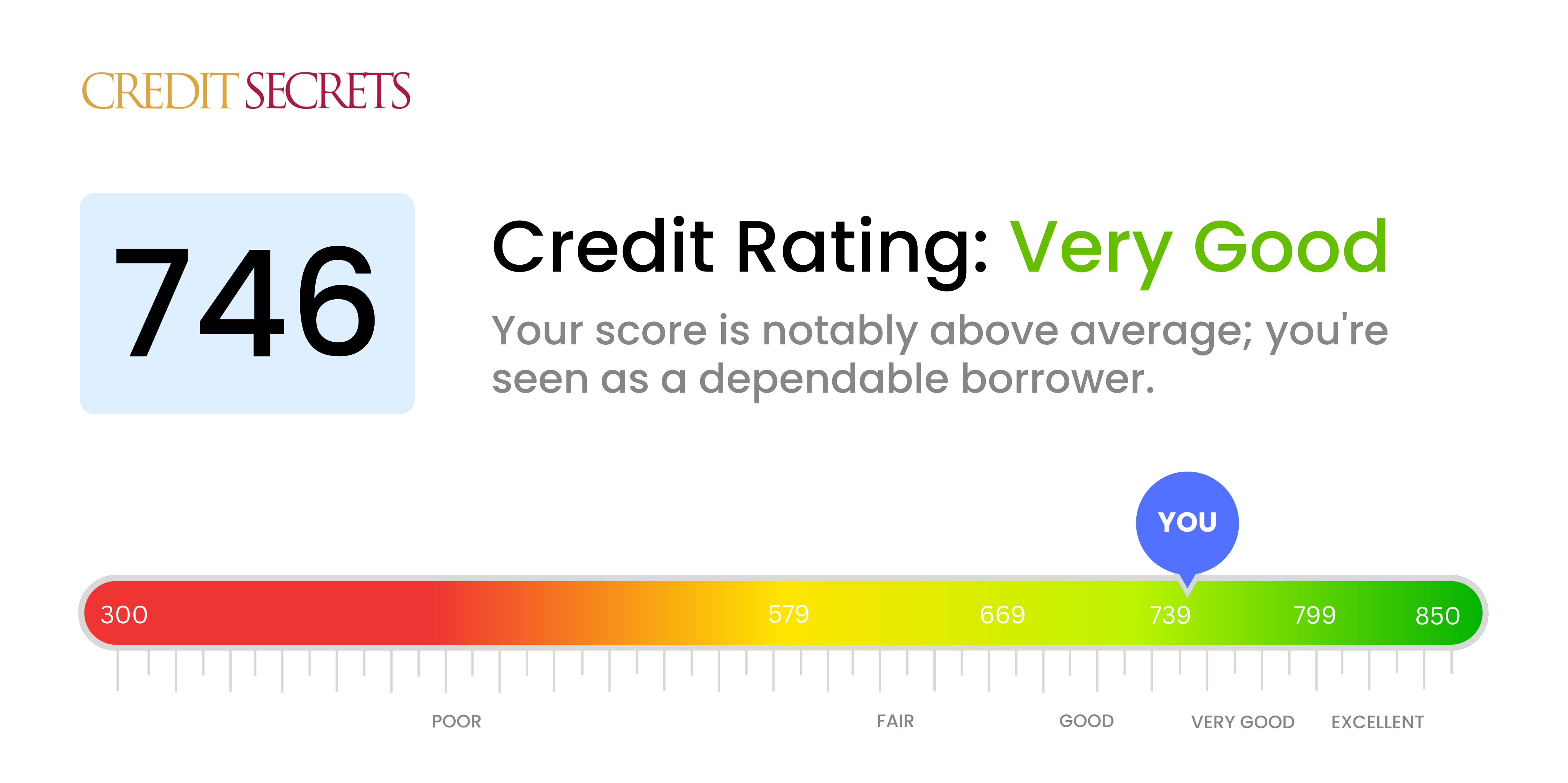

Is 746 a good credit score?

With a credit score of 746, you're in the 'Very Good' range. This tells lenders that you handle your financial responsibilities well which can make it easier for you to be approved for credit cards, loans, and get lower interest rates. However, keep in mind that individual lender criteria can vary.

While you're in a strong position, there's always room for improvement. Strive towards an excellent rating by paying your bills on time, keeping credit utilization low, and regularly checking your credit reports for accuracy. Remember, your credit score is a powerful number that can impact your life significantly—it's your ticket to better financial opportunities, so keep working on it.

Can I Get a Mortgage with a 746 Credit Score?

With a credit score of 746, you stand a good chance of being approved for a mortgage. Your score is comfortably above the minimum threshold most lenders require, reflecting a stable financial history and responsible credit use. This certainly puts you in a favorable position with potential lenders.

However, while a positive credit score increases your chances of approval, it doesn't guarantee it. Mortgage lenders don’t look solely at your credit score. They also consider factors like your income, your debt-to-income ratio, and the size of the down payment you're able to make. Additionally, while your credit score of 746 is likely to secure a mortgage, you should be aware that the highest available interest rates are usually offered to borrowers with credit scores of 760 and above. Every bit you can do to improve your credit score can save you significantly over the life of your loan. So, continue to make timely payments and use credit responsibly to boost your score even higher.

Can I Get a Credit Card with a 746 Credit Score?

With a credit score of 746, you're in a solid credit category in which approval for many credit cards is very likely. This score demonstrates you've done a great job managing your credit thus far. Lenders will see this as a sign of financial responsibility, appreciating your good track record. Clearly, credit isn't a mystery to you but it's always wise to continue learning and maintain those good habits.

Given your credit score, you're positioned well for premium credit cards that come with added benefits and rewards, such as travel or cashback cards. These cards tend to have lower interest rates and better rewards programs for their users, but remember, they often require a higher level of financial responsibility. Always consider your spending habits and your ability to meet payment deadlines, to ensure these cards are a good fit for you. Stay in control of your credit, and it'll benefit you in grand ways.

If you have a credit score of 746, you're in a strong position to secure a personal loan. This score reflects a history of responsible credit usage and prompt repayments, factors that afford a great level of confidence to lenders. You are seen as a low-risk candidate, suggesting that you're likely to get approval from most traditional lenders for a personal loan.

As a borrower with a good credit score, your loan application process can be smoother and faster. Besides, you can expect a wider range of loan options and better terms, including lower interest rates. Your 746 credit score opens up opportunities for negotiation and flexibility within your loan agreement. However, while your credit score is an influential factor, don't forget that lenders will also assess your income, employment history, and other financial information before finalizing your loan terms.

Can I Get a Car Loan with a 746 Credit Score?

With a credit score of 746, you are in a good place to be approved for a car loan. Lenders typically want to see scores above 660, so your 746 score puts you comfortably in the range considered to be good credit. This bodes well for you, as a higher credit score can often result in better loan terms.

When applying for a car loan, this high credit score can demonstrate to lenders that you have a consistent history of responsibly managing and repaying debt. As such, you may find that lenders are more willing to offer you competitive interest rates and terms on your car loan. Always remember, every lender is different, and while your credit score is a very important element, it's not the only factor that they consider. Stay optimistic and confident as you approach this process, your credit score of 746 is an asset working in your favor.

What Factors Most Impact a 746 Credit Score?

With a score of 746, you're moving towards a great credit profile. A few things may be holding your score back, so here's what you should focus on:

Credit Utilization

Even with a good score, high credit utilization can hinder progress. Your score increases when your balance is low relative to your limit across all cards.

How to Check: Analyze your credit card statements. Are they close to their limit? Strive to keep your balance lower than 30% of your limit.

Payment History

Ensure that your payment history is excellent. Late payments, even rare ones, can affect your score.

How to Check: Scan your credit report for any late payments. Try to maintain a record of paying on time every month.

Credit Mix

Your credit mix contributes to your score. A healthy balance between revolving and installment accounts shows lenders you handle various types of credit responsibly.

How to Check: Review your credit report to see your balance between credit cards, retail accounts, installment loans, and mortgages. A diverse credit portfolio helps raise your score.

New Credit

Opening several new accounts in a short time span lowers your average account age, impacting your score negatively. How you handle these accounts matters too.

How to Check: Evaluate if you've added new credit accounts recently. If so, ensure you're managing them wisely.

Work meticulously on these factors, and watch your score continue to climb.

How Do I Improve my 746 Credit Score?

Holding an impressive credit score of 746 puts you in a good place, but refining key aspects of your financial habits can push it into the excellent range. Here are a few strategic moves for you to consider:

1. Regular Credit Reports Review

One error on your credit report can dent your score. Regularly check your reports for discrepancies or outdated information. If you spot errors, dispute them promptly with the credit bureaus to maintain your score.

2. Maintain Low Credit Card Balances

Your credit utilization rate can impact your score significantly. It’s best to use less than 30% of your credit limit, and ideally, aim for under 10%. Pay downbalances on cards with higher utilization rates to keep your score healthy.

3. Manage Credit Accounts Responsively

Consider expanding your credit mix, but only if it aligns with your financial needs. This could include adding a installment loan or retail credit card. However, remember to only take on borrowing that you can manage effectively.

4. Monitor Your Credit Age

Longevity is a factor in your credit score, so try to avoid closing older credit accounts, as this can decrease the average age of your credit history and potentially lower your score.

5. Limit New Credit Applications

Many applications in a short period can cause small but significant damage to your score. So, while diversifying credit mix is positive, do it conservatively and avoid making several credit inquiries at once.