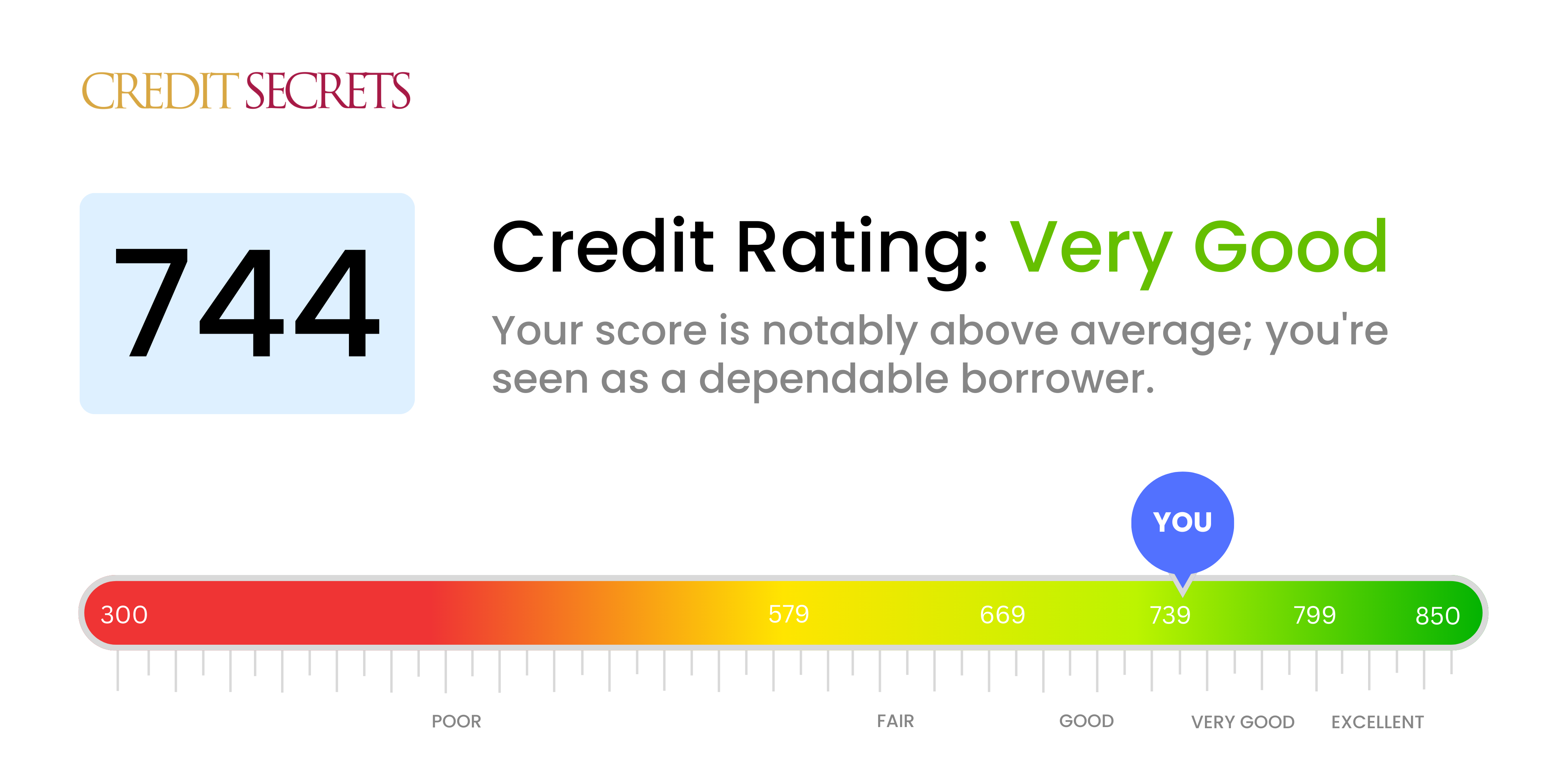

Is 744 a good credit score?

Your credit score of 744 falls into the 'Very Good' category. This means you're likely viewed as a low-risk borrower by financial institutions, which may make it easier for you to get approval on credit cards, loans, and other forms of credit at favorable rates.

Even though you're on the right track, there's always an advantage in boosting the score towards the 'Excellent' range. By making timely payments, keeping your credit utilization low, and avoiding hard inquiries on your credit report, you can improve your score further. This would yield better financial benefits and increased chances of approval for premium credit products. Remember, financial health is a journey and every step you take matters.

Can I Get a Mortgage with a 744 Credit Score?

If you have a credit score of 744, you will likely be approved for a mortgage. This number is seen as a good score that reflects a robust history of responsible financial behavior and consistent repayment of debts. Lenders will interpret this score as an indicator of your reliability in repaying a mortgage, thus showing trust in your ability to handle the loan.

During the mortgage approval process, lenders will carefully scrutinize your financial circumstances alongside your credit score. They will analyze your income, debt-to-income ratio, and employment history to ensure you can cover the mortgage payments. With a credit score of 744, your mortgage interest rate would be relatively low because you pose less risk to lenders. Remember, every mortgage experience is unique, and while your credit score plays a significant role, lenders consider a myriad of factors before granting approval. Stay prepared, patient, and proactive during the process.

Can I Get a Credit Card with a 744 Credit Score?

A credit score of 744 places you in the "good" category, which means your chances of being approved for a credit card are high. Lenders see this score as an indication of good financial health, which suggests that you're likely to meet your credit obligations consistently and on time. This is definitely a worthy accomplishment, presenting a sense of trust in your financial behavior.

Given your strong credit score, you have a broader range of options when it comes to selecting a credit card. You might want to consider premium travel cards or cash back cards, as these tend to offer rewarding perks and benefits to cardholders with good credit standings. However, remember to make a careful assessment of your financial situation and needs before making a decision. Keep in mind, while you are likely to receive competitive interest rates due to your good score, choosing a credit with the lowest possible interest rate and fees should always be a priority.

A credit score of 744, it's noteworthy to mention, is indeed a good score and could significantly increase your chance of getting a personal loan approval. Lenders view such a score as a mark of dependable financial behavior. This scale of credit score shows that you pay your bills on time and can efficiently manage your credit. Consequently, it makes you a less-risky candidate, implying that lenders would be more inclined to approve your personal loan.

In the process of applying for a personal loan, lenders may offer you more favorable interest rates due to your excellent score. This means lower cost borrowing for you, in the long run. While each lender's criterion for approval varies, a credit score of 744 plants you at a relatively comfortable position during the application process. Nonetheless, remember that while this is a major contributing factor, lenders may consider other aspects such as your income and employment status. Stay proactive in maintaining or improving your score, if possible.

Can I Get a Car Loan with a 744 Credit Score?

With a credit score of 744, you stand a very strong chance of getting approved for a car loan. Lenders typically seek applicants with scores above 660 because they consider such individuals to be less risky. Your score of 744 is well into this favored category, which paints a reassuring picture of your credit reliability. This is an indication to lenders that you've managed past credit well, making you a lower risk borrower.

As you embark on the car purchasing process, your solid credit score will positively impact the terms and conditions of your potential car loan, perhaps even securing you lower interest rates. Remember, the higher your credit score, the lower the interest lenders typically offer because of the reduced risk associated with your credit history. It's not a one-size-fits-all scenario though, so be prepared for slight variations depending upon the lender. Even with these positive auguries, your due diligence in selecting the right loan terms remains crucially important.

What Factors Most Impact a 744 Credit Score?

Understanding your credit score of 744 is key to achieving financial health. Your score is shaped by multiple factors, many of which can be managed and improved. Let's break them down.

Payment History

Your payment history significantly influences your credit score. If you've consistently paid your bills on time, this will have contributed positively to your score of 744.

How to Check: Examine your credit report for punctuality of payments. Ensure you've made payments on time. Late payments can negatively affect your score.

Credit Utilization Ratio

Your credit utilization ratio, the amount of credit used versus the total credit available, impacts your score. A lower ratio is better and has likely contributed to your strong score.

How to Check: Check your credit card balances against their limits. Aim to keep your balances lower than 30% of your limits.

Length of Credit History

A long credit history, if managed responsibly, contributes to your credit score. The longer the history, the more information lenders have about your credit behavior.

How to Check: Review your credit report, looking at the age of your oldest account and the average age of all accounts. New accounts can pull down your average.

Credit Mix

Handling a variety of credit types (credit cards, personal loans, mortgages) responsibly can positively influence your score, suggesting you manage your debts effectively.

How to Check: Evaluate your mix of credit accounts on your credit report. Ensure a varied mix and handle them responsibly.

Public Records and Collections

For a score of 744, it's likely that you have no public record or collection issues. If present, they significantly downgrade your score.

How to Check: Search your credit report for any public records and collections. If found, they should be dealt with promptly.

How Do I Improve my 744 Credit Score?

With a credit score of 744, you’re already in a good standing credit-wise. However, there is always potential for improvement. Here’s how you can push your score further:

1. Continual Payment History

This implies always paying your debt on time, which has a significant input on your credit status. Even at your impressive credit score, maintaining a spotless payment history is crucial to improving further. The better your payment history, the higher your score will rise.

2. Limit Your Credit Inquiries

Each time you apply for credit, a hard inquiry is recorded on your report, which slightly dips your score. To increase your credit score, try to lower the number of hard inquiries you’re recording in your report.

3. Sustain a Low Credit Utilization Rate

Keep your balances low on existing credit cards. A low credit utilization ratio – credit balance to credit limit – (ideally under 30%) can have a positive impact on your credit score. With a 744 score, you should aim to keep this rate even lower.

4. Keep Long-standing Accounts Active

To continue improving your score, don’t close old credit accounts, even if you no longer use them. A longer credit history typically results in a higher credit score. Keep these accounts open and use them occasionally to show active and responsible credit management.

5. Maintain a Healthy Credit Mix

A balance of installment loans and revolving credit can positively reflect on your creditworthiness. However, don’t engage in unnecessary credit. It is not advised to take on debt you cannot manage just to improve your credit mix.