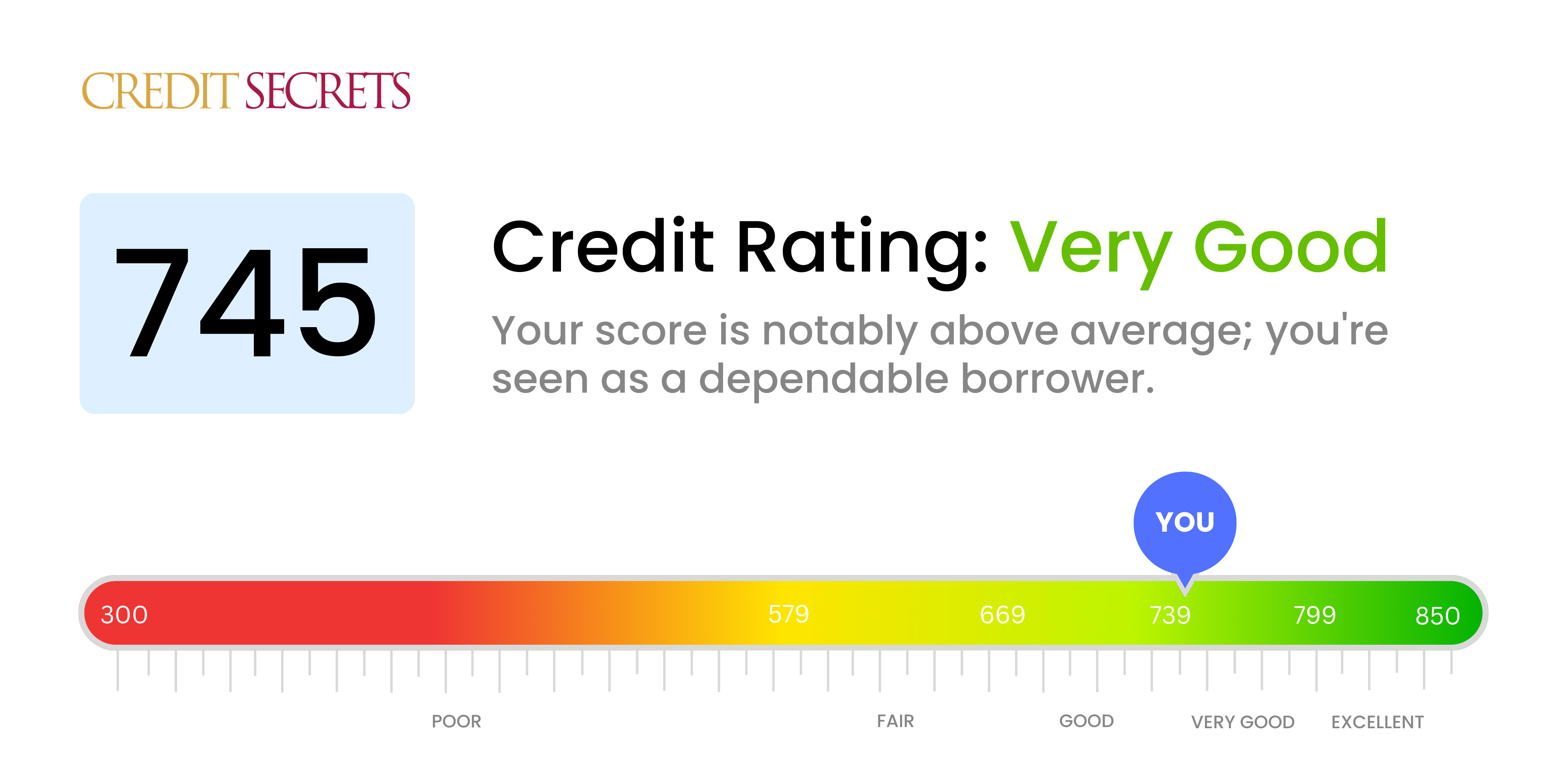

Is 745 a good credit score?

Your credit score of 745 is considered to fall into the 'Very good' category. This means you have done a great job with your credit, allowing you to access various credit and loan opportunities with favorable interest rates and terms. Stay consistent in making your payments on time, keeping your accounts in good standing, and managing your credit utilization rate to maintain or possibly even raise your credit score.

With your current credit score, lenders are likely to see you as a reliable borrower. You may qualify for loans and credit cards with lower interest rates and better terms than those who have lower credit scores. You're on the right path, just continue to manage your credit wisely to keep improving your financial health.

Can I Get a Mortgage with a 745 Credit Score?

Having a credit score of 745 places you in a favorable position to be approved for a mortgage loan. This score demonstrates to lenders that you have a strong history of responsible credit usage and timely payments, which substantially lowers your risk in the eyes of lenders.

During the mortgage approval process, you can expect lenders to examine your income, debt-to-income ratio, employment history, and the size of the down payment. Because your credit score of 745 is deemed as 'very good', your interest rates would be quite competitive. This means the cost of borrowing could be less than it would be for those with lower credit scores. However, always remember each lender has their own standards and you need to research well to find the most suitable deal for your situation.

Can I Get a Credit Card with a 745 Credit Score?

With a credit score of 745, it's highly likely that you'll be approved for a credit card. This score reflects a responsible credit history, showing lenders that you can effectively manage your financial obligations. It's clear that your hard work and consistent payments are paying off, putting you in a position to explore some enticing credit opportunities.

Given your strong score, you may be eligible for premium credit cards, which often feature attractive benefits such as travel rewards or cash back options. These cards can offer more value for your everyday purchases and can further enhance your responsible credit management. Should you wish to consider other options, starter cards could be another fit for your financial situation. Your solid credit score could also unlock lower interest rates, further advantageously positioning you in your credit card journey. Remember, every credit opportunity is a new chance to further build upon your good financial habits. So keep it up!

A credit score of 745 is highly favorable and makes you an attractive candidate for personal loans. With a score like this, lenders view you as a low-risk borrower, which can potentially enhance the approval process. When you apply for a loan, your credit score plays a significant role in determining not only your suitability, but also the terms which you'll receive.

With a score of 745, you step into the process with the advantage of being creditworthy. This credit score could give you access to competitive personal loan offers with lower interest rates, higher loan amounts, and flexible repayment terms in comparison to those with lower scores. However, bear in mind that while your credit score is a key factor, lenders may still consider other aspects such as your income and existing debts. Overall, your path to securing a personal loan appears promising with a credit score at this level.

Can I Get a Car Loan with a 745 Credit Score?

With a credit score of 745, you are in a solid position to be approved for a car loan. Lenders generally see scores above 700 as being good, which means your score is seen as less risky. When lenders see you as less of a risk, it can result in them offering you more advantageous loan terms.

Going through the car purchasing process with your score, you could potentially receive more benefits. This could mean better interest rates, longer loan terms, and/or higher loan amounts. However, it's still essential to thoroughly review the terms and negotiate where necessary, to ensure you receive the most favorable terms. Keep in mind that while a 745 credit score is typically good, the specifics of the loan approval process can vary depending on the lender.

What Factors Most Impact a 745 Credit Score?

Understanding a score of 745 is pivotal for your financial health, as it's a relatively good score. Let's guide you through factors that might have affected this rating. Persistently reviewing these can pave the way for a more prosperous financial future.

Credit Payment History

Consistent and timely payments greatly influence your credit score. Possibly, your score might have improved due to this financial discipline.

How to Check: Scrutinize your credit report for payment regularity. Reflect on the consistency and timeliness of your payments to understand their influence on your score.

Proportion of Balances to Credit Limits

Maintaining a lower credit utilization ratio can boost your score. Your credit score might have been influenced positively if your statement balances were substantially lower than the limit.

How to Check: Check your credit card statements. If your balances are reasonably lower than the limits, it can positively influence your score.

Credit History Duration

A longer credit history can positively affect your score. You might have a long-standing credit history, leading to a stable score.

How to Check: Analyze your credit report for the age of your accounts. The length of your credit history might have positively impacted your score.

Assortment of Credit and New Credit

Having a diverse portfolio of credit types can help increase your score. This suggests your capability in handling different types of credit responsibly.

How to Check: Scrutinize your portfolio. If it includes a good mix of credit types, it might have contributed to your current score.

Credit Inquiries

Minimized credit inquiries can positively affect your score. Fewer credit applications suggest financial stability and discipline.

How to Check: Examine your credit report for 'hard inquiries'. Avoiding frequent credit applications can steadily build your score.

How Do I Improve my 745 Credit Score?

With a credit score of 745, you have good credit but there’s always room for improvement. Here’s some actionable next steps tailored to your current situation:

1. Regularly Monitor Your Credit

Knowledge is power. By consistently checking your credit report, you’ll be aware of any changes that could affect your score. Look for any discrepancies or unfamiliar activities. Spotting and reporting these early can protect you from credit fraud and identity theft.

2. Maintain Low Credit Card Balances

Even though you have a high credit score, maintain the habit of keeping your credit card balances low. Aim to use less than 30% of your available credit at any given time. This will not only keep your credit utilization ratio low but also leave room for unexpected expenses.

3. Avoid Excessive Credit Inquiries

Each time you apply for new credit, a hard inquiry is made on your credit report, which may reduce your score. A lot of these inquiries in a short span of time can be viewed negatively, so apply for new credit sparingly.

4. Pay Bills on Time

Consistency is key. Always ensure that you pay all your bills on time, every time. This can include anything from utilities and rent, to student loans and auto loans. Your payment history greatly influences your credit score.

5. Diversify Your Credit

Having a mix of credit types can positively impact your credit score. These can range from credit cards, auto loans, mortgage loans and student loans. But remember, always manage it responsibly.