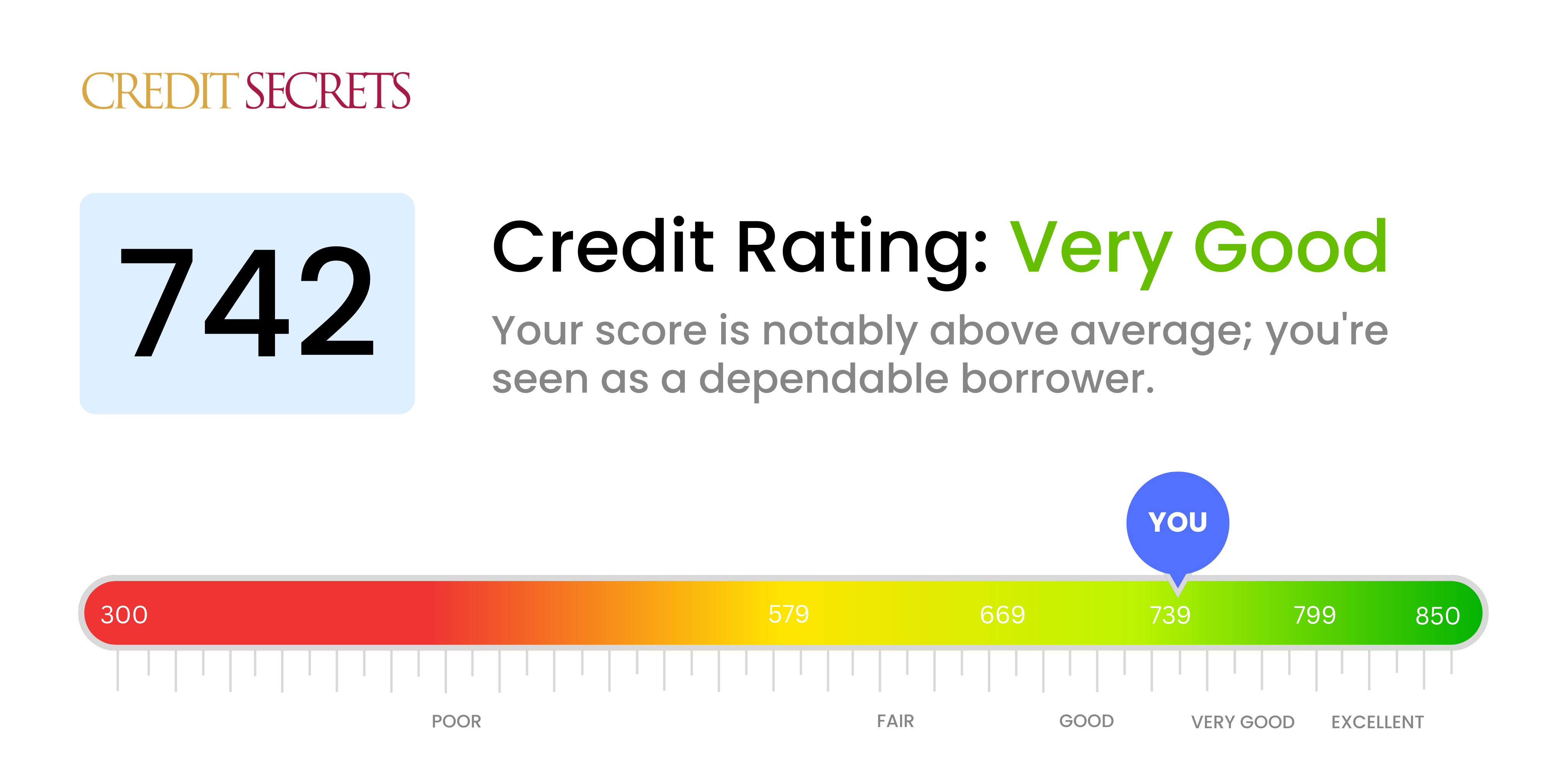

Is 742 a good credit score?

Having a credit score of 742 places you in the 'Very Good' category. This means you've done an impressive job in managing your credit, and most lenders will see you as a low-risk borrower. You can likely expect competitive interest rates on loans and credit cards, and even approval for higher loan amounts.

That being said, it's essential to remember that maintaining a good credit score requires consistent effort. Prompt payments, low credit utilization, and a varied credit mix are all integral to preserving or even enhancing your credit standing. Strive for excellence and aim for a credit score in the 'Excellent' range not just to have easier access to credit, but to be in the best possible financial health for yourself.

Can I Get a Mortgage with a 742 Credit Score?

With a credit score of 742, you are in fact very likely to be approved for a mortgage. This score is considered to be a good credit score in the eyes of financial institutions, demonstrating a consistent history of financial responsibility and timely payments. You have already crossed one of the major hurdles towards home ownership.

Moving forward in the mortgage approval process, you can expect to be seen as a creditworthy borrower by most lenders. This means you will likely face fewer obstacles during the application process. However, it's essential to remember that while a strong credit score like yours is a key factor, lenders will still consider other variables such as your income and overall debt levels. Furthermore, your admirable credit score can potentially lead to a lower interest rate on the mortgage, which can save you a significant amount of money over the life of the loan.

Can I Get a Credit Card with a 742 Credit Score?

Having a credit score of 742 is a positive reflection of your credit history. It indicates you're likely to be approved for a credit card. Lenders see this score as reassuring, signaling a history of responsible financial management. Recognize this as a sign of your financial competency and disciplined approach towards credit.

A credit score like this opens up a variety of credit card options. Opting for a premium travel card can be a wise decision as they often provide various travel-related benefits. Alternatively, cash back cards offer tangible rewards for your everyday purchases. It's integral to choose a card that aligns with your lifestyle and spending habits. Keep in mind, cards with higher rewards often come with higher interest rates and annual fee requirements. Therefore, evaluate these aspects and choose wisely. Your credit score is proof of your financial credibility and it's your ticket to broader financial possibilities.

If you're currently sporting a credit score of 742, you'll be pleased to know that your likelihood of getting approved for a personal loan is high. This score, which is well above average, presents you as a reliable borrower in the eyes of lenders. Having demonstrated responsible debt management, you signify a low risk of default, making you an attractive applicant for a personal loan.

Despite the good news, it's essential to maintain realistic expectations during the personal loan application process. Remember to account for factors like interest rates, which could be higher or lower based on your exact credit score, income, and other variables. It's also worth noting that each lender may have different credit requirements. Don't become discouraged if a particular lender denies your application - plenty of other lenders may approve your loan with a credit score of 742. The most important takeaway is to keep your financial health in order by continuing to pay your bills on time and manage your debts responsibly.

Can I Get a Car Loan with a 742 Credit Score?

With a credit score of 742, you're in a pretty solid position to be approved for a car loan. Lenders often seek scores around 660 or above, and your score considerably surpasses this threshold. This places you in a lower risk category from a lender's perspective and suggests you're likely to repay your loan on time. This strong credit score generally reflects a steady track record of timely payments and responsible credit use.

As you embark on the car purchasing journey, remember that your higher credit score may open the door to more favorable loan terms. One of the key benefits you can expect is a competitive interest rate, which can mean considerable savings over the life of your loan. It's an important factor to keep in mind as you negotiate and navigate the car buying process. Keep in mind though, interest rates and terms still can vary among lenders, so be sure to shop around for the ideal loan that matches your financial needs.

What Factors Most Impact a 742 Credit Score?

Possessing a credit score of 742 places you in the category of a good credit rating, yet there's still room for enhancement. Knowing the factors that impact your score can help you focus your efforts effectively. Each credit journey is unique and offers you chances to progress financially.

Credit Utilization

While your credit utilization is probably quite low, pushing it a bit lower can still improve your score. How much of your available credit you're using plays a significant role in your score.

How to Check: Review your current balances in relationship to your credit limits. Keeping balances below 30% of your credit limit can be beneficial.

Length of Credit History

Improving the duration of your credit history can boost your score further. The average history of your accounts, along with the lifespan of your oldest account, significantly impacts your score.

How to Check: Inspect your credit report to verify the age of your accounts. Account longevity and the frequency of newly opened accounts are subjects to consider.

Credit Mix

Even with a good score, broadening your credit mix by responsibly managing various types of credit can still benefit you.

How to Check: Look at your variety of accounts. Responsible management of different credit types such as credit cards, auto loans, or a mortgage can positively affect your score.

Inquiries

Excessive hard inquiries can dent your score. While you're likely managing this well, it's worth focusing on continued responsible behavior.

How to Check: Inspect your credit report for hard inquiries. Existing inquiries fall off after two years, so limiting new ones can help your score.

How Do I Improve my 742 Credit Score?

A credit score of 742 is a fairly solid score, and with targeted strategies, you can continue to strengthen your credit rating. Below are the best methods for someone in your situation:

1. Maintain Credit Card Balances

It’s of utmost importance that you keep your credit card balances low. Aim to keep the balances to below 30% of your overall credit limit. Prioritizing cards with the highest utilization can further improve your score. Make sure all your payments are also timely.

2. Regular Credit Card Use

Regular, responsible use of credit cards can bolster your score. Make small purchases regularly on your credit card and pay off the balance in full each month. This portrays a positive account activity that can further support your score.

3. Continuous Credit Monitoring

Keep a close eye on your credit report for any discrepancies. Any mistakes can have a significant impact on your score. If you notice anything unusual, like unexpected hard inquiries or errors in your personal information, dispute them promptly.

4. Long-term Credit Building

Length of credit history plays a part in your score. As long as you’re being responsible with your credit, try to keep older accounts open to boost your credit score over time.

5. Explore Different Credit Types

To showcase your creditworthiness, consider diversifying your credit. This could include taking out a small personal loan or opening a retail credit card. The key is to manage these new lines of credit responsibly.