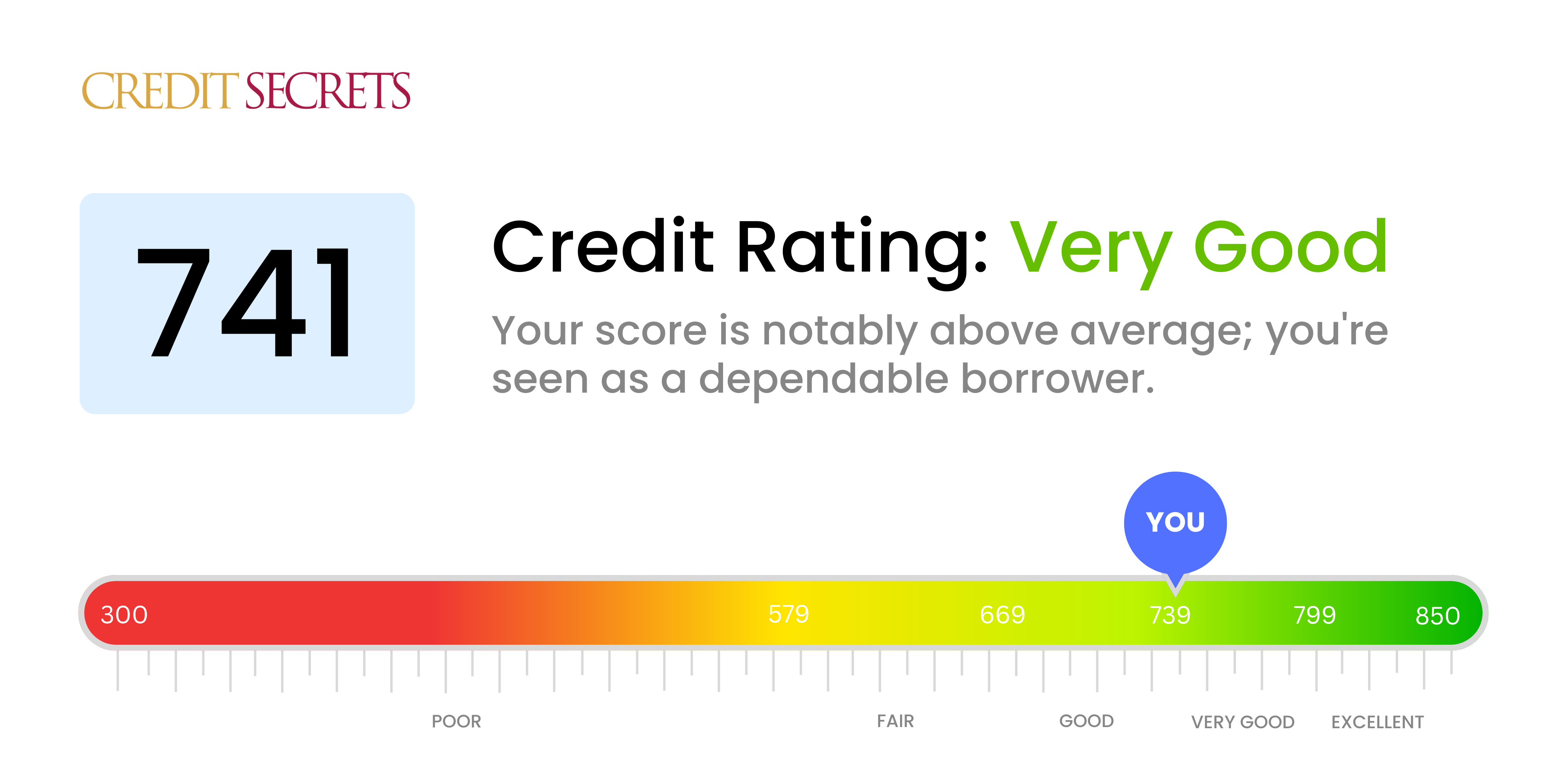

Is 741 a good credit score?

Your score of 741 puts you in the 'Very Good' category of credit rating. You can breathe a sigh of relief knowing that lenders consider you a reliable borrower, potentially opening more financial doors for you, whether it's securing a competitive mortgage rate, a car loan, or a higher credit limit on a credit card.

While this is indeed good news, always remember that maintaining this score or pushing it higher requires diligence in managing your credit lines and making payments on time. Adopting a proactive and responsible attitude towards your personal finance should always be your foremost objective, regardless of your credit score. Go forward with confidence but vigor, because a better financial future awaits with each step you take.

Can I Get a Mortgage with a 741 Credit Score?

With a credit score of 741, you are in a good spot when it comes to applying for a mortgage. Your credit score indicates that you have a strong history of responsible borrowing and timely payments. This score typically signifies to lenders that you are a low-risk borrower, which could result in more favorable loan terms.

As you navigate the mortgage approval process, do keep in mind that the actual mortgage rate you are offered will likely depend on a variety of factors, including your income, debt level, and the size of your down payment. While your credit score is an essential part of the puzzle, those additional factors will also play a significant role. And although a score of 741 generally leads to better loan terms, shopping around for the best mortgage rate is still highly recommended. This due diligence could lead to significant savings over the life of your loan.

Can I Get a Credit Card with a 741 Credit Score?

With a credit score of 741, there's a solid chance of being approved for a credit card. Having such a score indicates a history of responsible credit behavior and trustworthy financial management. No doubt, seeing this score may bring feelings of relief. It shows you're on the right path to achieving your financial goals and maintaining a healthy credit status.

Such a favorable score opens the door to a variety of credit cards suited to your needs and lifestyle. Premium travel cards and high reward credit cards can come into play, benefiting you by offering points for travel, dining, and other expenses. Consider researching cards that offer perks that align with your spending habits to make the most of these benefits. It's also advisable to remember that interest rates can vary, so it is wise to review the details before committing. While maintaining your credit score requires consistent responsible behavior, there's no denying that a score of 741 puts you in a strong place to continue your financial journey.

With a credit score of 741, you are highly likely to be approved for a personal loan. This score is considered "very good" by most lenders, showing your reliability as a borrower and indicating a low risk for the lender. However, keep in mind that your credit score is only one factor that is being considered during the loan approval process. Your income, expenses, and job status also play significant roles.

What can you expect when applying for a loan? The lender will generally review your application and credit report before making a decision. If they approve your loan, they will present you with the loan terms, including the interest rate. With a credit score of 741, you can anticipate a lower interest rate as compared to someone with a lower credit score. Remember, a lower interest rate can save you significant amounts of money over the life of the loan. Be sure to read the loan terms carefully and consider them in the context of your financial goals and capabilities.

Can I Get a Car Loan with a 741 Credit Score?

Having a credit score of 741 puts you in a favorable position for securing a car loan. Lenders typically look for scores in the 660 or above range and your 741 score is comfortably within that bracket. This means that lenders will view you as lower risk for repaying the loan, making them more inclined to grant approval.

What this implies during your car buying journey is generally more favorable terms in your loan agreement, including potentially lower interest rates. Remember, lenders are in the business of managing risk - the higher your credit score, the less risk you represent. Consequently, they are willing to offer more favorable conditions. Despite this, it's always wise to carefully read your loan agreement majority expects interest rates to continue to rise over the next year. While your solid credit score of 741 provides a strong foundation, always remember to review all contract details thoroughly before signing.

What Factors Most Impact a 741 Credit Score?

Understanding Your 741 Credit Score

With a credit score of 741, you're in a good spot, but there's always room for improvement. Here are a few aspects of your credit profile that may be affecting your score.

Credit Utilization

Your credit utilization might be negatively impacting your score. Strive to keep your usage below 30% of your total limit.

How to Check: Review your credit card statements. Look at the balances compared to your limits. If they're significantly high, this could be a factor.

Payment History

Do you consistently make on-time payments? Even occasional late payments can pull down your score.

How to Check: Scan your credit report for any late payments. Remember, consistency is key to improving your payment history.

Length of Credit History

The age of your credit accounts could also matter. Lenders like to see a longer credit history with the responsible use of credit over time.

How to Check: Check your credit report to find out the age of your oldest and newest credit accounts, along with the overall average.

Type of Credits

Having diverse types of credits (like credit cards, mortgage, auto loans) might positively impact your credit score.

How to Check: Review your credit report to evaluate your mix of credit types. It's fruitful to manage different types of credits responsibly.

Credit Inquiries

Too many hard inquiries in a short span can have a negative effect.

How to Check: Your credit report will list all recent inquiries. It's best to apply for new credit only when needed.

How Do I Improve my 741 Credit Score?

Having a credit score of 741 places you in a ‘good’ credit category, providing you with a solid foundation to enhance your score even further. Let’s quickly dive into the most achievable and effective strategies for an individual in your position.

1. Maintain Low Balances

One of the most accessible ways to give your score a boost is to maintain low balances on your credit cards. Strive to keep your credit utilization – which is the percentage of available credit you’re using – under 30%. But, focusing on bringing it down to just 10% can truly optimize your score.

2. Consistent On-Time Payments

You’re probably regularly meeting your payment obligations already. Keep it up. If you have any rare slips, try to avoid late payments. Consistently paying your bills on time is crucial for your credit health.

3. Strategically Apply for New Credit

Avoid frivolously applying for new credit. If you do need to apply for credit—be it a credit card, a car loan, or a mortgage—make sure it’s strategically timed and justified.

4. Review Your Credit Report

Take advantage of free credit reports to thoroughly review for any mistakes or inaccuracies. If you find any, make sure to dispute them immediately as such errors can ding your credit.

5. Keep Old Accounts Open

Don’t close your unused credit cards unless they carry expensive annual fees. Keeping them open can extend the length of your credit history and improve your credit utilization, both are beneficial for your credit score.