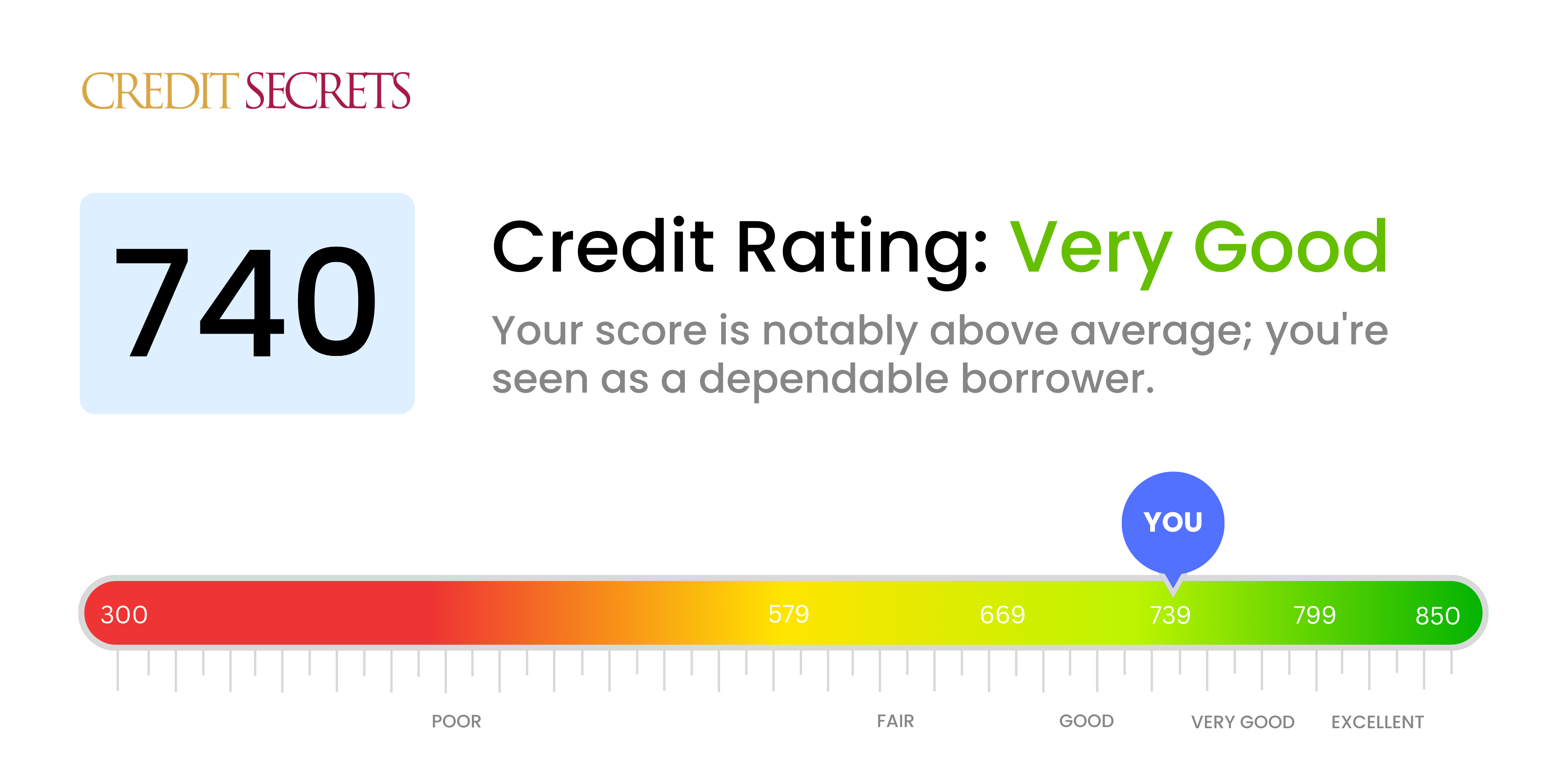

Is 740 a good credit score?

Your credit score of 740 is considered to be very good, which is a positive position for managing your personal finances. Having this score likely allows you to gain approval for loans at competitive interest rates, and you may also enjoy better deals on credit cards and insurance premiums, demonstrating the trust lenders have in your ability to repay debts consistently and on time.

Can I Get a Mortgage with a 740 Credit Score?

With a credit score of 740, it's more likely than not that you'll be approved for a mortgage. This credit score is seen as very good by most lenders, reflecting a history of responsible credit usage and timely repayments. This is encouraging news for your homeownership dreams.

Your strong credit score can be advantageous in the mortgage approval process. Lenders may not just give you an approval, but you can also expect potentially lower interest rates, making your home loan more affordable in the long run. Be prepared though, as the mortgage approval process involves more than just your credit score. Lenders will also look at your income, debt-to-income ratio, and the size of the down payment that you're able to make. It might be a demanding process, but bear in mind that your solid credit score of 740 is a significant piece of the puzzle. Keep going forward and remember, owning your dream home is within reach.

Can I Get a Credit Card with a 740 Credit Score?

Having a credit score of 740 makes you a favored candidate in the eyes of many credit card issuers. This score signifies a responsible credit history, which card issuers tend to see as an indication of less risk. Keep in mind, though, that approval always depends on the specific lender's criteria. Be proud of your good credit, but remember it's vital to maintain this level of fiscal responsibility.

With a score of 740, you have the ability to be somewhat selective about your card choice. You might consider premium travel cards, as many rewards cards offer generous introductory bonuses, free travel and other perks for those who continually demonstrate good credit. Additionally, many of these cards also come with lower interest rates, which means you could save money over time if you occasionally carry a balance. However, always carefully read the terms and conditions, and ensure the card aligns with your financial habits and goals.

Having a credit score of 740 puts you in a strong position to be considered for a personal loan. This score is viewed favorably by traditional lenders who regard it as a reflection of your responsible financial habits. A score such as this generally demonstrates a consistent history of timely payments and a healthy management of credit.

As you navigate the loan application process, you can anticipate a few benefits associated with your good credit score. The likelihood of getting approved is quite high, and you're more likely to be offered better terms. This might include lower interest rates, which can save you a substantial amount over the life of your loan. However, remember that while your credit score is a significant factor, lenders also consider other aspects such as your income and employment situation when evaluating your loan application.

Can I Get a Car Loan with a 740 Credit Score?

With a credit score of 740, you're in a strong position to get approved for a car loan. Lenders typically see scores above 700 as demonstrating good credit management, and your score of 740 is comfortably within that range. You've shown to lenders that you can handle your financial obligations responsibly, which bodes well for getting the green light on your car loan application.

Entering the car purchasing process with a credit score of 740 opens up several positive possibilities. For instance, you can expect to receive lower interest rates on your car loan compared to those with lower credit scores. The lower the interest rate, the less you'll have to pay back in addition to the borrowed amount. Keep in mind though, while your strong credit score significantly improves your likelihood of loan approval, a few other factors like income and debt-to-income ratio may also come into play. But in general, a 740 credit score puts you on a good path towards car ownership.

What Factors Most Impact a 740 Credit Score?

Decoding a credit score of 740 is an essential step on your road to financial empowerment. Let's take a look at the factors that might be contributing to this score, which sits firmly in the good range. Remember each financial journey is unique and full of learning experiences.

Credit Utilization Ratio

A crucial component of your score is your credit utilization ratio. Maintaining balances significantly lower than your credit limits demonstrates responsible usage.

How to Check: Scrutinize your credit card statements to check if your balances are far from the limits. Aim to keep your utilization as low as possible.

Credit History

Length of credit history plays a considerable role. The longer your history, the higher the score.

How to Check: Examine your credit report to determine the ages of your oldest and most recent accounts, as well as the overall average age of all your accounts.

Credit Mix

Having a diverse credit mix, including credit cards, installment loans, and mortgages, contributes positively to your score.

How to Check: Assess the variety of credit accounts you own. Ensure you're shrewdly managing all types of credit.

Recent Inquiries

Arrival of new credit can temporarily drop your score. Frequent applications for new credit could be a factor if your score is lower than expected.

How to Check: Scan your credit report to identify recent inquiries or new accounts.

Through understanding and adjusting these elements, you can continue your journey in improving your robust 740 credit score even further.

How Do I Improve my 740 Credit Score?

A 740 credit score is classified as very good, putting you favorably in the eyes of lenders. However, there’s always room for enhancement to reach an excellent range. Here are some steps you can take at your current score level:

1. Maintain Low Balance-to-Limit Ratios

Though likely not maxed out, aim to keep your credit utilization below 20% for each card. For example, if your credit limit is $5,000, aim to keep balances below $1,000. This can help nudge your score upwards.

2. Pay On Time, Every Time

Consistently making payments on time has a major impact on your credit score. Even at a high credit score, a single 30-day late payment can significantly drop your score. Set up automatic payments to avoid this common pitfall.

3. Limit Credit Applications

Hold off on applying for new credit. You should avoid hard inquiries on your report because these can decrease your credit score when lenders check you out.

4. Monitor Your Credit Report

Though you’re in a strong position, monitor your credit report for errors. Even minor inaccuracies can negatively impact your score and could indicate potential fraud. Correct any errors as soon as you find them.

5. Diverse Credit Portfolio

If you only have one type of credit, try diversifying it. Having a mix of credit types — credit cards, student loans, mortgages — can positively influence your score, as long as all are managed responsibly.