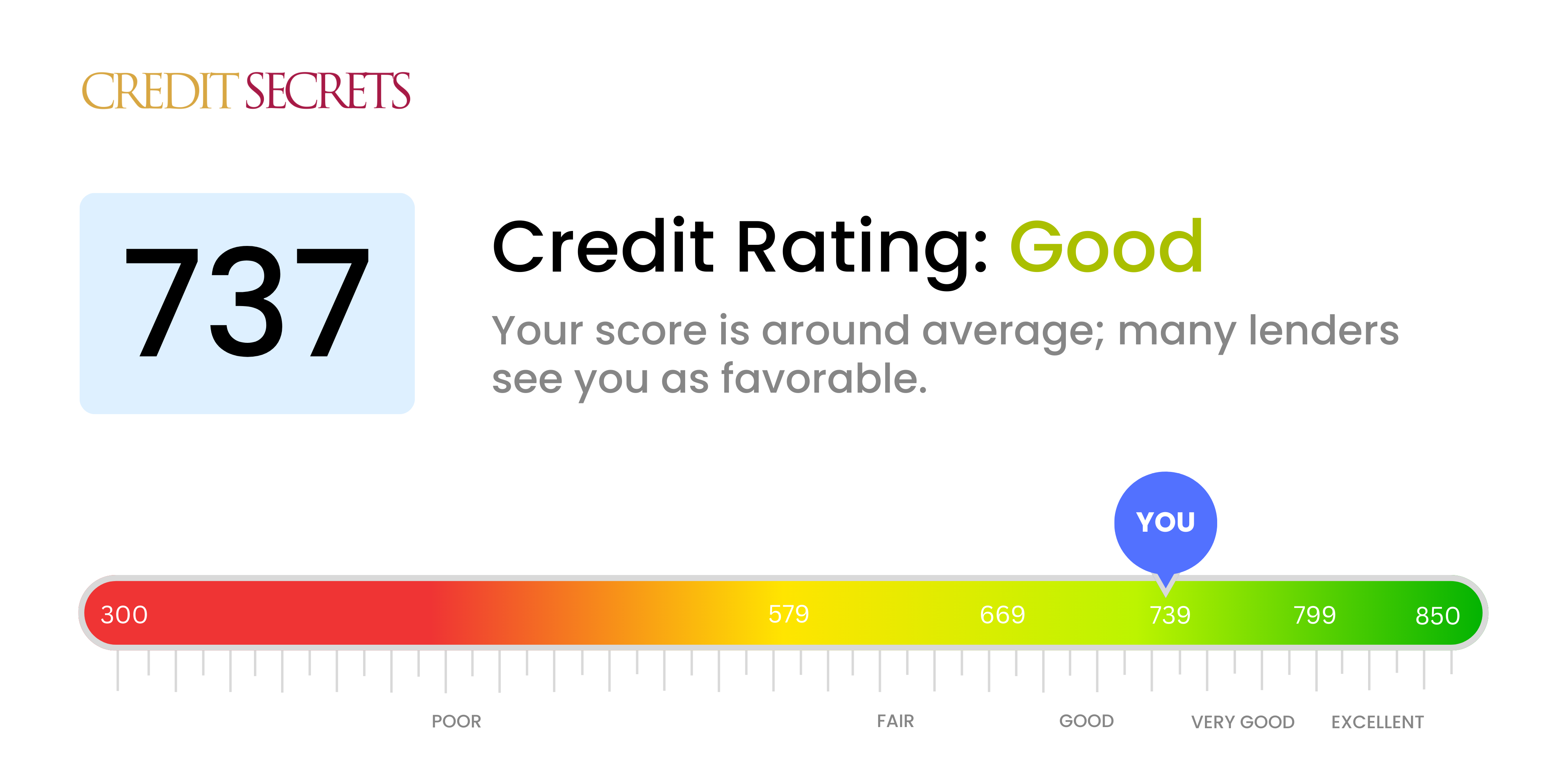

Is 737 a good credit score?

With a credit score of 737, you're just on the edge of a Very Good credit rating. This is a commendable achievement, reflecting responsible credit use, and it suggests that you've done a great job managing your finances.

With this score, lenders are likely to see you as a trustworthy debtor and offer favorable terms on loans or credit. This improved standing could make it easier for you to secure financing for big-ticket items like a new car or home. However, remember, even with this score, it's crucial to continue making timely payments and keep balances low to maintain or even improve your credit health.

Can I Get a Mortgage with a 737 Credit Score?

Having a credit score of 737 puts you in a favorable position for being approved for a mortgage. This score is considered a good credit score by most lending institutions, which implies a reliable history of debt repayments and responsible lending habits. Lenders are more likely to trust you with their money, making mortgage approval more attainable.

As you enter the mortgage approval process, anticipate being viewed as a lower risk candidate by lenders due to your good credit score. This might also positively influence the interest rates on your mortgage, potentially securing more favorable terms. Remember, while a 737 credit score increases your chances of mortgage approval, other factors like your income, employment history, and debt-to-income ratio also play important roles. Broadly, a good credit score provides a solid foundation for your mortgage application, increasing the likelihood of a positive result.

Can I Get a Credit Card with a 737 Credit Score?

With a credit score of 737, you are in a good position to get approved for a credit card. This score is seen favorably by lenders, reflecting your ability to manage credit well. It's crucial to respect this positive score and understand that it opens up a variety of financial opportunities for you.

Given this strong credit score, you can consider a range of credit cards that best fit your needs. If you are just starting out, a starter card could prove useful. However, if you have a handle on credit and can manage it carefully, premium travel cards or reward cards may be within reach. These cards often require a higher credit score but come with perks like travel rewards or cash back options. Always remember, even with a good credit score, interest rates can vary based on the provider, card type and your personal financial situation. So, it's important to do your homework before applying.

If your credit score is 737, you'll likely be viewed favorably by lenders for a personal loan. This score falls within the good to excellent range, indicating that you're responsible with your credit. It showcases that you make your payments on time and have a history of effectively managing debt. Hence, lenders typically have more trust in borrowers with these scores, making your application process a bit smoother than for those with lower scores.

When applying for a personal loan with a credit score of 737, lenders usually offer competitive interest rates, more favorable repayment terms, and a faster approval process. However, it's essential to remember that while your credit score is a significant factor, lenders also consider other elements such as your income, job stability, and debt-to-income ratio. Therefore, maintain a good financial habit and always compare loan offers from different lenders to get the best possible deal.

Can I Get a Car Loan with a 737 Credit Score?

Holding a credit score of 737 usually puts you in a good position to get approved for a car loan. This score is well above the average and is commonly considered to be good. Lenders use credit scores as one measure of your financial reliability, and your score of 737 indicates credit-worthiness in the eyes of most lenders.

You can anticipate receiving favorable loan terms due to your credit score. When purchasing a car, lenders will likely offer you lower interest rates, which means your monthly car payments may be more affordable. However, it's important to remember that while your credit score plays a critical role, lenders will also consider other factors such as your income and employment history. Nonetheless, a credit score of 737 generally provides an advantageous starting point in the car purchasing process.

What Factors Most Impact a 737 Credit Score?

With a credit score of 737, you're on the right path towards achieving excellent credit. However, there might still be room for improvement. Understanding the aspects that greatly influence your score will provide additional clarity and help you craft a good strategy for your financial progress.

On-Time Payments

Prompt payment of your bills is critical for maintaining a good credit score. Late payments or defaults might have pulled your score down.

How to Check: Have a look at your credit report for any marks of late payments or defaults, as these lapses could have negatively impacted your score.

Credit Card Utilization

Credit utilization, which is the amount of credit you're using compared to your credit limit, can significantly affect your credit score. If your credit utilization is high, it might be holding your score back.

How to Check: Analyze your credit card bills. Are you frequently pushing the limits? Keeping your balances low in relation to your overall credit limit is advisable.

Length of Credit History

If the duration of your credit history is relatively short, your score might benefit by maintaining your credit accounts for a longer period.

How to Check: Examine your credit report for the age of your oldest and newest accounts, as well as the average age of all your credit accounts.

Recent Credit Inquiries

Making too many credit inquiries in a short timeframe can reduce your credit score. It's important to manage new credit responsibly.

How to Check: Review your credit report to see if multiple new inquiries or recently opened credit accounts are impacting your score.

Public Records

Any presence of public records like bankruptcies or tax liens can take a large toll on your credit score.

How to Check: Browse your credit report for any such public records. Any such entries require your prompt attention.

How Do I Improve my 737 Credit Score?

With a credit score of 737, you’re on the right path to an excellent credit history. However, there are some key steps you can take for further improvement:

1. Maintain Low Credit Card Balances

Keep your credit card balances as low as possible, ideally under 10% of the card’s limit. This keeps your credit utilization ratio down, which is a major factor in credit scoring models.

2. Pay Bills On Time, Every Time

Your payment history is the most influential factor with regard to your credit score. Make it a priority to pay each bill before the due date, showing lenders your reliability.

3. Monitor Your Credit Report Regularly

Stay aware of what’s on your credit report. Regularly reviewing your report allows you to spot and correct any inconsistencies or errors quickly.

4. Limit Hard Inquiries

Hard inquiries occur when a lender or company checks your credit as part of a loan or credit approval process. Too many can lower your score, so limit these where you can.

5. Plan and Follow a Budget

Plan a budget that helps you spend within your means and save consistently. Improving your personal financial habits will have a positive impact on your credit score over time.