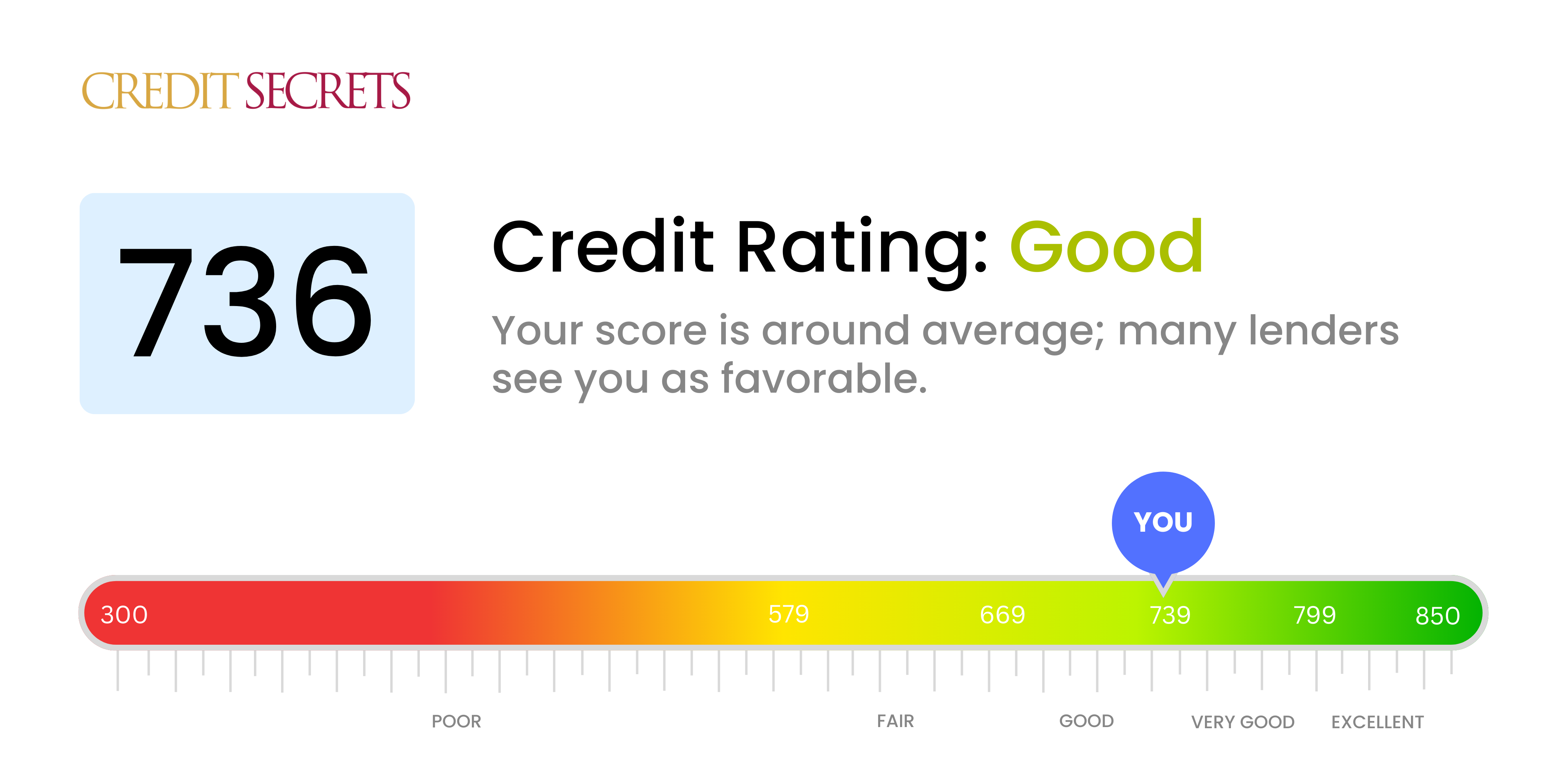

Is 736 a good credit score?

With a credit score of 736, yours sits right on the cusp of being 'Very Good.' Despite being a touch below this range, it's important to remember that a 736 credit score is still recognized as 'Good'.

What does that mean for you? Well, you're likely to receive relatively favorable terms when applying for credit or loans. Though you may not receive the absolute best interest rates, lenders see you as a dependable borrower. Keeping up the good work and pushing your score into the 'Very Good' range can open the door to even better opportunities. Stay positive, your financial journey is on a steady course.

Can I Get a Mortgage with a 736 Credit Score?

If your credit score is 736, you should be in a decent position to be approved for a mortgage. A score in this range generally indicates reliable financial habits like consistent, on-time payments and responsible use of credit. This score is widely considered good and should help open doors to various lending opportunities.

However, bear in mind that your credit score is just one component in the mortgage approval process. Lenders also consider factors like your employment history, income, and the amount of debt you currently hold. With a score of 736, while relatively good, may still yield higher interest rates than those with top-tier credit. Mortgage rates tend to be more favorable for borrowers with credit scores above 760. Nonetheless, this should not deter your aspirations of homeownership; it simply provides an area for potential improvement in the quest for better lending provisions.

Can I Get a Credit Card with a 736 Credit Score?

With a 736 credit score, you stand a good chance of approval for a credit card. This score reflects financial responsibility and is likely to be seen positively by many lenders. It's vital to recognize that attaining such a score reflects diligence and careful financial management, paving the way for potentially better financial opportunities.

Given your score, a range of credit card options could be suitable. Secured cards might not be necessary as they are often more suited to those with lower scores. Instead, you might consider standard credit cards that offer benefits such as cash back and rewards points. Premium travel cards could also be within your reach, offering a variety of perks including travel points and access to exclusive lounges. However, these often come with steep annual fees. Be sure to consider your lifestyle and spending habits to select a card that suits your needs whilst optimizing benefits. Remember, even with a good score, it is important to compare interest rates and fees to ensure the best financial choice.

A credit score of 736 is generally deemed good by most lenders. With a score in this range, there's a high likelihood that your application for a personal loan will be approved. Your good credit score represents a lower degree of risk for lenders, and it indicates that you have a history of handling your financial obligations responsibly.

This score will also be beneficial to you during the loan application process, as it could qualify you for more favorable interest rates. Though rates can vary depending on the specific lender and your overall financial situation, having a good credit score often translates into lower interest costs over the life of the loan. With a credit score of 736, you can approach the loan application process with confidence and optimism, knowing that you have a strong likelihood of approval.

Can I Get a Car Loan with a 736 Credit Score?

With a credit score of 736, you are in a solid position for securing a car loan. Typically, lenders see scores above 660 as a positive sign, showing that the borrower has a strong history of managing their financial obligations. Your score is well above this threshold, suggesting that you have responsibly handled your credit in the past. This provides lenders with the confidence that they are not taking a large risk by approving your loan.

During the car purchasing process, you can expect some advantages due to your healthy credit score. For instance, you will likely receive offers with lower interest rates from lenders compared with individuals who have lower credit scores. This reduces the overall cost of your loan, making your car purchase more affordable over time. Even so, it's crucial to carefully review the terms of any loan offers you get. Always remember that understanding your financial commitments fully is key to maintaining your strong credit score.

What Factors Most Impact a 736 Credit Score?

Understanding your 736 credit score and the factors impacting it can guide you to a brighter financial future. The particular elements most likely impacting your score at this level demand some exploration.

Credit Utilization

Your credit utilization rate plays a significant role in your credit score. Even with a score of 736, high balances relative to your limits could be negatively affecting it.

How to Verify: Look over your credit card balances. If they are nearing their limit, it will be beneficial to reduce them, thereby improving your credit utilization rate.

Length of Credit History

Your length of credit history impacts your credit score. If your credit history isn't long, this might be a contributing factor to your current score.

How to Verify: Check your credit report to see the age of your oldest and most recent accounts, along with the average age of all your accounts. Recent account openings might be impacting your score.

Credit Inquiries

Frequent credit inquiries could potentially lower your score. Responsible behavior towards new credit is crucial to maintain and improve your score.

How to Verify: Review your recent credit activities. Too many new credit applications within a short period might be impacting your score.

Payment History

While someone with a score of 736 likely has a good payment history, even one or two late payments can lower the score.

How to Verify: Check your payment history on your credit report. Ensure all payments have been made on time, as any delay can decrease your score.

How Do I Improve my 736 Credit Score?

A credit score of 736 is considered good, and it’s just a few steps away from the ‘excellent’ category. Here are the most impactful strategies for this score level:

1. Maintain On-Time Payments

Consistency in paying your bills on time is crucial for enhancing your credit score. Your payment history has a significant impact on your credit, so ensure all bills – be it utilities, rent or credit card – are paid promptly each month.

2. Monitor Your Credit Report

Regularly reviewing your credit reports can identify any inaccuracies that could unfairly lower your score. If you spot any, promptly dispute them with the respective credit bureau.

3. Optimize Your Credit Utilization

Strive to keep your credit card balances well below your total credit limits. While you may be doing well already, aiming for under 20% can positively influence your score.

4. Limit New Credit Applications

Resist the temptation to apply for unnecessary credit. Too many hard inquiries on your report can lower your score.

5. Be Patient

Increasing your credit score is a marathon, not a sprint. Continue responsible financial habits, and your score will reflect it over time.