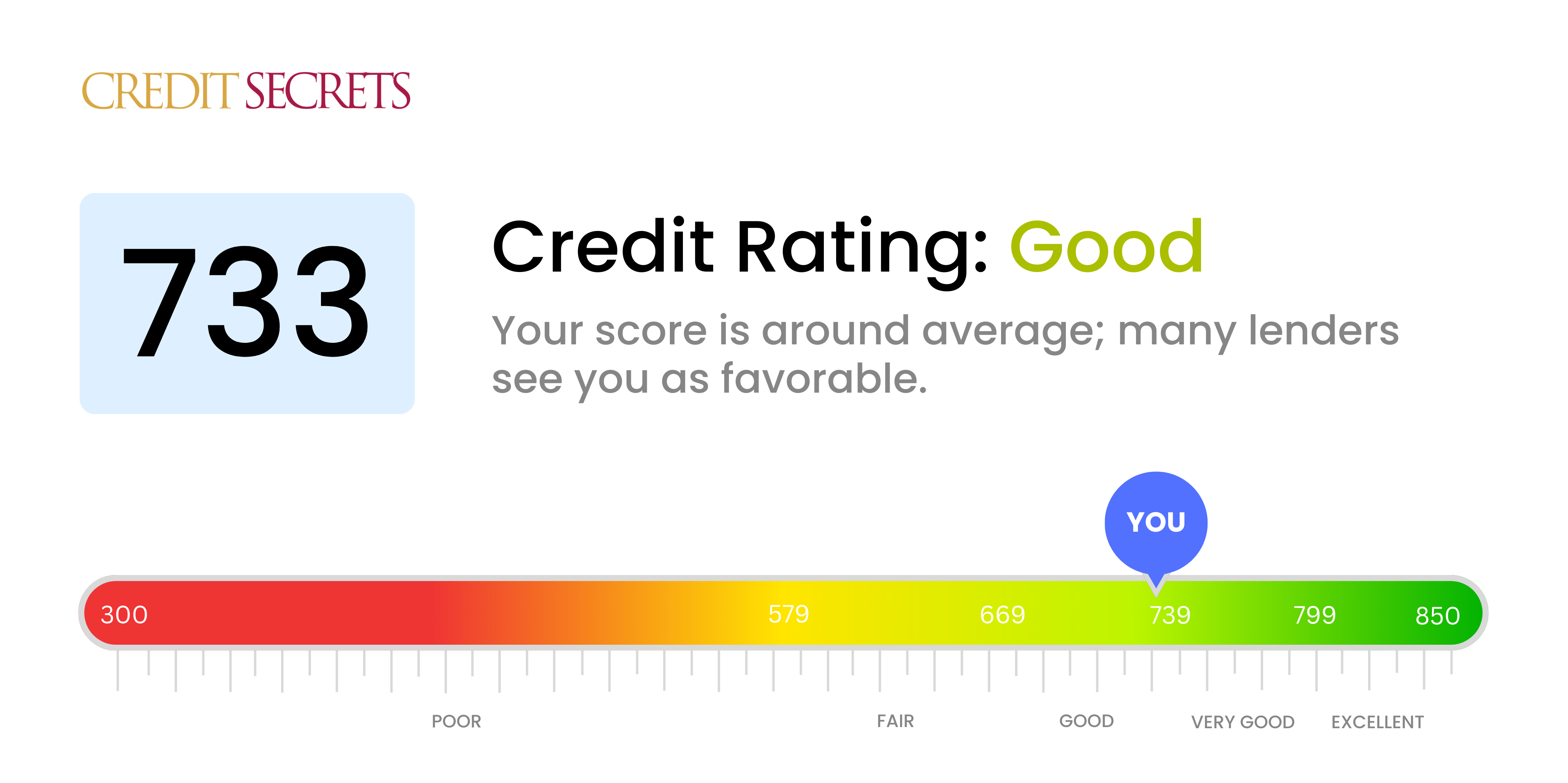

Is 733 a good credit score?

With a credit score of 733, you're right on the cusp of a very good rating – you're doing well. While your score isn't quite in the 'very good' range of 740 to 799, it's significantly above average, solidly in the 'good' range of 670 to 739.

What this means for you is that lenders and financial institutions see you as relatively low risk, so you're often more likely to be approved for credit. While you might not always get the absolute best interest rates on loans or credit cards, you should still receive reasonably competitive offers. Making steady, timely payments and maintaining low card balances could potentially move your score into the higher range. Remember, every improvement is a step towards achieving your financial goals.

Can I Get a Mortgage with a 733 Credit Score?

With a credit score of 733, there's a great likelihood that you would be approved for a mortgage. This is a solid score which most lenders consider as good, reflecting a responsible credit history which includes prompt bill payments and balanced use of your credit limit. Bear in mind that your credit score is a significant factor when lenders determine your mortgage eligibility.

Whilst approval is likely, you should understand more about the mortgage approval process. On receiving approval, the interest rate offered may still vary given that the best rates are usually reserved for those with exceptional credit scores, typically 800 or above. However, with a score of 733, your rate should still be competitive and certainly workable. Yet, keep in mind that the approval process also includes assessing factors such as your employment history, income, and debt-to-income ratio. So prepare yourself to provide documentation to prove your financial stability.

Can I Get a Credit Card with a 733 Credit Score?

At a credit score of 733, you stand a remarkably solid chance of being approved for a credit card. This score reflects financial responsibility and consistent management of credit, which makes lenders more likely to trust you with their product. It's heartening to realize that your diligent effort in maintaining a good credit score has indeed paid off. However, it's also crucial to ensure that you continue to handle your finances sensibly to maintain this advantageous position.

With a credit score as strong as 733, there's an array of credit cards you're eligible to apply for. Secured and starter cards can help you continue to build your credit, but you are also eligible for some premium travel cards that offer extensive benefits like airline miles and travel insurance. However, remember that even for those with good credit scores, interest rates can still vary greatly, so it’s important to carefully consider the terms of any potential credit card. With your excellent credit score in hand, you're on the road to fulfilling your financial goals.

A credit score of 733 is generally seen as a good score by most lenders. With this score, there's a high likelihood you can be approved for a personal loan. Keep in mind that it's not simply a guarantee, as other finance variables are also factored into approval decisions. However, a credit score of 733 puts you in a favorable position.

When applying for a personal loan, lenders will review your credit report and look at factors such as payment history, debt usage, and length of credit history. Having a score of 733 means you've shown responsible credit behavior in the past, which is a positive indicator for potential lenders. Interest rates offered will largely depend on these factors too. Generally, the better your credit score, the more likely you are to secure a lower interest rate on your loan. However, it's always important to read the terms carefully and ensure you will be able to afford repayments.

Can I Get a Car Loan with a 733 Credit Score?

Having a credit score of 733 can put you in a steady position when it comes to being approved for a car loan. This score typically falls into the 'good' credit category which means lenders view you as a lower risk borrower. Your 733 score signifies a history of responsible borrowing and timely repayment of debts, and lenders should be more willing to grant you a loan with favorable terms.

When applying for a car loan, it's important to understand that your credit score will impact the interest rates and the terms you’ll be offered. A higher score like yours can often result in lower interest rates, making the overall cost of the car loan more affordable. Remember, while a solid credit score boosts your chances, approval isn't guaranteed. Every lending institution has unique lending criteria, so it's a good idea to research and understand what different lenders have to offer. Despite this, your credit score of 733 provides a strong base for securing a car loan with reasonable terms.

What Factors Most Impact a 733 Credit Score?

A credit score of 733 suggests you're managing your finances responsibly. Let's dive into the factors that are most likely affecting your score and how you can elevate it even higher.

Credit Utilization

With a score of 733, your credit utilization rate is probably already decent. However, keeping on top of this - using less of the credit available to you - can further improve your score.

How to Check: Review your credit card statements. Ensure your balances remain well below your credit limits.

Payment History

On-time payments strengthen your score. An area for improvement could be any late payments or defaults in your history.

How to Check: Peek at your credit report. Look for any late payments or defaults and commit to timely repayments to avoid any future mark downs.

Credit History Length

Longer credit history demonstrates a more extensive record of responsible credit management.

How to Check: Examine your credit report for the age of your existing accounts. Try not to open new accounts unless necessary to keep the average age of your accounts high.

Mix of Credit

A variety of credit types shows you can manage different forms of debt responsibly.

How to Check: Analyze your mix of credit. Do you have various forms of credit like credit cards, personal loans, or mortgage? Diversification is favorable.

Public Records

Lastly, public records can significantly impact credit scores. Though likely not affecting a score of 733, it's always good to be aware.

How to Check: Consult your credit report for public records like bankruptcies or tax liens. Resolve any pending issues if possible.

How Do I Improve my 733 Credit Score?

With a score of 733, you’re doing well, but there’s always room to futureproof your financial health. The following steps can help raise a good score to an excellent one:

1. Review Your Credit Report

Start by thoroughly checking your credit report for errors. Faults or inaccuracies could unfairly lower your score. If you spot errors, dispute them with the relevant credit bureau.

2. Maintain Low Balances

Keep your credit card balances low. Even if you pay in full every month, large balances can reflect negatively. Aim to keep your card usage below 20% of your limit.

3. Check your Credit Utilization Rate

Your credit utilization rate should stay below 30%. Divide total debt by total credit limit to figure it out. If it’s high, work on lowering your debts or consider asking for a credit limit increase.

4. Don’t Close Old Credit Cards

Don’t close old or unused credit cards unless they carry high fees. Long credit history can increase your score.

5. Limit Hard Credit Inquiries

Only apply for credit when necessary. Too many hard inquiries can negatively affect your score.

Remember, the keys to a higher credit score are patience and responsible credit habits. Stick to your plan and see your credit health flourish.