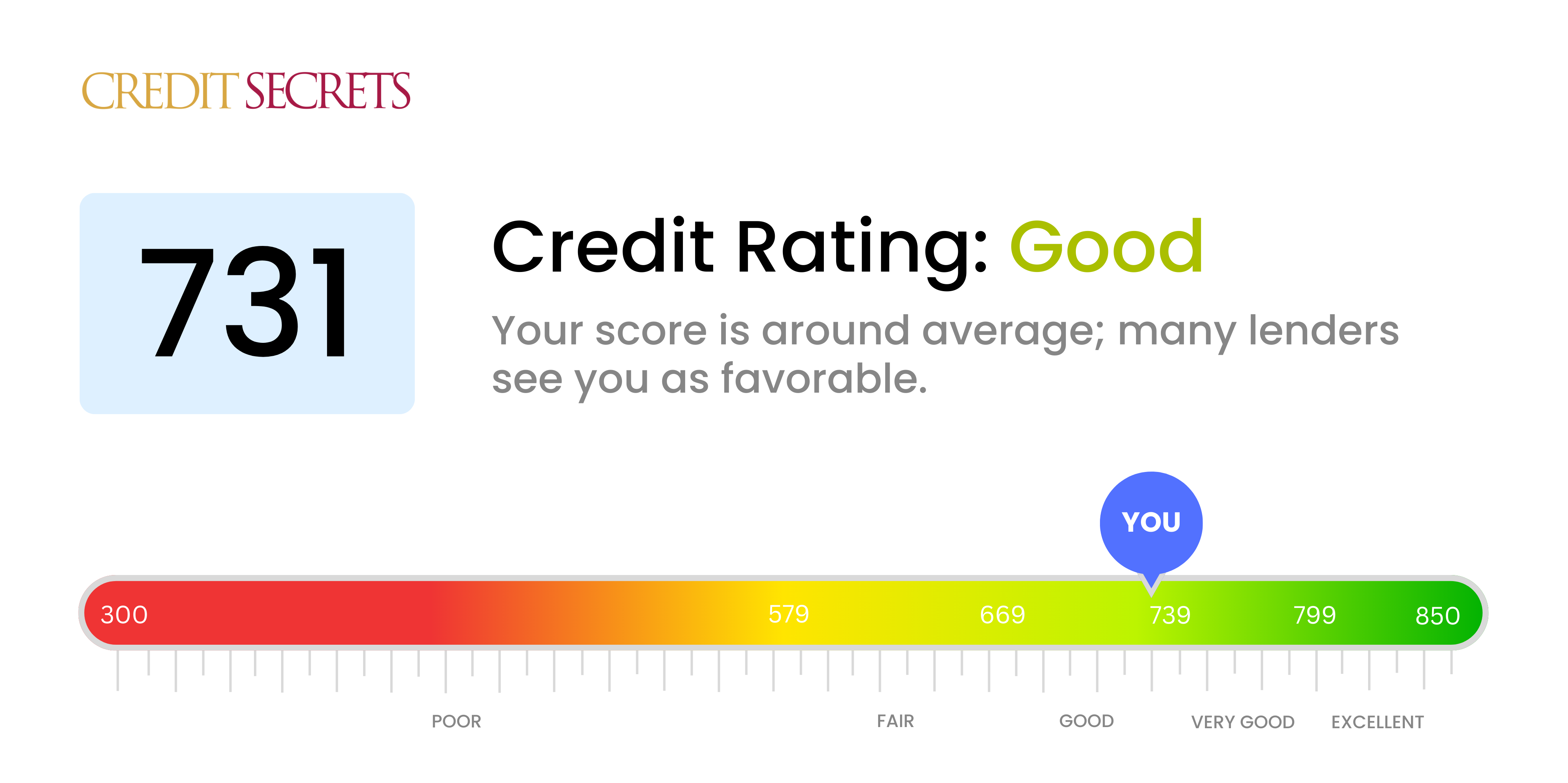

Is 731 a good credit score?

With a credit score of 731, your financial situation is considered good. This rate is just a few points shy of being classified as "very good", so you're in an advantageous position in the credit world.

Generally, a good credit score like yours can open some promising doors — you'll likely qualify for most loans and credit cards, often with favorable interest rates. While a score in the "very good" or "excellent" range could offer even more beneficial terms, your credit health is solid. Remember, maintaining and continuing to improve your credit should always be the goal.

Can I Get a Mortgage with a 731 Credit Score?

With a credit score of 731, you are in a promising position to be approved for a mortgage. This score is within the 'good' range of credit ratings, indicating that you've been financially responsible and consistently met your credit obligations. As a result, lenders are more likely to view you as a low-risk borrower.

You should anticipate a relatively smooth mortgage approval process. Typically, lenders will assess your ability to repay the loan, examining factors such as your income, employment history, and outstanding debts. Your score of 731 means you can also expect competitive interest rates, which could save you a substantial amount of money over the life of your mortgage. However, keep in mind that while this credit score puts you in a good position, it's just one aspect of your overall financial profile. You should continue to manage your finances wisely and maintain your credit habits to ensure a successful mortgage application.

Can I Get a Credit Card with a 731 Credit Score?

Having a credit score of 731 signifies a strong credit history and reflects responsible financial behavior. Lenders generally perceive this as a low-risk score, making credit card approval more likely. It's a realistic yet promising position to be in as you strive towards achieving greater financial stability.

With such a good score, a wide range of credit cards could be available to you. Secured cards and starter cards might not be necessary in your situation. It could be a good idea to explore premium travel cards or rewards cards that offer cashbacks and perks tied to your spending. These cards tend to be available to those with higher credit scores, and could provide the chance to maximize benefits from a credit card. Regardless, remember to consider the interest rates and terms before committing to any form of credit. Being informed and careful is key as you navigate your financial journey.

A credit score of 731 is in the good range and signals to lenders that you have a solid repayment history and a lower risk profile. For these reasons, you are likely to be approved for a personal loan. Remember, this doesn't mean it's a sure thing. Each lender has its own criteria, even though your credit score heavily influences their decision.

Once you apply for a personal loan, lenders might offer a loan term and interest rate based on your credit score of 731. The higher your score, the better the terms, usually. In your case, you can expect a competitive interest rate and fair terms. However, don't just settle for the first offer. Try shopping around to find the best deal for your specific needs. Also, be cautious of how many inquiries are made on your credit report, as these can affect your score. Stay optimistic, you are on the right path to achieving your financial goals.

Can I Get a Car Loan with a 731 Credit Score?

A credit score of 731 is commendable and a strong indicator that you will likely be approved for a car loan. Creditors generally prefer lending to individuals with credit scores of 690 or above, as a strong credit score presents a lower risk. Your score of 731 falls firmly within this range, providing a level of assurance to lenders that you will promptly and consistently meet your repayment responsibilities.

In terms of what to expect during the car purchasing process, your excellent credit score will likely make the transaction smoother and more favorable. You can anticipate getting lower interest rates than those with lower credit scores. Using this leverage, you might be able to negotiate terms that best suit your budget and financial goals. The process might seem complex, but the advantage is in your hands due to your strong credit standing. Take your time to analyze the offers that come your way and choose the best fit. Remember, making informed decisions is key to managing your credit responsibly.

What Factors Most Impact a 731 Credit Score?

If you have a score of 731, understanding what influences your credit score is the key to optimizing your financial journey. Regardless of past financial decisions, the possibilities for improvement and growth still remain.

Credit Utilization Ratio

Your credit utilization ratio can heavily impact a score of 731. Did you know that maintaining a balance on your credit card might not be ideal?

How to Check: Review your credit card balances. If they are above 30% of your available credit, this could be impacting your score.

Public Records

Even at a score of 731, public records could cause a dip. Settling outstanding issues can help avoid this.

How to Check: Review your credit report for any public records like tax liens or bankruptcies.

Length of Credit History

Insufficient time to establish a solid credit history can affect a score of 731.

How to Check: Examine your credit report to determine the age of your oldest account, the age of your newest account, and the average age of all your credit accounts.

Promptness of Payments

Your 731 score might be affected by late or missed payments in your recent credit history.

How to Check: Verify your payment history to ensure that all payments are made on time.

Credit Diversity

Avoiding diversity in your credit types may be causing a limitation in your score.

How to Check: Analyze the mix of your credit facilities like credit cards, mortgage loans or retail accounts. Ensure you have a balanced mix of credit types.

How Do I Improve my 731 Credit Score?

A credit score of 731 is considered good, putting you in the realm of financial stability. To continue improving, below are a few strategies tailored to your current situation:

1. Keep Balances Low & Credit Utilization Rate Down

For your credit score, managing your credit card balances becomes crucial. Retain your balances below 30% of your credit limit, while aiming to lower them to 10% in the long-term. This helps reduce your credit utilization rate, a key factor in credit score calculations.

2. Maintain Responsible Credit Activity

You are likely to have access to more credit at this level. Use new credit responsibly; avoid making large, unnecessary purchases that you cannot afford to pay off in a reasonable time frame.

3. Avoid Creating Unnecessary Inquiries

Unnecessary credit applications can cause small, but needless dents in your score. Apply for new credit only when necessary, ensuring each application is given mindful consideration.

4. Check Your Reports Regularly

Ensure there are no errors on your credit report that can potentially drop your score. The three major credit bureaus provide one free annual report, make sure to utilize this to stay on top of your credit history.

5. Long-term Planner

Start planning any large future loans such as auto loans or mortgages. Consider adopting savings strategies, or pre-tax account contributions, actively demonstrating financial planning can further improve your score.