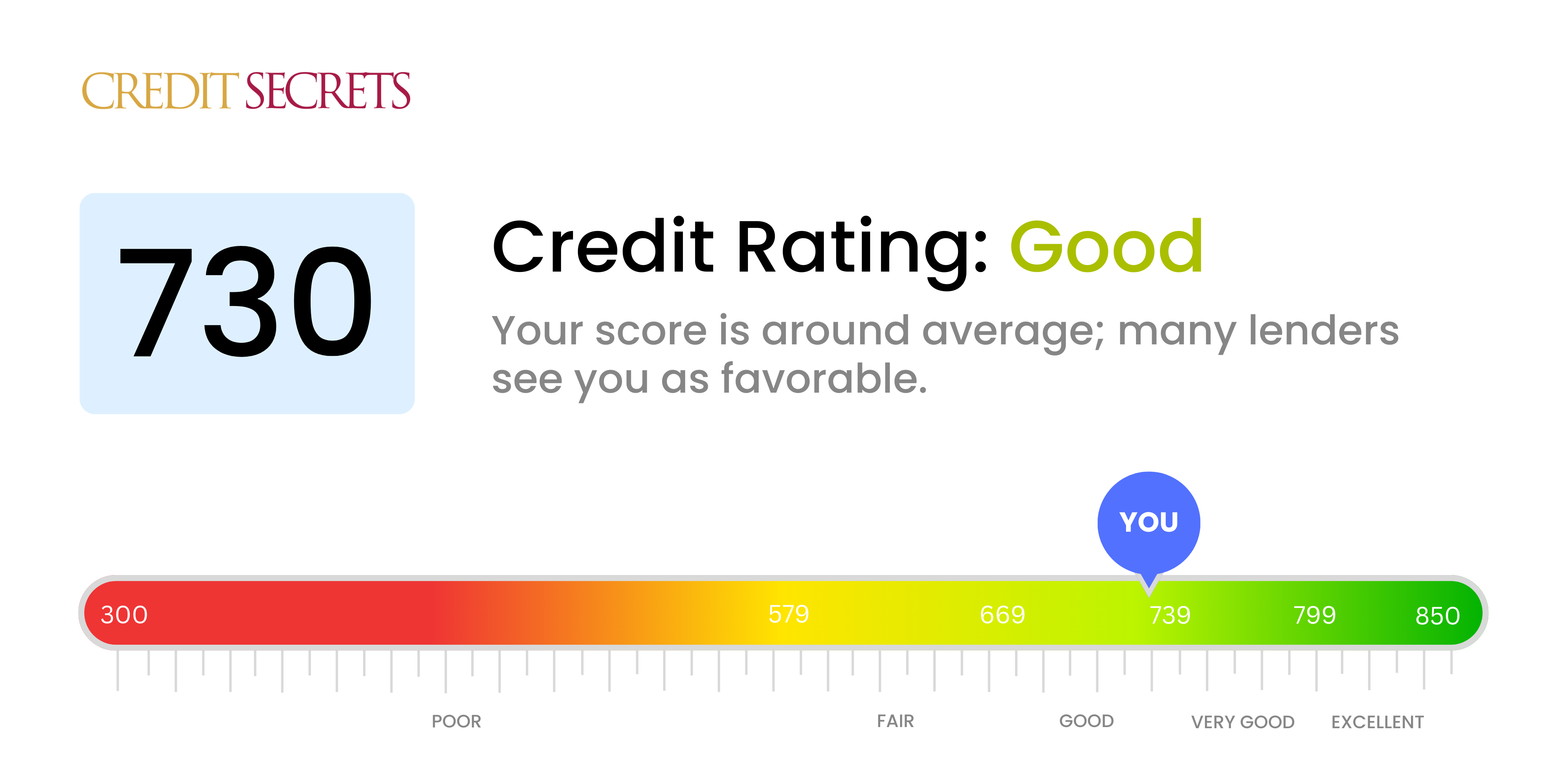

Is 730 a good credit score?

With a credit score of 730, you're sitting pretty in the 'Good' category. This signifies to lenders that you're generally reliable when it comes to managing your debts, though there may be some minor hiccups in your financial history.

Typically, a score of 730 means you may not always get the very best terms and conditions on loans and credit cards but you're likely to be approved for most types of credit. It still might be beneficial to work on boosting your score to the 'Very Good' or 'Excellent' range for the best possible opportunities. With right decision, financial responsibility, and awareness, you can improve your scenario further.

Can I Get a Mortgage with a 730 Credit Score?

With a credit score of 730, you're in a strong position to be approved for a mortgage. This number is well above the minimum requirement set by most lenders, reflecting a consistent history of financial responsibility and creditworthiness. It’s always sensible to remember that other factors may come into play during the approval process, but a score within this range generally signifies that you have demonstrated good financial habits.

As you initiate the mortgage application process, it can be anticipated that your interest rates will likely be more advantageous than those with lower scores. Because lenders view you as a relatively low-risk borrower, you can take advantage of this security by getting better terms on your loan. However, always be attentive to read the fine print and understand the terms and conditions of the mortgage agreement fully. Remember to make consistent, on-time payments to maintain and potentially increase your credit score.

Can I Get a Credit Card with a 730 Credit Score?

With a credit score of 730, it's highly probable that you'll be approved for a credit card. This score is seen as a responsible one by lenders, indicating a record of well-managed credit. It's not easy maintaining such a score, but your efforts are paying off, opening doors to financial options.

This score positions you well for various types of credit cards. If you're new to credit cards or looking to keep things simple, consider a starter card. For frequent travelers, a premium travel card may offer worthwhile perks. Secured credit cards, which are primarily used to build or rebuild credit, might not be necessary unless you feel more comfortable with that option. Remember to always look over the interest rates. Though your score is good, interest rates vary and can impact your financial planning. Be sure to choose the card that most suits your lifestyle and financial goals.

With a credit score of 730, you're likely viewed as a manageable risk to lenders and are therefore more probable to get approval for a personal loan. It's a comforting position to be in, with strong possibilities ahead. But remember, every lending institution has its guidelines regarding lending, so this doesn't entirely eliminate potential challenges in the application process.

As you embark on your personal loan journey, expect lenders to examine your score thoroughly to assess your creditworthiness. Thanks to your higher score, you are likely to have access to better interest rates compared to those with lower scores. Yet, always be prepared to demonstrate your capacity to repay. Documentation of steady income, stable employment, and manageable debt-to-income ratio will be key. It’s clear - a 730 credit score opens the door to better borrowing options and more financially sound future. Strive to maintain or even improve your score for even brighter possibilities.

Can I Get a Car Loan with a 730 Credit Score?

If your credit score is at a comfortable 730, you're in a solid place when it comes to pursuing a car loan. Lenders typically view scores above 660 as a sign of a responsible borrower, and so, your score of 730 places you well above this threshold. This credit score shows lenders that you're unlikely to default on the loan, reflecting positively on your creditworthiness. As such, lenders are likely to approve your car loan application.

As you navigate the car purchasing journey, your solid credit score is likely to unlock favorable terms for your loan. This typically translates into lower interest rates because lenders consider you less risky. While this score doesn't automatically guarantee the best terms available in the market—it's always influenced by various factors—it certainly puts you in a better position to negotiate. Always do your homework about the current market rates to ensure you're not paying more than you should. While the process may seem daunting, rest assured, your credit score of 730 puts you a step ahead in securing a favorable car loan.

What Factors Most Impact a 730 Credit Score?

A credit score of 730

Your credit score of 730 shows that you're a responsible borrower, but there's still room for enhancement. Paying attention to the below factors can help you improve further.

Credit Utilization

High credit utilization, up to or beyond 30%, can hamper your score.

How to Check: Take a look at your recent credit card statements. If your balances are nearing your credit limit, this might be bringing down your score. Aim to keep your balances 30% or below of your credit limit to improve your score.

Length of Credit History

Your credit history length can influence your credit score. A longer history with good credit management is better.

How to Check: Peek at your credit report. Review the age of your oldest and newest accounts and the average age of all your accounts. Avoid opening new accounts unnecessarily as it can shorten your average credit history.

Credit Mix

A good mix of different types of credit like credit cards, auto loans, and mortgages can improve your score.

How to Check: Assess your credit report for your mix of credit accounts. A varied mix suggests to lenders that you're capable of handling different types of credit.

On-time Payments

Consistent on-time payments can enhance your score. A single late payment can set back your score progress.

How to Check: Review your credit report for any late or missed payments. Remember, making payments on time is the simplest way to boost your credit score.

How Do I Improve my 730 Credit Score?

With a credit score of 730, you’re in a decent position, but there’s always room for improvement. Let’s dig deeper and discover ways you can boost your credit score even higher:

1. Monitor Your Credit Report

One of the most essential things you can do with a score of 730 is regularly check your credit reports. Spot any errors and dispute them immediately to maintain your credit score.

2. Manage Credit Utilization

Mind your credit utilization ratio — the amount you owe compared to your credit limit. Aim to keep it under 30%. You could ask for a line of credit increase or pay off balances more frequently to manage this ratio.

3. Maintain Older Credit Lines

Demonstrate long-standing creditworthiness by maintaining your oldest lines of credit. Even if you no longer need them, consider keeping these accounts open and in good standing.

4. Limited Hard Inquiries

Each time a potential lender checks your credit it may slightly lower your score. Try to limit new credit applications to once every six months or so.

5. Pay Bills Timely

Even with a good score, late or missed payments can knock a few points off your credit. Try setting up automatic payments or reminders to ensure that all bills are paid on time.

Remember, growing your credit score is not a sprint, but a marathon. By staying disciplined and committed, achieving a higher credit score is within your reach.