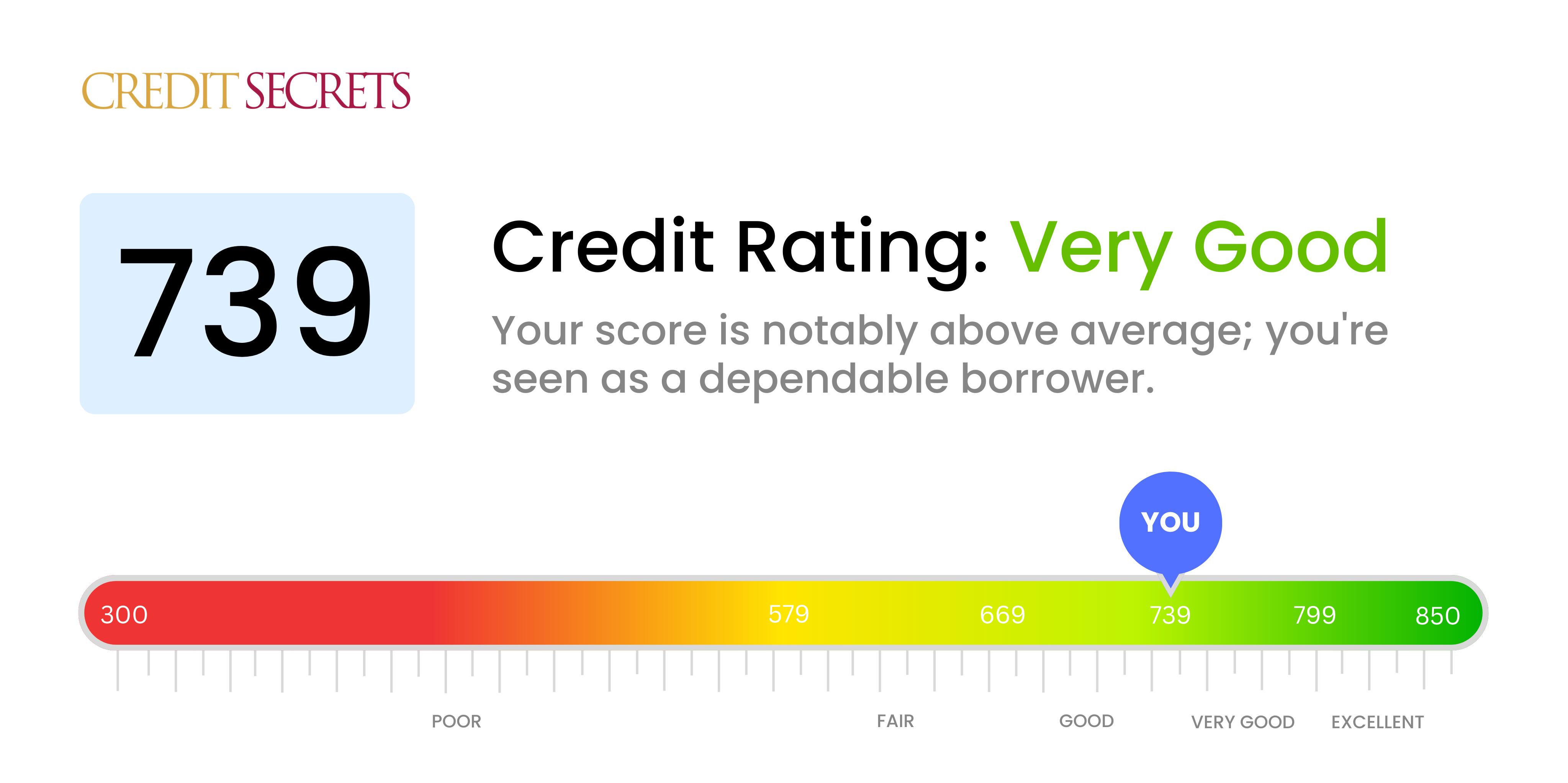

Is 739 a good credit score?

Having a credit score of 739 places you just within the 'Good' range. This is a solid foundation, but there can still be room for improvement to attain even better terms and interest rates on loans and credit cards.

With your score, you're likely to be approved for most credit, although not always at the very best rates. Continue your positive financial habits, such as making on-time payments and keeping your credit utilization low, and you'll be on the path to a 'Very Good' or even 'Excellent' credit score in no time.

Can I Get a Mortgage with a 739 Credit Score?

Having a credit score of 739 puts you in a solid position for mortgage approval. This score is considered good on the credit scale, showing that you've managed past credit responsibly. Lenders regard people with similar scores as low-risk borrowers and are more likely to extend mortgage offers to them. This does not mean that approval is guaranteed, as other factors also come into consideration. However, it's certainly a strong starting point.

In terms of the mortgage approval process, you can expect lenders to closely examine your financial history, income, and outstanding debt apart from your credit score. Having a strong credit score of 739 could potentially influence the interest rates offered to you. Generally, a higher credit score equals lower mortgage rates, meaning you could pay less over the life of your loan. Remember, it's always best to shop around and consider different lenders for the most favorable terms.

Can I Get a Credit Card with a 739 Credit Score?

With a credit score of 739, chances of being approved for a credit card are quite high. This score is seen favorably by lenders as it indicates a reliable history of managing finances and meeting financial obligations. It's not exactly easy to maintain such a score, so it's vital to acknowledge this accomplishment and continue exercising great financial habits.

With a score in this range, a variety of credit card options can be beneficial depending on your specific needs. If travel is a frequent part of your life, looking into premium travel cards might be the right fit for you. These cards often offer substantial rewards on travel-related expenses. If you're more focused on saving money, a cash back card could be a suitable option. These cards offer a percentage of cashback on every purchase made. Keep in mind that while your credit score qualifies you for these cards, your interest rate will still depend on various factors, including your income and existing debts.

With a credit score of 739, your financial standing falls within a range typically viewed favorably by lenders. This score indicates a history of reliable credit management, thus increasing your likelihood of approval when applying for a personal loan. It's a positive situation, but it doesn't guarantee approval, as other factors may come into play. However, knowing your credit score can offer clarity on your lending possibilities.

In the personal loan application process, lenders consider this score as a key indicator of trustworthiness. As such, you can expect that your solid credit score will likely lead to more favorable interest rates as compared to someone with a lower score. However, it's yet important to be mindful that each lender has their own set of rules and requirements. With your 739 credit score, you are generally well-positioned to be considered for loans with agreeable terms.

Can I Get a Car Loan with a 739 Credit Score?

With a credit score of 739, getting approval for a car loan is likely to be straightforward for you. Car lenders typically search for scores above 660 to offer favorable terms, and your score easily exceeds this benchmark. This above-average score demonstrates to lenders that you're a responsible borrower who can be trusted to repay financial obligations in a timely manner.

Your impressive score of 739 puts you in a strong position in the car purchasing procedure. You can likely expect a wide array of loan options and negotiating power when it comes to your terms and interest rates. Due to your solid track record of financial responsibility, lenders are inclined to offer you loans with low-interest rates and flexible repayment terms. However, even with a strong credit score like yours, it's crucial to shop around to ensure you choose the most favorable car loan deal available. Always carefully review all of the terms before agreeing to a loan.

What Factors Most Impact a 739 Credit Score?

Understanding your credit score of 739 is key to navigating your financial roadmap. Acknowledging what can impact this score will equip you for improving and continuing to maintain a healthy financial status. Remember, every financial pathway is distinctive with room for personal progress and valuable insights.

Late Payments

Even sporadic late payments can have a significant effect on your credit score. This could be why your score isn't higher.

How to Check: Scrutinise your credit reports for late payments in your history. Look back and identify any situations where bills or payments were behind schedule.

Credit Utilization

If you are consistently utilizing a high percentage of your available credit, this could impact your score.

How to Check: Analyze your credit card statements to see if you are habitually close to your credit limit. Efforts to reduce your balance could help uplift your score.

Length of Credit History

Short credit history may be a factor that's holding your score back. The longer your credit history, the better it is for your score.

How to Check: Look at your credit report and check the duration of your oldest and newest accounts. Evaluate the average duration of your overall credit history.

Credit Variety

Having a diverse range of credit types can positively influence your score. If your credit usage is concentrated into one type, this might be a limiting factor.

How to Check: Determine the variety of credit accounts you own, including credit cards, mortgages, installment loans, retail accounts etc. Try to maintain a healthy balance between them all.

Public Records

Any public records, like tax liens or bankruptcies, can lower your score considerably.

How to Check: Investigate your credit report for any recorded public instances. Any such incidents should be dealt with promptly.

How Do I Improve my 739 Credit Score?

With a credit score of 739, you are deemed creditworthy by most lenders and may already qualify for loans at favorable rates. However, small changes can elevate this score into the ‘excellent’ range, making you an even more attractive borrower. Here are beneficial steps for your situation:

1. Monitor Your Credit Reports

Closely watch your credit reports for inaccuracies or suspicious activity, which could potentially drag down your score. You are entitled to a free report from each credit bureau every year. Review these documents thoroughly for mistakes and dispute them right away.

2. Maintain Low Balances

Keep your credit card balances low compared to your limit – ideally below 10% – to exhibit excellent credit usage. This demonstrates to lenders that you responsibly manage your available credit.

3. Pay Bills on Time

Keep up with timely payments on all your bills, not just credit cards or loans. Late payments for utilities, rent, or cell phone services can be reported to credit bureaus, negatively impacting your score.

4. Be Cautious of Hard Inquiries

Every time you apply for new credit, a ‘hard inquiry’ is recorded on your report. These can drag down your score. Be discretionary about applying for new credit to keep your hard inquires to a minimum.

5. Diversify Your Credit Types

Lenders like to see diversity in your credit types, which can be credit cards, mortgages, installment loans or store accounts. This mix can give your score a slight boost. However, ensure you can handle additional credit responsibly before taking this step.