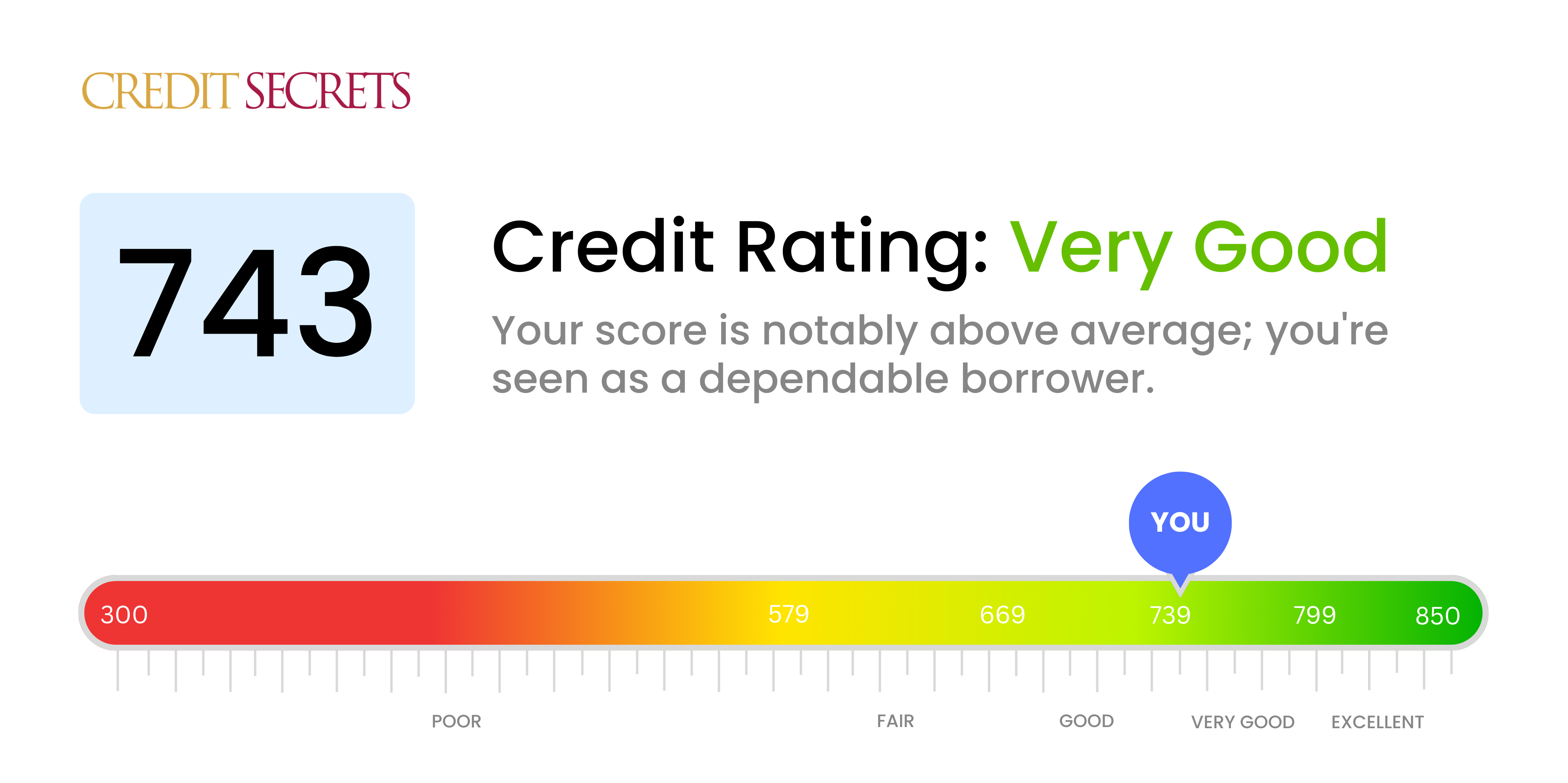

Is 743 a good credit score?

Your 743 credit score falls into the 'Very good' category. A score in this region certainly shows responsible credit behavior and represents your trustworthy character to lenders, thus, opening doors to better interest rates and attractive credit offers.

While this is indeed a strong credit score, there's always room for improvement. Ensuring timely payments, borrowing only as much as you need, and working on other credit-boosting strategies can help you gradually push your score toward the 'Excellent' bracket. But remember, every little step toward financial health counts, and you are already on the right path.

Can I Get a Mortgage with a 743 Credit Score?

With a credit score of 743, it's highly probable you'd be approved for a mortgage. This score is considered good and reflects a steady history of responsible credit usage and on-time payments. While every lender's criteria differ, a score in this range typically meets their requirements.

During the mortgage approval process, lenders will scrutinize your credit history, employment status, and income. You can anticipate several stages, including pre-approval, home appraisal, and closing. A credit score like yours may also qualify you for more favorable interest rates, potentially saving you considerable money over the term of your loan. While getting approved is a major step, it's important to shop around to secure the best mortgage terms possible. Keep in mind, getting approved does not obligate you to a particular mortgage until you sign the closing documents.

Can I Get a Credit Card with a 743 Credit Score?

Having a credit score of 743 indicates that you're indeed a responsible borrower. This credit score is often viewed favorably by lenders, demonstrating a history of meeting financial responsibilities and a low risk of default. This generally improves your prospects of being approved for a credit card. However, it's vital to remember that though beneficial, having a good credit score isn't the only factor taken into consideration when applying for credit.

A credit score of 743 opens up a range of credit card options for you. You might explore unsecured cards, travel rewards cards or cash back credit cards, depending on your lifestyle and how you intend to use the credit. Unsecured cards, for instance, don't require a deposit and often come with more perks and features. Needless to say, it would be wise to carefully examine all terms and conditions, including any potential annual fees and interest charges, before making a final decision. Keep in mind that timely repayments will be essential to maintaining or further improving your credit score.

With a credit score of 743, you're positioned well for the personal loan application process. This score falls within the 'good' credit range, which is typically embraced by most loan providers. It demonstrates to lenders that you have been responsible with your past credit, making you a less risky borrower in their eyes. Therefore, the chance of securing approval for a personal loan is reasonably high.

During the application process, make sure your ability to pay the loan back is apparent, as lenders not only look at credit scores, but also income stability, debt-to-income ratio, among others. With your score, you can anticipate a more straightforward process and a better chance of qualifying for competitive interest rates. Bear in mind that varying lenders have differing credit score requirements, thus, exploring several options and choosing what best suits your needs is advisable.

Can I Get a Car Loan with a 743 Credit Score?

A credit score of 743 is typically seen as a strong indicator of reliability. Car loans are often granted to those with such scores. When lenders see this score, they will likely see you as a lower risk to lend to because it suggests you have a good history of paying back your debts on time. This may make it easier for you to obtain car loan approval.

That being said, the rate of interest on your car loan would heavily depend upon this score. Even though a credit score of 743 would likely qualify you for a loan, it may still not entitle you to the lowest interest rates. The best rates are typically reserved for those with credit scores in the high 700s or above. In your car purchasing journey, it's essential that you read and understand all terms and conditions. Remember, every bit as important as getting approved for a loan is ensuring you're comfortable with the repayment terms and interest rate.

What Factors Most Impact a 743 Credit Score?

Getting a grip on what a score of 743 entails is crucial as you forge ahead with your financial plans. Delving into the factors impacting this score can set the stage for a sound financial future. Every credit journey is unique and presents an opportunity to learn and grow.

Total Amounts Owed

While your score of 743 is above average, the total amount of debt you're carrying could be pulling it down. This includes both installment debt such as mortgage and car loans, and revolving debt such as credit cards.

How to Check: Glance through your credit report to find your total debt. Ideally, your credit card balances should be well below your limits.

Payment History

Have you ever missed a payment? Though you may have a good score, past late payments or delinquencies can still limit how high it climbs.

How to Check: Check your credit report to identify any late payments or defaults that could negatively affect your score.

Length of Credit History

A relatively young credit history may be limiting the growth of your good score. Creditors value the predictability that long-term credit behaviour provides.

How to Check: Look at your credit report and calculate the average age of all your accounts to assess the length of your credit history.

New Credit Inquiries

Applying for numerous new credit lines over a short period of time can cause a slight dip in your credit score.

How to Check: Review your credit report for recent hard inquiries. Consider applying for new credit sparingly.

How Do I Improve my 743 Credit Score?

A credit score of 743 is viewed as a good score; however, you still have some room for improvement. Here are some practical, effective steps tailored to your current score:

1. Keeping Credit Utilization Low

One key factor for credit scores above 700 is your credit utilization ratio. Keeping a low balance on your credit cards relative to your overall credit limit can make a considerable difference. Continue paying off your balances in full each month if you’re able to.

2. Limiting New Credit Inquiries

Each new credit application can lead to a small, temporary drop in your score. Limiting new credit applications will avoid unnecessary dings to your score.

3. Keeping Old Accounts Open

Assuming they’re in good standing, older credit accounts can contribute positively to your credit score by extending your history. Resist closing these accounts unless necessary.

4. Regularly Checking Your Credit Report

Once in a while, errors may appear on your credit report. Regular monitoring can help in spotting any incorrect information that could be dragging your score down. If you find any, dispute them immediately with the credit burea.

5. Be Consistent

A consistent record of on-time payments and responsible credit use can help steadily increase your credit score over time. Continue to pay your bills on schedule and use credit judiciously to maintain and improve your score.