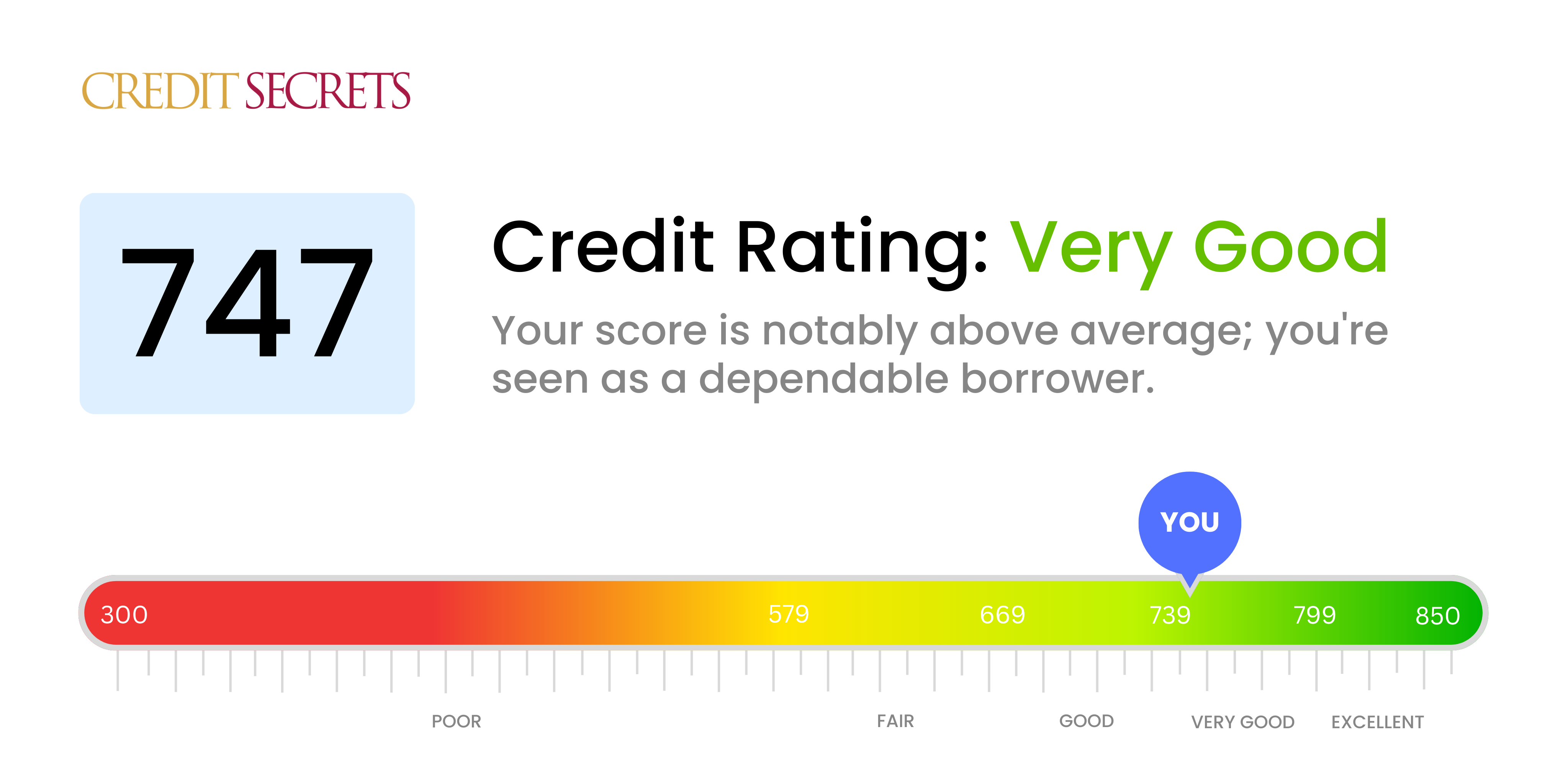

Is 747 a good credit score?

Your credit score of 747 is classified as very good. This typically means you may expect to secure loans or credit with more favorable terms, such as lower interest rates, as lenders perceive you to be a lower-risk borrower.

However, there's always room to strive for excellence. By consistently paying your bills on time, reducing your overall debt, and responsibly managing your credit, you can further improve your score which will provide you with even better financial opportunities.

Can I Get a Mortgage with a 747 Credit Score?

A credit score of 747 is generally considered good, which means you're likely to be approved for a mortgage. This score indicates that you've been responsible with credit in the past, and lenders look favorably upon this when considering mortgage applications.

During the mortgage approval process, lenders will assess your creditworthiness, along with other factors such as your income and debt levels. As someone with a 747 credit score, you're likely to encounter fewer issues. It's important, though, to keep up your credit-healthy habits during this process. It's also worth noting that a good credit score can help you negotiate a lower interest rate, which could end up saving you large amounts of money over the life of your loan. Remember, being proactive and informed about your credit standing can give you an edge when applying for a mortgage.

Can I Get a Credit Card with a 747 Credit Score?

A credit score of 747 is indeed a healthy sign. This qualifies one as likely to be approved for a credit card. This score indicates a history of thoughtful and responsible credit usage. It's a powerful testament to consistent and timely payments, as well as judiciously managing borrowings.

Being creditworthy opens up a wide range of options. Aided by a robust credit score, you can explore the realm of premium travel cards or cashback credit cards. These cards often come with significant perks such as airline miles, hotel points, and cashback options. Depending upon the lifestyle, these cards can offer immense value. Premium cards tend to come with higher annual charges, but the benefits often outweigh these costs for active card users. As always, it's important to stay aware of the interest rates and the implication on personal finances while availing of these credit cards. Remember, a strong credit score, such as 747, commands the respect of lenders and unlocks a world of potential financial benefits.

Having a credit score of 747 situates you well in the eyes of most lenders. This score signifies you are a generally responsible borrower, dramatically increasing your chances of being approved for a personal loan. It's not a guarantee, but it certainly puts the odds in your favor as it's a clear indication to financial institutions that you present a lower risk.

When applying for a personal loan with a credit score of 747, you can anticipate certain benefits. Often, lenders will offer you lower interest rates than those with lower scores, resulting in savings over the life of the loan. This desirable interest rate reflects your borrower's reliability. Although the process will likely involve forms and documentation, your credit score could expedite approvals. A word of caution though, remember that every application is reviewed individually, and, while your strong credit score will certainly help, it’s not the only factor considered.

Can I Get a Car Loan with a 747 Credit Score?

Having a credit score of 747 means you're in a solid financial place. This score is well above the average and typically considered as very good. When car loan lenders see a score like yours, they generally interpret it as proof of a responsible borrower. This indicates that you have a history of handling your finances well, making it more likely for you to be approved for a car loan.

With a credit score of 747, you stand a good chance of enjoying favorable terms when purchasing a car. Lenders may offer you lower interest rates given the low risk they take in lending you money. You might be surprised at how smooth the car purchasing process can be with your credit score. However, it's still important to read and understand all the terms and conditions before signing any loan agreement. While your credit score can make the process easier, diligence is still the key to a wise financial decision.

What Factors Most Impact a 747 Credit Score?

A credit score of 747 indicates you're on a solid financial path and demonstrate responsibility with your credit. However, there are a few areas worth focusing on to bring your good score to an excellent level.

Payment Consistency

Consistent timely payments can significantly influence your credit score. Any slip-up, such as late payments or defaults, could be a factor impacting your score.

How to Check: Check your credit report and ensure every payment status is proper. Reflect on your payment patterns and rectify any inconsistencies.

Credit Utilization

Your credit utilization ratio may affect your score. Ideally, keep your credit card balances lower than 30% of the card's limit.

How to Check: Take a look at your credit card statements and analyze your spending habits. If your balances are often near the full credit limit, it's time to manage your finances better.

Credit History Length

A long and positive credit history can impress lenders and help improve your score.

How to Check: Your credit report indicates the length of your credit history. If your credit history is relatively short, maintaining good credit habits over time will help enhance your score.

Credit Mix

A well-managed variety of credit, like credit cards, personal loans, and mortgages, can boost your score.

How to Check: Review your credit account types in your credit report to ensure you have a diverse credit mix. However, do remember not to borrow more than you can repay.

Hard Inquiries

Multiple hard inquiries, commonly associated with applying for new credit too often, can lower your credit score.

How to Check: Check your report for any hard inquiries; if you find a considerable amount, try to limit new credit applications.

How Do I Improve my 747 Credit Score?

With a credit score of 747, you’re well on your path to excellent credit. However, there are still a few things you can do to inch closer to perfection, namely:

1. Keep Your Hard Inquiries Low

Hard inquiries drastically affect your score. While shopping for necessary loans is acceptable, avoid frivolously applying for credit, as each application can cause your score to drop temporarily.

2. Watch Your Credit Utilization

Your credit card balances shouldn’t exceed 30% of your available credit limit. Strive to keep balances even lower to see your score improve.

3. Maintain Older Credit Accounts

Longevity is key for credit scores. If you have older accounts in good standing, keeping them open can benefit your average account age and, in turn, your score.

4. Diversify Your Credit

While you might already have credit cards and loans, your credit mix still counts. If you’re missing one type, consider opening a new, necessary line of credit.

5. Ensure Accurate Reporting

Always be vigilant of your credit reports to guarantee accuracy. Any incorrect negative marks should be disputed right away with the credit bureaus.