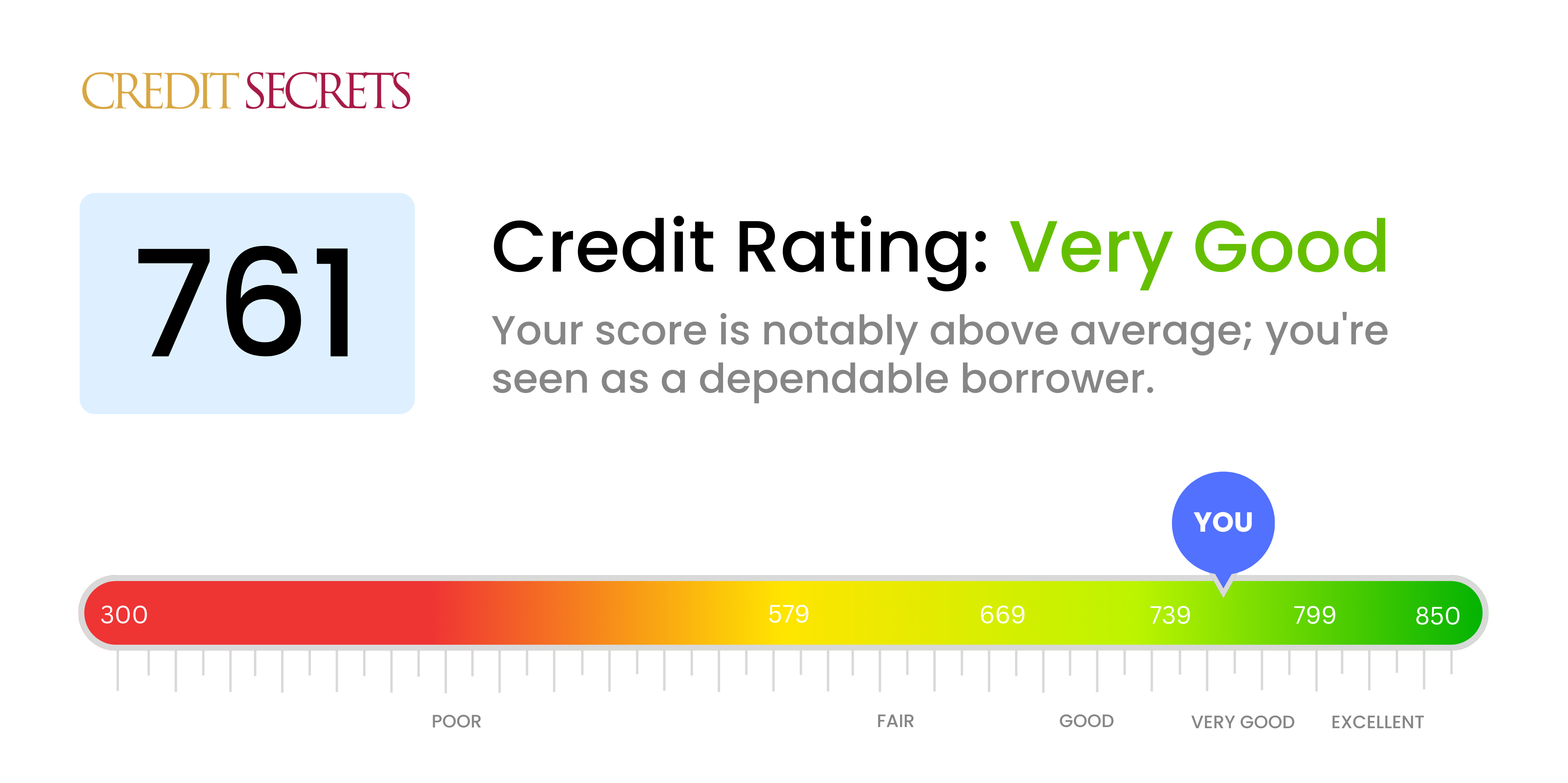

Is 761 a good credit score?

A credit score of 761 is indeed a very good score. With a score in this range, you're viewed as a responsible borrower, which can lead to better terms and lower interest rates on loans or credit cards.

The financial doors are wide open for someone with a 761 credit score, as such a score typically allows for easier approval for loans, credit cards and mortgages. Remember, healthy financial habits are key to maintaining and possibly improving your score, so continue paying bills on time and limiting unnecessary debt. You're certainly on the right path toward excellent credit.

Can I Get a Mortgage with a 761 Credit Score?

A credit score of 761 is generally considered a very good one. In the realm of credit, such a score puts you in a strong position as it suggests a consistent track record of handling credit responsibly. Therefore, it's likely that you would be approved for a mortgage with this score.

As you move through the mortgage approval process, bear in mind that your good credit score is only one factor that lenders consider. They'll also look at other aspects of your financial health, such as your income and your debt-to-income ratio. However, a high credit score like 761 can influence positively, potentially earning you a lower interest rate than someone with a weaker credit score. This could ultimately save you a significant amount of money over the lifetime of your loan. It's important to understand that while your strong credit score can increase your chances of approval, the final decision rests with each individual lender.

Can I Get a Credit Card with a 761 Credit Score?

Navigating the world of credit can be daunting but with a score of 761, you're in an ideal place. This score is seen as excellent by many credit card companies, suggestive of responsible management and regular payment of debts. Being in this position allows for a higher degree of financial freedom, and is certainly an achievement to be proud of.

Since your credit score is topnotch, an array of credit card options are open to you, including premium travel cards and cash back credit cards that come with great rewards. These types of credit cards often require strong creditworthiness, which your score demonstrates. You may also be offered lower interest rates due to your favorable score, as lenders perceive you to be a low risk. Always remember, even with these available options, continue to manage your credit responsibly to maintain or even increase your credit score.

With a credit score of 761, you're in an excellent position for obtaining a personal loan. Considering this score falls squarely in the good to excellent range, lenders usually view this as a solid indication of responsible credit use and punctual repayments. This strong credit history signifies less risk to potential lenders, increasing your chance of loan approval.

As you navigate the personal loan application process with such a credit score, you'll likely encounter more favorable terms than someone with a lower score. This could mean lower interest rates and more flexible repayment options, which can make a substantial difference over the life of the loan. Always remember to thoroughly review your options and contract terms before agreeing to a loan, even when you have a great credit score like 761. It's important to maintain that excellent credit reputation by ensuring you can responsibly manage the added debt.

Can I Get a Car Loan with a 761 Credit Score?

With a credit score of 761, you are in an excellent position to qualify for a car loan. This score range is generally regarded highly by lenders, as it demonstrates responsible credit management and a lower lending risk. This favorable perception can translate into a smoother loan approval process for you.

Given your solid credit score, you might even have the luxury of shopping around for better terms, including lower interest rates. However, while your credit score significantly impacts your loan eligibility and interest rate, it's not the sole factor that lenders consider. Your income and debts will also be evaluated to ascertain your capacity to repay the loan. Overall, having a robust credit score of 761 should put you in good stead to navigate the car buying journey with confidence and peace of mind.

What Factors Most Impact a 761 Credit Score?

Understanding your credit score of 761 is key in striving to improve your financial health. This number might seem perplexing, but by assessing the potential contributing factors, you can make meaningful changes.

Length of Credit History

A longstanding credit history justifies your score. The older your accounts, the more trustworthy you are deemed by lenders, reflecting positively on your credit score.

How to Check: Access your credit report to determine the duration of your oldest and most recent account and the cumulative age of all your accounts.

Credit Mix

Managing varied types of credit accounts well can enhance your score. This might reveal your ability to handle a range of debts responsibly.

How to Check: Assess the diversity of your credit accounts such as credit cards, retail accounts, installments and loans.

Credit Utilization

Your credit utilization ratio could have a crucial impact on your score. Lower usage of your available credit could be helping maintain a good score.

How to Check: Scan through your credit card statements. A low ratio of the balance to the credit limit is beneficial.

Records of Timely Payments

Consistent and timely payments can support a good score, demonstrating good financial habits and responsibility.

How to Check: Refer to your credit report for confirmation of timely payments.

Public Records

Free from negative public records like bankruptcy or tax liens, undoubtedly assists in retaining a healthy score.

How to Check: Evaluate your credit report to assure no traces of public records affecting your score negatively.

How Do I Improve my 761 Credit Score?

With a credit score of 761, you’ve got a good start on your credit health, but there’s always room for improvement. Here are practical steps tailored for your current credits situation:

1. Maintain Low Balances

Keep your credit card balance significantly lower than your available credit limit. A utilization rate of less than 30% will positively impact your credit score. To reach new heights in your credit rating, strive for a utilization rate below 10%.

2. Stay Punctual with Payments

Consistency is crucial when it comes to credit health. Make sure all bill payments including utilities, rentals, and credits are done on time. Automate your payments to avoid any potential slip-ups.

3. Expand Your Credit Portfolio

By diversifying your credit types, such as installment loans or retail accounts, you show lenders that you can manage different kinds of credits responsibly. Just make sure you handle this new credit responsibly.

4. Limit New Credit Requests

Avoid applying for new credit unless it is absolutely necessary. Every time you apply for credit, a hard inquiry is made which can impact your score temporarily. Limit these to maintain your score.

5. Monitor Your Credit Report

Check your credit reports regularly to identify any inaccuracies or fraudulent activities. A quick response to these issues can save your credit score from unnecessary drops.